5 best digital banks in Singapore 2026: Top picks compared

Last update: 12 Dec 2025

Singapore has become one of Asia’s most active hubs for digital banking innovation. Supported by the Monetary Authority of Singapore’s (MAS) digital banking framework, new providers are giving customers more control over their money than ever before.

For business owners, it comes down to choosing a digital bank that actually delivers more: better account features, fairer fees, stronger currency options and practical lending support.

The goal of this guide is to help you navigate those choices.

We’ll review the best digital banks in Singapore in 2026, how each one operates and what sets them apart from traditional financial institutions.

You’ll also see where a specialised global payments solution like the WorldFirst’s World Account can give your business even greater flexibility for cross-border transactions.

Key takeaways:

- Digital banks in Singapore are reshaping local banking: New MAS-licensed digital banks such as GXS, MariBank, ANEXT and GLDB now provide fast, mobile-first accounts with lower fees, daily interest and easier onboarding

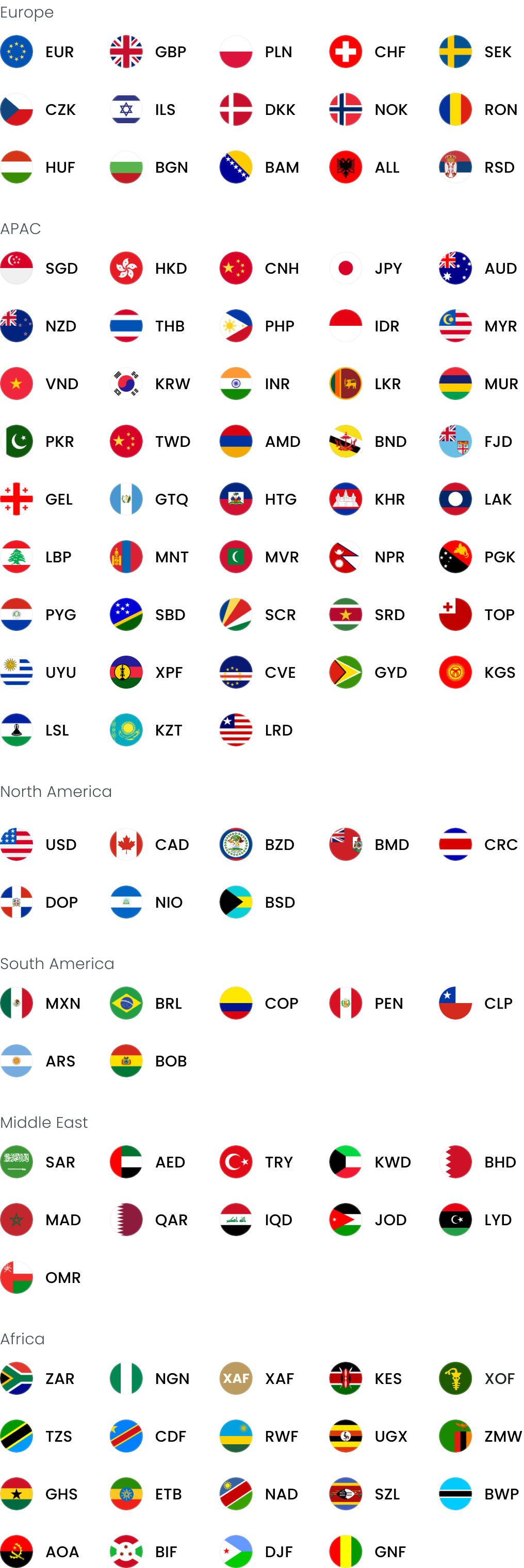

- Multi-currency access remains limited: Most local digital banks only support SGD or a few major currencies, often relying on SWIFT for international transfers. This limits the flexibility of exporters, e-commerce sellers and SMEs that operate across multiple markets

- Cross-border payments are still expensive through banks: Despite competitive domestic offers, international transfers through digital banks often include hidden FX spreads, limited transparency or higher flat fees, which can quickly add up for businesses handling frequent overseas payments

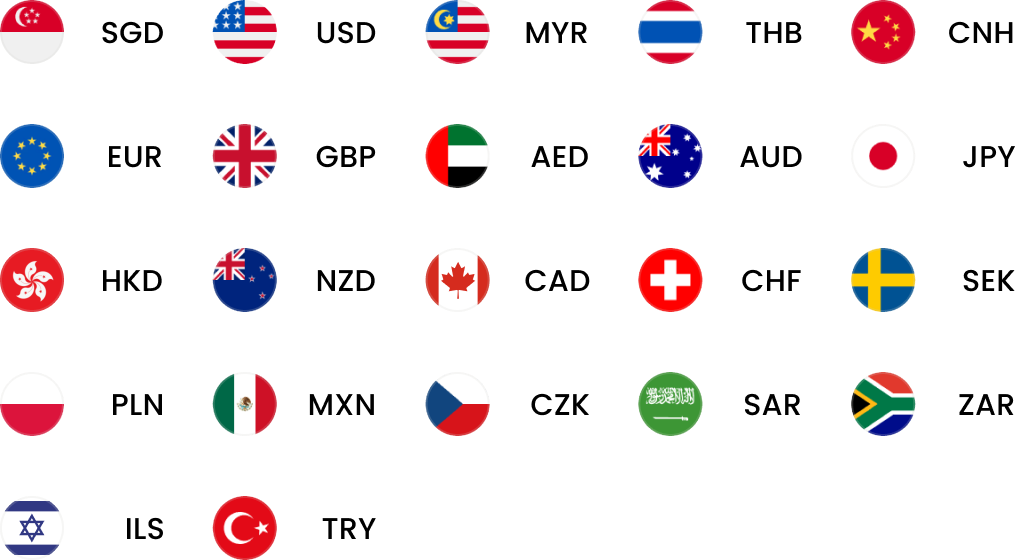

- WorldFirst offers a better global alternative: The World Account lets Singapore businesses hold, send and receive 20+ currencies with no setup or monthly fees. You can collect overseas payments like a local, access transparent FX rates and send funds to 200+ countries quickly and securely

Open a World Account and manage global payments from Singapore with ease.

What is a digital bank?

A digital bank is a licensed financial institution that operates entirely online. Instead of maintaining physical branches, these banks manage everything through secure websites and mobile apps. Their purpose is to make banking faster, more affordable and easier to manage from any location.

Singapore’s new digital banks design their services around advanced technology. They were created for online use from the beginning, which allows for a smoother user experience and stronger security standards. Most provide straightforward navigation, instant access to key services and reliable protection for customer data.

Some are designed for personal banking, while others cater to businesses that need features such as team access, expense tracking and integration with accounting software. Many also support instant domestic payments and efficient international transfers, giving users flexibility without relying on a traditional branch network.

MAS digital banking licences in Singapore

In 2019, the Monetary Authority of Singapore (MAS) introduced two types of digital banking licences: the Digital Full Bank (DFB) and Digital Wholesale Bank (DWB) licences. This marked a significant step toward allowing more regulated, technology-driven players to offer banking services in Singapore.

These two licence types define who each provider can serve and the range of products they can offer.

Here’s how they differ:

| Licence type | Who they serve | What they offer |

|---|---|---|

| Digital Full Bank (DFB) | Retail customers | Savings and current accounts, debit cards, payments and lending |

| Digital Wholesale Bank (DWB) | SMEs and business customers | Business accounts, foreign currency services and corporate lending |

Digital full banks focus on individual customers, while digital wholesale banks support companies that need reliable business accounts, multi-currency capabilities and tailored credit options for growth.

- Open 20+ local currency accounts and get paid like a local

- Pay suppliers, partners and staff worldwide in 100+ currencies

- Collect payments for free from 130+ marketplaces and payment gateways, including Amazon, Etsy, PayPal and Shopify

- Save with competitive exchange rates on currency conversions and transfers

- Lock in exchange rates for up to 24 months for cash flow certainty

Top 5 digital banks in Singapore

To help you check the essentials, the table below summarises the key business account features of Singapore’s digital banks:

| Bank | Licence type | Target segment | Key features | Stand-out strength |

|---|---|---|---|---|

| GXS Bank | DFB | Retail + small business | Savings pockets, digital app, debit/credit card | Strong consumer-tech backing |

| MariBank | DFB | Retail and SME | Online savings, transfers abroad in several currencies | Good for cross-border transfers for SMEs |

| ANEXT Bank | DWB | SME/business | Multi-currency business account including USD, CNY, EUR | Focused on business/multi-currency from the start |

| Green Link Digital Bank | DWB | MSMEs/trade-finance | Business deposit accounts, trade-finance orientation | Tailored for cross-border SMEs and trade flows |

| Trust Bank | Full Bank (digital-only model) | Retail | Savings with competitive rate, credit card rewards | Broad retail offering, backed by major institutions |

*Wise Business pricing checked in October 2025.

1. GXS Bank (Grab & Singtel)

GXS Bank, launched in 2022 by Grab Holdings and Singtel, is one of Singapore’s first digital full banks. Initially focused on individuals, it expanded in 2025 to serve micro-businesses and sole proprietors, many of whom were already within the Grab or Singtel network.Business account:

The GXS Biz Account is app-based, with onboarding via Singpass in under four minutes. There are no account-opening or monthly fees, and SGD transfers via FAST and PayNow are free. Accounts are SGD-only; foreign-currency payments are automatically converted at GXS’s rate.

Interest and lending:

Deposits earn up to 2.68% p.a. (promotional) credited daily, among the highest business rates in 2025. The FlexiLoan Biz line offers unsecured financing up to SG$150,000 with rates from 4.99% p.a. and no early-repayment charges.

Limitations:

Only sole proprietors can open accounts. Multi-currency support, team access and corporate cards are not yet available and international transfers lack transparent FX pricing.

Deposit protection:

As a fully licensed bank, GXS participates in the Singapore Deposit Insurance Scheme, covering up to SG$100,000 per depositor.

Best for:

Freelancers, gig workers and sole proprietors who manage income in Singapore dollars and want a simple, high-interest account with no fees or minimum balance requirements. Not ideal for businesses handling overseas payments or multiple currencies.

2. MariBank (Sea Group)

MariBank, launched in 2022 by Sea Group (parent company of Shopee and SeaMoney), is a digital full bank serving both consumers and SMEs. Closely tied to the Shopee ecosystem, it gives online sellers faster access to their earnings and tools designed for e-commerce businesses.

Business account:

The Mari Business Account is SGD-only with no opening fees, minimum balance or monthly charges. Customers complete onboarding through the app or website. All local transfers via FAST, GIRO and PayNow are free. Shopee sellers benefit from daily withdrawals of their sales funds with no fee, improving cash flow and simplifying reconciliation.

Interest and lending:

Business deposits earn 1.0% p.a., credited monthly. SMEs can apply for unsecured financing through Business Credit Lines (up to SG$200,000) or Term Loans (up to SG$500,000) with flexible tenures and no annual fees.

International transfers:

MariBank supports payments to 40+ countries in 20 currencies. Rates include a conversion spread but remain competitive. Incoming overseas transfers are not yet supported.

Limitations:

Only SGD balances are available. There is a minimum SG$500 per transfer and small payments may not go through. Inbound foreign transfers and multi-currency accounts are unavailable.

Deposit protection:

As an MAS-licensed bank, MariBank is part of the Singapore Deposit Insurance Scheme, insuring deposits up to SG$100,000 per depositor.

Best for:

Shopee sellers and local SMEs that mainly transact in SGD and value seamless Shopee integration, quick cash access and simple digital banking without fees.

3. ANEXT Bank (Ant Group)

Backed by Ant Group, ANEXT Bank is one of just two digital wholesale banks in Singapore dedicated to SMEs. It focuses on inclusive, transparent banking using Ant’s tech and data expertise to reach small enterprises.

Business account:

ANEXT offers a multi-currency business account supporting SGD, USD, EUR and CNH. Balances in SGD, USD and EUR earn 1.0% p.a. interest, credited daily. There are no setup or monthly fees and onboarding for Singapore-registered companies is fully digital via Singpass and Corppass.

Payments:

Local transfers through FAST, GIRO, MEPS and PayNow are free. Batch payments (up to 100 transactions at once) simplify payroll and supplier payouts.

International transfers:

ANEXT supports SWIFT payments in nine currencies with flat fees (typically SG$10–SG$50 depending on route). Incoming international transfers are free.

Lending and deposits:

SMEs can access unsecured loans up to SG$500,000 and fixed deposits in SGD, USD and EUR with tenors up to 36 months. ANEXT applies flat, transparent pricing for all clients, regardless of company size.

Partnerships:

Through its ANEXT Programme for Industry Specialists, the bank partners with platforms such as WorldFirst, enabling SMEs to earn interest on e-wallet balances and to integrate financial tools directly into their business platforms.

Limitations:

Accounts are open only to Singapore-incorporated companies. No corporate cards, accounting integrations or 24/7 support are offered.

Best for:

SMEs and startups managing multiple currencies who need transparent, low-cost digital banking with simple lending and partnership integrations.

4. Green Link Digital Bank (GLDB)

GLDB, launched in 2022 by Greenland Financial Holdings and Linklogis, is Singapore’s first operational digital wholesale bank. It focuses on trade and supply-chain finance between Singapore and China.

Business account:

GLDB offers SGD and USD accounts with no setup or monthly fees. Account closure within six months costs SG$50. Local FAST transfers are free, while MEPS transfers cost SG$20 each.

Fixed deposits:

SGD and USD fixed deposits are available with tenors from six to 18 months. Larger deposits (around SG$250k or US$250k) can earn up to 4.7% p.a., appealing to established SMEs.

Trade finance:

GLDB specialises in payables and receivables financing – covering up to 100% of supplier invoices or 90% of buyer invoices for up to 180 days. Interest is charged only for the period used. These facilities support importers, exporters and supply-chain firms that need working-capital flexibility.

International transfers:

The bank charges a percentage-based fee on each cross-border transfer, with a minimum of SG$40 and maximum of SG$150. Large payments benefit from the low percentage, but small ones can be costly.

Limitations:

Only SGD and USD accounts are available. No cards, app integrations or accounting tools. Onboarding can be strict, with documentation required for trade activity.

Best for:

Importers, exporters and supply-chain SMEs that need trade financing and hold USD balances for cross-border settlements between Singapore and China.

5. Trust Bank

Trust Bank is somewhat distinct from the above four because it wasn’t part of the 2020 digital bank licence cohort. Still, it launched in 2022 as a partnership between Standard Chartered Bank (Singapore) and the local FairPrice Group (NTUC). Trust Bank operates under a full bank licence held by Standard Chartered, effectively making it a digitally-native offshoot of a traditional bank.

We include Trust Bank because it frequently appears on lists of Singapore’s digital banks, though it serves only retail customers.

Consumer focus:

Products include a savings account, credit cards, personal loans and insurance. The Trust Savings Account offers a competitive tiered interest (around 1.5% base rate, higher for FairPrice members) and the Trust Card provides cashback on FairPrice spending.

Performance:

Within its first year, Trust Bank gained over 450,000 users, including a large senior customer base, supported by its user-friendly app and integrated FairPrice rewards.

Limitations:

No business accounts or SME loans. Trust Bank does not offer corporate cards, merchant services or business financing.

Best for:

Individual consumers, families and FairPrice members are seeking a convenient personal digital bank with rewards and everyday savings features. Not suitable for business use.

Best alternative to digital banks – the World Account from WorldFirst

While Singapore’s digital banks offer strong local solutions, some internationally minded businesses may find that a global fintech platform better suits their needs.

One such platform is WorldFirst, a global payments provider (now part of Ant Group) that operates in Singapore and across the Asia Pacific.

WorldFirst’s World Account is a multi-currency business account that can complement or even outperform, local banks in certain scenarios.

Global reach and currencies:

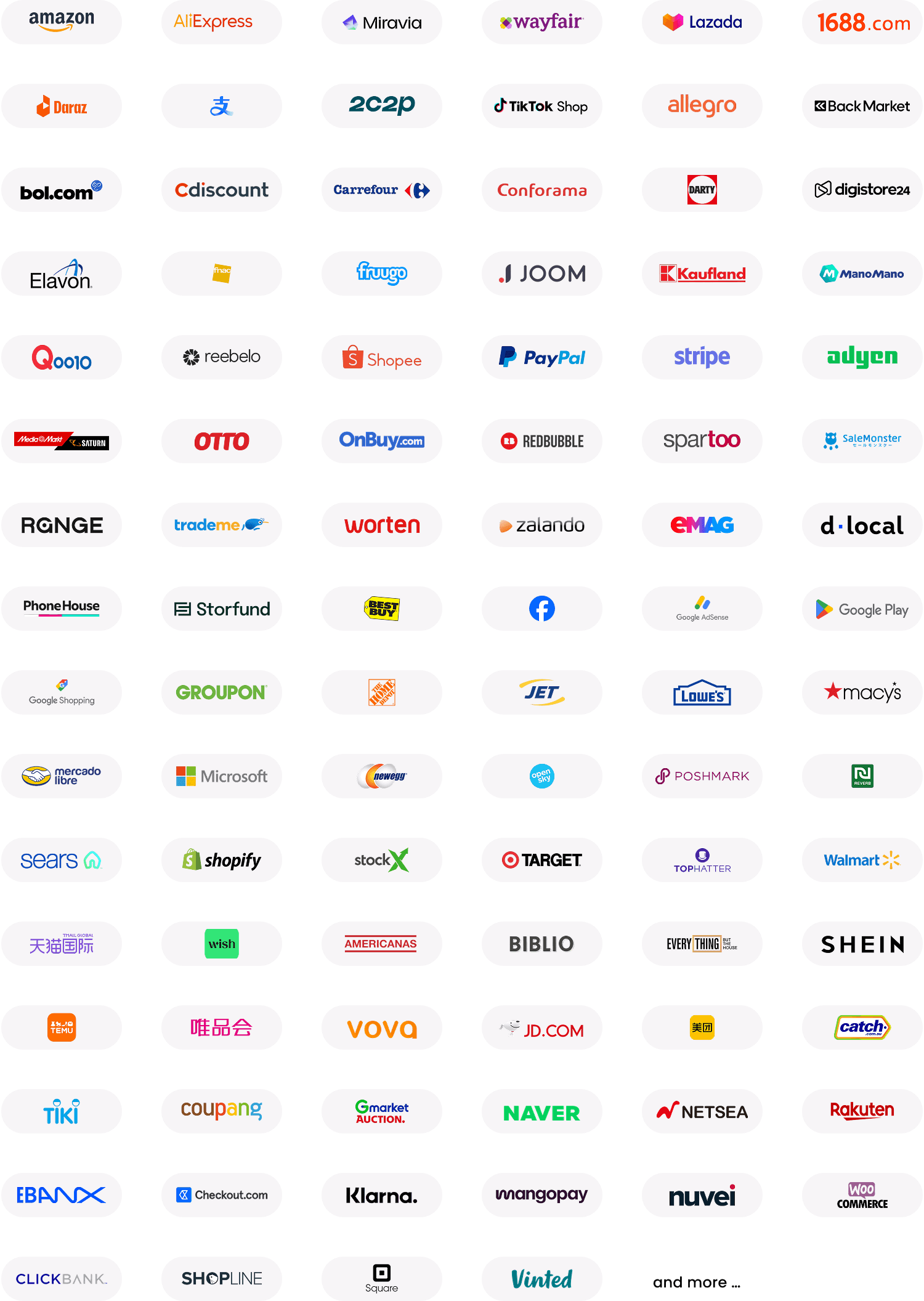

Digital banks in Singapore focus mainly on SGD and a few foreign currencies. In contrast, WorldFirst lets businesses hold and manage 20+ currencies in one account and open local receiving accounts in key markets such as the US, UK, Europe and Australia. This means you can receive USD, EUR or GBP like a local, without paying incoming wire fees.

Cross-border payments:

WorldFirst supports payments to 200+ countries in 100+ currencies, often through local payment rails for faster, low-cost transfers. Its FX rates are transparent, helping businesses save on every conversion.

Cost efficiency:

There are no setup or monthly fees and receiving funds is free. Compared with banks that impose flat transfer fees and high FX markups, WorldFirst often delivers lower total costs for frequent cross-border payments.

E-commerce integration:

WorldFirst connects with over 130 global marketplaces and payment gateways, including Amazon and eBay, letting sellers collect, hold and pay in multiple currencies. You can consolidate international revenue and pay overseas suppliers directly in their local currency.

Speed and security:

Account setup takes only minutes and most transfers clear the same day. The Monetary Authority of Singapore (MAS) regulates WorldFirst in Singapore and the company partners with ANEXT Bank to safeguard client funds and offer interest-bearing accounts.

Best for:

WorldFirst is a perfect choice for exporters, online sellers and international SMEs that move money across multiple markets and want a secure, low-cost alternative to traditional or local-only banks.

WorldFirst vs local digital banks – when a global platform works better

If your business is predominantly domestic or if you highly value features such as local loans, SGD deposit interest or integration with local ecosystems (Grab/Shopee), then the Singapore digital banks are the right choice.

However, if your business is international in scope – selling overseas, sourcing globally or expanding to new markets – a global account like WorldFirst’s could be better suited than a local digital bank account.

For instance:

- You need to invoice customers in multiple currencies and either hold them or convert at opportune times. A digital bank might force immediate conversion to SGD (with unknown fees), whereas WorldFirst lets you hold balances in, say, USD or EUR until you decide to convert

- You have significant foreign payables every month. With WorldFirst, you can pay 200 suppliers abroad in one go and benefit from clear, competitive FX rates and batch payment tools (some fintechs have this)

- You want to avoid SWIFT fees and delays. WorldFirst routes many payments through local banking partners, meaning no intermediary deductions and often same-day or next-day receipt by your beneficiary – whereas a SWIFT transfer from a bank can take 2–5 days with unpredictable correspondent charges

Looking for more than what local digital banks offer?

Open a World Account for free and manage global payments in multiple currencies with ease.

Sources:

- https://www.mas.gov.sg/regulation/banking/digital-bank-licence

- https://www.gxs.com.sg/business

- https://www.gxs.com.sg/help/business-account

- https://www.gxs.com.sg/help/flexiloan-biz

- https://www.maribank.sg/business

- https://www.maribank.sg/faq

- https://www.anext.com.sg/business-account

- https://www.anext.com.sg/business-loans

- https://www.anext.com.sg/help

- https://www.gldb.com.sg/products

- https://www.gldb.com.sg/faq

- https://www.fintechnews.sg/77320/digitalbanking/gxs-bank-singapore-launch/

- https://www.fintechnews.sg/107498/digital-banking-news-singapore/best-digital-banks-in-singapore/

- https://statrys.com/sg/guides/banking/digital-banks

- https://sg.news.yahoo.com/maribank-gxs-bank-singapore-055635727.html

- https://www.worldfirst.com/sg/products/world-account

- https://www.worldfirst.com/sg/blog/business-banking-insights

Businesses trust WorldFirst

- Almost 1,500,000 businesses have sent US$500B+ around the world with WorldFirst and its partner brands since 2004

- Your money is safeguarded with leading financial institutions