Brief Summary:

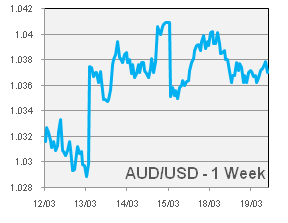

- Australia released amazingly strong employment figures last Thursday. 71,500 new jobs were created in February; the strongest figure in 13 years. The data led to a broad AUD rally, AUDUSD reached a high of 1.0400.

- The botched bailout of Cyprus is currently gripping markets. The Cypriot parliament have rejected the European Central Bank proposal to levy all bank accounts to pay for the bailout, an alternative must now be negotiated. The attempted levy has caused a run on Cypriot banks that many are fearful could spread to other parts of Europe. The EUR moved broadly weaker as a result of the tumult.

- Ben Bernanke, Chairman of the U.S. Federal Reserve, is expected to voice stronger commitment to the Fed’s quantitative easing program tonight in response to recent comments by more hawkish members of the board against the policy.

Men At Work – Down Under

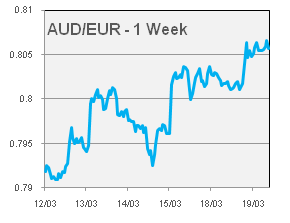

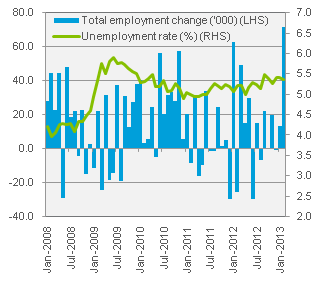

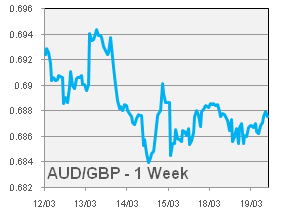

- Last Thursday, Australian employment data was released and like the song from 1981 it was a top 10 hit. 71,500 new jobs were created in February and the unemployment rate was steady at 5.4%. The headline figure was the strongest since July 2000 and the ninth best figure ever. The AUD soared half a US cent on release and reaching 1.0400, also breaking 0.8000 against the EUR (or 1.2500 as the rest of the world views it).

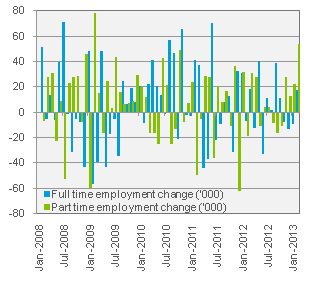

- Reading into the release further, however, reveals the labour market is not as strong as the headline figure may imply. The figure was skewed by part-time employment which grew by 53,700, whereas full-time employment grew by only 17,800. It is normal for this split to move in opposite directions as full-time work is substituted for part-time during worsening economic conditions and vice versa. Considering the last three months have delivered full-time job losses totalling about 30,000, labour conditions can still be considered soft and it would be too soon to call this a reversal.

|

|

|

|

USD

- Last Wednesday, U.S. Retail Sales figures were released for February showing 1.0% growth from 0.5% expected. The figure supported the USD, although the finer details of the data reveal the main contributors to the figure were highly volatile vehicle sales and gasoline stations that do not reflect broader economic conditions. Consumer durable sales remain subdued.

- The HSBC Flash Manufacturing Purchasing Managers’ Index will be released tomorrow at 12:45pm. The figure is a measure of manufacturing activity in China and will influence the AUD. Last month’s reading was 50.4 indicating mild expansion; it is expected to be 51.2 this month.

EUR

- The proposal was for bank deposits of EUR 100,000 or more will be hit with a one-time tax of 9.9%, and those under EUR100,000 similarly taxed at 6.7%. The decision to opt for such a strategy unsettled markets and caused a run on Cypriot banks as citizens rushed to withdraw their funds. It also caused jitters in other Eurozone countries as it sets a precedent that bank deposits are not safe from sovereign bailouts.

- The rejection of the proposal is two-fold as it not only means that the EUR 5.8 billion will not be raised and deposits will now flee the country regardless reducing the pool of funds. Banks remain closed and the Cyprus central bank will introduce capital controls in an attempt to control the exodus of funds from the country.

- The background of the Cypriot bailout is complex and other factors motivated the highly criticised proposal. Firstly, the fiscal problems in Cyprus began with its banks. Its banking sector, said to be eight times the size of its GDP (The Economist), was caught out by bad investments in Greek sovereign debt and highly indebted. Secondly, Cyprus is a major hub for offshore Russian deposits, the main reason for its oversized banks. Simply, the politics of taxing Russian deposit holders is easier than convincing northern European countries to pay for another periphery bailout.

- The EUR fell almost two U.S. cents from Saturday’s close to Monday’s open falling from 1.3076 to 1.2906. The EUR also fell against the AUD, AUDEUR closing at 0.7961 on Saturday and opening at 0.8024 on Monday morning.

- The world now waits as the ECB and Cyprus investigate an alternative that may include a lower levy rates or assistance from Russia. An exit from the Euro would be the most costly option for both Cypriots and foreign deposit holders.

- The German ZEW Indicator of Economic Sentiment, a measure of German investors’ view of economic conditions, rose slightly in February to 48.5. After rising sharply for the past four months the index now sits at it highest level since April 2010. Depending on the outcome of Cyprus and its implications, we may see this indicator softening in coming months.

GBP |

|

|

|

By Chris Chandler