What is a forward exchange contract?

A deliverable forward contract is an agreement where a business or an individual will purchase a particular volume of currency at an agreed exchange rate to settle at a future date.

This exchange rate will be locked in for the entire length of the currency forward contract, providing the buyer a guaranteed rate of exchange. WorldFirst allows an exchange rate to be locked in for up to two years and requires a small initial deposit ranging from 3-10%, depending on the length of the contract.

A forward exchange contract in action for an individual

An Australian living in Sydney agrees to purchase a property in Auckland for $NZD 500,000. The settlement is in three months’ time and the buyer is concerned the Australian dollar will weaken before the property’s settlement date. So, using a currency forward contract, locks in an exchange rate based off today’s market rate. This effectively removes all risk of currency fluctuations ahead of the settlement date. The buyer pays a 5% deposit and WorldFirst purchases the full amount of NZD currency required for settlement of that house.

A forward exchange contract in action for a business

A small business in Melbourne importing women’s designer shoes from Italy (Alex Millar Pty Ltd) has noticed the AUD has weakened 10% against the EUR since the start of the year and is worried they will have to increase the price of goods if the AUDEUR continues to fall.

Alex Millar Pty Ltd estimates a requirement of EUR 200,000 to buy next season’s stock, and so, using a forward exchange contract locks in a rate today to buy 200,000 EUR to settle in 6 months’ time. At the time of executing the trade, Alex Millar Pty Ltd only pays the 5% deposit required, EUR 10,000 (or AUD equivalent), to secure the contract, keeping more capital within the business to put towards other requirements. The currency forward also means Alex Millar Pty Ltd avoids passing on their increased costs to their customers.

Reasons for using a currency forward contract

It’s always important to consider your own circumstances before committing to a forward, however here are some of the circumstances that may drive a business or individual to consider using a forward contract:

- When your business has an invoice to pay in a foreign currency, but the due date is in the future.

- Anytime you’re looking for certainty around a required amount of foreign currency.

- If you believe a currency may move against you in the future.

- If you feel a currency is particularly high, but your requirement is in the future, you can take advantage of this higher rate.

- When a business sets its budget rates and cannot take the risk of the currency moving against them.

- When profit margins are tight and the ability to adjust product pricing is not an option.

Remember that it is important to never ‘over hedge’ only book out the currency you are certain will need to be delivered.

Reasons against using a currency forward contract

- If the currency moves in your favour you’re locked in regardless of fluctuations.

- A deposit is usually required – WF can set up a credit limit (audited financials required).

- If a currency swings by a large amount, you may be asked to top up your initial deposit. This is called a margin call. This is not an additional fee or charge, simply a top up. You’re still locked in at the rate originally agreed!

- A currency forward is a hedging product, so it’s important you have a sound understanding of how currency markets work and potential risks.

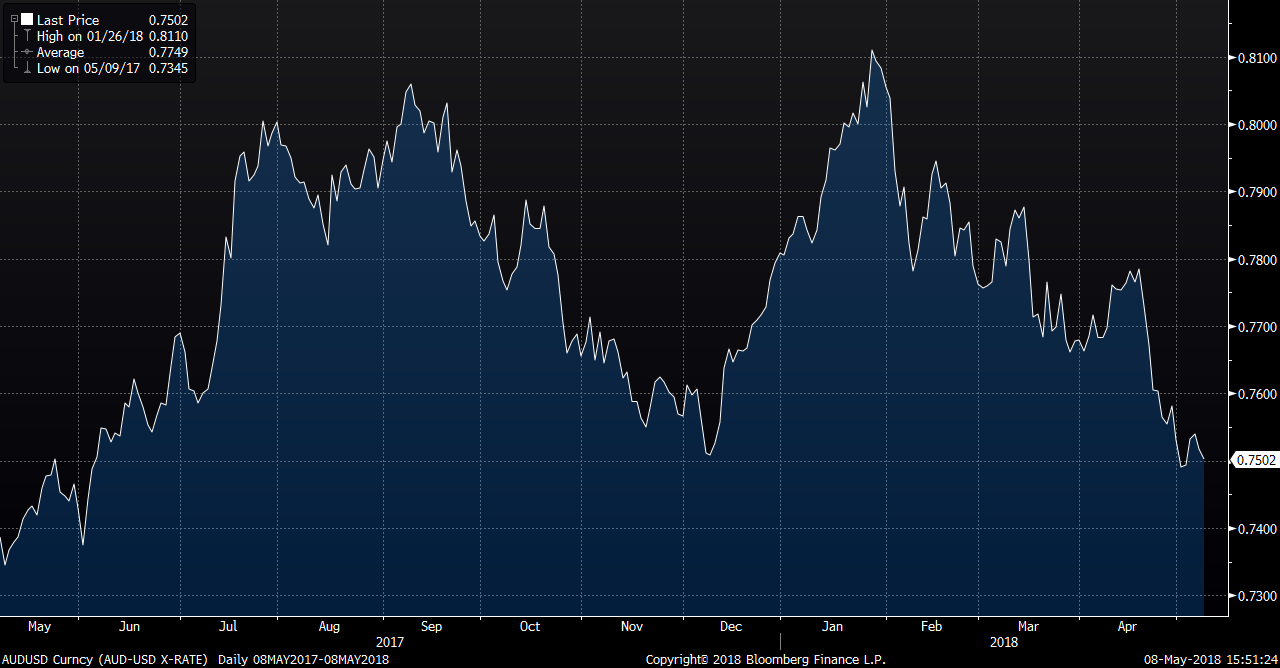

Fluctuation in action – AUDUSD

WorldFirst Forward Exchange Contracts

WorldFirst can help individuals and businesses lock in an exchange rate for up to two years. You’ll benefit from no fees, great exchange rates and service from your dedicated currency specialist.

Contact us to learn more about forward contracts:

1800 701 540

worldfirst.com.au

Disclaimer:

These comments are the views and opinions of the author and should not be construed as advice. You should act using your own information and judgement. Whilst information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice. Please consider FX derivatives are high risk, provide volatile returns and do not guarantee profits.