Brief Summary:

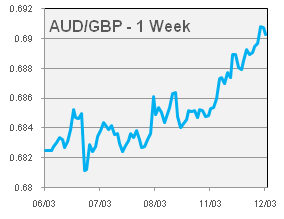

- The AUD hits a record high against the GBP of 0.6954 after U.K manufacturing data disappoints and anticipation further monetary easing increases.

- The U.S. released strong employment numbers for February leading to broad USD strength; discussed in detail below.

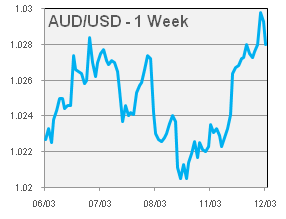

- The AUD has gained about a cent against the USD from Monday’s low of 1.0205, ahead of Australian employment data tomorrow at 11:30am. 9,500 jobs are expected to have been added in February, though the number of full-time jobs will be the crucial metric which declined for the last few months. The unemployment rate is expected to be 5.5%, up from 5.4% last month.

- The Reserve Bank of New Zealand will meet tomorrow to set the benchmark interest rate. It is expected to be held at 2.50%, though some are expecting a more hawkish accompanying statement that may lend the NZD support.

- Australia’s Trade Balance was released on Thursday with the deficit widening to 1.06 billion. The decline was much worse than the expected 0.51 billion, but was mostly due to seasonal factors and extraordinary weather events. Iron ore export volumes fell by 15-19% and coal export volumes fell 16%, undoing almost all the volume increases in December. The RBA will likely look past this figure as the market did in pricing the release.

Not the same old USD

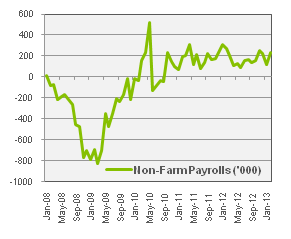

- On Friday, U.S. Non-Farm Payrolls was released, a monthly measure of the number of jobs created excluding agriculture. The figure was much better than expected at 236,000 from 162,000 expected; the strongest figure since this time last year.

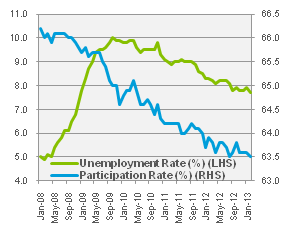

- The unemployment rate also fell to 7.7% from 7.9%, a target figure of the Fed’s asset purchase program. It is worth noting that this month’s unemployment figure included a 0.1% decrease in the participation rate as 130,000 people left the labour force. The participation rate decline has been in decline since the global financial crisis as people give up looking for work or retire. Disenfranchised workers will find it increasingly difficult to return to work when conditions improve and become a strain on the already stressed welfare system.

- The figures lead the USD stronger; the AUD fell about half a cent against it, supporting the recent trend of positive U.S. data propping up the USD.

|

|

|

|

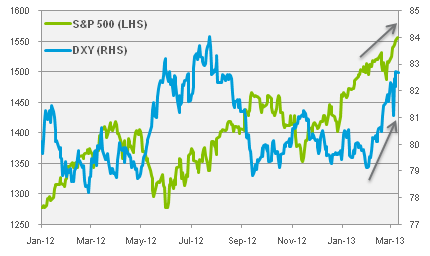

- This can be seen on the chart throughout 2012 where the U.S. Dollar Index (DXY), a trade weighted index of USD against major currencies, and the S&P 500, an equity index, move in opposite directions. It is a relationship so established it is written into textbooks.

- Since February 2013, however, this negative relationship has become positive one. This is apparent above where the DXY and the S&P 500 begin to move in the same direction. The main reason for this is the market is anticipating the wind up of quantitative easing, or the Fed’s asset purchase program. The stronger the recovery, the sooner the easy monetary conditions may end. Fed members have given loose targets like unemployment improving to 6.5% as a trigger point. However, with the participation rate declining and unemployment becoming structural, the Fed may need to look at other indicators to ensure monetary stimulus is not switched off too early.

- The recent rally in U.S. equity markets has returned some indices to their 2007 record highs, but several indicators point to U.S. shares being over-valued. According to the Economist, cyclically adjusted price-earnings ratios are 39% above their long-term average. Going forward the equities rally is likely to fade, the clincher for FX markets will be whether the current USD-equities relationship holds or reverts to the norm.

- Please see below for specific currency commentary.

USD

- U.S. retail sales data will be released tonight. Expectations are for 0.5% monthly growth, up from the 0.1% reading last month. Similar to last month’s release, the figure will give a better indication of the effects on consumption of the January 1 fiscal cliff tax increases. The figures will also test the USD relationship discussed above; strong numbers may lead the USD higher.

EUR

- On Tuesday, the German ZEW Economic Sentiment Index will be released, a survey of investors’ opinions on economic conditions. The index has made substantial gains in the last three months and currently sits at its highest level in three years. The questions will be whether these gains can be sustained given the continued bleak economic outlook for the Eurozone.

GBP

- Yesterday, the U.K released monthly manufacturing production figures that posted a 1.5% decline, shedding almost all of January’s growth. A triple dip recession looks more and more likely.

- Some further insight will be gained next Wednesday when the BoE release the minutes from its Thursday monetary policy decision. The minutes will reveal details about exactly how close the decision not to increase quantitative easing was. An increase in the number of ‘yes’ votes may weaken the Pound further.

-

The Financial Times has reported that George Osborne, the Chancellor of the Exchequer, will look to give the BoE more scope to deliver monetary stimulus by reviewing the 2% inflation target.

By Chris Chandler