Home > blog > Global Business Tips > Top online marketplaces in Germany for UK e-commerce sellers: 4 options

Germany is the largest economy in Europe, and it provides great growth opportunities for small UK businesses looking to expand abroad.

However, if you’re looking to sell in Germany, you may feel overwhelmed by the sheer volume of e-commerce platforms out there. With so many options, how do you know which ones are worth selling on?

In this article, we run through the top four online marketplaces in Germany to help you decide which is best for your business.

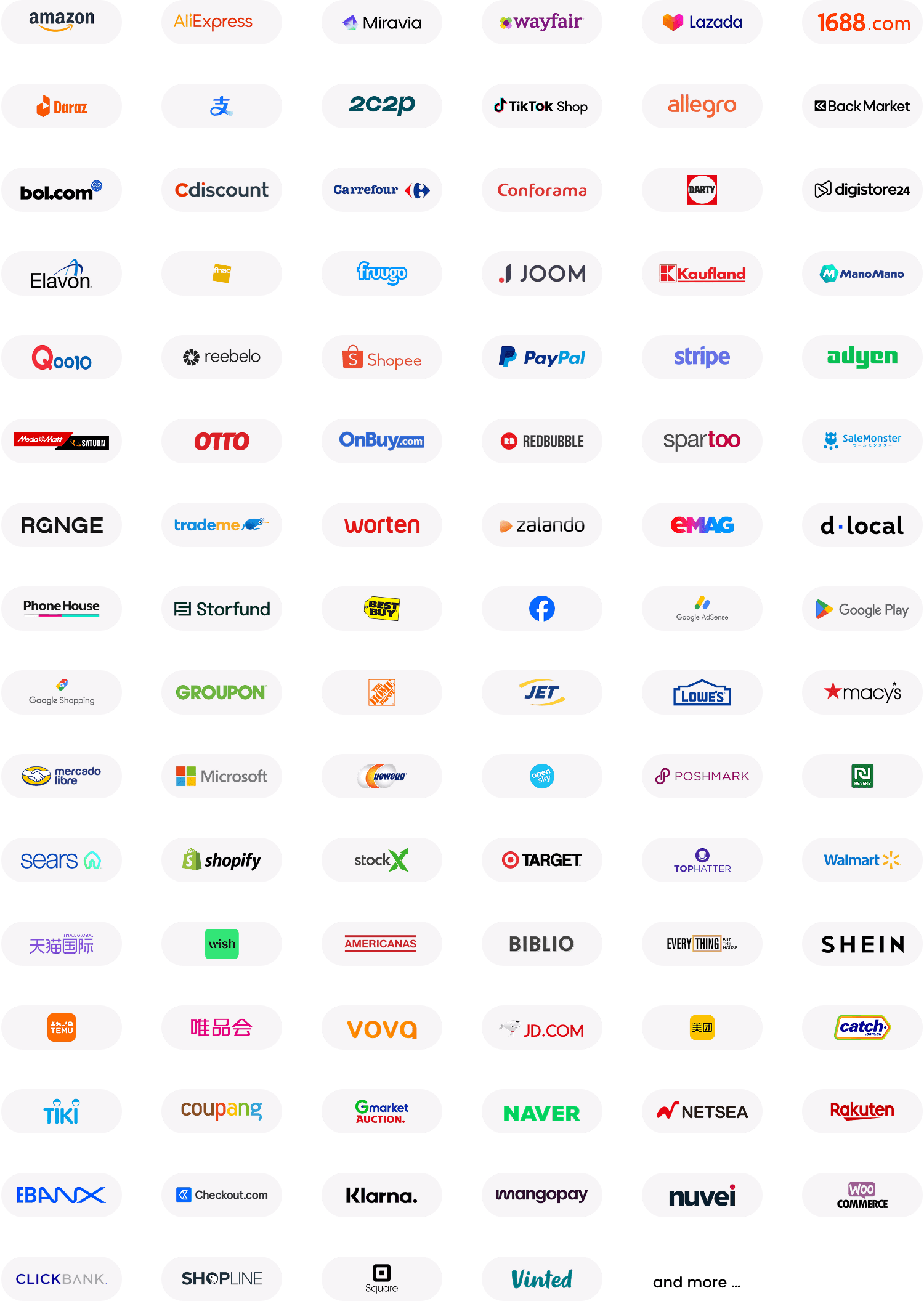

We also introduce you to WorldFirst, a global payments platform that makes it simpler for you to start selling on German marketplaces (and 130+ other e-commerce sites across the world).

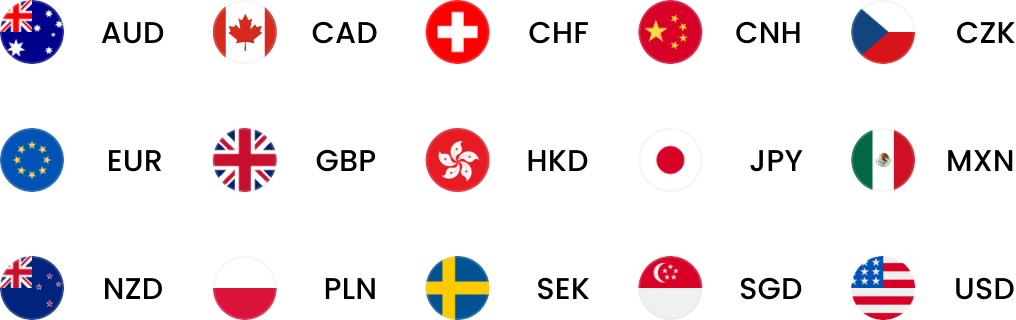

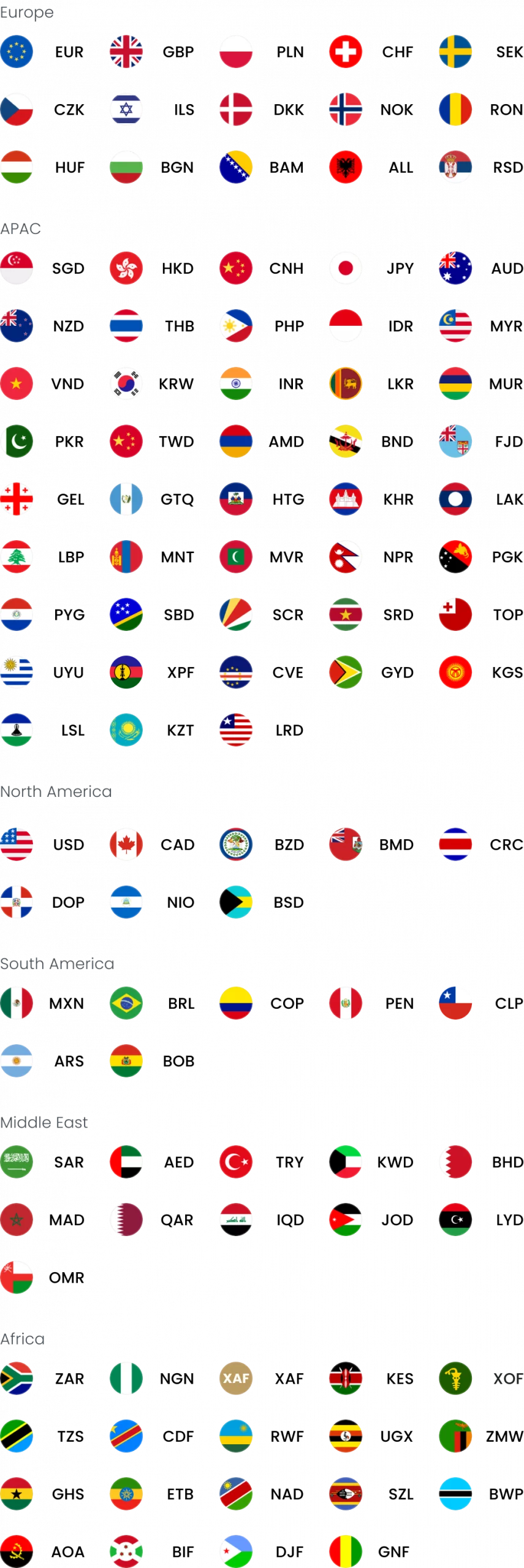

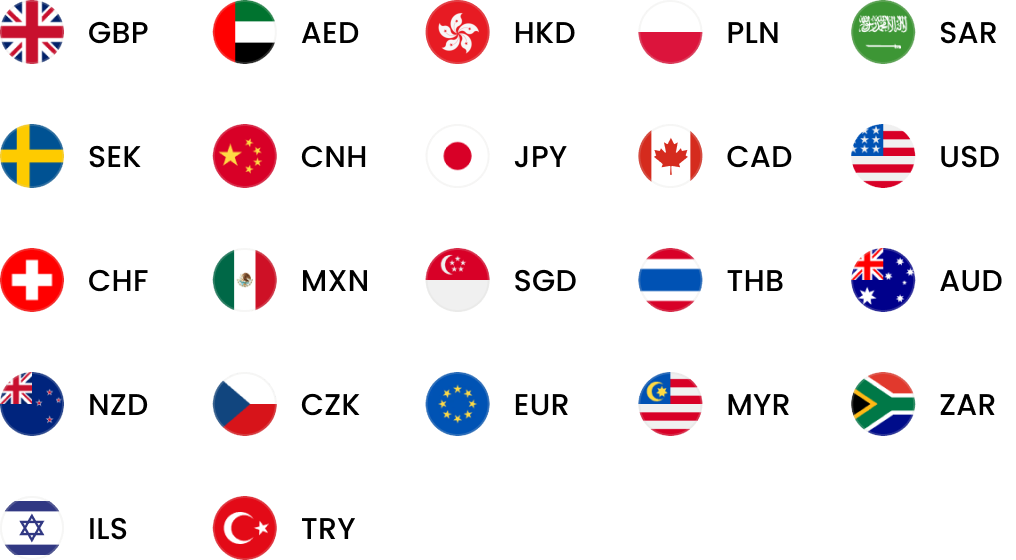

With our multi-currency World Account, you can streamline your marketplace payouts, create local account details and hold funds in EUR, GBP and 20+ other currencies.

We cover:

- 4 things UK sellers should know about German e-commerce

- 4 best e-commerce marketplaces in Germany

- How WorldFirst helps you sell to the German e-commerce market

Get started selling on German e-commerce sites by signing up for a World Account today.

Key takeaway

To sell online in Germany from the UK, businesses need to choose a German marketplace (such as Amazon.de, Otto or Zalando), comply with German VAT and customs rules, localise product listings in German, and offer preferred payment methods such as PayPal. UK sellers must also follow post-Brexit import procedures, including EORI registration and customs documentation. Once compliant, UK businesses can sell in Germany just like local merchants.

4 things sellers should know about German e-commerce

German e-commerce growth has accelerated in the past few years, with 13.4% of total purchases now made online (as of 2024). While the UK is similar in this respect, there are some key differences when it comes to selling online in Germany.

Here are four things UK businesses should be aware of when selling on German marketplaces:

- PayPal was the most popular payment method in Germany in 2023, accounting for almost 30% of all online purchases. If you’re selling to the German market, make sure that you offer PayPal (and other payment gateways) as payment methods, though most German marketplaces have a PayPal integration built in.

- Germany has strict packaging/recycling regulations that every box, label and piece of padding must follow, meaning you’ll have to join the German Packaging Register (LUCID) before you can ship any parcels. Registering is free, but you might have to pay a waste management fee depending on the type of packaging you use.

- If you’re shipping goods from the UK (or any non-EU country), there may be duties and taxes to pay. For example, excisable goods such as alcohol, tobacco and mineral oils are subject to their own taxes. Customs must approve all your imports, though once all items have been cleared and brought into Germany, they’re free to be sent anywhere in the EU without further restrictions.

- Lastly, EU importing rules have changed considerably following Brexit. Although the EU signed a free trade agreement with the UK which is now in effect, there are some significant differences importers should consider. For the most up-to-date regulations, check the official EU-UK Trade and Cooperation Agreement.

Read more: Setting up a business in Europe? Here are 5 things to think about

4 best e-commerce marketplaces in Germany

Here are the top four German e-commerce marketplaces for UK businesses:

1. Amazon.de

Launched in Germany in 1998, Amazon.de1 is a well-known international e-commerce platform with a huge product range that includes household appliances, consumer electronics, clothing, beauty products and packaged food, among others.

With a Professional Seller account, you can run promotions (including free shipping), create listings in bulk, access on-site advertising tools and manage your inventory with spreadsheets or reports.

Sending products to an Amazon warehouse can take a lot of pressure off you. They have fast deliveries and will handle your returns for you, but only if you use Fulfilment by Amazon (FBA). FBA services will cost you monthly storage fees of up to €47.45 per cubic metre.1b Alternatively, if you choose to fulfil your own orders, then you’ll be responsible for return costs.

Amazon seller fees:

- The individual selling plan is €0.99 per unit sold and the professional selling plan is €39 (excluding VAT) per month, no matter how many units you sell. Individual plans are made for sellers that sell fewer than 40 items per month1a

- Amazon charges a referral fee for each item sold. The exact amount depends on the product category, though most referral fees are between 8% and 15%

Read more: How to sell globally on Amazon (& top tips)

2. eBay.de

Launched in Germany in 1999, eBay.de2 is similar to Amazon in that it sells everything: electronics, clothing, sports equipment, furniture and more. eBay is a ‘classifieds’ platform, which means users can post short ads to buy, sell, rent or trade goods and services.

eBay’s main differentiator is that it offers both new and secondhand items for sale, so it’s a great fit for resellers. Customers can also bid on listings, which is beneficial for businesses selling rare items, since customers can bid on your offering and drive up the price. (If you sell primarily handmade items, you might benefit more on Etsy.)

When you become an eBay shop (rather than just a professional seller), you benefit from lower fees, the ability to sell items abroad at low costs, and a range of advertising tools.

eBay seller fees:

- There are three types of fees for selling items on eBay: a sales commission when your item sells, a listing fee when you create your listing, and fees for add-ons2a

- An eBay shop subscription starts at €39.952d

- The sales commission consists of a percentage of the total transaction amount, plus €0.35 per listing (for sellers without an eBay shop subscription)2b

- There’s an additional fee for certain listing options. For example, adding a subtitle to your listing costs €1.502c

Your fees and other sales costs will be automatically deducted from your sales proceeds. eBay requires you to set up a valid payment method to cover your sales costs just in case your earnings are insufficient.

3. Otto Online

OTTO3 is a German online retailer that offers a broad range of products, including fashion, electronics, garden, DIY supplies and home goods. In the 2024/2025 financial year, OTTO raised a total sales volume of €7 billion, and supported over 12.2 million active customers.3e

OTTO owns the delivery service Hermes, which lets them offer exclusive services like two-hour delivery windows for large items. It also makes their return process simple for traditionally awkward items like old appliances or hard packaging. This is a huge advantage for sellers since customers will be less reluctant to buy these large-ticket items.

However, while OTTO offers free returns for all customers, their sellers are expected to bear the burden of any return costs.3c Additionally, their commission rates are high, with figures ranging from 7% all the way up to 22% for certain product categories like jewellery.3d

To sell at OTTO, you need to meet strict requirements. This is to ensure their marketplace stays fair and high-quality, though it does make it much harder to sign up.

Here are OTTO’s seller requirements:

- You must be legally registered as a German company and have a registered office in Germany

- Your business must have its own German VAT ID – organisations with a common VAT ID won’t be approved

- Your goods must be shipped from a warehouse either within Germany or the EU

- You must offer native-level German-speaking customer service

OTTO seller fees:

- OTTO’s monthly fee is €99.90, regardless of the number of products you offer3b

- Commission fees that vary depending on the type of product you sell. For example, electronics have a 7% commission, while home decor incurs a 15% commission

4. Zalando

Launched in 2008, Zalando4 is an online fashion retailer that sells a variety of clothing and lifestyle products online, primarily clothing, shoes, and accessories. In 2024, Zalando achieved an active customer base of 51.8 million.4b

In line with their fashion offerings, they also let you list both designer and secondhand clothing options. However, your secondhand items must be in mint condition since Zalando inspects every item to ensure it meets their high quality standards.

Additionally, Zalando has a 30-day return policy which all sellers are required to meet. If you’re unable to meet these requirements within your own logistics channels, you could let Zalando handle fulfilment and shipping (including last-mile delivery) for a variable fee.4c

Sellers are unable to register interest in or sign up to sell on Zalando directly – instead, the platform will reach out to you with an offer to join the partner program.

Zalando seller fees:

- Merchants participating in the Connected Retail (service for brick-and-mortar stores to sell on Zalando) and the Zalando partner program pay €40 euros per month (€480 per year).4a

How WorldFirst helps you sell to the German e-commerce market

Many German marketplaces settle earnings exclusively in euros, which means you’ll often need an EU bank account in order to receive payouts. For UK businesses, this can be a major hurdle, since setting up with a German or European bank often requires extensive paperwork and an overseas business address.

Luckily, you can avoid this by opening an EU business account with WorldFirst instead.

WorldFirst is a digital payments platform that helps global e-commerce sellers hold, send and receive payments from worldwide markets – with no business presence in Germany required. Since 2004, we’ve helped over 1.5 million international businesses send more than US$500 billion across the globe.

With our multi-currency World Account, you get local EU account details and can use them to apply for all the German marketplaces above (and 130+ others worldwide). The account is free to open and maintain, with no initial deposits, minimum balance requirements or fees for receiving payments.

Here’s what you get when you sign up for a World Account:

Integrate with German marketplaces and streamline all your payouts into your World Account

You can integrate your World Account with multiple German marketplaces, as well as 130+ global platforms, and funnel all of your online sales directly into your World Account.

It’s an automated process, which improves your cash flow since you don’t need to manually release funds.

We allow you to integrate with multiple marketplaces at once, including all of the ones above, entirely for free. You can even integrate with marketplaces (such as Amazon) that require local banking information to process payments.

We also support integrations with third-party payment gateways like PayPal, so even if you sell online without a marketplace, you can still accommodate German buyers who prefer this payment method.

Additionally, it’s possible to integrate your World Account with third-party accounting software like Xero or NetSuite to further automate your reconciliation process.

Read more: How to choose a multi-currency business account (+ 6 options)

Create local EUR account details to make and receive same-day payments

WorldFirst lets you instantly create EU account details with unique IBANs, BICs, account numbers and routing codes.

These details allow you to make same-day payments, and it works like this. When you make a payment using your EUR account details, your transfer is sent through domestic EU payment rails like SEPA, rather than international networks like SWIFT.

This cuts out intermediary banks from your transfers, which speeds up your settlement times significantly. With WorldFirst, 80% of payments settle on the same day and 90% settle by the next day.

You can also create local account details in 20+ other currencies, including USD, GBP, CZK, PLN, CNH and AUD, among others.

Read more: How to receive international payments: 3 top methods for businesses

Pay low FX fees when converting between EUR and GBP, or avoid conversion costs entirely

You can hold EUR and 20+ other currencies in your World Account for as long as you’d like, entirely for free.

This means you don’t have to immediately convert received funds to GBP, which saves you from paying unnecessary conversion costs, especially since most German marketplaces only payout in euros. You can also wait until exchange rates are favourable before converting, or use your EUR balance to pay local suppliers, staff, or tax authorities without any international transfer fees.

If you do make an FX conversion, we add a small fee of 0.5% onto the mid-market exchange rate for major currencies (including euros and pounds), while for all non-major currencies, our FX markup is capped at 0.75%.

Read more: Receiving foreign currency? Here’s what you need to know

Create up to 50 World Cards for budgeting

Create up to 50 virtual World Cards to help manage your World Account balances. Assign cards to vendors, expenses, teams or even to individual currencies like EUR and GBP, and create budgets by setting individual payment limits for each card.

This helps you organise your currency balances and keep track of spending, which is especially important when all your earnings flow into the same account. You can even create multiple sets of euro balances.

All your cards can be managed from your World Account dashboard, so if you suspect a card has been compromised, you can freeze or delete it instantly.

This gives you protection when buying from a new platform that you aren’t familiar with – simply sign up, make your payment, then immediately delete your card. That way, you ensure no card data gets stolen.

Additionally, you’ll earn up to 1.2% unlimited cashback on your business expenditure when you spend with your World Card. We don’t limit you to certain categories or vendors, which means you’ll earn cashback from paying suppliers, shipping items or even paying platform fees.

Read more: How to get an instant virtual debit card online: Your options

Simplify international marketplace transactions with WorldFirst

In this article, we’ve shared four of the best options for cross-border businesses looking to sell to the German e-commerce market. We’ve also shared how WorldFirst can help you simplify your overseas marketplace operations.

For example, with a World Account, you can:

- Integrate with 130+ marketplace platforms and streamline all your payouts into your World Account

- Create a euro account, receive local EU bank details and make same-day payments to European suppliers

- Pay low and transparent FX fees when converting funds from euros to pounds

- Link to PayPal and other payment methods preferred by German consumers

Ready to start selling to Germany? Sign up for a World Account today.

Sources:

- https://www.amazon.de/?language=de_DE

- https://www.ebay.de/

- https://www.ebay.de/verkaeuferportal/verkaufen-bei-ebay/gebuehren-gewerblich?srsltid=AfmBOopCBBP1pskiySC486Ynsz1G9K7RhITJJN_wUV73OBTvFQrcSxqk

- https://www.ebay.de/help/selling/fees-credits-invoices/selling-fees?id=4809

- https://www.ebay.de/help/selling/fees-credits-invoices/selling-fees?id=4809#section4

- https://www.ebay.de/help/selling/fees-credits-invoices/ebay-shoppakete-und-ihre-vorteile?id=5147

- https://www.otto.de/

- https://www.zalando.de/

Shawn Ma leads business development at WorldFirst UK, with a deep expertise in fintech, risk management and cross-border commerce.

Shawn Ma

Author

Continue reading

Subscribe

The Weekly Dispatch

Get the latest news and event invites. Signup for our weekly update from the worlds of fashion, design, and tech.

You might also like

Choose a product or service to find out more

E-commerce guides

Doing business with China

Exploring new markets

Business Tips

International transactions

E-commerce expansion guides