Brief Summary:

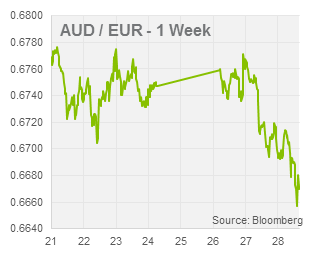

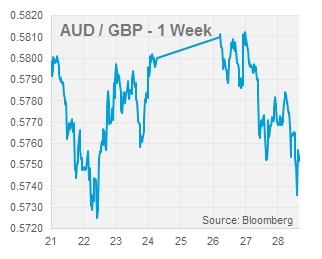

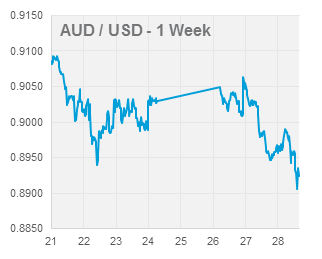

- After two years of civil war, the escalating crisis in Syria has started reverberating through financial markets. International military intervention seems imminent after a suspected chemical weapons attack on civilians that gained broad attention and condemnation. Emerging market currencies felt the most pain, an obvious loser was the Turkish Lira falling about 3.5%, while the Indian Rupee and Indonesian Rupiah lost over 5% against the USD in as many days. The AUD has also fallen victim to risk aversion, falling almost 1.5 US cents from Monday’s open of 0.9040.

- Last Thursday, the HSBC Flash Manufacturing PMI, a survey of manufacturing industry participants in China, unexpectedly climbed to 50.1 after 48.3 was expected. The positive surprise buoyed the AUD and the HSBC economist commented that further upside surprises would be likely as Chinese growth stabilised. The China Federation of Logistics and Purchasing will release its PMI figure over the weekend that will be important for the AUD.

- The majority of market economists still believe the U.S. Federal Open Market Committee will taper its quantitative easing program in September after the minutes from its last meeting revealed no new information.

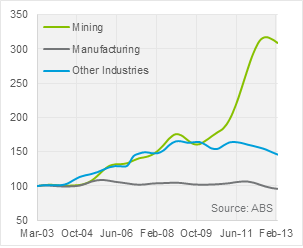

Australian Private Capital Expenditure

On Thursday, Australian Private Capital Expenditure will be released for the second quarter. The data details industry capital investment in buildings, plants, equipment and machinery. The chart to the right shows normalised industry investment levels for the last ten years.

On Thursday, Australian Private Capital Expenditure will be released for the second quarter. The data details industry capital investment in buildings, plants, equipment and machinery. The chart to the right shows normalised industry investment levels for the last ten years.

The peak in mining investment (green line) has been obvious for some time and other sectors must now pick up to avoid a downturn in growth. However, the Reserve Bank of Australia stated in its recent minutes that, “Near-term prospects for business investment outside the resources sector remained subdued, with quite weak levels of confidence across many segments of business”. This outlook has soured somewhat from March where they stated, “recent data suggested a modest increase in non-mining business investment was in prospect during 2013/14”. While the manufacturing outlook remains bleak, the weaker currency should start to foster investment in other industries rendered uncompetitive by the high exchange rate.

For Thursday, the market is expecting a headline figure of 0.2% new expenditure. However, the complexity of the release means the market reaction depends on analysis of the forecast versus actual expenditure and the industry breakdown rather than the headline number.

On Tuesday the RBA will meet for its September monetary policy decision. After last month’s cut this decision is expected to be a non-event. The following day, Australian second quarter GDP growth will be released.

USD

Early on Thursday morning, the U.S. Federal Open Market Committee released the highly anticipated minutes of its July 31st monetary policy meeting. The chain of events was strangely familiar – minutes are released, market buys USD on any mention of tapering, market realises minutes contain no real changes, market calms and reverts to pre-minutes positioning.

Early on Thursday morning, the U.S. Federal Open Market Committee released the highly anticipated minutes of its July 31st monetary policy meeting. The chain of events was strangely familiar – minutes are released, market buys USD on any mention of tapering, market realises minutes contain no real changes, market calms and reverts to pre-minutes positioning.

The focus of most news services was this sentence, “First, almost all participants confirmed that they were broadly comfortable with the characterization of the contingent outlook for asset purchases that was presented in the June post meeting press conference and in the July monetary policy testimony”.

What was presented in that June press conference? “The Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year”. This means asset purchases (quantitative easing) will still occur, but at a slower rate. Not exactly a clear timeline, although with three remaining meetings this year not a particularly vague one either. 65 percent of economists surveyed on Bloomberg believe this will begin in September, the September Taper, with a monthly reduction in asset purchases of 10 billion. Further to this, they will “continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear”.

Earlier this week, U.S. Durable Goods Orders unexpectedly declined by 0.6% in July, following the lead of industry PMI readings that also softened in the month. To draw any further conclusions on tapering we need to look to U.S. employment data next Friday.

EUR & GBP

The EUR and GBP remained strong against the AUD especially as the Syrian crisis boosted demand for safer assets.

PMI surveys for manufacturing and service sectors were released for Eurozone industries last Thursday; mostly surprising on the upside. Germany and the Eurozone indicated the strongest expansionary business conditions for two years. France, however, dipped below 50.0 on both measures.

The second estimate of GDP growth was released in the U.K. showing an upward revision of the second quarter result to 0.7%.