Brief Summary:

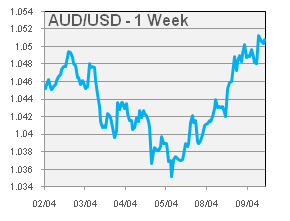

- Disappointing U.S. employment data was released last Friday causing a brief dip in risk sentiment. The AUD reached a low of 1.0367 before recovering strongly.

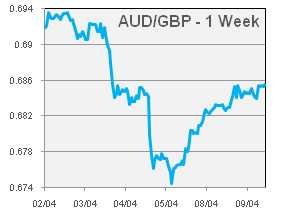

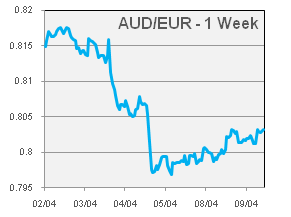

- Mario Draghi managed to calm markets at last week’s European Central Bank monetary policy meeting. Draghi provided some valuable insight into the Cypriot bail-out and called for greater Eurozone regulation. The EUR clawed back ground against most currencies.

- China released its Trade Balance for March. The unexpected deficit of 0.9 billion was the result of a 14.4% increase in exports. This caused the AUD to rally over 1.0500 against the USD.

- The Bank of Japan surprised markets last Thursday issuing an aggressive monetary policy change. The Bank moved its policy away from setting a benchmark interest rate, currently less than 0.10%, towards targeting the actual monetary base. Monetary base stimulus involves directly increasing the amount of money circulating in the economy. The monetary base is expected to be doubled to the end of 2014, in an attempt to reach an inflation target of 2%. The Yen has declined sharply across all crosses since the release. USDJPY climbed from 92.75 to 99.03, and the AUD climbed from 97.5 to 104.15; the highest level since the financial crisis in 2008. Bill Gross of PIMCO, a global investment firm, tweeted “BOJ QE is twice the size of US. 14% /GDP balance sheet expansion vs. 7%. It may not work but they will go down swinging. Sell yen.”

AUD set to soar

- Australian economic indicators showed continued improvement as Retail Sales grew by 1.3% and Building Approvals, a measure of housing and construction activity, grew by 3.1% in February. The figures support last month’s outstanding employment growth that, at first, appeared somewhat anomalous. The AUD climbed to 1.0494 as the figures remove nearly all remaining short term justification of an easing bias. The most recent monetary policy decision was virtually void of negative statements; we believe the easing bias exists solely to avoid any unnecessary appreciation of the exchange rate.

- Australian Employment figures will be released tomorrow at 11:30am. After last month’s blockbuster figure, the market is expecting a slight negative of -6,500 jobs. The unemployment figure is expected to hold steady at 5.4%. The low expectations mean even a modest growth figure may be positive for the AUD. Full-time job growth, still down on trend, will be crucial in determining underlying labour market strength. The AUD may be set to soar.

- The minutes of the most recent monetary policy decision will be released on Tuesday at 11:30pm.

Please see below for specific currency commentary.

USD

|

|

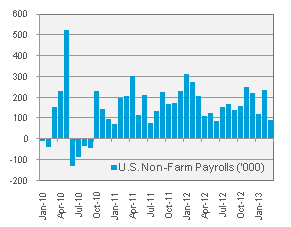

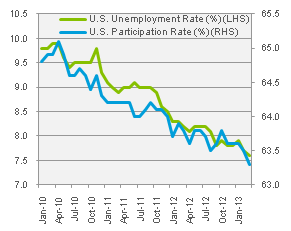

- The Federal Open Market Committee will release the minutes from last week’s monetary policy meeting. The minutes generally outline points raise by all voting and non-voting members, which have recently included concerns about the quantitative easing program. The concerns voiced in January strengthened the USD; however, this month’s soft employment figure should reduce their potency.

EUR

|

|

- Draghi reiterated strongly, “that Cyprus is not a template!” after Eurogroup President Jeroen Dijsselbloem’s unsettling slip of the tongue. He went on to comment about the bail-in of uninsured Cypriot deposit holders. He stressed that the bail-in was in essence not the problem but, “the absence of ex ante rules gives the impression of an ad hoc approach in such situations”. He said such rules should include a creditor hierarchy, similar to that in place for corporate insolvencies, but for sovereign bail outs. Such rules are currently being drafted and he urged that they be in place by 2015; the current trajectory has them finished in 2018. He also pushed the case for stricter banking supervision so that banks are “not outsizing the economy in which they reside”. The banking system in Cyprus was almost nine times its GDP in 2010.

- The Cypriot problem began in its outsized banking sector. After being bailed out by the Cypriot Central Bank, the burden of losses fell on the state. With Laiki Bank nationalised, the losses were forced up the creditor hierarchy to bondholders and finally deposit holders. Draghi’s comments regarding this were rational and logical; it was only the lack of this established hierarchy that caused fear in markets. If everybody knew what was about to happen, the process would have been much smoother. These comments regarding the bail–in managed to quell the fears that threatened to spread to other troubled Eurozone countries.