Brief Summary:

- Foreign Exchange markets will be closed for the Easter long weekend. Markets will be closed from Good Friday to Easter Monday and resume trading on Tuesday morning.

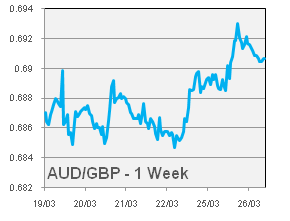

- The Reserve Bank of Australia will meet on Tuesday for their April monetary policy decision. Expectations of a rate cut have been greatly reduced after strong employment growth in February. We expect the cash rate to remain at 3.00% with the easing bias reinstated. Even if it is warranted, it will be difficult for the RBA to remove its easing bias without causing further appreciation in the AUD.

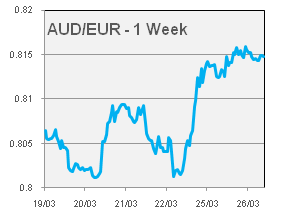

- Eurozone officials and the Cypriot parliament reached a bailout deal in their second attempt this week. The revised terms are much more costly for uninsured deposit holders of EUR 100,000 and sent shock waves through markets. The EUR fell to four month lows against most major currencies.

USD

|

|

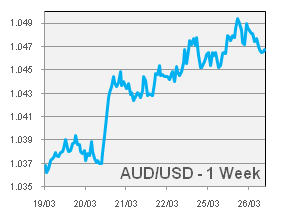

- Quantitative easing lowers borrowing costs in the U.S. which makes it a preferred currency for investors to borrow money in to fund investments in higher yielding currencies like the AUD. Despite comments by some committee members and senators, not all members are eligible to vote in the decision. The March meeting showed no change in the number of votes for and against the currently policy; with only one vote against. The vote count weakened the USD and fuelled the half a cent jump in the AUD upon release early on Thursday morning. The next meeting will be on the 30th of April.

- In China, the HSBC Flash Manufacturing PMI, a measure of manufacturing sector activity, was released. The figure was 51.7 improving from 50.4 last month and beating the 51.2 expected. The figure indicates expansion when over 50.0 and the report cited stronger orders and production growth as the main contributors to the index gain. The figure added to the AUD support that begun with the above Fed release.

EUR

- After last week’s failed attempt, European officials and the Cypriot parliament agreed to an alternative bailout deal on Monday morning. The new deal will not levy deposits below EUR 100,000, previously to be taxed 6.7%, however ‘uninsured’ deposits of over EUR 100,000 and other creditors must accept losses of 30-100%. The deal is significantly more costly for deposits greater than EUR 100,000 that were originally to be taxed at 9.9%. The decision is motivated by the preference to protect ordinary Cypriots rather than offshore depositors; namely wealthy Russians. Such Russian deposits are said to be 20 – 30 billion of the EUR 68 billion total of deposits.

- Part of the deal involves closing down the troubled bank Cyprus Popular Bank, aka. Laiki Bank. The bank, already 84% state owned as a result of previous assistance, will be merged into the Bank of Cyprus. Deposit and bond holders at both banks will bear the majority of losses.

- The immediate concern is for further financial institution defaults caused by the torrential outflow of funds that will ensue when banks open. Banks have now been closed for eleven days and the Central Bank of Cyprus has confirmed they will impose capital controls in an attempt to stem the flow.

- The market was particularly spooked by comments from Jeroen Dijsselbloem, the President of the Eurogroup, who reportedly said that the Cyprus bailout was a template for future bail-outs. He later claims to have been misinterpreted; however, the damage was already done. Deposit holders throughout the Eurozone are now fearful that their savings may be used to contribute to bank bailouts.

- Additionally out of Europe, PMI figures were released last Thursday for German, French and Eurozone, manufacturing and services sectors. Importantly, German manufacturing slipped back into contraction reading 48.9 and services fell from 54.1 to 51.6. The figures, while overshadowed by happenings in Cyprus, shows increased Eurozone confidence may have been premature.

GBP

|

|

By Chris Chandler