Home > blog > International Transactions > Revolut review 2025: Is it the right bank for you?

Revolut is now one of the UK’s most popular multi-currency platforms. For individuals, it delivers convenience and modern design.

For businesses, the question is more complex: can it truly support cross-border operations or do you need a platform built for trade?

This Revolut review takes an in-depth look at where the platform stands in 2025. It covers all its business features, explains how fees and exchange rates really work and outlines how your funds are protected through FSCS and safeguarding rules.

We also compare Revolut with WorldFirst so you can choose the right business account for your needs.

Key takeaways:

- Revolut suits smaller, flexible businesses: Ideal for companies handling a few currencies, that value app convenience over advanced controls

- Customer support can be slow: Users praise the app but often report delays, chat-only support and occasional account freezes during fraud checks

- Not built for high-volume global trade: Revolut lacks tools such as hedging, predictable FX rates and broad local accounts, which larger importers and exporters need

- WorldFirst is better for international business: The World Account offers free setup, transparent FX, local accounts in 20+ currencies and advanced payment tools for growing UK SMEs

Open a World Account for free today for fast, transparent international transfers.

What Is Revolut?

Revolut is a financial technology platform that provides digital banking, payments and money management services for individuals and businesses.

Founded in 2015 and based in London, Revolut has expanded to serve more than 40 million personal users and over 500,000 business customers across 35 countries.

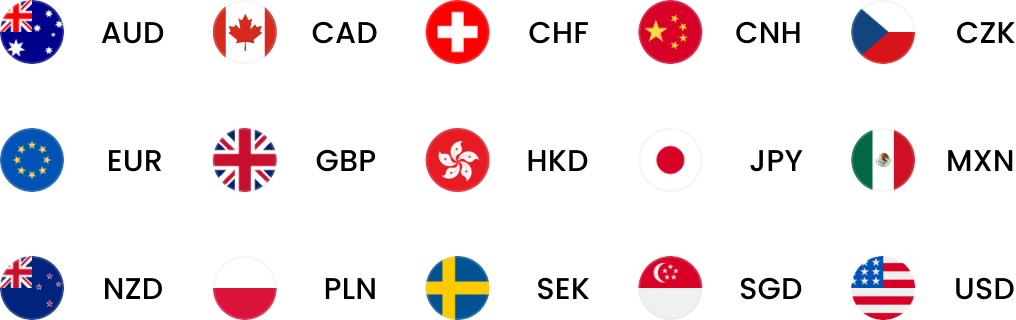

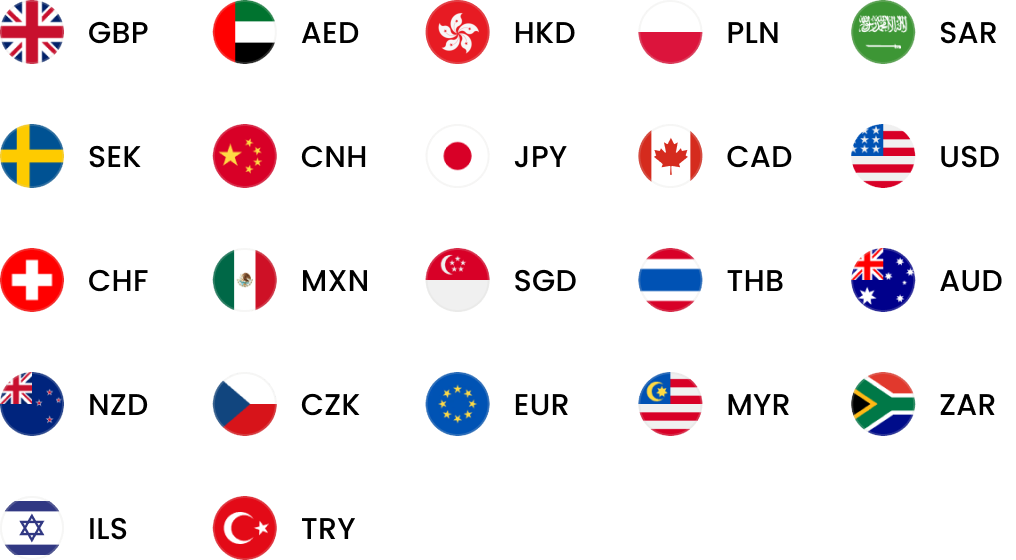

The platform offers multi-currency accounts that allow users to hold, exchange and transfer funds in over 30 currencies. It also provides debit cards, international payments, budgeting tools, savings products and investment features within one app.

Revolut aims to give users greater control over their finances by combining everyday banking and global payments in a single digital platform.

Quick look: pros and cons of Revolut Business Account

Revolut Business offers flexibility and modern tools for companies that trade or operate globally. However, it is not without limitations.

The table below summarises the main advantages and drawbacks to help you assess if it suits your business needs:

| Category | Pros | Cons |

|---|---|---|

| Currency support | Hold, send and receive in 25+ currencies, suitable for cross-border operations | Currency conversion fees apply once free monthly allowance is used; weekend FX markups may apply |

| International payments | Fast transfers with competitive exchange rates and transparent pricing | Limited number of free transfers on lower plans; SWIFT payments can include third-party fees |

| Account integration | Connects easily with Xero, QuickBooks and other accounting tools; supports invoice creation | Some integrations require higher-tier plans or manual setup |

| User experience | Modern, mobile-first design with fast onboarding and intuitive dashboards | Customer support mainly via chat, with no phone or in-person assistance |

| Regulatory protection | FCA-authorised e-money institution with safeguarded client funds | No FSCS protection for e-money accounts; only partner bank savings qualify for FSCS cover |

| Payment methods | Virtual and physical business debit cards; supports team spending and expense tracking | No cash or cheque deposits; no overdrafts or credit facilities |

| Scalability | Tiered plans allow businesses to upgrade features as they grow | Higher tiers increase monthly costs; free plan is limited in features |

| Reliability | Well-established fintech with global reach and 500,000+ business users | Some users report account freezes or compliance holds without prior notice |

Revolut Business fees: the breakdown

The following summary outlines the fees for UK businesses using Revolut Business:

| Fee type | Typical cost/allowance |

|---|---|

| Monthly account fee | £10 (Basic), £30 (Grow), £90 (Scale), Custom (Enterprise) |

| Local transfers (GBP/EUR/CHF) | 10 free (Basic), 100 free (Grow), 1,000 free (Scale), £0.20 per extra transfer |

| International transfers | £5 per transfer after free limit (Grow/Scale plans include some free) |

| Currency exchange (FX) | Free up to £1,000 (Basic), £15,000 (Grow), £60,000 (Scale); then ~0.6% markup |

| Out-of-hours/weekend FX | Approximately 1% additional markup on conversions |

| ATM withdrawals | 2% fee after plan limit |

| Additional physical cards | Over £4.99 each after included allowance |

| Payment acceptance/card processing | From 1% + fixed fee (depends on currency) |

*Revolut Business pricing checked in October 2025.

Revolut Business features

Revolut Business is designed for companies that trade or operate internationally, offering modern tools to simplify payments, manage currencies and control team spending. Its features vary by plan, but the core functionality remains focused on efficiency, visibility and global reach.

1. Account types and pricing plans

Revolut Business offers several tiers to suit different company sizes and transaction volumes:

- Basic (£10/month),

- Grow (£30/month),

- Scale (£90/month),

- Enterprise (custom pricing).

Each plan provides specific allowances for free transfers, FX volume and team members.

2. Multi-currency and international payments

Businesses can hold, receive and send payments in over 35 currencies and transfer money to 100+ countries. Revolut’s FX rates are competitive within monthly allowances, after which a 0.6% markup typically applies. Conversions made outside market hours are subject to an additional 1% weekend markup.

3. Cards, spending and expense control

Revolut provides both virtual and physical debit cards for employees, integrated with expense management tools and real-time spending analytics. Free ATM withdrawal limits vary by plan, with a 2% fee once you reach the cap. Multi-currency cards help teams manage travel and supplier payments without needing multiple accounts.

4. Integrations and automation

The platform connects with Xero, QuickBooks and other accounting software, enabling automated reconciliation and invoicing. Businesses can schedule payments, create approval workflows and issue invoices directly from the dashboard, improving visibility and reducing manual work.

5. Security and fund protection

Revolut Ltd, an FCA-authorised electronic money institution, operates Revolut Business. Client funds are safeguarded in segregated accounts and never lent or reinvested, but the FSCS does not cover them.

Savings products offered through partner banks may qualify for FSCS coverage up to the applicable limit. Security features include biometric access, instant card freeze and role-based user permissions for teams.

Pricing and potential hidden costs

Revolut’s plan pricing is transparent at first glance, but the total cost of using the platform depends on how your business transacts. Fees can vary based on plan limits, transaction timing and currency volume.

Subscription fees

Paid business plans start from £10 per month, increasing with higher allowances for transfers, FX and team members. Each tier sets its own limits, so it’s important to confirm the details before upgrading.

Weekday vs weekend FX

Currency conversions made outside market hours attract an additional 1% weekend markup. For example, exchanging funds on a Saturday to pay suppliers in US dollars or Chinese yuan may cost more than scheduling the same conversion on a weekday.

High-value exchanges

Each plan includes a monthly FX allowance. Once you exceed that threshold, additional conversions incur a 0.6% fee on the excess amount. Always check your remaining limit before initiating large transfers.

Cash withdrawals

ATM withdrawals are free within plan-specific limits, after which a 2% fee applies. Monitoring your monthly allowance in the app helps avoid unnecessary charges.

Example scenario:

A UK importer needs to pay CN¥700,000 to a supplier in China on a Saturday. Converting pounds to Chinese yuan within Revolut during the weekend would trigger the 1% weekend markup plus any plan-based FX fees. That timing alone can raise the total cost of the transfer.

To keep payments predictable, many importers schedule conversions on weekdays or use services that offer more control over rate timing and transparency.

How to open a Revolut Business account

To open a Revolut Business account in the UK, you’ll need to provide basic company details and identification for directors and owners.

Here are the steps to follow:

- Start your application on the Revolut Business website. The online sign-up takes around 10 minutes

- Enter business details, including legal entity type, company name, incorporation number, trading name and business activity

- Provide identification for all directors and beneficial owners, including a valid ID (passport or driving licence), selfie or video verification and proof of address

- Upload supporting documents like the certificate of incorporation, proof of business activity (invoices, contracts or website), ownership structure documents and registered address proof

- Submit authorisation if you’re not a director or shareholder. This can be an authorisation letter confirming your right to open the account

- Submit your application for review. Revolut usually completes verification within 1–5 working days

- Access your account once approved. You can then hold, exchange and send funds, issue cards and manage team payments directly from your dashboard

Customer feedback and reputation

Revolut enjoys strong praise for its app experience and feature set, but user feedback also raises valid concerns around support and fraud handling.

What users like:

- On Trustpilot, Revolut holds a 4.6/5 “Excellent” TrustScore, with over 280,000 reviews

- Common positives include the intuitive app interface, real-time spending notifications, budgeting tools and seamless handling of multiple currencies

- Many users cite fast international transfers and competitive FX rates as standout benefits

Where concerns appear:

- Customer support is a recurring pain point: complaints often mention slow response times or difficulty resolving complex issues via chat

- Account freezes triggered by anti-fraud systems are a frequent source of frustration. While Revolut resolves many cases quickly, some users report delays in regaining access to their funds

- Revolut leads the UK in the number of fraud and scam complaints escalated to the Financial Ombudsman Service. In 2024 alone, 3,242 APP (Authorised Push Payment) complaints were filed against it, more than any other bank or fintech

- While Revolut says it blocks large volumes of fraud, its refund practices and dispute-resolution processes have drawn criticism from users

When Revolut fits and when you might need an alternative

When Revolut is a good fit:

- Your business operates in only a few currencies and primarily accepts cards, with occasional transfers. Revolut Business supports holding and exchanging over 30 currencies and making international payments to more than 100 countries

- You prefer convenience and speed over deep financial controls. Revolut’s mobile-first design, instant payment notifications and integrated budgeting tools make it easy to manage daily activity

- Your transfer amounts are relatively small and timing is flexible. If you stay within monthly FX allowances, Revolut’s exchange rates remain competitive for most use cases

When to consider an alternative:

- You receive and pay in multiple currencies every month and need a higher FX volume limit than Revolut’s tiered plans allow

- You handle larger transaction volumes or trade across regulated markets and need faster issue resolution or dedicated account support

For many UK businesses that trade globally, Revolut is an efficient starting point. However, as payment complexity increases and the need for currency controls grows, businesses often switch to alternatives built specifically for cross-border trade.

How WorldFirst outperforms Revolut for UK companies trading internationally

If your priority is managing international business finances, it’s worth comparing WorldFirst – a UK-based fintech specialising in global payments – to see how it stacks up as an alternative or complement to Revolut.

Why UK businesses choose WorldFirst over Revolut:

Built for cross-border trade

The WorldFirst World Account helps UK businesses buy, sell and operate globally. It enables you to receive, hold, convert and pay in multiple currencies from one dashboard.

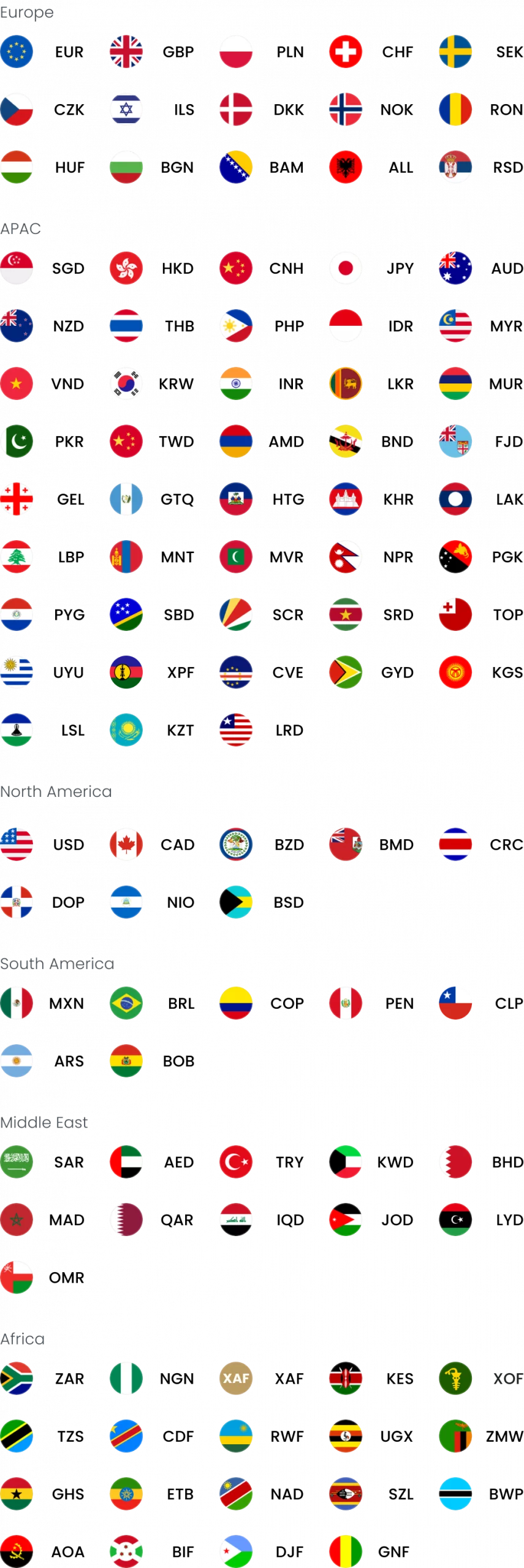

You can open local accounts in 20+ major currencies and send payments in 100+ currencies to 200+ countries, all with local banking details for easier settlements.

Opening a World Account is free, with no setup or monthly fees.

Transparent FX and control

WorldFirst offers market-based exchange rates with margins up to 0.5% for major currencies.

Businesses can also access forward contracts and rate targets to manage FX risk. Transfers are fast and fully visible, helping finance teams plan conversions and protect margins.

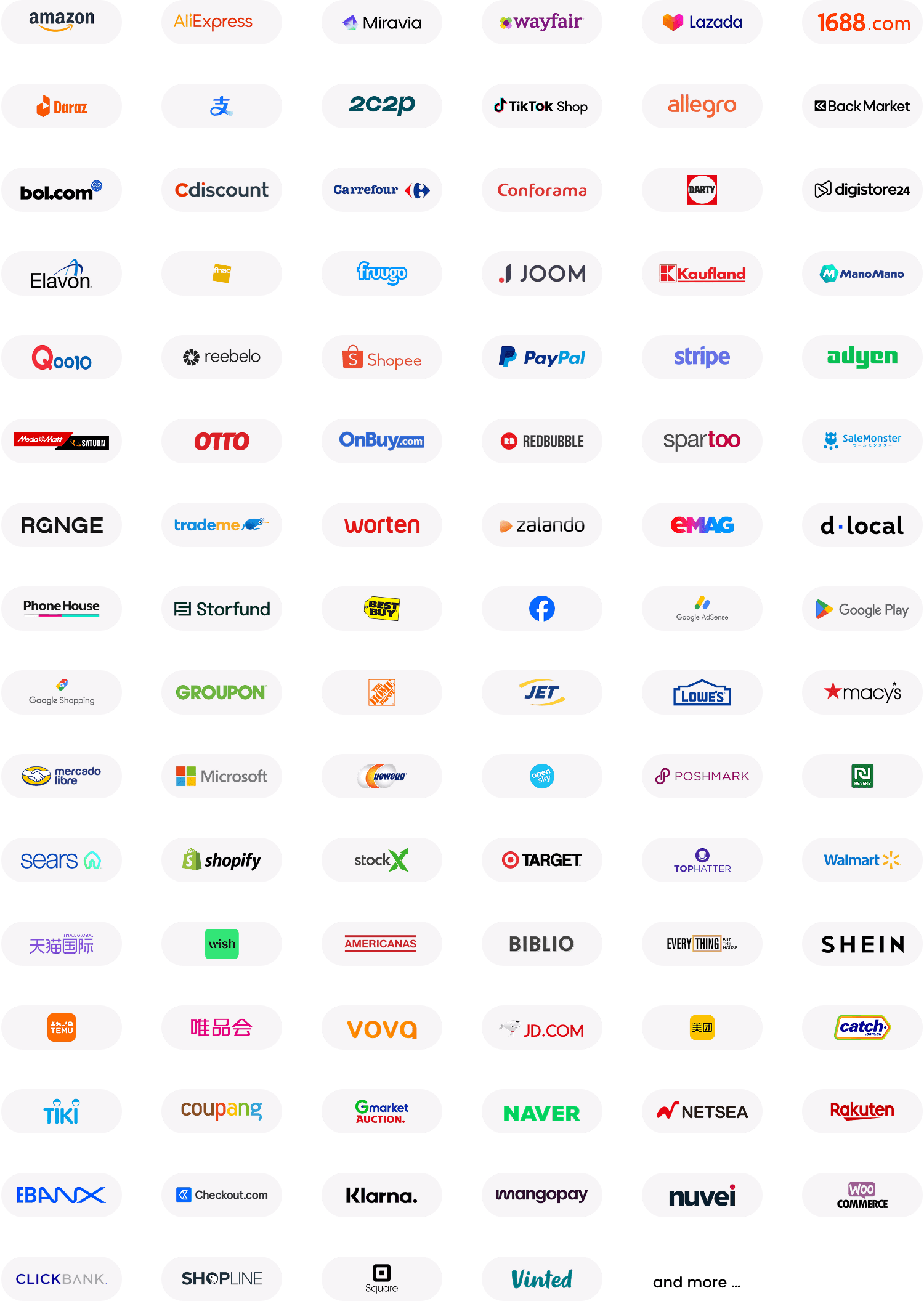

Global reach and integrations

Receive payments like a local, pay suppliers worldwide and connect to 130+ marketplaces and payment gateways, including Amazon, eBay and AliExpress. WorldFirst also integrates with Xero and NetSuite, giving seamless reconciliation and visibility across accounts.

The World Card

The World Card lets businesses spend in 150+ currencies worldwide. Transactions in the same currency as your balance have 0% FX fees and the card supports 15 major currencies for direct spending. It offers up to 1.2% cashback, no monthly fees and advanced security features, including instant freeze and 3D Secure.

Trusted, compliant and business-focused

WorldFirst is FCA-authorised and serves only business customers. Client funds remain safeguarded under UK regulations, with dedicated support ensuring reliability for SMEs and online sellers managing global cash flow.

If you’re still unsure about Revolut or WorldFirst, check out our comparison of fees:

| Feature | Revolut Business | WorldFirst |

|---|---|---|

| Monthly fee | From £10 (Basic), higher for Grow/Scale | Free |

| Multi-currency account | Included with plan | Free local accounts in 20+ currencies |

| Receiving funds | Free for local transfers; SWIFT may incur costs | Free in supported currencies |

| Holding multiple currencies | Free | Free |

| Payments to same network | Free and instant to other Revolut users | Free and instant to other WorldFirst users |

| Payments to other accounts | From £5 per international transfer | From £0.30, varies by currency |

| Currency conversion | Free within plan limit, then 0.6%; +1% weekends | Up to 0.5% for major currencies |

| Debit card | Virtual free; physical £4.99 each | Free for up to 20 cards |

*Fees checked in October 2025.

Simplify your global payments and save on FX.

Open a World Account for free today and start sending international transfers at competitive rates.

Sources:

Jennifer Dodd leads marketing for WorldFirst UK, and has over 20 years' experience in financial services and publishing.

Jennifer Dodd

Author

Continue reading

Subscribe

The Weekly Dispatch

Get the latest news and event invites. Signup for our weekly update from the worlds of fashion, design, and tech.

You might also like

Choose a product or service to find out more

E-commerce guides

Doing business with China

Exploring new markets

Business Tips

International transactions

E-commerce expansion guides

Doing business with China

The simpler way to pay and get paid

Save money, time, and have peace of mind when expanding your global business.