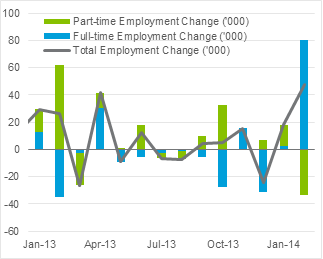

Australian employment data smashed expectations this morning with 47,300 jobs added in February. It was the strongest figure since 2012 and full-time employment growth posted the largest monthly increase since records began. The unemployment rate was steady at 6.0%. The AUD climbed about half a US cent throughout the morning and then another half on release; losses from the weekend’s disappointing Chinese trade balance were recouped.

Buyers beware, there is some important fine print that can be overlooked in this release. The bureau declare in the release that sample changes have skewed employment growth numbers. Regarding the change of sample they state, “This incoming rotation group contributed, in original terms, 37% of the increase in total employment and 29% of the decrease in persons not in the labour force in February 2014. The trend estimates provide a better measure of the underlying level and direction of the series especially when there are significant rotation group effects.” This means February’s numbers, whilst still positive, are somewhat overstated.

Buyers beware, there is some important fine print that can be overlooked in this release. The bureau declare in the release that sample changes have skewed employment growth numbers. Regarding the change of sample they state, “This incoming rotation group contributed, in original terms, 37% of the increase in total employment and 29% of the decrease in persons not in the labour force in February 2014. The trend estimates provide a better measure of the underlying level and direction of the series especially when there are significant rotation group effects.” This means February’s numbers, whilst still positive, are somewhat overstated.

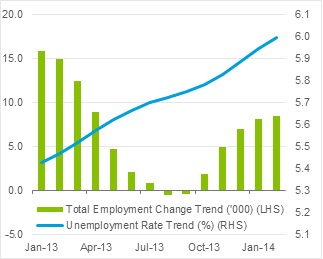

As per their recommendation we should look to the trend estimates for a more accurate view. The trend shows employment growth slowing with unemployment steadily increasing; currently at 6.0%. The RBA predict unemployment will continue climbing until early 2015, where revived economic growth will reverse the trend. The participation rate, the percentage of the population either working or looking for work, has stabilised at 64.7%. According to the RBA, about half the participation rate decline in the last couple of years was due to demographic changes as baby-boom generation workers moved into retirement.

As per their recommendation we should look to the trend estimates for a more accurate view. The trend shows employment growth slowing with unemployment steadily increasing; currently at 6.0%. The RBA predict unemployment will continue climbing until early 2015, where revived economic growth will reverse the trend. The participation rate, the percentage of the population either working or looking for work, has stabilised at 64.7%. According to the RBA, about half the participation rate decline in the last couple of years was due to demographic changes as baby-boom generation workers moved into retirement.

This month’s employment numbers are positive, however, should not be taken at face value. The labour market remains relatively weak although not weak enough to prompt a serious change of policy from the RBA. The RBA’s forecasts predict the continued increase in the number of unemployed throughout 2014 before non-mining sector economic growth picks up the slack. The latest AUD confidence is only as good as the next shaky Chinese data release.

By Chris Chandler