Home > blog > Global Business Tips > How to choose a virtual euro card for international business spending

If you’re searching for a virtual euro card, you’re likely facing one or more of these common challenges:

- Opening an account in a foreign country can take time, with lengthy setup and approval processes that may even require a local address or an in-person visit.

- You’re seeing unexpected charges on your card statements – like FX markups, poor exchange rates or fees you didn’t anticipate – and you want more control over what you’re paying.

- Your business relies on recurring euro payments (like ads or SaaS services), and using a traditional bank card leads to messy accounting and inconsistent costs.

No matter the frustration, it comes down to one thing. You need a faster, more flexible way to manage euro payments, without high FX fees or local banking hurdles.

That’s where solutions like the World Card come in.

The World Card is a multi-currency virtual card from WorldFirst. It’s linked to the World Account, where you can hold 20+ currencies for free. Built for global businesses, the World Card is a simple, cost-effective way to send regular EUR payments across 30+ European countries – including the France and Germany.

In this article:

- What to look for in a virtual euro card

- Why World Card is a top virtual euro card for global business

- How the World Card compares to standard bank-issued debit cards

- How to set up your virtual euro card with WorldFirst

Open a multi-currency account with WorldFirst for free and instantly sign up for your World Card.

What to look for in a virtual euro card

A virtual euro card should support the way your business operates in Europe, not slow it down. Whether you’re managing recurring EUR expenses or expanding into new markets, here’s what to look for when choosing the right payment solution.

- A fully online setup so you can start doing business right away. The right virtual euro card should be easy to set up, with no in-person visits or long, drawn-out processes. Most people don’t realise you don’t need to open a traditional European bank account to pay in EUR. Instead, a fully online solution gives you access to your virtual card as soon as your account is approved, not in days or weeks.

- Built-in security features so you can feel at ease when making euro payments. A multi-currency virtual card should offer real-time controls so you can manage risk as you spend. Keep an eye out for features like spending limits, 3DS authentication and the ability to instantly freeze or cancel cards – so you can stay protected against fraud and feel assured that your money’s safe.

- Low-cost euro payments so fees don’t eat into your margins. You shouldn’t have to worry about losing money to hidden costs every time you use your card. A good virtual card lets you pay in euros without excessive FX markups. It goes without saying that the provider should always be upfront and honest about their fees too.

- The ability to create multiple cards. As your business grows, you’ll need solutions that give you more control over the way you do business. Look for a dashboard that offers full visibility into spending, so you can easily track where money is going and manage who can spend what. The ability to create multiple virtual cards for different purposes also helps keep expenses organised and makes reconciliation faster and cleaner.

Read more: How to get an instant virtual debit card online: Your options

Why World Card is a top virtual euro card for global businesses

Many virtual cards make it easy to pay in EUR, but few are built to support businesses as they grow globally. They may solve an immediate need, but often fall short once teams expand and operations stretch across regions.

The World Card was built with your reality in mind – running a business that operates and makes frequent payments across borders.

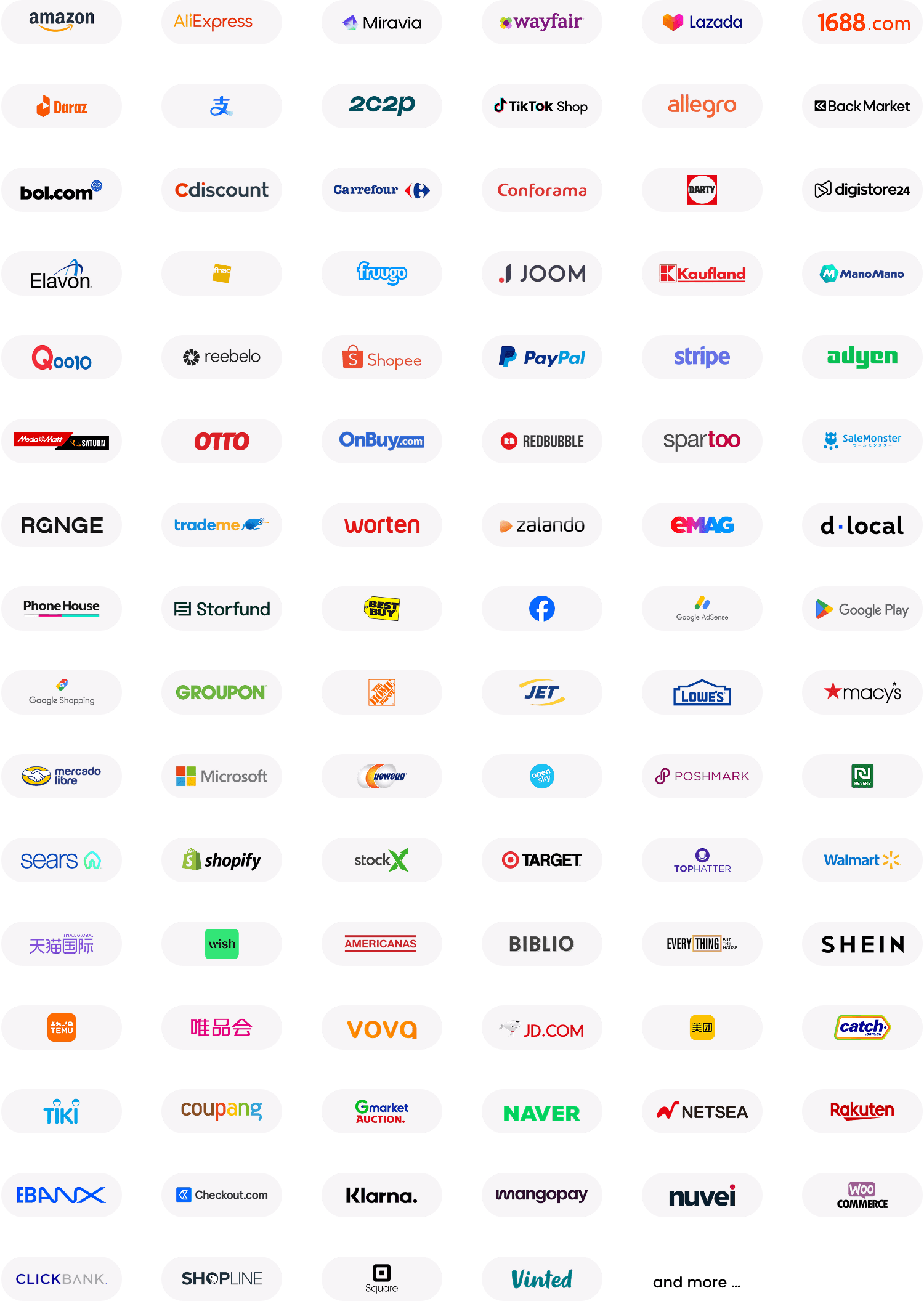

As it’s connected to your multi-currency World Account, you get more than just a debit card. You can securely receive and hold money in 20+ currencies, handle growing transaction volumes and avoid hidden fees or the need for local bank accounts.

Here’s why the World Card is especially well-suited for SMEs that need to pay and receive money in EUR.

Set up a virtual euro card without opening a European bank account

Most virtual euro cards require you to open a local European bank account first, which often means lengthy approval times, in-person setups and extra paperwork. With WorldFirst, it’s much more straightforward.

To get started, you simply set up a World Account, which is fully online and is usually approved within 24-48 hours. From there, you can apply for your World Card and start spending in EUR as soon as you hold a balance. And with no signup costs, the whole setup stays simple and cost-effective.

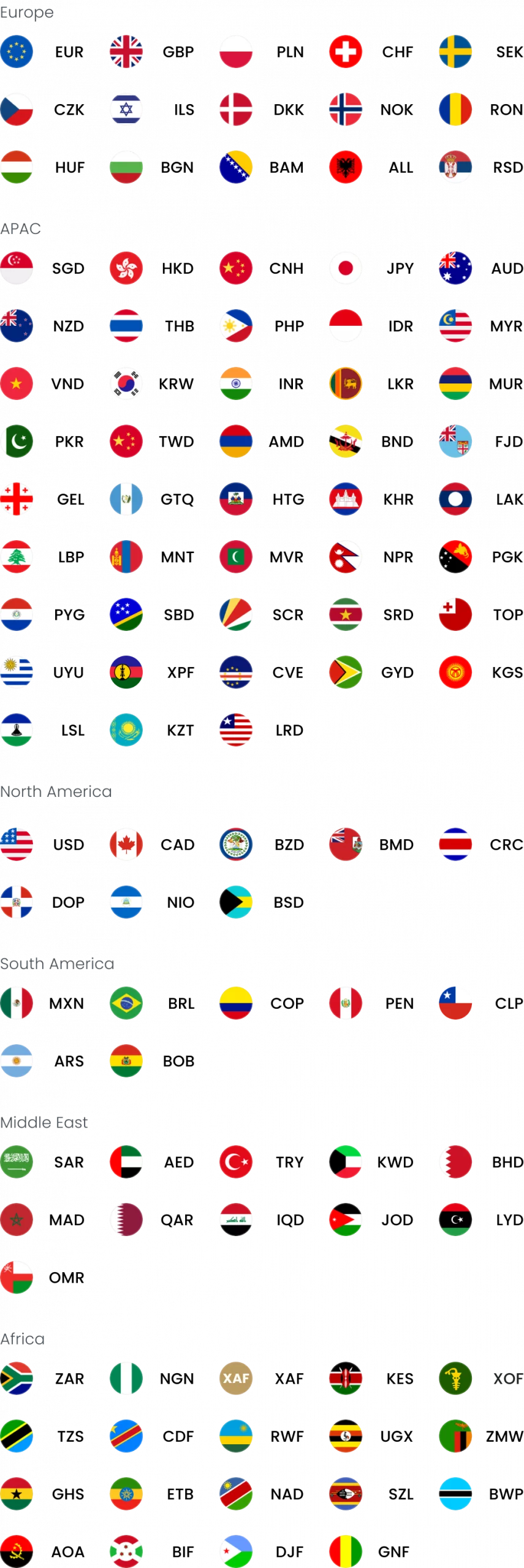

What’s more, with your World Card, you can pay in over 150+ currencies, wherever Mastercard is accepted, across more than 210 countries and territories worldwide – all from one platform.

Read more: Best euro business account UK: 4 options compared

Spend in EUR (and other currencies) with no FX fees

When you’re paying in euros, unnecessary currency conversions or hidden FX markups can add extra steps and unexpected costs.

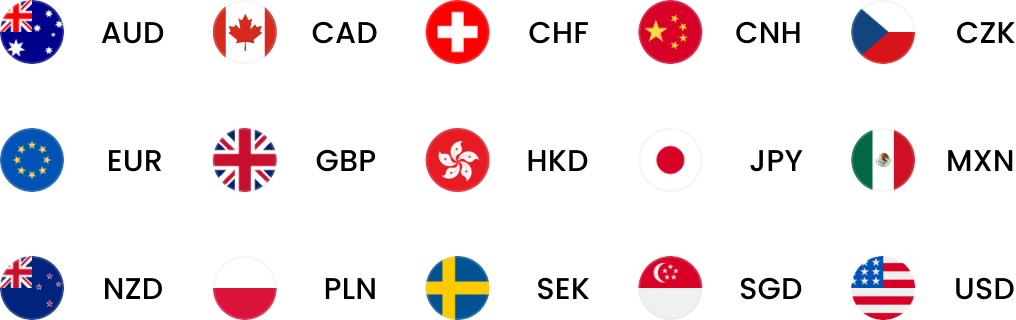

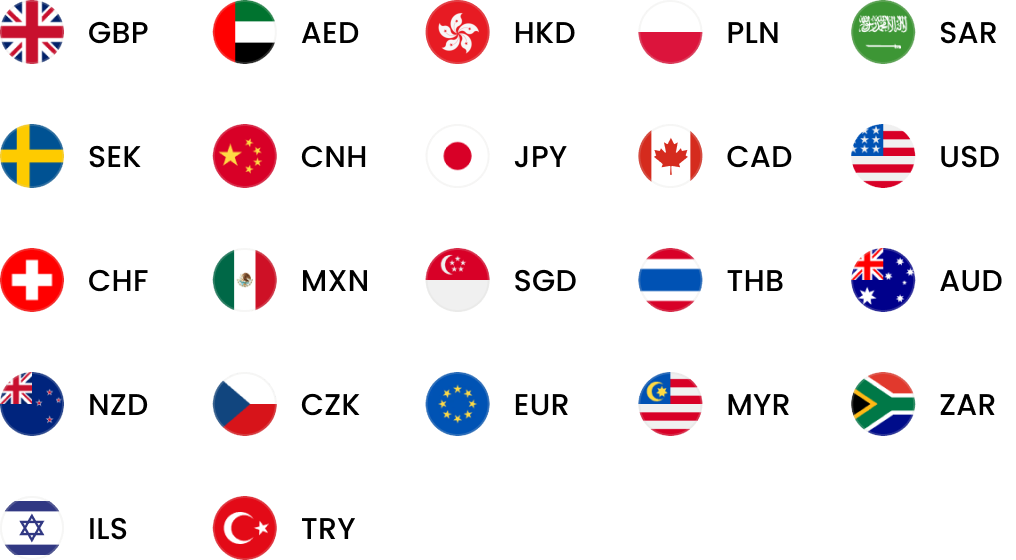

With a World Card, when you make payments in 15 currencies (including EUR, GBP, USD, NZD, SGD and HKD), you’ll pay zero foreign exchange fees. If your World Account has existing balances in euros, your payment will come directly from that balance without having to pay a conversion fee.

For all other currency conversions, WorldFirst uses the mid-market exchange rate, with a low, transparent markup. You can read more about our pricing here.

On top of that, you earn up to 1.2% cashback on eligible card purchases. Over time, that cashback can help offset everyday business expenses, turning regular euro payments into a financial benefit rather than just a cost.

Read more: Best business bank accounts for foreign transactions: 9 top options

Organise expenses across European tools and services

When you’re working with multiple European tools, platforms and service providers, keeping track of your expenses can get complicated. With WorldFirst’s dashboard, you can clearly see where your money is going across all card purchases.

You can also issue up to 50 free virtual cards and assign each new card to a specific purpose, such as a project, team member or single-use situation. This makes it easier to separate expenses, track spending and keep reports clean.

You can also sync your WorldFirst account with Xero and NetSuite, or export structured transaction data, to simplify reconciliation and reporting.

Read more: What is the best virtual card for ads? Your essential guide

Protect how you spend and receive EUR

When you’re managing euro payments, ensuring your money is safe and secure matters. With the World Card, you can instantly freeze or cancel individual virtual cards to stop fraud or prevent accidental overspending.

Every World Card transaction is protected with 3D Secure (3DS), also known as Mastercard Identity Check. This added layer of verification may appear during online checkout and requires the cardholder to confirm the payment using a one-time, 6-digit code sent via SMS or email. It helps prevent unauthorised use while keeping legitimate payments moving.

On top of the card security, your World Account is also secured with two-factor authentication (2FA). This verifies that only approved users can access and manage account funds.

How the World Card compares to standard bank-issued debit cards

Lorem ipsum dolor sit amet,

When looking to spend abroad, most businesses will think of using a standard, bank-issued business Mastercard from their local bank. While it can be used internationally, those transactions often trigger extra checks, currency conversions or foreign transaction fees.

That’s why the World Card is a much better option. It’s built specifically for businesses that operate globally, including in Europe. It’s designed to help you pay European vendors, tools and teams directly in EUR, giving you more control over currency, fees and cross-border spending.

Here’s how these two kinds of cards compare:

| Bank-issued business Mastercard World Card | Digital/Alternative Solution | |

|---|---|---|

| Paying in EUR | Issued in your home currency EUR payments are converted each time |

Spend directly from a EUR balance No FX fees in 15 supported currencies, including EUR No unnecessary conversions |

| FX & Fees | FX markups often included | Real-time tracking and zero/low conversion fees |

| Banking setup | Tied to a domestic bank account May require a European bank account for true EUR use |

No European bank account required Fully online setup |

| Control and organisation | One shared card Limited spend controls Replacing cards can disrupt payments |

Up to 50 virtual cards Spending limits by card or team Instant freeze or cancel Clear EUR tracking |

| Scaling globally | Works for occasional international spend Gets inefficient as regions grow |

Pay in 150+ currencies Pay in 210+ countries |

How to set up your free virtual euro card with WorldFirst

It’s easy to set up your World Card. The first step is to open a WorldFirst Account. All you need to do is fill out a quick, online application and wait for a same-day or next-business-day approval.

Take these steps to set up your World Account:

- Get started by visiting our official online portal

- Fill in your details

- Provide the necessary verification documents

- Wait up to 48 hours for your account to be approved

Now that your World Account is set up, you can apply for your virtual euro card:

- Go to the main navigation menu and click “World Card”

- Click “Apply Now” after reviewing the terms and conditions

- Choose a nickname for your first virtual card and click “Apply”

- Select the cardholder – you can assign it to yourself or another verified company director.

Once your World Card is issued, you can start using it right away.

Ready to start making quick, easy payments in EUR? Open a WorldFirst account for free today.

FAQs

Can non-EU businesses apply for a virtual euro card?

WorldFirst supports businesses based outside the EU. As long as your business is eligible, you can apply online and use the World Card to pay European vendors, platforms and services in EUR.

What if I start in Europe but expand to other regions?

WorldFirst is designed to grow with your business. You can start by paying in EUR across Europe, then expand and send payments to partners in other regions – all from the same platform, without needing to switch providers or open new accounts.

Can I use the World Card with Google Pay or Apple Pay?

Apple Pay and Google Wallet support are coming soon. Once available, you’ll be able to add your payment card to your digital wallet and make quick, contactless payments – whether you’re online shopping or paying in-store.

How do I pay with my World Card?

You can use your World Card just like any other traditional debit or credit card. At checkout, enter your card details – including the card number, expiration date and CVV code – to complete your online purchase. If there’s an extra security step, you’ll receive a one-time code to confirm the payment.

What can businesses use the World Card for?

The World Card is built for everyday digital payments, including:

- Paying suppliers or service providers who accept card payments

- Managing recurring SaaS subscriptions

- Running digital ads on platforms like Meta, Google and TikTok

- Covering travel, accommodation and other business expenses

Because it’s a true business debit card linked to real balances, it works smoothly across most online platforms.

Is there a physical World Card?

Not yet, but it’s coming soon. Once available, you’ll be able to use a physical World Card for in-store purchases, ATM withdrawals and anywhere that accepts physical card payments, alongside your virtual card.

Jennifer Dodd leads marketing for WorldFirst UK, and has over 20 years' experience in financial services and publishing.

Jennifer Dodd

Author

Continue reading

Subscribe

The Weekly Dispatch

Get the latest news and event invites. Signup for our weekly update from the worlds of fashion, design, and tech.

You might also like

Choose a product or service to find out more

E-commerce guides

Doing business with China

Exploring new markets

Business Tips

International transactions

E-commerce expansion guides

Doing business with China