Home > blog > e-Commerce & Online Sellers > Multi-currency e-commerce: Guide for global businesses

Global e-commerce offers an enormous opportunity. Just in 2024, worldwide online retail (B2C) sales reached about USD 6 trillion, greater than the GDP of Germany.

Yet managing multiple currencies can feel overwhelming. Unstable exchange rates, extra fees, complex reconciliations and local regulations threaten margins. This tension can make businesses wonder if global expansion is worth it.

The good news is that multi‑currency e-commerce lets you offer local pricing and checkout, collect earnings in local currencies and convert or pay in the way that maximises profits.

This guide walks you through multi-currency e-commerce in direct terms, points out where businesses usually lose money and shows how a well-chosen multi-currency account can keep more of that cash in your pocket.

Key takeaways:

- Local pricing boosts conversions: Shoppers are far more likely to buy when prices are shown in their own currency. Nearly half of consumers abandon checkout if local payment options are missing, making multi-currency pricing a direct driver of sales.

- Margins depend on strategic currency management: Forced or repeated conversions eat into profits. By holding and converting funds only when it makes sense, businesses can reduce FX (foreign exchange) losses and keep more of their revenue.

- Cash flow improves with local settlement: Traditional cross-border transfers are slow and costly. Receiving payments in local currencies speeds up settlement, helping businesses reinvest faster and cover expenses without delays.

- Scaling globally requires more than currency: As cross-border e-commerce grows, customers also expect local checkout experiences. Ignoring this can hold back international expansion.

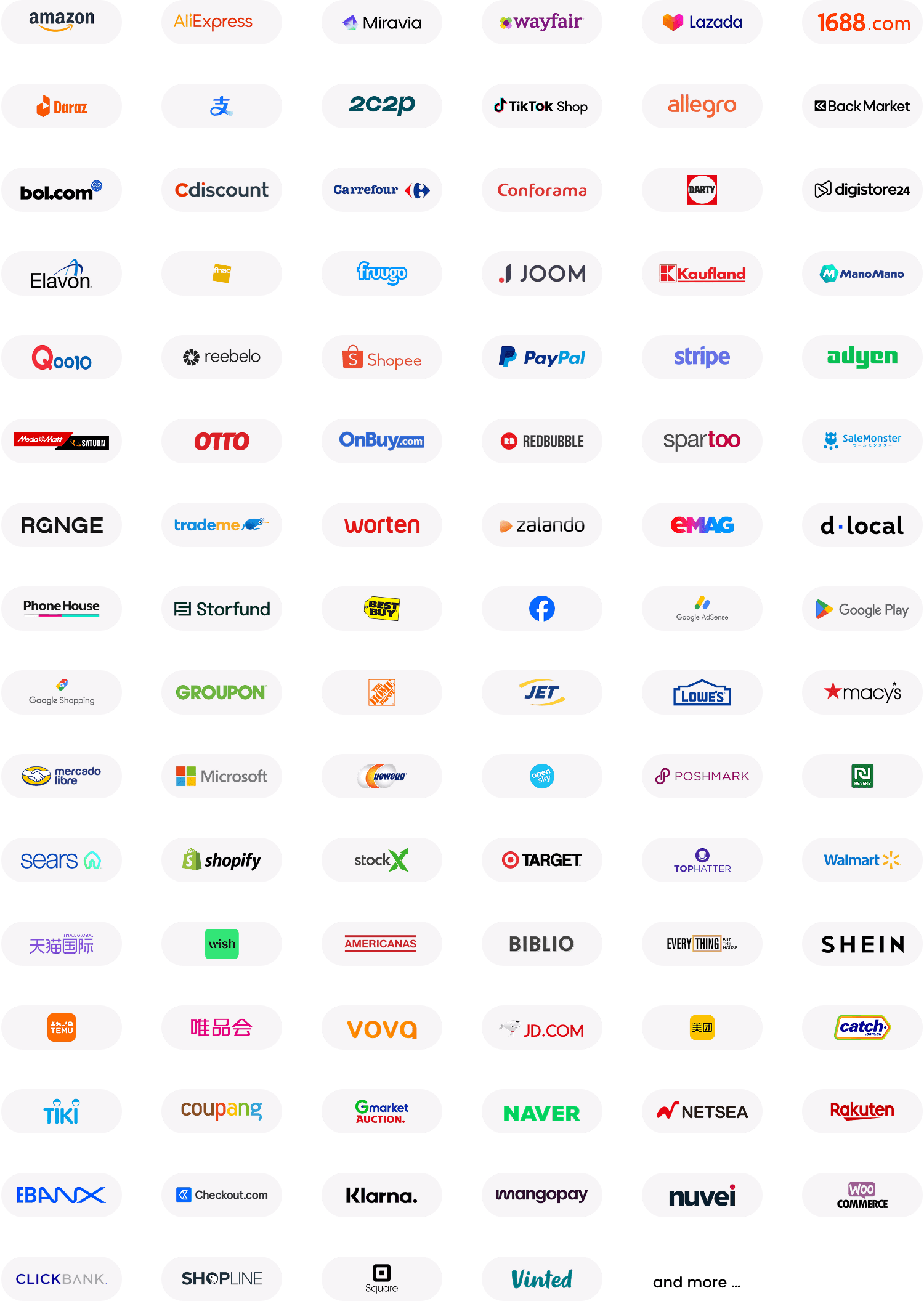

- WorldFirst simplifies multi-currency e-commerce: With local receiving accounts, competitive FX, global payments, risk management tools and direct integrations with 130+ marketplaces, WorldFirst provides local accounts, competitive FX, global payments and marketplace integrations to support international growth.

What is multi-currency e-commerce?

Multi-currency e-commerce enables the presentation of prices in customers’ own currency, seamless payment acceptance and the management of complexity in holding, converting and paying across multiple currencies on the back end.

Two essential components define it:

1. Multi-currency pricing

The customer-facing element involves showing and charging in local currency at checkout. This approach creates a smoother experience, builds trust and gives buyers greater confidence in completing their purchase.

The operational foundation lies in accounts that allow you to receive, hold, convert and pay in several currencies without being forced into repeated foreign exchange transactions that erode margins. Businesses gain control over when and how to exchange funds, making international sales and supplier payments more cost-efficient.

Why multi-currency matters for global e-commerce

Modern customers expect local currency pricing and payment options. Studies show that 59% of global shoppers buy from overseas businesses at least sometimes and offering local currency can boost sales and trust.

Based on predictions, global payments will increase from about USD 190 trillion in 2023 to USD 290 trillion by 2030, reflecting the rapid expansion of international transactions.

Why global businesses need multi-currency e-commerce

1. Higher conversion and trust

Displaying prices in local currency removes uncertainty and avoids surprise fees.

In a survey of US and UK consumers, 49% said they would abandon a purchase if they could not use a payment option local to them.

2. Protected margins

Multi-currency accounts let businesses choose when to convert funds, reducing losses from volatile exchange rates.

With digital payment volumes expected to double to USD 33.5 trillion by 2030 the cost of unmanaged conversion fees will only grow.

3. Faster cash flow

Traditional cross‐border transfers often come with long delays and extra banking intermediaries.

Receiving funds locally and using faster payment rails gives businesses quicker access to cash so they can reinvest and cover expenses without delays.

4. Scalable global expansion

Cross-border sales are increasing every year. Localised pricing and payment options are critical today for brands that want to compete internationally.

How to implement multi-currency e-commerce into your system

Building a smooth multi-currency strategy involves several steps.

Here is a step-by-step approach:

1. Enable localised checkout to build trust

Start by ensuring your online store or marketplace can display and accept payments in the customer’s local currency.

Configure your e-commerce platform to automatically detect location or allow shoppers to choose their preferred currency, such as USD, GBP or EUR. Beyond showing prices, you should also enable local payment methods (regional cards, wallets and bank transfers such as iDEAL in the Netherlands, Sofort/Klarna in Germany, or Bancontact in Belgium).

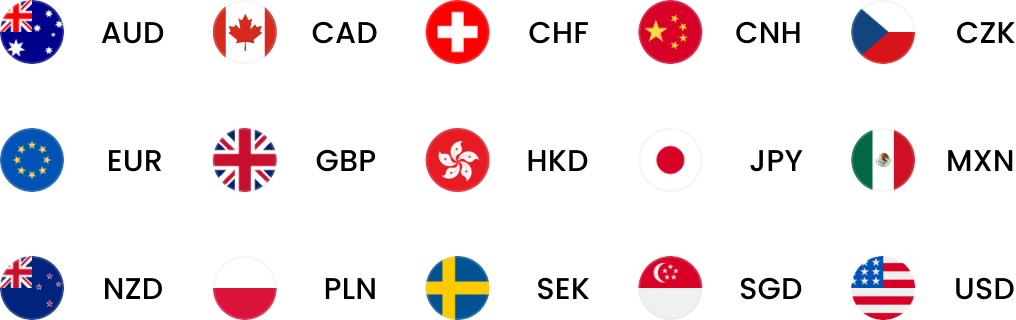

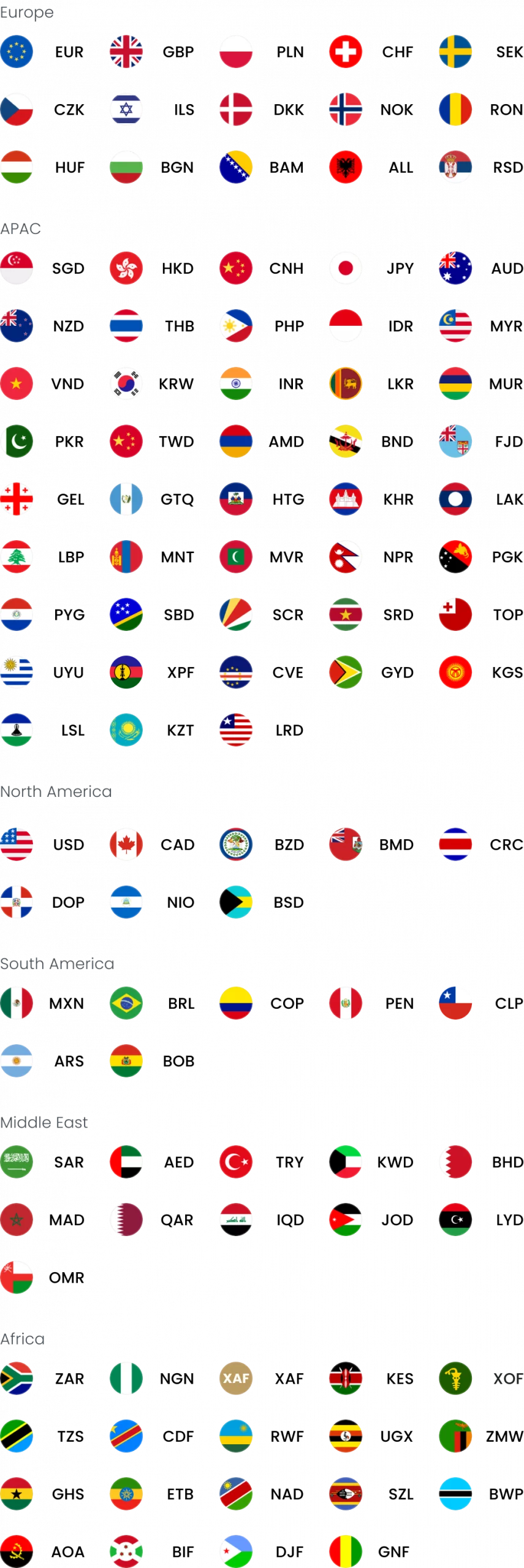

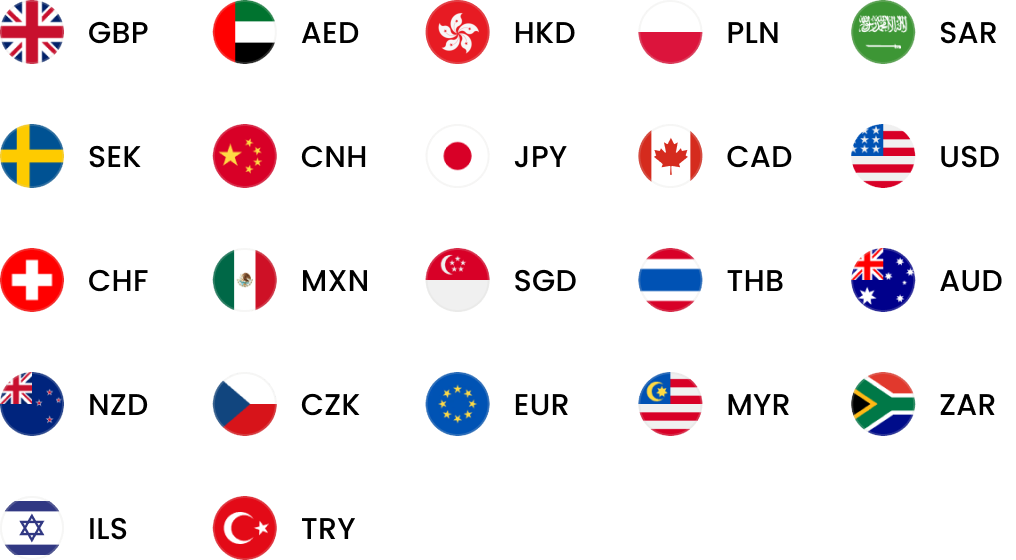

Pro tip: WorldFirst provides local receiving account details in 20+ major currencies, often without requiring a local address. You can collect payments from marketplaces using those local accounts, which helps reduce conversion costs and makes the experience feel local.

2. Open multi-currency accounts to hold and use funds

Create dedicated receiving accounts for each primary market you serve. This means that if you sell in the United States, you receive USD into a USD account and if you sell in Europe, you receive EUR into a EUR account.

Instead of being forced into expensive auto-conversions, you can hold those currencies and decide later how to use them.

Pro tip: With a World Account, you can collect from 130+ marketplaces/payment platforms directly into those local currency accounts.

3. Convert currency strategically with competitive FX rates

When you do need to convert funds, avoid relying solely on your bank or default payment processor, since spreads and hidden charges can erode margins.

Choose a platform that offers transparent, low-cost FX and consider converting in bulk to secure better rates. If your business has predictable inflows, forward contracts or scheduled conversions can help you protect against rate swings.

Pro tip: Review upcoming invoices or supplier payments 3-6 months ahead. If the costs are material, lock in a forward contract for at least part of that volume. Maintain a balance sheet of “known vs. unknown” foreign currency exposure to decide how much to hedge.

4. Manage FX risk to protect your budget

Foreign exchange risk can quietly eat into your profits if it’s unmanaged. If you anticipate needing to pay overseas suppliers monthly or expect steady foreign currency inflows, consider using tools that allow you to lock in rates in advance.

A forward contract, for example, can fix your exchange rate for up to 12–24 months, protecting your budget from sudden market movements. At a minimum, monitor live exchange rates and plan conversions strategically instead of reacting on the spot.

5. Pay suppliers directly in their local currency

A multi-currency system is not just for receiving money. It also ensures that you can pay suppliers in their local currency without double conversions.

For example, if you import goods from China, paying directly in CNY avoids costly USD–CNY–GBP hops. Setting up suppliers as payees in your multi-currency platform allows you to settle invoices locally and keep payment costs predictable.

6. Integrate multi-currency accounts with your accounting system

Accounting is often where multi-currency complexity shows up. Integrate your multi-currency accounts with your accounting software so that the system automatically tracks each balance, conversion and transaction.

Platforms like Xero or QuickBooks can invoice in 100+ currencies and automatically update exchange rates, which saves hours of manual reconciliation.

Pro tip: WorldFirst supports integrations (for example, with Xero) so that transactions, virtual card spend, receipt of local payments, conversions, etc., flow into your books more cleanly.

7. Reconcile and report regularly to optimise costs

Do not treat reconciliation as an afterthought. Make it a routine to reconcile foreign receipts with invoices and record currency gains or losses at the time of conversion.

Use dashboards to monitor exposure in each currency and track the total FX cost on your sales. Regular reviews help you identify where fees are eating into margins and where you can optimise.

Common pitfalls to avoid

Even with great tools, some mistakes can undercut your gains. Watch out for these common traps.

1. Double conversions

The quickest way to lose margin is by letting funds bounce through two conversions. For instance, getting paid in USD, converting to GBP in a UK bank, then paying a supplier in EUR means you’ve paid for two spreads.

The smarter move is to hold the USD and convert once, directly into the currency you need. With WorldFirst, you can receive USD, pay USD invoices directly or convert to EUR in a single step – skipping the unnecessary middle stage.

2. Poor timing on FX

Converting too quickly at an unfavourable rate can shave off significant profit. Exchange rates can swing 5–10% within a year and rushing conversions at the wrong time locks in those losses. The solution is to plan conversions in advance.

Use forward contracts to fix rates for future payments or set alerts to trigger conversions only when the market reaches your target level. A disciplined schedule (weekly, monthly or by threshold) helps avoid emotional, costly decisions.

3. Fragmented accounts

Managing multiple local bank accounts, PayPal balances and small FX providers creates a reconciliation headache and often hides the actual cost of fees. Consolidating into a single multi-currency account streamlines operations.

4. Ignoring local preferences

Selling internationally is not only about currency; it is also about the full checkout experience. Shoppers expect local payment methods, such as Klarna in Europe or AliPay in China and often prefer seeing checkout pages in their own language.

If you only display USD or GBP, some customers will hesitate.

5. Underutilising platform features

Finally, many businesses fail to make use of the reporting and automation tools already available.

Accounting software such as Xero and QuickBooks offer live rate updates, consolidated reports and automated reconciliation across currencies. Instead of relying on manual spreadsheets, tag each invoice with the correct currency and automate imports.

Why WorldFirst is a unified multi-currency solution

Among various fintech platforms, WorldFirst (World Account) stands out as a comprehensive multi-currency solution for e-commerce sellers and B2B traders. It explicitly serves merchants who sell on global marketplaces or import and export goods.

In this video, Cobi explains how WorldFirst empowers SMEs to manage cross-border payments with speed, security, and cost efficiency:

Key features include:

1. Local-currency receiving accounts

WorldFirst lets you open multiple local accounts online without visiting a branch. You can hold GBP, EUR, USD, AUD and more, so marketplaces like Amazon can pay you directly in the right currency.

As an official Amazon Payment Service Provider, WorldFirst supports receipts from 12+ Amazon marketplaces. Sign-up is quick and free and over 300,000 Amazon sellers already use it to bypass intermediary banks and their fees.

Why this matters: Get paid like a local, keep more of every sale and unlock markets that would otherwise be costly to enter.

2. Holding and conversion at competitive rates

Once funds are in your account, you can hold them until needed instead of converting straight away.

When you do convert, WorldFirst applies competitive real-time FX rates. You can also time conversions strategically or lock in rates in advance to protect your margins.

Why this matters: You stay in control of conversions, cut out expensive bank spreads and turn FX from a cost centre into a strategic advantage.

3. Global payments and virtual card

WorldFirst allows payments to over 200 countries from your currency balances. It offers instant supplier payments on 1688.com, plus a free virtual Mastercard (World Card) that draws on your account balance.

The card supports multiple currencies and provides up to 1.2% cashback on overseas spending in supported regions, making it useful for supplier invoices, online platforms or travel expenses.

Why this matters: Pay suppliers and expenses worldwide without friction, while earning

cashback that boosts your bottom line.

4. FX hedging tools

Forward contracts let you lock in an exchange rate for up to 24 months, shielding you from sudden currency swings.

WorldFirst offers flexible options, including fixed and window forwards, so that you can match contracts to your cash flow. A small deposit secures the rate now, with the balance settled later, giving you certainty when budgeting for future invoices.

Why this matters: Secure predictable rates, protect your profit margins and budget with confidence even in volatile markets.

5. Integrated marketplace and software connectors

WorldFirst connects with over 130 marketplaces and platforms worldwide, including Amazon, eBay, Etsy, Shopify and TikTok Shop.

You can set it as your payout method directly in Amazon Seller Central. Integration with accounting platforms like Xero makes reconciliation easier, with automatic transaction feeds and multi-currency reporting built in.

Why this matters: Sync sales, payments and accounts in one flow, saving hours of admin and eliminating reconciliation headaches.

Ready to simplify multi-currency e-commerce?

Open a World Account today and take control of how you send, receive and manage money across borders.

Shawn Ma leads business development at WorldFirst UK, with a deep expertise in fintech, risk management and cross-border commerce.

Shawn Ma

Author

Continue reading

Subscribe

The Weekly Dispatch

Get the latest news and event invites. Signup for our weekly update from the worlds of fashion, design, and tech.

You might also like

Choose a product or service to find out more

E-commerce guides

Doing business with China

Exploring new markets

Business Tips

International transactions

E-commerce expansion guides

Doing business with China

The simpler way to pay and get paid

Save money, time, and have peace of mind when expanding your global business.