Brief Summary:

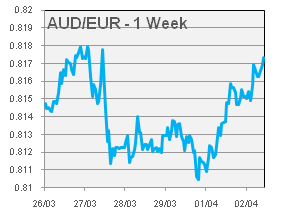

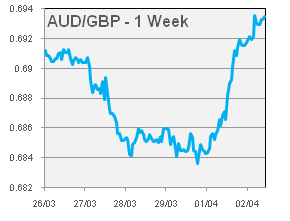

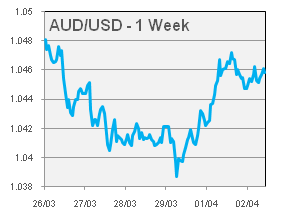

- The Easter long weekend disrupted markets in most parts of the western world this week. The AUD continued its run of strength on the back of an interest rate hold by the RBA.

- The U.S. will release employment data for March this Friday.

- The European Central Bank and Bank of England will set their benchmark interest rates on Thursday; expectations are for holds at 0.75 and 0.5%, respectively.

The Easing Bias Remains

- The Reserve Bank of Australia decided to hold the cash rate at 3.00% at yesterday’s monthly monetary policy meeting. The decision was widely expected and the market looked to the accompanying statement for direction. The statement was slim on content but overall more positive than previously. The easing bias was maintained in the final paragraph, though we believe this is partly to prevent unnecessary exchange rate appreciation. The statement lacked any comment regarding last month’s employment data. The surprise positive figure cast doubt on RBA’s easing bias but the market remains without official insight into the figures.

- Australia’s Trade Balance was released earlier today, narrowing significantly to a deficit of $178 million, and far slimmer than the $1 billion deficit expected. A strengthening of exports was led by the resumption of resource shipments that were delayed by adverse weather events in February. Additionally, a decline in capital imports contributed to the stronger figure.

- Australian Building Approvals and Retail Sales will be released tomorrow at 11:30am. The monthly figures are not significant releases but may influence the AUD.

- Today, Glenn Stevens was reappointed as Governor of the RBA for a further three years from September 17 when his term ends.

- Please see below for specific currency commentary.

USD

|

|

- In the U.S., the Institute of Supply Management released its Manufacturing PMI figure on Monday. The figure missed expectations of 54.2 reading 51.3 and led the USD slightly lower. Tonight, the Non-Manufacturing report will be released with expectations of 55.9. The figure a more important gauge of the economy as it represents the majority of U.S. GDP. The recent trend of positive U.S. data being positive for the USD may see the USD strengthen on a strong figure.

- On Thursday, U.S. Federal Reserve Chairman Ben Bernanke will speak. On Friday, U.S. Non-Farm Employment Change, the primary measure of job growth in the U.S. will be released with expectations of 201,000 new jobs in March. The Unemployment Rate will also be included in the release. Currently at 7.7% and expected to be steady, the market will react to any move toward the Fed’s 6.5% target.

EUR

GBP

By Chris Chandler