Brief Summary:

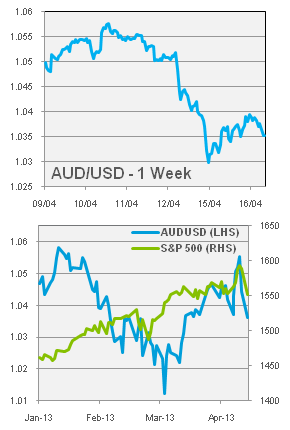

- The AUD rode a wave of sentiment last week, rallying to a three month high of 1.0580 against the USD. The rally followed the lead of U.S. equities; the S&P 500 closed at a record high of 1,593.37 on Thursday.

- The positive mood was quickly reverse as China release worse than expected GDP figures and a terrorist attack struck the Boston marathon in the U.S., curbing the demand for risk assets.

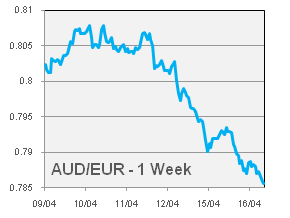

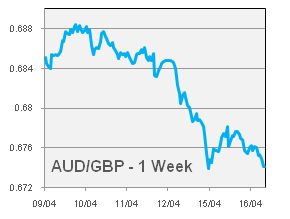

- The Pound and Euro strengthened as their inflation readings held steady, reducing the scope for further interest rate cuts.

Australian Employment

|

|

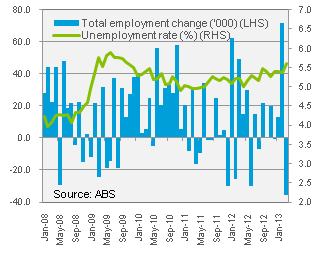

- The Unemployment Rate ticked up to 5.6% from 5.4%, and the Participation Rate, the number of people in the work force, gave up two thirds of the gains made in February; falling 0.2% to 65.1%.

- Yesterday, the Reserve Bank of Australia (RBA) released the minutes of its April monetary policy meeting. The board shifted its language slightly in recognition of improved domestic indicators yet also maintained its easing bias. Notable changes from March’s release include comments on employment numbers. The board upgraded from “modest employment growth in the near term” to “moderate growth in employment in the months ahead”, although commented that February’s outsized jobs growth “appeared to reflect changes in the sample”, referring to the data collection methods used. The statement in parenthesise was also removed from the final remark which can be viewed as a slightly hawkish tilt, “At this meeting, the Board’s assessment was that, {while further reductions may be required}, on the information currently to hand it was appropriate to hold rates steady, and to assess further developments over the period ahead.”

- Australia’s Consumer Price Index, the primary measure of inflation, will be released next Wednesday. The RBA expect inflation to remain contained within its target range of 2 – 3% in the near term. A much higher than expected figure may force the RBA to drop its easing bias, indicating that the next interest rate movement may be up rather than down.

Please see below for specific currency commentary.

USD

-

Two explosions at the finish line of the Boston Marathon killed three people and injure dozens in a suspected terror attack. The news caused markets to sell risk assets sharply. The AUD, that had found support at 1.0400, resumed its free fall reach 1.0291 early on Tuesday morning.

-

Next Tuesday, the HSBC Flash Manufacturing PMI will be released. The index is a measure of Chinese Manufacturing activity, indicating expansion when over 50.0, and read 51.6 last month.

EUR

|

|

- Slovenia gained some unwanted attention this week as rumours circulated that it would be the next in need of a sovereign bail-out. The situation is similar to that in Cyprus, albeit not as severe. Its banks need to be recapitalised, but are already owned by the state. Like seen in Cyprus, if losses overwhelm the state, they are forced onto other creditors up the hierarchy. However, Slovenia’s banking system is only 130% of GDP, far smaller than the 800% of GDP Cyprus’ banks managed to bulge to.

- Purchasing Managers’ Indices will be released for France, Germany and the Eurozone on Monday. The surveys of business conditions in Manufacturing and Service sectors will drive Eurozone sentiment and provide forward indicators of GDP growth and employment.

GBP

|

|

By Chris Chandler