- Foreign exchange markets have had little hard data to trade off in February but lots of speeches by central bank officials. RBA Governor Glenn Stevens spoke last Friday and Assistant Governor Guy Debelle spoke on Tuesday leading to mixed interpretations by the market.

- Stevens’ speech was on the hawkish side, suggesting the RBA was on hold and that an FX intervention was off the cards. Stevens stated that “[there is a] good deal of interest rate stimulus in the pipeline.” He went on to say, “It is not that interest rates are seeking a particular exchange rate response, but they are being set with a recognition of the exchange rate’s effect on the economy.”

- Debelle, however, stated “We still obviously retain scope to lower interest rates further, should the need arise, including to counterbalance the pressures of an elevated exchange rate.” Debelle’s comments drew headlines and were interpreted as a sign rates may be cut in response to the exchange rate, even though he essentially echoed Stevens.

- The RBA have very limited scope to participate in the much publicised currency war. The domestic economy is sensitive to inflation and further rate cuts may see it increase. This is unlike that of Japan, Switzerland or the U.S. economies where inflation is zero or negative. An aggressive devaluation policy like that of the Swiss National Bank would also mean the RBA has to sell AUD and buy large amounts of low yielding USD and JPY, accumulating massive foreign currency reserves. The RBA has little market influence in a currency war against the likes of the U.S., U.K., Japan and Europe and will be forced to the sidelines.

- Steven’s goes on to state, regarding intervention, “The truth is, the power of the forces at work here, you need to be pretty confident that it is seriously over-valued, or the market is behaving in some quite irrational way, before you would launch a large scale intervention.” In other words, the RBA is very unlikely to pursue devaluation; they only seek to reduce volatility in times of irrational market behaviour. The last time this occurred in 2008-2009 was detailed in Debelle’s speech.

|

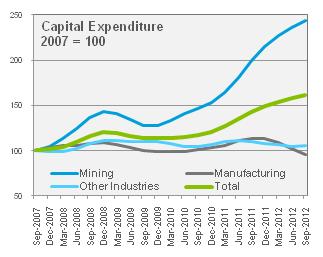

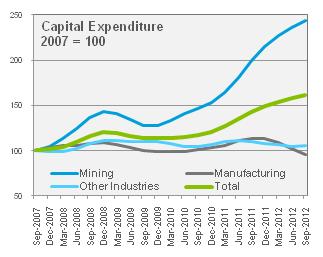

- A softer than expected figure may mean this peak is beginning to occur sooner than expected. It may also mean that other areas of the economy are suffering, illustrated on the right as manufacturing investment declines and other industries is nearly flat.

- When Glenn Stevens spoke last Friday, he made repeated mention of the cuts already made and the prudence of rates remaining on hold. While the capital expenditure figure will be an important figure, its future trajectory is fairly well known to the RBA, “peaking within the next few quarters”. Given the comments made on Friday, their policy of not targeting exchange rates and no other significant data released in the last month, we don’t expect a policy shift on Tuesday.

- The final piece of the 2012 puzzle quarterly GDP growth will be released next Wednesday. The figure is the broadest measure of Australian economic performance and will be one of several significant risk events for the AUD next week.

- Please see below for specific currency commentary.

|