Home > blog > Global Business Tips > Best foreign currency card: 6 options for businesses and travellers

Most foreign currency cards cater to individual consumers, with features designed for safer spending and lower fees when you travel.

But with often quite strict spending limits, low maximum balances and high FX fees, they don’t usually make sense for cross-border business users.

For international businesses, a strong option is a multi-currency World Card from WorldFirst. It’s connected to your World Account and you can spend up to £200,000 a day in 150+ currencies, from anywhere in the world. Plus, you can earn up to 1.2% cashback on every eligible business spend, uncapped, and paid monthly.*

*T&Cs apply.

Below, we’ll showcase the benefits of the World Card, then share some of the top offerings for individual users.

In this article:

- Why World Card is a strong choice for the best foreign currency card for business

- How to open a World Account

- Top 5 foreign currency cards for individual travelers

Looking for a foreign currency card that’s built for business spending? Open a World Account for free today and get 50 virtual World Cards.

Why World Card is the best foreign currency card for businesses

WorldFirst is a global fintech platform that helps business and sole proprietors manage cross-border payments with ease. Founded in 2004, we’ve processed over US$500 billion for over 1.5 million clients over the last two decades.

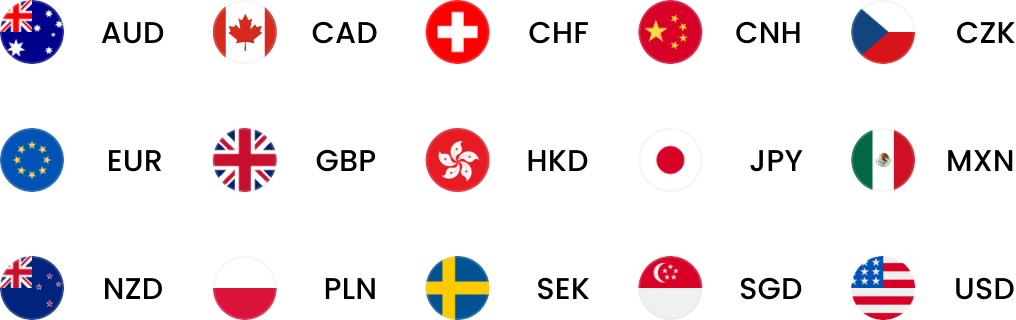

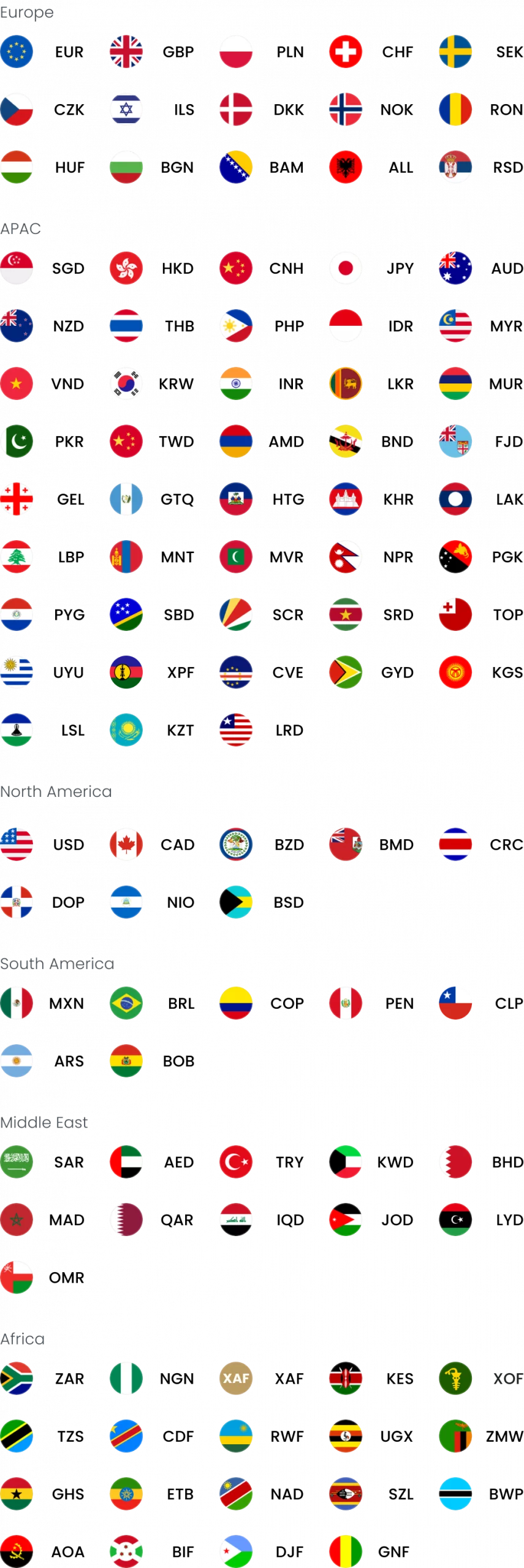

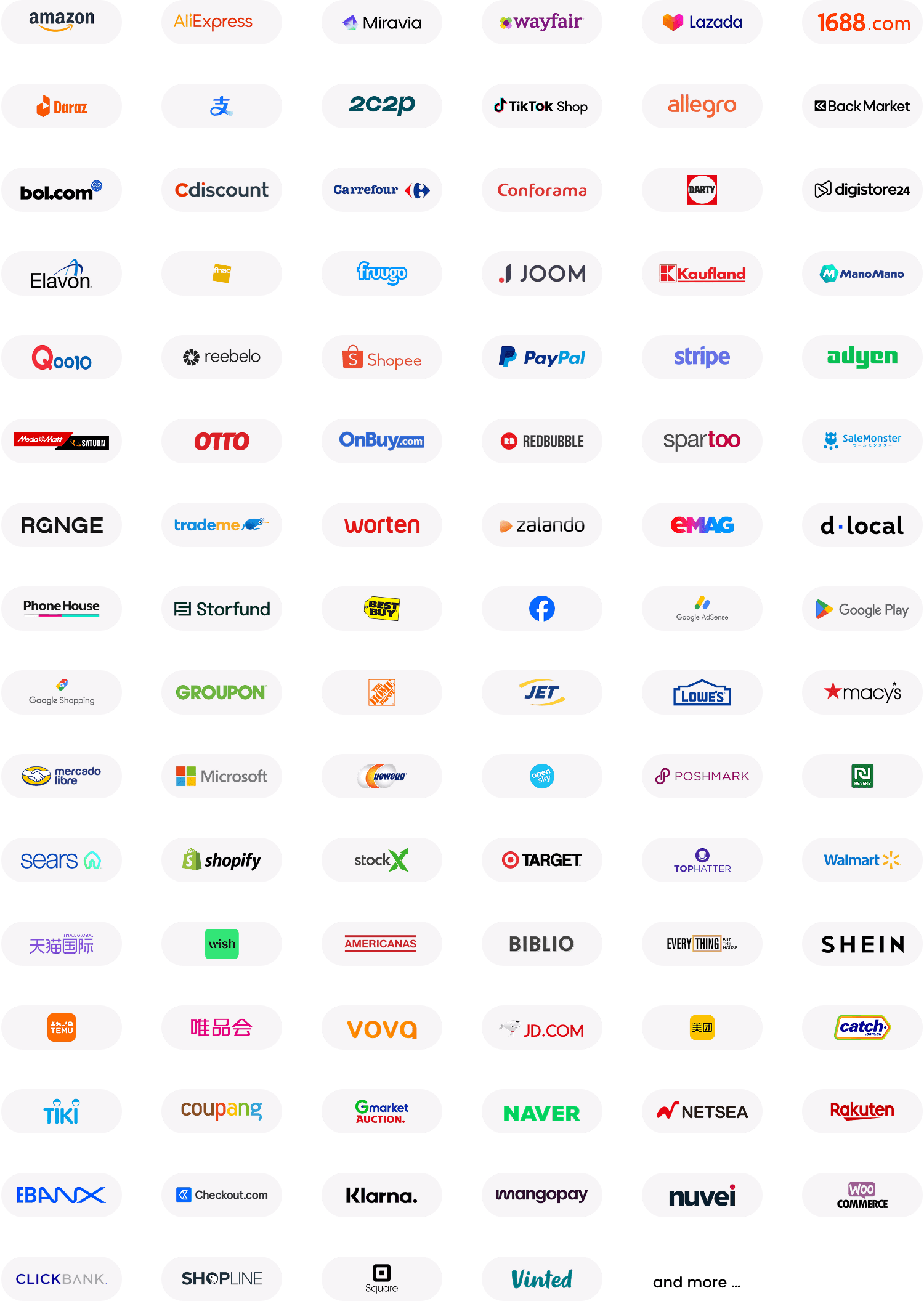

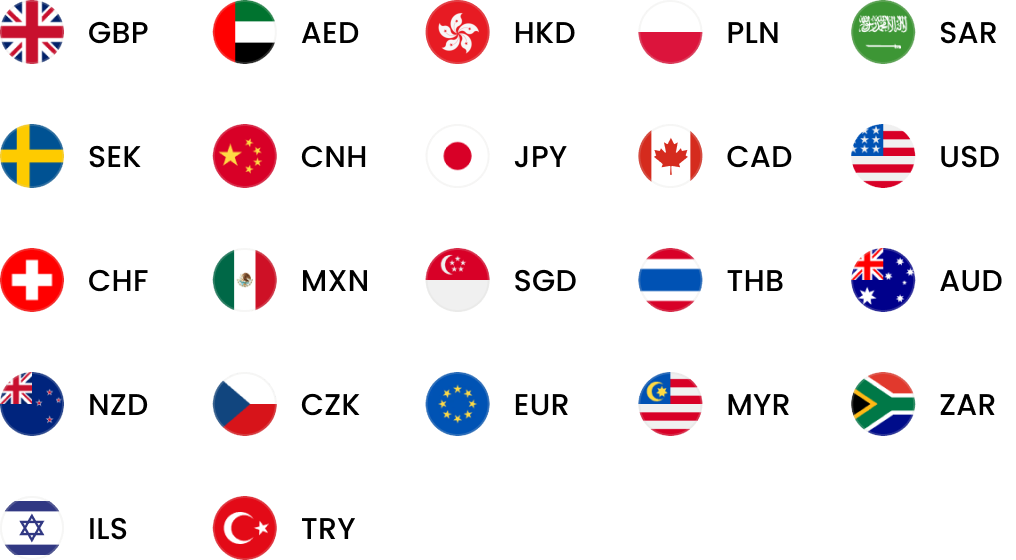

With our multi-currency World Account, users can receive and hold funds in 20+ currencies, and make payments in 100+ currencies to 210+ destinations. Every World Account also comes with 50 free World Cards – our multi-currency virtual cards designed for easy spending in 150+ currencies.

World Cards are built for cross-border business, with adjustable limits to prevent fraud, theft, and accidental overspending. Use them to segment expenses by department, expense type, supplier and more, for simplified reporting and accounting.

Plus, pay no FX fees when you spend from your balance in 15 major currencies, and get up to 1.2% unlimited cashback on all your spending.

Here are the top reasons to choose the World Card as your business foreign currency card:

Pay in 150+ currencies to 210+ destinations anywhere Mastercard is accepted

Traditional foreign currency cards often restrict you to just one or two currencies at a time, since they’re primarily designed for holiday spending. Or, they restrict you to a short list of common currencies.

Your World Card lets you pay in 150+ currencies to 210+ destinations, all from the same card, anywhere Mastercard is accepted. You can also use your World Card to pay with Alipay+ when traveling in China.

Your World Card is linked to a multi-currency account that lets you receive, hold and pay in 20+ currencies using local payment rails. With your World Account, you can make international payments faster and cheaper than traditional bank wires. You can also hold funds in your recipients’ preferred currencies to save on foreign exchange fees.

Read more: What’s the best online bank with a virtual debit card? Your options

Pay zero FX fees when you spend in 15 major currencies, plus no setup or maintenance fees and no hidden charges

Some virtual cards charge monthly fees and high foreign exchange fees when you use unsupported currencies. With your World Card, you pay zero FX fees when you pay in 15 major currencies from your World Account balance.

There are no monthly fees, no annual fees, no sign-up fees, no top-up fees and no hidden fees to get a World Account or use your World Card. And if you need to exchange currencies with your World Account, you only pay the mid-market exchange rate plus a small, transparent markup.

What’s more, with 1.2% unlimited cashback on your spending,the more you spend, the more you can reinvest in your business.

Read more: Cross-border business payments: Everything you need to know

Get secure spending and simplified expense tracking with features designed for global business

Traditional foreign currency cards typically lack special features for international business spending, but WorldFirst puts businesses first. We make it easy to prevent accidental overspending and reduce risk due to theft or fraud.

Set custom spending limits and freeze, unfreeze or cancel cards instantly, all from your World Account dashboard or app. And get up to 50 World Cards for free and separate out expenses by team, expense type, supplier and more, for easier financial management.

You can view each card’s history from the same dashboard and easily export structured data for simplified reconciliation. Or, use our direct integrations with Xero and NetSuite to sync your data with the business accounting software you already use.

Read more: How to choose a multi-currency business account (+ 6 options)

Apply online in minutes and get approved in as little as 48 hours (or less)

Anyone with a World Account can get a World Card, and it only takes a few minutes to apply for your World Account. You don’t need to visit a bank branch, establish a local business presence or submit extensive financial documents.

Unlike many other business payment cards, you don’t need to demonstrate certain sales history or be a registered company to get a World Card. You can apply as a sole proprietor, and there’s no minimum deposit or minimum balance to open and maintain an account.

With our fully online application process, you can apply at any time. Most World Account applications are approved within 48 hours. As soon as you’re approved, you can log in to your World Account and start issuing virtual cards in seconds.

How to open a World Account

To open your World Account and start using World Cards:

- Head to our Sign up page

- Add your personal and business details

- Upload required verification documents

- Set up your account requirements

- Go to “World Card” in your World Account online portal and follow the instructions to start issuing World Cards

Need additional assistance? See official Help Centre guide.

Top 5 foreign currency cards for individual travellers

If you’re not looking for a business foreign currency card and just need a great option for your next international holiday, consider these five alternative prepaid currency cards:

| Card | Currencies | Application process | Fees | Limits |

|---|---|---|---|---|

| Wise Travel Money Card | 40+ currencies | Apply online Digital card available instantly Physical card sent by post |

• Low conversion fee for unsupported currencies • £7 card fee • £10.85 express delivery • £2.50 replacement • 2 free ATM withdrawals/month (then 1.75% + £0.50) |

• Limits vary by country and payment type |

| Travelex Money Card | 22 currencies | Order online or in-store Activate in app |

• 5.75% FX fee on unsupported currencies • 2% GBP top-up fee • £2 inactivity fee • Free ATM withdrawals |

• £500 ATM limit • £3,000 daily spend • £30,000 annual limit |

| Sainsbury’s Bank Travel Money Card | 22 currencies | Apply online Collect in-store or request delivery |

• 5.75% FX fee on unsupported currencies • 2% GBP reload fee • £2 inactivity fee • ATM fees may apply |

• £500 ATM limit • £3,000 daily spend • £30,000 annual limit |

| Post Office Travel Money Card | 22 currencies | Apply online or in-app Collect or receive by post |

• FX margin applies when converting • No usage fee • ATM fees may apply |

• £5,000 max top-up • £10,000 balance • £30,000 annual limit |

| Hays Travel Mastercard | 22 currencies | Apply online, in-store or by phone | • 5.75% FX fee on unsupported currencies • 2% GBP top-up fee • £2 inactivity fee • ~£1.50 ATM fee |

• £500 ATM limit • £3,000 daily spend • £30,000 annual limit |

*The information above was checked as at November 2025

1. Wise Travel Money Card

Wise offers a multi-currency debit card for overseas travellers, with up to three digital cards, 40+ currencies and the ability to pay with certain wearable devices.

Currencies:

40+ currencies including GBP, EUR, USD, AUD, NZD, CAD, CHF, CNY, HKD, JPY, SGD, THB, AED, CZK, DKK, HUF, NOK, PLN, RON, SEK, TRY, ZAR and more (usable in 160+ countries).

Application process:

Apply online via the Wise app or website. You’ll receive a digital card instantly which you can use with Apple Pay or Google Pay, and a physical card by post (additional fee for express delivery).

Foreign exchange fees:

- No foreign transaction fees

- Convert at the real mid-market rate in the Wise app

- Low conversion fees when spending in unsupported currencies

- Volume discounts for large currency conversions

Other fees:

- £7 to order card

- £10.85 for express delivery

- £2.50 replacement fee

- Two free ATM cash withdrawals per month (up to £200), then 1.75% + £0.50 per withdrawal on additional withdrawals

- 2% fee to top up external e-wallets

- Conversion required (with fee) if you don’t hold enough of the spending currency

- Spend leftover currency in UK for a fee

Limits:

- Daily, monthly and per-transaction limits vary by country and purchase type (contactless, swipe, online, etc.)

Other

- Change your spending limits in the app for additional security

- Pay with your Garmin or Fitbit device

2. Travelex Money Card

Travelex’s award-winning travel money card lets individuals spend in 10 different currencies wherever Mastercard Prepaid is accepted. Users can join Travelex Plus for free to get exclusive trip discounts.

Currencies:

22 currencies: GBP, AED, AUD, CAD, CHF, CZK, DKK, EUR, HKD, HUF, ISK, JPY, MXN, NOK, NZD, PLN, SEK, SGD, THB, TRY, USD, ZAR.

Application process:

Order online or in-store and register through the Travelex Money App. Cards can be delivered by post or collected at Travelex locations.

Foreign exchange fees:

- 5.75% fee when spending in unsupported currencies

- No fee when spending in currencies preloaded on your card

Other fees:

- Free ATM withdrawals worldwide

- Free replacement card

- 2% fee for GBP top-ups (free for foreign currency top-ups)

- £2 inactivity fee after 12 months

- £10 shortfall fee if balance goes below zero

- £5 for an additional backup card

Limits:

- Minimum load £50

- £500 ATM cash withdrawal limit per day

- £3,000 daily spend limit

- £5,000 maximum balance

- £30,000 annual load limit

- Limit one account at any time

Other

- Freeze and unfreeze your card from the app

- Join Travelex Plus for free and get a first trip discount valid for 30 days

3. Sainsbury’s Bank Travel Money Card

Sainsbury’s travel card lets users lock-in the current exchange rate when they load or convert currencies before a trip.

Currencies: 22 currencies: GBP, AED, AUD, CAD, CHF, CZK, DKK, EUR, HKD, HUF, ISK, JPY, MXN, NOK, NZD, PLN, SEK, SGD, THB, TRY, USD, ZAR.

Application process: Apply online and pick up in-store the next day, or select delivery (5–8 working days). Manage and reload via the Sainsbury’s Bank app.

Foreign exchange fees:

- 5.75% FX fee for unsupported currencies or insufficient balance

- No FX fee when spending in supported currencies

Other fees:

- Free to get and load funds

- 2% reload fee when using GBP

£2 inactivity fee after 24 months - Standard ATM withdrawal fees apply

Limits:

- Minimum load £50

- £500 daily ATM withdrawal limit

- £3,000 daily spend limit

£5,000 maximum reload - £30,000 annual load limit

- One additional card and one active account allowed

4. Post Office Travel Money Card

The Post Office travel money card is accepted at over 36 million locations and can be refunded in 3–5 working days in the event that a trip is cancelled.

Currencies:

Carry up to 22 currencies and use wherever Mastercard is accepted: EUR, USD, AUD, AED, CAD, CHF, CNY, CZK, DKK, GBP, HKD, HUF, JPY, NOK, NZD, PLN, SAR, SEK, SGD, THB, TRY, ZAR.

Application process: Apply online or via the app, then collect at any Post Office branch with a valid passport or UK driving licence, or receive by post within 2–3 working days. Activate using the steps in the welcome letter.

Foreign exchange fees:

- No fees when spending in supported currencies

- FX margin applies when converting between currencies

Other fees:

- No fee for card usage or local-currency spending abroad

- Standard ATM withdrawal fees may apply

- No foreign transaction fee

Limits:

- Minimum top-up £10

- Maximum top-up £5,000

- £10,000 maximum balance

- £30,000 annual balance limit

Other:

- Make contactless Apple Pay and Google Pay payments

- Easily top up, swap currencies or freeze your card in the app

5. Hays Travel Mastercard

A 2024 British Travel Awards winner, the Hay’s Travel Money Card can be used anywhere Mastercard Prepaid is accepted and comes with 24/7 phone support.

Currencies: Carry up to 22 currencies with one prepaid travel card: AED, AUD, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HUF, ISK, JPY, MXN, NOK, NZD, PLN, SEK, SGD, THB, TRY, USD, ZAR

Application process: Apply online, in-store or via phone. Cards are delivered by mail or available for pickup.

FX fees:

- 5.75% FX fee when spending in unsupported currencies or insufficient balance

- No FX fee when spending in supported currencies

Other fees:

- 2% fee for GBP top-ups

- £6 cash-out fee

- Around £1.50 ATM fee (varies by currency)

- £2 monthly inactivity fee after 18 months

- £5 fee for an additional card

Limits:

- Minimum top-up £50

- £5,000 daily top-up in store, £2,500 via app, £1,500 by phone

- £500 daily ATM withdrawal limit

- £3,000 daily spend limit

- £5,000 maximum balance

- £30,000 annual load limit

Other:

- Use with Apple Pay and Google Pay

- Instantly top up from anywhere in the world in the app and check real-time balances

- Freeze and unfreeze your card from the app

WorldFirst: The business-first foreign currency card

There’s no shortage of great foreign currency cards for individuals, whether you’re heading off on holiday or doing some online shopping abroad. But if you need a foreign currency card designed for cross-border business needs, only the World Card ticks every box.

Open your World Account today, for free, and start using your World Card in 48 hours or less.

Frequently asked questions (FAQs)

What’s the difference between a multi-currency card and a prepaid travel card?

A multi-currency card lets you spend in many currencies – like euros, US dollars or pounds – and save on FX fees. It’s ideal for businesses that need to make international purchases or pay for marketplace seller fees, online.

A prepaid travel card, by contrast, is designed for tourists who want to save on fees and protect their funds while they travel, compared to using their regular credit or debit card issued by a bank. Because prepaid travel cards aren’t connected to users’ bank accounts, they can be more secure than using an everyday debit card.

How do foreign currency cards compare to using a regular debit card abroad?

Using an everyday debit card or current account for overseas spending can lead to extra fees, poor conversion rates or dynamic currency conversion at the point of sale. A foreign currency card or multi-currency card is built to avoid those costs. It allows fee-free spending in supported currencies and gives you access to better exchange rates.

Do I need to pass a credit check to get a foreign currency card?

Most prepaid and multi-currency debit cards don’t require credit checks or a high credit score, since they aren’t linked to borrowing or repayments. You simply load money to your card or multi-currency account and spend what you have available. If you apply for a travel credit card, however, a lender will likely run a full credit check to assess your eligibility and set your spending limit.

How can I tell if a foreign currency card provider is secure?

Check they’re authorised or registered with the Financial Conduct Authority (FCA). Reputable providers publish their FRN (Financial Reference Number) and registered office details in their terms. Some operate as an appointed representative of a larger institution. These signals indicate strict safeguarding of client funds and compliance with UK standards.

Can I use a foreign currency card for purchases abroad?

For prepaid travel cards, yes: most work for in-person and online purchases at any retailer that accepts Mastercard or Visa, and many support cash machine withdrawals.

Multi-currency World Cards, on the other hand, are designed primarily for online spending. For the time being, you can use World Cards to pay via Alipay+ when spending in-person in China. In-person payments via Apple Wallet, Google Wallet and physical cards are coming soon.

Sources:

- https://wise.com/gb/pricing/card-fees

- https://wise.com/gb/pricing/

- https://www.travelex.co.uk/travel-money-card

- https://www.sainsburysbank.co.uk/travel-money/prepaid-travel-money-card

- https://www.postoffice.co.uk/travel-money/card

- https://www.haystravel.co.uk/travel-products/travel-money-card/

- https://www.haystravel.co.uk/mediaLocal/qfwdhg3q/hays-travel-money-card-tc-may-2024.pdf

Disclaimer: The information contained is general only and largely our views. Before acting on the information you should consider whether it is appropriate for you, in light of your objectives, financial situation or needs. Although information has been obtained from and is based upon multiple sources we believe to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions, estimates, mentioned products/services and referenced material constitute our own judgement as of the date of publish and are subject to change without notice. WorldFirst shall not be responsible for any losses or damages arising from your reliance of such information.

Abdul Muhit has 17 years' experience in banking and payments, spanning across regulation, payment networks, acquiring, issuing and treasury. He has served across strategic and delivery roles in product, technology and operations functions at global companies including JP Morgan, KPMG and Visa."

Abdul Muhit

Author

Continue reading

Subscribe

The Weekly Dispatch

Get the latest news and event invites. Signup for our weekly update from the worlds of fashion, design, and tech.

You might also like

Choose a product or service to find out more

E-commerce guides

Doing business with China

Exploring new markets

Business Tips

International transactions

E-commerce expansion guides

Doing business with China

The simpler way to pay and get paid

Save money, time, and have peace of mind when expanding your global business.