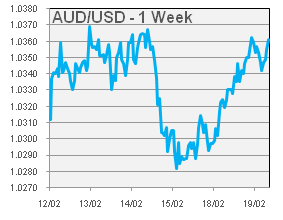

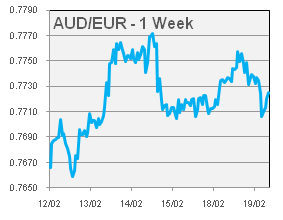

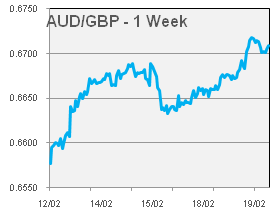

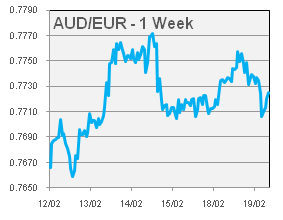

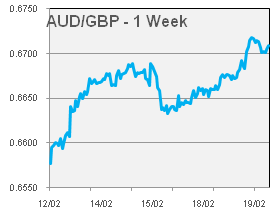

- Markets traded thinly this week as the U.S. observed Presidents’ Day on Monday. Australian economic data was lacking, nevertheless the AUD dipped against the majors into the weekend. The sentiment driven fall quickly reversed as the U.S. returned to trading on Tuesday. AUDUSD pared losses after touching a low of 1.0275 to be 1.0360. AUDEUR gained from its recent lows to 0.7719. AUDGBP reached a 6-month high, climbing to 0.6710 from 0.6574 a week ago (all rates at time of writing).

- Yesterday, the Reserve Bank of Australia (RBA) released the minutes from its February interest rate decision. The rhetoric, while continuing to show an easing bias, was more hawkish implying a preference to hold rates. The board noted improved global economic conditions and the stabilisation of China. They also reiterated the previous monetary easing steps and that the effects would continue to flow through. Mention of the high AUD was mentioned, although the RBA are unlikely to solely target the exchange rate with monetary policy.

- Disappointing European GDP figures were released last Thursday, indicating negative growth in the Germany and France, the region’s major economies. The figures did not prompt a reversal of the recent Euro zone confidence however; German economic sentiment reached a three year high.

- Please see below for specific currency commentary.

|