Best business bank accounts for foreign transactions: 9 top options

Last update: 10 Oct 2025

Most traditional business bank accounts just aren’t built for foreign transactions.

With typical accounts from high-street banks, international payment capabilities aren’t a priority feature – they’re more of an expensive add-on. As a result, you’ll be paying high transaction fees (as much as 2–4% per transfer) and poor exchange rates, and you’ll have to settle for slow transfer times too (up to six business days via the SWIFT network).

So, what’s the better option for businesses that are making payments across borders?

If international payments are a key part of your business processes, look for an account that offers you:

- Multi-currency accounts, so you can hold and transact in different currencies from a single account (without additional fees)

- Same-day transfer capabilities using domestic payment rails and local account details instead of the SWIFT network

- Transparent, competitive FX rates. Some accounts offer markups as low as 0.5–1% (vs 2–4% at traditional banks)

- Digital-first account management with real-time visibility on spending across all currencies

- Integration with international marketplaces for streamlined global e-commerce payments

In this guide, we share nine of the best business accounts for foreign transactions. We’ll start with the World Account, our multi-currency account at WorldFirst, that’s built specifically with the needs of cross-border businesses in mind.

With a World Account, businesses can hold 20+ currencies, make use of competitive exchange rates and trust that most payments will land the same day or next day.

In this guide:

- Why the World Account is the best business account for foreign transactions

- Top business accounts for foreign transactions compared

- Eight alternative business accounts for foreign transactions

Ready to enjoy simpler, faster international payments? Open a World Account for free today.

Why the World Account is the best business account for foreign transactions

Unlike most traditional banks, the World Account was built from the ground up to solve the specific challenges of business operating across borders.

At WorldFirst, we have over 20 years of experience making international payments faster and simpler for global businesses. Over that time, we’ve processed over $300 billion in payments, for over one million global businesses.

Our business World Account is designed specifically with cross-border payments in mind. Here’s why it’s the best business account for foreign transactions.

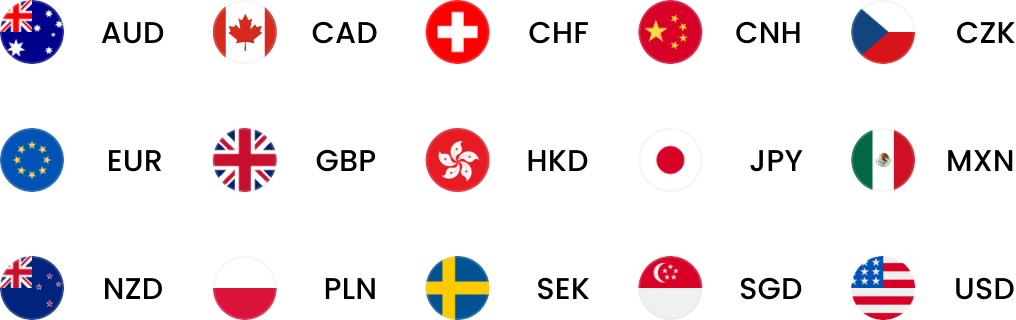

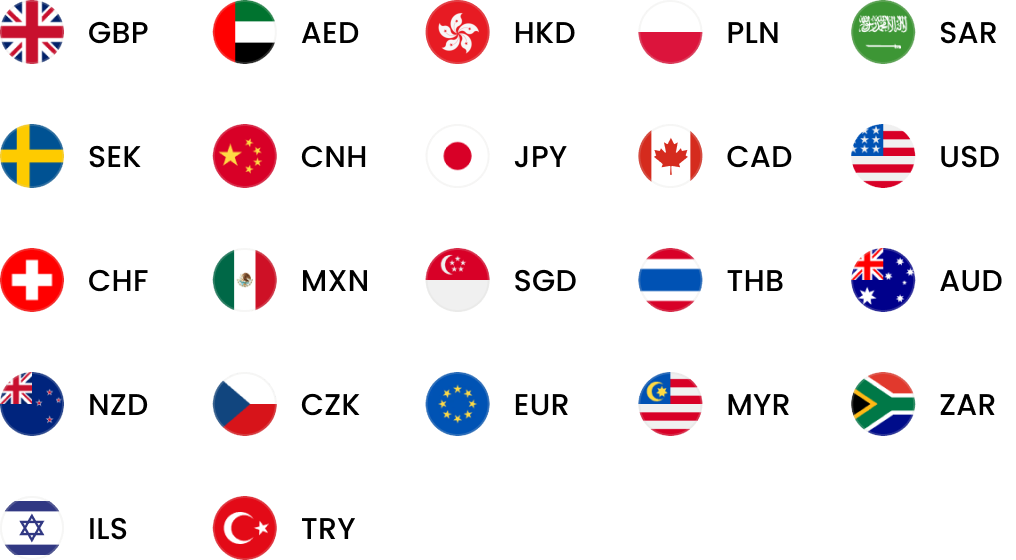

Hold 20+ currencies from a single account, for easier foreign transactions

With a World Account, you can hold and manage funds in 20+ currencies, including USD, GBP, EUR, CNH, AUD, JPY and more, all from a single platform. This way, you can pay suppliers in CNH, receive sales revenue in GBP and send money to contractors in EUR all from one place.

What’s more, you get local receiving account details for each currency – USD routing numbers, UK sort codes, EU IBANs – so you can receive payments like a local business without needing a physical presence or local business registration.

Typically, if you were doing business in different currencies, you’d need to open a separate bank account in each territory where you operate. This can require a local address, and often means you need to attend each bank in person to open an account (not to mention the maintenance fees you need to pay for each account).

With a World Account, instead, you can simply hold all currencies in one account and get real-time visibility across your entire international operation from one dashboard .

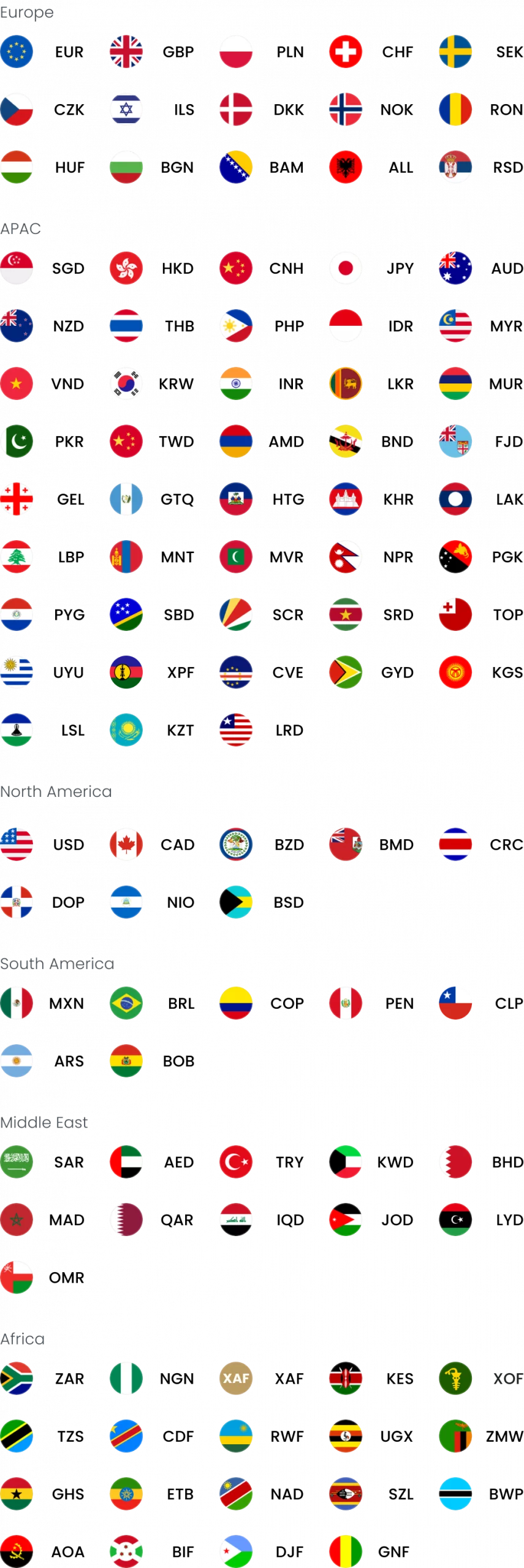

Beyond holding multiple currencies, you can also send payments in 100+ currencies to over 200 countries, giving you comprehensive global payment capabilities from a single account.

Find out more: How to choose a multi-currency business account (+ 6 options)

Make same-day transactions using local payment rails

80% of the payments you make with a World Account land on the same day. This is true whether you’re sending GBP to a local employee or SGD to Singapore.

It’s possible because we use local payment networks instead of traditional SWIFT correspondent banking chains. When you send money, the funds travel through domestic payment systems in the destination country rather than bouncing between multiple intermediary banks.

This approach means your suppliers receive funds in their domestic currency without intermediary bank deductions or delays, saving you money and ensuring suppliers get paid on time. For businesses with World Accounts in different regions, transfers between accounts are processed instantly, helping you move money efficiently across your global operations.

The ability to make payments quickly becomes particularly valuable when building supplier relationships. Faster payments often translate to better terms, priority treatment, and stronger partnerships with international vendors who appreciate reliable, quick settlement.

Access competitive FX rates that protect your margins

WorldFirst caps exchange rates at 0.50% for major currencies, compared to the 2–4% markups typically charged by traditional banks. For businesses converting substantial amounts regularly, this difference can save thousands annually on currency conversion costs.

Plus, the platform includes advanced foreign exchange tools designed for international businesses:

- Forward contracts let you lock in exchange rates for up to 24 months, protecting your budget from currency volatility when planning international purchases or managing ongoing supplier relationships.

- Firm orders provide another layer of control by automatically executing currency exchanges when the market hits your target rate. Rather than constantly monitoring currency markets or making conversion decisions under pressure, you can set your preferred rates and let us execute trades automatically when conditions are favourable.

Together, these tools help you save potentially huge sums on business payments and currency exchange.

Read more: Foreign exchange risk management: How to make international business more affordable

Make payments to China more easily than with any other platform

At WorldFirst, we’re specialists in payments to China. Today, we’re a subsidiary of Ant Group and we have close relationships with supplier platforms such as Alibaba, AliExpress and 1688.com.

Even if you don’t use these platforms, we can make payments to China much easier. Our Pay-on-Behalf-Of (POBO) service lets you pay mainland Chinese suppliers in CNH without the complexity and cost of opening a local Chinese bank account. This service handles the regulatory requirements and local banking relationships, while you simply initiate payments from your World Account.

Using local payment rails, your payments to Chinese suppliers typically settle the same day – often faster than domestic payments in other countries. This speed advantage can be crucial for securing inventory, maintaining supplier relationships, and managing cash flow in competitive sourcing environments.

Read more: Doing business in China: 5 key strategies and expert insights

Pay with World Card, for multi-currency virtual cards with zero FX fees

Another reason why the World Account is the best account for foreign transactions is the World Card.

You can issue up to 20 virtual Mastercard debit cards with zero foreign exchange fees when paying in 15 major currencies from your existing account balances. These currencies include USD, EUR, GBP, CNH, AUD, CAD, JPY and others commonly used in international business.

You can create separate cards for different expense categories – advertising spend, supplier payments, travel expenses – providing clear spending visibility and budget control across different areas of your business. Each card can have customised spending limits and controls to match your operational needs.

The cards also offer up to 1.2% cashback on eligible purchases, effectively turning routine business expenses into additional savings. Combined with the zero FX fees on major currencies, this creates a cost advantage over traditional business credit cards that typically charge 2–3% foreign transaction fees on international purchases.

Read more: How a multi-currency virtual card helps your business grow

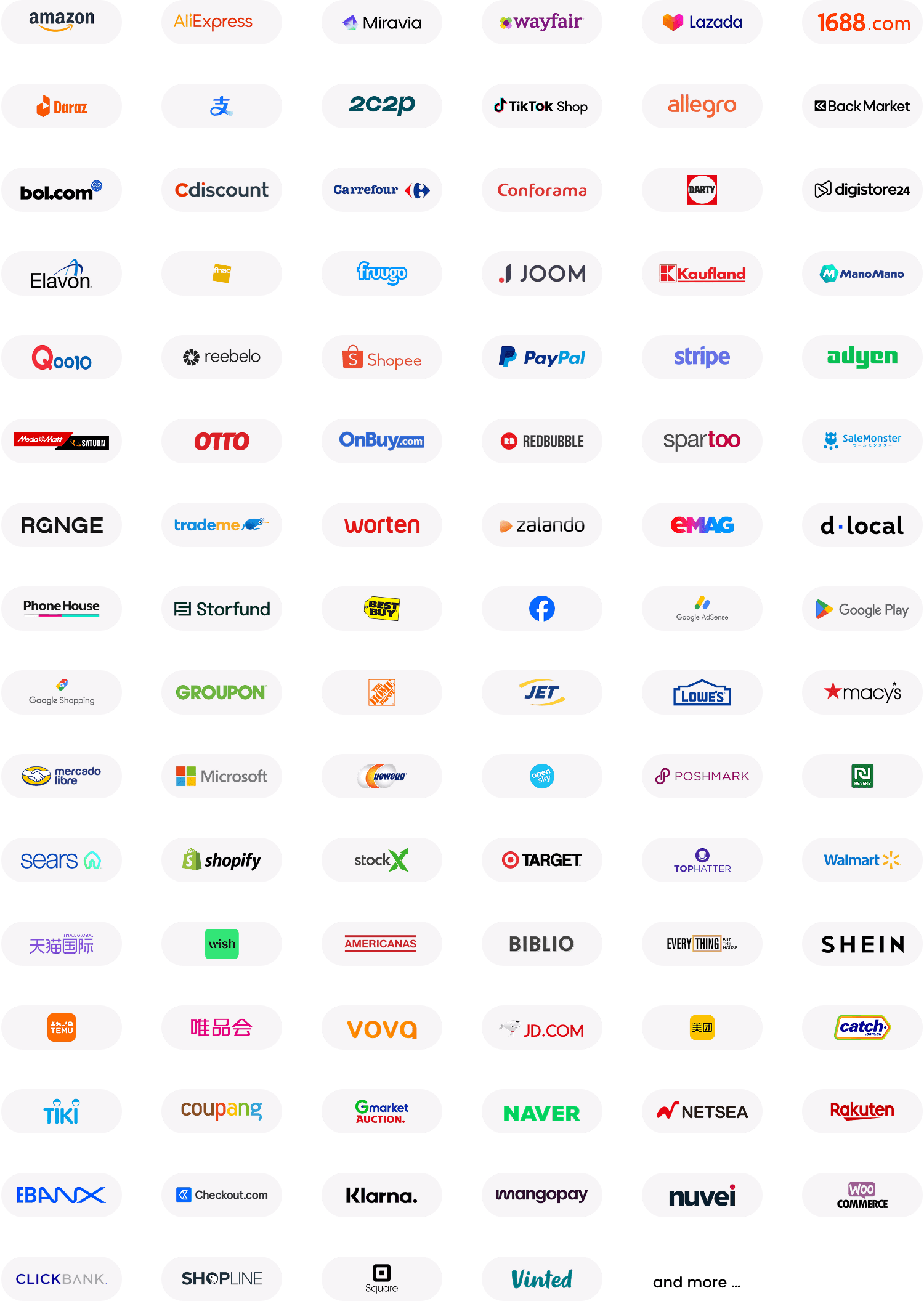

Integrate with 130+ marketplaces and payment platforms across the world

If you’re a digital business, WorldFirst can connect you directly with over 130 global marketplaces and payment platforms to make it easier to get paid online.

For instance, you can benefit from certified integration with Amazon’s Payment Service Provider Program. This enables same-day access to marketplace earnings across all global Amazon sites, rather than waiting for standard Amazon payout cycles.

Plus, WorldFirst is the only international business account provider offering direct payment integration with 1688.com, China’s leading wholesale marketplace. Our exclusive connection gives you the ability to process payments instantly to over 10 million Chinese suppliers.

The integration extends to major platforms like TikTok Shop, Etsy, Shopify, PayPal and dozens of other e-commerce and payment gateways. It means that marketplace payouts land directly in your local currency accounts, so you can avoid the forced conversions that many payment processors impose.

For e-commerce sellers operating across multiple platforms and regions, this centralised approach streamlines financial management by consolidating earnings from various sources into organised, currency-specific accounts within your World Account dashboard.

Read more: How to pick the best online business bank account (12 options)

Open a World Account for free today

If you’re ready to start sending and receiving international payments, opening a World Account couldn’t be easier.

Simply head to our sign-up page, answer some questions about yourself and your business, and submit the necessary verifying documents. Then, once we’ve checked your application, you’ll be ready to add funds and start making international transactions. Most applications are approved on the same day.

The whole process is entirely online, with no need for you to visit a branch or talk to a rep over the phone.

Top business accounts for foreign transactions compared

| Provider | Best for | Currencies you can hold | Currencies you can pay | Intl. transfer fees | FX markup / rate policy | Notable digital tools |

|---|---|---|---|---|---|---|

| WorldFirst | Scaling e-commerce & marketplace sellers needing local rails | 20+ currencies | 100+ currencies to 200+ countries | Transparent fees shown up-front | Exchange rates capped at 0.5% | Integrations with Xero, NetSuite; one account to manage all your different currencies |

| Wise Business | SMEs needing high-volume cross-border ops; freelancers | 40+ | 40+ (send to 160+ countries) | Transparent per-transfer fee shown upfront | Mid-market rate, no hidden markup; you pay a small conversion fee | Open API, batch payments, Xero/QuickBooks feeds & bill pay |

| Revolut Business | Card-led spend + payables with built-in approvals | 30+ supported account currencies | 30+ currencies to 150+ countries | Free within FX allowance; 0.6% fee above allowance; 1% weekend markup | Interbank rate within allowance; 0.6% above; +1% at weekends | Xero/QuickBooks/FreeAgent integrations; spend controls; APIs |

| HSBC Global Wallet (Business) | Established firms wanting bank-grade stack + relationship mgt | No public fixed count of supported currencies | Pay/receive/hold multiple currencies “like a local” | Fees & margin shown in-flow; standard bank international payment fees apply | FX Prompt shows mid-market and the margin before you accept | HSBCnet enterprise tools; cash-management, payables/receivables |

| Starling Business | UK SMEs wanting bank account + occasional FX | GBP + optional EUR (£2/m) & USD (£5/m) accounts | Intl. payments from GBP with local/SWIFT delivery | 0.4% conversion fee + delivery fee (e.g., SWIFT £5.50) | “Real” rate + 0.4% fee on conversions | Clean app, account switching, spaces; (multi-currency applications paused at times) |

| Barclays Business (Currency a/c + Intl. payments) | Firms already with Barclays needing currency a/cs | “Wide range” of currencies (no fixed public count) | Send EUR + ~60 other currencies to ~90 countries | Overseas bank charges £4–£12; USD cover £3; branch payment £25; tariffs updated Mar 2025 | Bank FX margin varies | Online banking/app; same-day settlement in core currencies |

| Santander Business (Currency Current Account) | Businesses needing bank currency a/cs in many currencies | 26 currencies | Intl. payments in major currencies | International payments £0–£25 depending on type; tracker for SWIFT | Bank FX margin (rates include margin; varies) | Online banking + SWIFT Payments Tracker |

| Monzo Business | Micro/SMEs prioritising app UX + light international use | Hold GBP; supports sending/receiving 40+ currencies via partnership with Wise | 40+ currencies to 70+ countries; receiving in non-GBP incurs fee | Receiving non-GBP: 1% (cap £1,000). Sending: fixed (≤£9) + variable 0–1.8% | Monzo advertises “real exchange rate” | App-first; Xero/FreeAgent/Sage feeds; expense receipt-sync |

| Tide Business | UK micro-SMEs needing simple EUR SEPA & basic tools | Primarily GBP; SEPA EUR payments supported (no true multi-currency wallet) | EUR (SEPA) + GBP; foreign-currency card spend allowed | SEPA: 20p each on free plan; free on paid plans (allowance). FX card fees 2.75% on free plan | FX markup on card spend 2.75% (free plan); paid plans remove this fee | Integrations with Xero/QuickBooks/Sage/FreeAgent; in-app invoicing |

| Provider | Best for | Currencies you can hold | Currencies you can pay | Intl. transfer fees | FX markup / rate policy | Notable digital tools |

|---|---|---|---|---|---|---|

| WorldFirst | Scaling e-commerce & marketplace sellers needing local rails | 20+ currencies | 100+ currencies to 200+ countries | Transparent fees shown up-front | Exchange rates capped at 0.5% | Integrations with Xero, NetSuite; one account to manage all your different currencies |

| Wise Business | SMEs needing high-volume cross-border ops; freelancers | 40+ | 40+ (send to 160+ countries) | Transparent per-transfer fee shown upfront | Mid-market rate, no hidden markup; you pay a small conversion fee | Open API, batch payments, Xero/QuickBooks feeds & bill pay |

| Revolut Business | Card-led spend + payables with built-in approvals | 30+ supported account currencies | 30+ currencies to 150+ countries | Free within FX allowance; 0.6% fee above allowance; 1% weekend markup | Interbank rate within allowance; 0.6% above; +1% at weekends | Xero/QuickBooks/FreeAgent integrations; spend controls; APIs |

| HSBC Global Wallet (Business) | Established firms wanting bank-grade stack + relationship mgt | No public fixed count of supported currencies | Pay/receive/hold multiple currencies “like a local” | Fees & margin shown in-flow; standard bank international payment fees apply | FX Prompt shows mid-market and the margin before you accept | HSBCnet enterprise tools; cash-management, payables/receivables |

| Starling Business | UK SMEs wanting bank account + occasional FX | GBP + optional EUR (£2/m) & USD (£5/m) accounts | Intl. payments from GBP with local/SWIFT delivery | 0.4% conversion fee + delivery fee (e.g., SWIFT £5.50) | “Real” rate + 0.4% fee on conversions | Clean app, account switching, spaces; (multi-currency applications paused at times) |

| Barclays Business (Currency a/c + Intl. payments) | Firms already with Barclays needing currency a/cs | “Wide range” of currencies (no fixed public count) | Send EUR + ~60 other currencies to ~90 countries | Overseas bank charges £4–£12; USD cover £3; branch payment £25; tariffs updated Mar 2025 | Bank FX margin varies | Online banking/app; same-day settlement in core currencies |

| Santander Business (Currency Current Account) | Businesses needing bank currency a/cs in many currencies | 26 currencies | Intl. payments in major currencies | International payments £0–£25 depending on type; tracker for SWIFT | Bank FX margin (rates include margin; varies) | Online banking + SWIFT Payments Tracker |

| Monzo Business | Micro/SMEs prioritising app UX + light international use | Hold GBP; supports sending/receiving 40+ currencies via partnership with Wise | 40+ currencies to 70+ countries; receiving in non-GBP incurs fee | Receiving non-GBP: 1% (cap £1,000). Sending: fixed (≤£9) + variable 0–1.8% | Monzo advertises “real exchange rate” | App-first; Xero/FreeAgent/Sage feeds; expense receipt-sync |

| Tide Business | UK micro-SMEs needing simple EUR SEPA & basic tools | Primarily GBP; SEPA EUR payments supported (no true multi-currency wallet) | EUR (SEPA) + GBP; foreign-currency card spend allowed | SEPA: 20p each on free plan; free on paid plans (allowance). FX card fees 2.75% on free plan | FX markup on card spend 2.75% (free plan); paid plans remove this fee | Integrations with Xero/QuickBooks/Sage/FreeAgent; in-app invoicing |

8 alternative business accounts for foreign transactions

1. Wise Business

Wise offers a transparent and flexible international business account. You can hold and convert more than 40 currencies, and pay out in those currencies to over 160 countries.

Transfer fees are shown upfront and vary slightly by currency and method, but they are generally lower than traditional banks. Importantly, Wise uses the real mid-market exchange rate without hidden mark-ups, and simply adds a small conversion fee.

Wise’s digital tools are strong: you get batch payments functionality, and seamless integrations with accounting platforms like Xero and QuickBooks. There’s also in-app bill payment.

Wise is best suited for small and medium businesses that need to send or receive high volumes of cross-border payments, or freelancers not requiring advanced FX management tools.

2. Revolut Business

Revolut Business supports 30+ account currencies, letting you hold balances and pay out to over 150 countries.

International transfers are free within your monthly FX allowance, but after that, Revolut charges a 0.6% fee. There is also a 1% markup at weekends. They use the interbank rate during the week (within allowances), which keeps FX competitive.

Revolut’s digital tools include integrations with Xero, QuickBooks, and FreeAgent, spend controls, virtual cards, and developer APIs.

This account is particularly well-suited for businesses that combine international payments with card-led team spending, and want built-in approval flows.

3. HSBC Global Wallet

HSBC Global Wallet is a multi-currency facility built into HSBCnet, allowing you to hold, pay, and receive funds in multiple currencies.

While HSBC doesn’t publish a fixed number of supported currencies, it’s designed for companies with global trade needs. International transfer fees are in line with typical bank charges – which will be higher than platforms like WorldFirst – but HSBC shows you the exchange margin alongside the mid-market rate before you confirm a transaction.

Digital tools revolve around the HSBCnet ecosystem, which includes cash management, payable/receivable solutions, and enterprise reporting.

HSBC Global Wallet is best for established firms that value bank-grade infrastructure, relationship management and integration with broader corporate services.

4. Starling Business

Starling Bank lets you hold balances in GBP, EUR (for £2/month), and USD (for £5/month).

International payments can be sent from GBP accounts via local and SWIFT rails. Starling charges a 0.4% FX conversion fee on top of the live market rate, plus a small delivery fee (for SWIFT, typically £5.50).

The bank’s mobile and online banking platforms are user-friendly, with budgeting “Spaces”, real-time notifications, and straightforward FX features.

Starling is best suited for UK SMEs that primarily operate in GBP but need occasional, competitively priced international transfers.

5. Barclays Business (Currency Accounts + International Payments)

Barclays offers a range of foreign currency accounts, though it doesn’t publicly state the full number of supported currencies. Barclays’ digital platform includes online business banking and same-day settlement in key currencies.

Payments can be made in EUR and around 60 other currencies to 90+ countries. Transfer fees range from £4–£12 for overseas charges, with additional charges for USD cover (£3) or in-branch services (£25).

FX conversions include a bank margin, which varies depending on the transaction.

This option will be most attractive to companies already banking with Barclays who need reliable international facilities within their existing relationship.

6. Santander Business (Currency Current Account)

Santander’s business currency account lets you hold balances in 26 different currencies. You can make international payments in major currencies, and fees vary depending on the service: £0–£25 depending on type and delivery.

FX rates include a bank margin, and Santander provides a SWIFT payments tracker for visibility. The account links directly into Santander’s digital banking services.

This is a strong option for businesses that need access to a relatively wide set of currencies and value Santander’s infrastructure.

7. Monzo Business

Monzo Business accounts are primarily GBP accounts, but the bank has partnered with Wise to enable payments in 40+ currencies to 70+ countries.

Receiving international payments in non-GBP incurs a 1% fee (capped at £1,000), and sending costs a fixed fee (up to £9) plus a variable fee up to 1.8%.

Monzo uses the real exchange rate and displays all fees clearly. Its digital experience is excellent, with app-first design, Xero, FreeAgent and Sage integrations, and receipt-matching for expenses.

Monzo suits microbusinesses and SMEs that prioritise app usability and need occasional international payments.

8. Tide Business

Tide’s international features are more limited. You can primarily hold GBP, but Tide supports SEPA euro transfers and allows card spending in foreign currencies. SEPA payments cost 20p each on the free plan (or free within allowances on paid plans). FX card transactions carry a 2.75% markup on the free plan, which is waived on higher tiers.

Tide integrates with Xero, QuickBooks, Sage, and FreeAgent, and has strong in-app invoicing features.

It’s best for UK micro-SMEs that only need basic euro payments (e.g., to suppliers in the EU) and simple bookkeeping support, rather than a full multi-currency wallet.

For the best business account for international payments, choose WorldFirst

If you’re in the market for a business account specialising in foreign transactions, there’s no need to look any further than WorldFirst.

Our World Account allows you to hold 20+ currencies and make payments in 100+ more. Whether you’re paying overseas suppliers or receiving funds from international sales, our business account can support you.

It couldn’t be simpler to open an account. Get started today. Open a World Account online for free.

Sources

https://wise.com/gb/blog/manage-currencies-in-one-account

https://wise.com/gb/pricing/business

https://wise.com/gb/business/api

https://help.revolut.com/help/receiving-payments/currency-exchanges/which-currencies-can-i-exchange-and-keep-in-my-account/business/

https://help.revolut.com/business/help/receiving-payments/currency-exchanges/allowance-of-fx-at-interbank-rate/

https://help.revolut.com/help/receiving-payments/currency-exchanges/business-exchange-rate-for-my-cash-withdrawal-is-wrong/business/

https://www.revolut.com/business/integrations/

https://www.business.hsbc.uk/en-gb/products/hsbc-global-wallet

https://www.business.hsbc.uk/en-gb/corporate/insights/managing-cash-flow/take-the-driving-seat-on-overseas-payments

https://www.business.hsbc.uk/corporate

https://www.starlingbank.com/business-account/multi-currency/euro-business-account/

https://help.starlingbank.com/business/topics/sending-and-receiving-money/how-much-does-it-cost-to-make-an-international-payment/

https://www.starlingbank.com/business-account/multi-currency/

https://www.barclays.co.uk/current-accounts/foreign-currency-account/?SEGMENT=PublicBusinessHub&

https://www.barclays.co.uk/ways-to-bank/international-payments/

https://www.barclays.co.uk/business-banking/business-abroad/foreign-currency-accounts/

https://www.santander.co.uk/content/dam/sites/santander-uk-cb/resources/documents/international/international_current_account_tariff.pdf

https://www.santander.co.uk/business/support/payments/making-international-payments

https://www.santander.co.uk/personal/support/current-accounts/making-international-payments

https://www.santander.co.uk/corporate/solutions/global/global-payments-and-receipts

https://monzo.com/business-banking/features/international-payments

https://monzo.com/legal/files/fee-information/version-1-9/fee-information-version-1-9.pdf

https://monzo.com/business-banking/features/integrated-accounting

https://www.tide.co/features/international-payments/

https://www.tide.co/blog/tide-update/sepa-payments-with-tide/

https://www.tide.co/support/joining/what-is-tide/how-much-does-tide-cost/

https://www.tide.co/support/features/tide-accounting/accounting-software-integrations/

Overseas business bank accounts: 4 options compared

It’s often a challenge for UK companies to open business bank accounts overseas. In this guide, we share how a multi-currency account can solve that problem.

Feb / 2026

Virtual US debit card for non-residents: Key features and a top option

Virtual debit cards make it easy to segment your spending and make your transactions more secure. In this guide, we share top US options for non-residents.

Feb / 2026

How to pay overseas contractors safely, quickly, and affordably

If you’re working with contractors in all corners of the world, you’ll need a way to manage them all in one place. In this guide, we share some options.

Feb / 2026WorldFirst articles cover strategies to mitigate risk, the latest FX insights, steps towards global expansion and key industry trends. Choose a category, product or service below to find out more.

- Almost 1,500,000 businesses have sent US$500B+ around the world with WorldFirst and its partner brands since 2004

- Your money is safeguarded with leading financial institutions