Currency specialist Joe Donnachie reflects on the performance of the AUD in the first half of 2019.

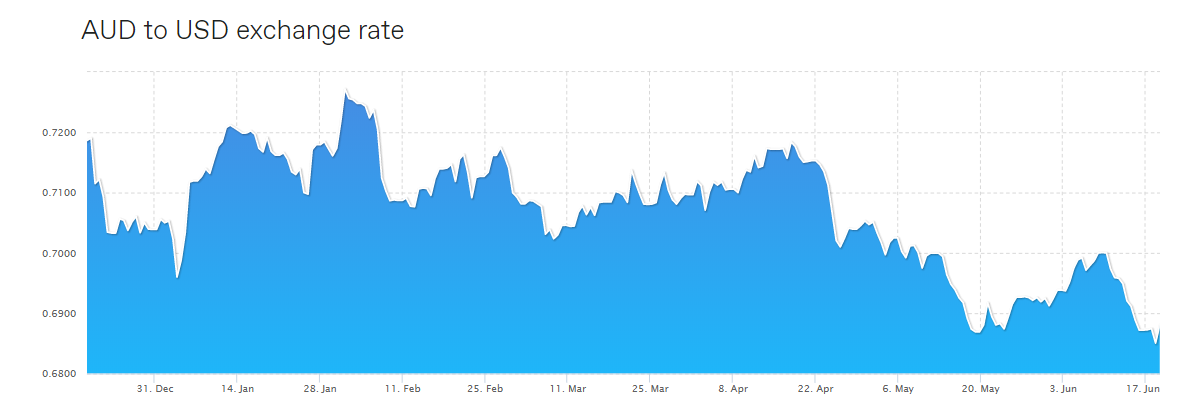

While we expected some volatility to kick off 2019, there was some optimism surrounding the AUD. Now at the mid point of the year, we’ve seen a 9.58% drop vs the USD with further market information indicating that the Australian dollar will maintain a bearish outlook.

So, what’s been the key drivers of the AUD weakness?

The Australian economy

Although Australian employment data posted relatively positive readings, it did not do enough to have any major influence on the outlook of the AUD. Following a decade low GDP figure, it looks like another rate cut may be required by the RBA with August looking like the most probable month.

This week’s RBA minutes all but validated the central banks stance towards future monetary easing. If rates are cut again, it may prove to be a mountain too high for the Aussie to climb – lower interest rates usually increase borrowing and provide competition for exporters. It also tends to devalue the underlying currency and thus it has an indirect effect on imported goods and services as they become relatively more expensive for Australian consumers and businesses.

In response, Australian residents are likely to change their consumption patterns to demand more import-competing goods and services produced in Australia, leading to a decrease in the volume of imports. This, in turn, has a likely impact on how attractive or unattractive (in this case Australia) is for foreign investment. Furthermore, the cash flow figure that guides lending and deposit rates could fall to a historic low of 0.5% , imposing more uncertainty over the AUD.

Global factors

Other factors that are having a significant influence include the current trade war between China and the US. Over the past year, this supposed trade ‘deal’ was there to benefit both economies, however the prospect of the tariff war deteriorating over the months ahead could be a major concern for the currency. It is likely that the Australian dollar will suffer as investors are fearful over the slowdown in the Chinese economy. Both the AUD and NZD are exposed to both China’s slowdown and the US’s macroeconomic data, with a direct correlation as to how it is effecting the two commodity-based currencies.

Looking at how trade deals have effected commodity-based currencies in the past, it doesn’t look good for both the Aussie and the Kiwi. According to Bloomberg, China’s economic growth has stagnated, with industrial output at its lowest since 2002 , this matched with a 0.5% drop in fixed asset investment has made investors wary of the worlds second largest economy, leaving some investors believing it’s hit the proverbial ceiling. What does that mean for the Aussie dollar?

Well with Auto manufacturing being effected as well as many import tariffs being implemented, this has had a negative impact on global trade. Only if we see tensions dissipate will there be a boost for ‘risk on’ currencies, otherwise, as we have already seen, central banks will be required to loosen monetary policy.

Other interesting catalysts having an influence on the Aussie price, include farming protocols which are being released in conjunction with water shortages as well as doubts over exporting live animals overseas. New stringent regulations and lack of demand for Australian mining commodities, such as iron ore and gold; are also taking its toll.

What’s next for the AUD?

No one can predict what will happen in the future, however one can decipher all the macroeconomic data that is coming out that could have an impact on the currency. Unfortunately, other than the central banks being able to protect their underlying asset through rate cuts, for example, the AUD is dependent on other countries as it looks to find some substantial gains on the market.

There are 3 main outcomes that will be detrimental to the Aussie dollar and they include:

- The US economy rises, US political risks ease, and their central bank increases interest rates, supporting the USD.

- The Australian economy falters and inflation only slowly and gradually picks up, increasing the chance of interest rate cuts from the RBA.

- China’s economic growth slows more than expected, lowering demand for our commodities.

Currently, it looks like the dollar is still on a short term bearish outlook with uncertainty growing over the volatility of the AUD. As the trade “deal” continues, there will not be much movement as the total number of exports will still be in decline. Once we see an agreement between the two powerhouses, then we might see some gains back toward the 75 cent mark due to a heightened number of orders from its largest buyer. On the other hand, with a slowdown in global growth and sentiment towards a recession of productivity, this could push the currency down to the 66 cent level and one could argue this is the most likely of the two.

A smarter way to manage your foreign exchange

WorldFirst’s currency transfers are up to 7x cheaper than the big 4 banks. We also offer currency solutions which help businesses and individuals manage their foreign exchange risk. Visit our website to find out more about how WorldFirst can help you or your business.

Whilst every effort is made to ensure the information is accurate, you should confirm the latest exchange rates with WorldFirst prior to making a decision.

The information published is general in nature only and does not consider your personal objectives, financial situation or particular needs and is not recommending any particular product to you.

Full disclaimer available online