If you’re selling through a marketplace or platform you’re likely to have internationally based customers, suppliers or partners. This means a currency strategy should form a key pillar of your business strategy. Here are some tips for managing your currency transfers.

RECEIVE FOREIGN MARKETPLACE SALES REVENUE IN LOCAL CURRENCY

Global selling through marketplaces like Amazon is a no-brainer for many online sellers, but this means that your sales will be made in a foreign currency. Should you choose to enter your local bank details into Amazon Seller Central, your payout from Amazon will be at set times and generally exchanged at poor exchange rates. For example, if you’re located in Australia and selling on Amazon US, your payments will be made fortnightly and exchanged from USD to AUD at a poor exchange rate.

WorldFirst provides local currency receiving accounts which allow you to achieve better exchange rates and make transfers at times that suit you.

If you’re selling internationally through a platform like Shopify, simply attach your local currency receiving account to your payment gateway.

FEATURES TO LOOK FOR IN A CURRENCY RECEIVING ACCOUNT & SERVICE PROVIDER

Here are some key features you should assess:

- Exchange rate or spread offered. This may vary according to your transfer amount.

- Are there any fees?

- Will you get a dedicated eCommerce account manager?

- Hold time. How many days can you hold your funds in the account for?

- Location of accounts. Are the foreign currency accounts based in those countries or in Australia? This is an important factor for Amazon compatibility.

- Is there a maximum annual transfer amount?

DON’T USE A BANK TO PAY FOREIGN SUPPLIERS

If you’re selling locally but importing your goods from overseas you will most likely need to make foreign currency payments. The most common currencies used for supplier payments are USD, EUR and GBP, and if you pay with your bank your transfer could be costing you more through poor exchange rates. Try not to use your bank and use a currency transfer specialist.

KEEP ABREAST OF MARKET CONDITIONS

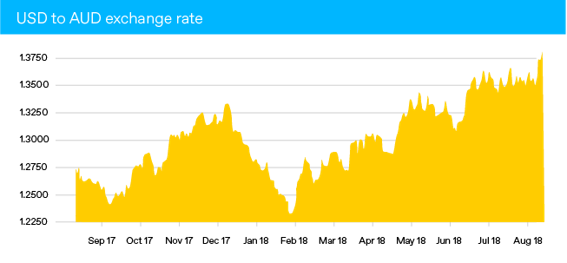

Currency markets are constantly moving and fluctuations can seriously impact your profit margins, particularly in price competitive marketplaces like Amazon. Signing up to currency updates and keeping up-to-date with important data releases and events effecting markets can help you plan. Rate alerts can also notify you when your desired exchange rate hits.

Sellers should also be aware of products such as forward contracts which allow you to lock in an exchange rate for up to two years.

Fluctuation in action:

Hear from our clients

Disclaimer:

These comments are the views and opinions of the author and should not be construed as advice. You should act using your own information and judgement. Whilst information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice. Please consider FX derivatives are high risk, provide volatile returns and do not guarantee profits.