Home > blog > Latest Happenings > Digital payments in Singapore: Trends, providers and 2026 guide

Singapore’s digital payment system has been built carefully over time and it shows. Local transfers happen instantly, suppliers expect same-day settlement and finance teams work with real-time visibility as a baseline.

Those expectations match Singapore’s role in global trade. Businesses move money across Asia, the US and Europe every day, often in multiple currencies. They collect revenue in one market, pay suppliers in another and manage cash across various jurisdictions.

In 2025, digital payment volumes in Singapore have exceeded US$92 billion, with cross-border settlements averaging around US$47 billion per day.

For finance and operations teams, this raises the bar. Local payment methods still matter, but they are rarely enough on their own. The real challenge is connecting domestic and international payments while keeping costs clear and control intact as volumes grow.

This guide explains how digital payments in Singapore work, the trends shaping 2025 and what businesses need when cross-border payments become part of everyday operations.

Key takeaways:

- Digital payments in Singapore move fast by default: Instant transfers and same-day settlement are now expected, not optional, especially for businesses managing cash flow in real time

- Customer payment preferences are clear: Consumers rely on wallets, PayNow and mobile payments for daily spending, so checkout experiences must support these methods to avoid friction

- Different payment methods serve different jobs: Domestic rails handle local payments well, cards and wallets support revenue collection and cross-border payments enable international trade

- Cross-border payments cause the most friction: FX costs, delays and limited visibility impact margins and working capital once businesses operate across markets

- World Account simplifies cross-border digital payments: WorldFirst’s World Account lets Singapore businesses receive, hold and pay in multiple currencies from one platform, making international payments part of daily operations

Open a World Account for free and manage cross-border digital payments from one platform built for global trade.

Consumer behaviour and payment preferences in Singapore

Singapore is a leader in Southeast Asia in cashless adoption, with retail point-of-sale use of electronic payments at around 97%, a level few markets in the region match.

This movement shows up first in how people shop and pay. Online purchases are a routine part of life for many Singaporeans and the way they check out reflects that. Consumers now expect merchants to support familiar payment options through a reliable payment gateway that works smoothly across devices.

Digital wallets such as Apple Pay, GrabPay, DBS PayLah! and Google Pay now account for nearly 39% of e-commerce transaction value, a dramatic rise from just 7% a decade ago.

In physical stores, contactless and wallet-based payments are also common. Digital wallets accounted for about 29% of point-of-sale transaction value in 2024, compared with roughly 1% in 2014.

Mobile payments now play a central role in everyday spending, not just transport or food delivery. Among younger consumers, adoption is most obvious. Around 68% of Singapore’s Generation Z prefer PayNow, while 29% regularly use GrabPay, showing how instant transfers and wallets have become part of daily life.

Taken together, these shifts show that consumers expect fast, flexible ways to pay, whether they are shopping online, scanning a QR code at a hawker stall or settling services in person. These patterns shape checkout design and influence how finance teams choose payment partners.

6 most popular digital payment methods in Singapore

Singapore offers a range of established payment systems for consumers and businesses. The following are the primary payment methods used:

Power your global growth with one account

Get local currency accounts, fast payments and competitive FX – all in one place.

1. PayNow and PayNow Corporate

PayNow is Singapore’s real-time account-to-account payment system. It allows money to be transferred instantly between bank accounts using simple identifiers, such as a mobile number, NRIC or business UEN.

PayNow has fundamentally changed how local money moves. Before PayNow, businesses relied on cheques, GIRO or manual bank transfers, which introduced delays and additional reconciliation work. PayNow made instant settlement the norm for domestic payments.

Why it matters:

For small and mid-sized businesses, PayNow improves cash flow predictability by delivering funds instantly rather than days later. Larger organisations benefit from lower operational overhead, with fewer payment confirmations, follow-ups and exceptions to manage.

PayNow’s main strength is certainty. The trade-off is scope. PayNow only supports Singapore dollar payments within Singapore, so once a business operates internationally, it can no longer rely solely on PayNow.

Pros:

- Instant settlement with same-day certainty

- Easy setup via existing bank relationships

- Low cost compared with card processing or cheque handling

- High adoption among local consumers and business partners

Cons:

- SGD only; no direct foreign currency support

- Not suitable for international suppliers or receipts

- Does not support credit terms; it’s a push payment only

Where it fits:

Best for local revenue inflows, paying domestic partners, utility and vendor bills and cases where speed and certainty matter more than currency flexibility.

2. Credit and debit cards

Card payments run through global card networks such as Visa, Mastercard, American Express and UnionPay. They allow customers to pay using issued cards, either online or at physical terminals, with settlement handled through acquiring banks and processors.

Cards remain deeply embedded in global commerce. They are familiar, trusted and universally recognised, especially by international buyers.

Why it matters:

Cards solve one problem extremely well: customer access. If you sell online, accept international customers or operate in the tourism industry, cards remain essential. They remove friction at checkout and allow buyers to pay in a way they already understand.

For businesses, however, cards introduce drawbacks. Fees are higher than bank transfers. Settlement is delayed compared to real-time rails. Chargebacks and disputes require active management.

Cards are also poorly suited for paying suppliers, especially in B2B environments where transfer size, timing and reconciliation matter more than consumer convenience.

Pros:

- Global acceptance

- Familiar and trusted by customers

- Strong support for online and international sales

Cons:

- Higher processing fees

- Settlement delays

- Chargebacks and disputes add overhead

Where it fits:

Use cards primarily to collect revenue, especially from online or international customers. Avoid relying on them for supplier payments or day-to-day cash flow management.

3. E-wallets and mobile payments

E-wallets are app-based payment tools that store value or payment credentials and enable users to pay via QR codes, NFC or in-app checkout. In Singapore, typical examples include GrabPay, DBS PayLah!, ShopeePay and FavePay.

Many wallets support SGQR, enabling merchants to accept payments from multiple wallets with a single QR code at the point of sale.

Why it matters:

Wallets fit mobile-first behaviour and make payments fast and intuitive, especially for everyday spending. For merchants, wallets improve checkout speed and reduce friction in both online and offline environments.

From a business operations perspective, wallets usually play a supporting role. They are effective for specific channels such as retail, food and beverage or marketplace sales, but they rarely serve as the central hub of a finance operation.

Pros:

- Fast and convenient checkout

- Strong consumer adoption

- Works well for QR and contactless payments

Cons:

- Fragmented balances across providers

- Limited multi-currency support

- Additional reconciliation steps

Where it fits:

Wallets suit consumer-facing retail and local e-commerce, where convenience drives conversion. They typically sit alongside other payment rails rather than replacing them.

4. Bank transfers and FAST

FAST or Fast And Secure Transfers, is Singapore’s near-real-time bank transfer system. It allows money to move directly between bank accounts with minimal delay, typically within seconds.

Unlike PayNow, FAST usually relies on traditional bank details and is commonly used for structured payments such as payroll, supplier settlements or internal fund movements.

Why it matters:

FAST provides reliability and familiarity. Finance teams understand it, banks support it and it works consistently for domestic obligations. It is well-suited to predictable, repeatable payments where audit trails and control matter.

FAST is a domestic rail. It does not address international payments, foreign currency holding or FX exposure. It also often requires manual initiation unless integrated into payment systems or ERP workflows.

Pros:

- Fast and reliable domestic transfers

- Well understood by finance teams

- Suitable for recurring payments

Cons:

- Domestic only

- Limited automation without integrations

- No FX or multi-currency capability

Where it fits:

FAST works well for payroll, regular supplier payments and internal transfers within Singapore. It does not address cross-border settlement or foreign currency needs.

5. Cross-border payments and international transfers

Cross-border payments transfer money across countries and currencies, typically via correspondent banking networks or specialised international payment providers. These payments often involve multiple intermediaries before funds reach the final recipient.

Why it matters:

This is where payment complexity becomes most visible. Delays, unclear fees, forced FX conversions and limited tracking all affect how businesses manage cash.

For Singapore businesses sourcing from China, selling into the US or Europe or paying global service providers, these issues directly impact margins and working capital. A payment that arrives two days late or converts at an unfavourable rate is not just inconvenient.

International payments demand more than basic bank transfers. They require visibility, flexibility in currency and control over timing and conversion.

Pros:

- Enables global trade

- Supports foreign currency payments

- Necessary for international suppliers and platforms

Cons:

- Slower settlement through traditional banks

- Opaque fees and FX spreads

- Limited visibility during transit

Where it fits:

International transfers are essential once a business pays overseas suppliers or receives revenue from global platforms. They require more control and visibility than domestic rail systems can provide.

6. Buy now, pay later (BNPL)

BNPL allows customers to split purchases into installments at checkout, typically with little or no upfront interest. Providers such as Atome and ShopBack PayLater integrate directly into online checkout flows.

Why it matters:

BNPL affects purchasing behaviour rather than payment infrastructure. It can increase conversion rates and average order value, especially for higher-ticket consumer goods.

For businesses, BNPL is a commercial lever rather than an operational one. Its value lies entirely in customer acquisition and conversion.

Pros:

- Higher conversion for certain products

- Familiar to digital-first consumers

Cons:

- Higher merchant fees

- Slower settlement

- Not relevant for supplier payments

Where it fits:

BNPL fits best in consumer e-commerce, particularly for higher-ticket items. It is a commercial tool rather than a core payment rail.

How to decide which payment methods your business should use

These are the key areas to focus on when deciding which payment methods make sense for your business:

1. Begin with how money enters your business

The first question is not which payment methods are popular. It is how your customers already try to pay you.

Different customer groups behave differently. Local buyers often favour instant bank transfers or wallets. International customers default to cards. Business buyers care more about reliability and clarity than speed at checkout.

You can uncover these patterns without guesswork:

- Review where payments complete smoothly and where they stall

- Look at abandoned checkouts and failed payment attempts

- Pay attention to the payment methods customers ask for, especially during sales or support conversations

2. Treat cost as a system, not a line item

Payment fees rarely appear in a single place. Transaction charges, FX spreads, delayed settlement and manual reconciliation all affect profitability, but they show up in different parts of the operation.

When comparing payment methods, consider how they behave end-to-end:

- How long does it take for funds to become usable?

- When and how does currency conversion happen?

- How often do finance teams need to step in to fix issues?

- What happens when volume increases?

3. Build security into the foundation

Strong payment methods protect businesses and customers through layered controls that verify identity, protect sensitive data and preserve transaction accuracy. If a payment option weakens any of those areas, it increases exposure rather than improving experience.

In practice, this means favouring methods that meet established banking and regulatory standards rather than relying on workarounds or add-ons.

4. Make sure payments work with the rest of your operation

Payments do not end when money leaves a customer account. They continue through reconciliation, reporting, tax and cash planning.

Before adding a payment method, consider how it connects to:

- Accounting and ERP systems

- Order and inventory tracking

- Revenue reporting and forecasting

- Automation and workflow tools

A method that requires manual intervention at every step becomes a bottleneck as volume increases.

5. Choose for where your business will be next

Many businesses start with local payment methods and add others later. The challenge is that switching or rebuilding payment setups is rarely simple.

It helps to think ahead. If international customers, overseas suppliers or multi-currency pricing are part of your future, your payment choices should reflect that early. Flexibility matters more than completeness.

The right payment mix supports growth quietly in the background. The wrong one becomes visible only when it starts to slow everything down.

How WorldFirst supports digital payments for Singapore businesses

As Singapore businesses expand internationally, payment complexity increases rapidly. Multiple currencies, overseas suppliers and global platforms introduce delays and added costs when payment systems cannot support cross-border trade.

WorldFirst builds its platform for businesses that operate across multiple markets. The World Account sits at the centre, giving companies a multi-currency business account designed to handle international business payments as part of everyday operations.

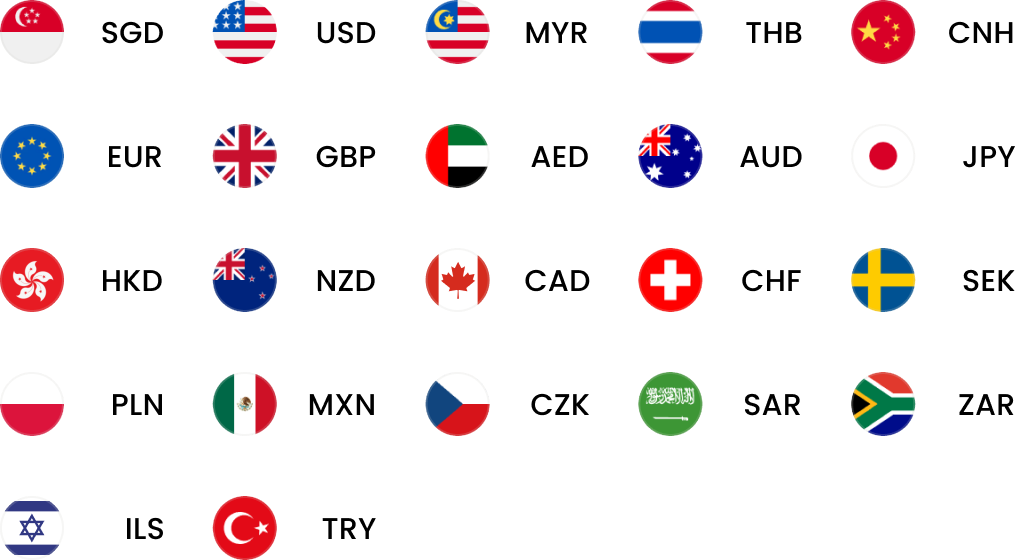

With a World Account, Singapore businesses can:

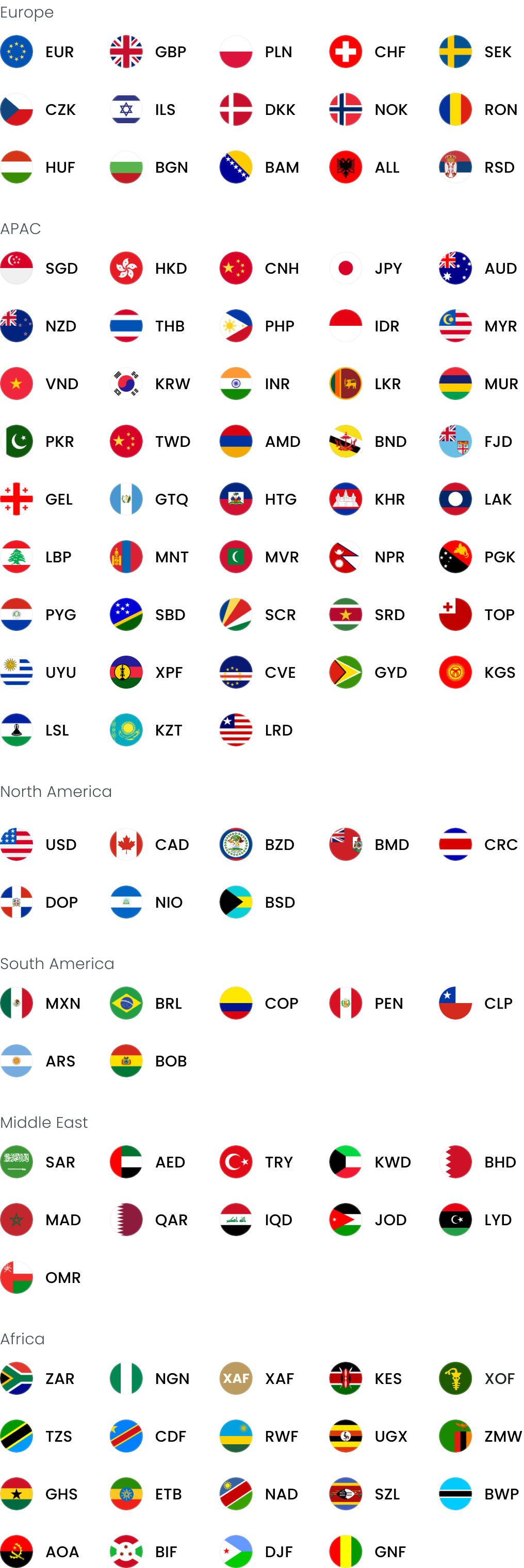

- Receive payments in 20+ currencies using local receiving details

- Hold balances in multiple currencies without forced conversion

- Pay suppliers in 100+ currencies across global markets

- Convert currencies when it suits the business, not when a bank requires it

- Withdraw funds to local bank accounts when needed

- Integrate with accounting systems such as Xero and NetSuite, enabling automatic reconciliation and streamlined financial workflows

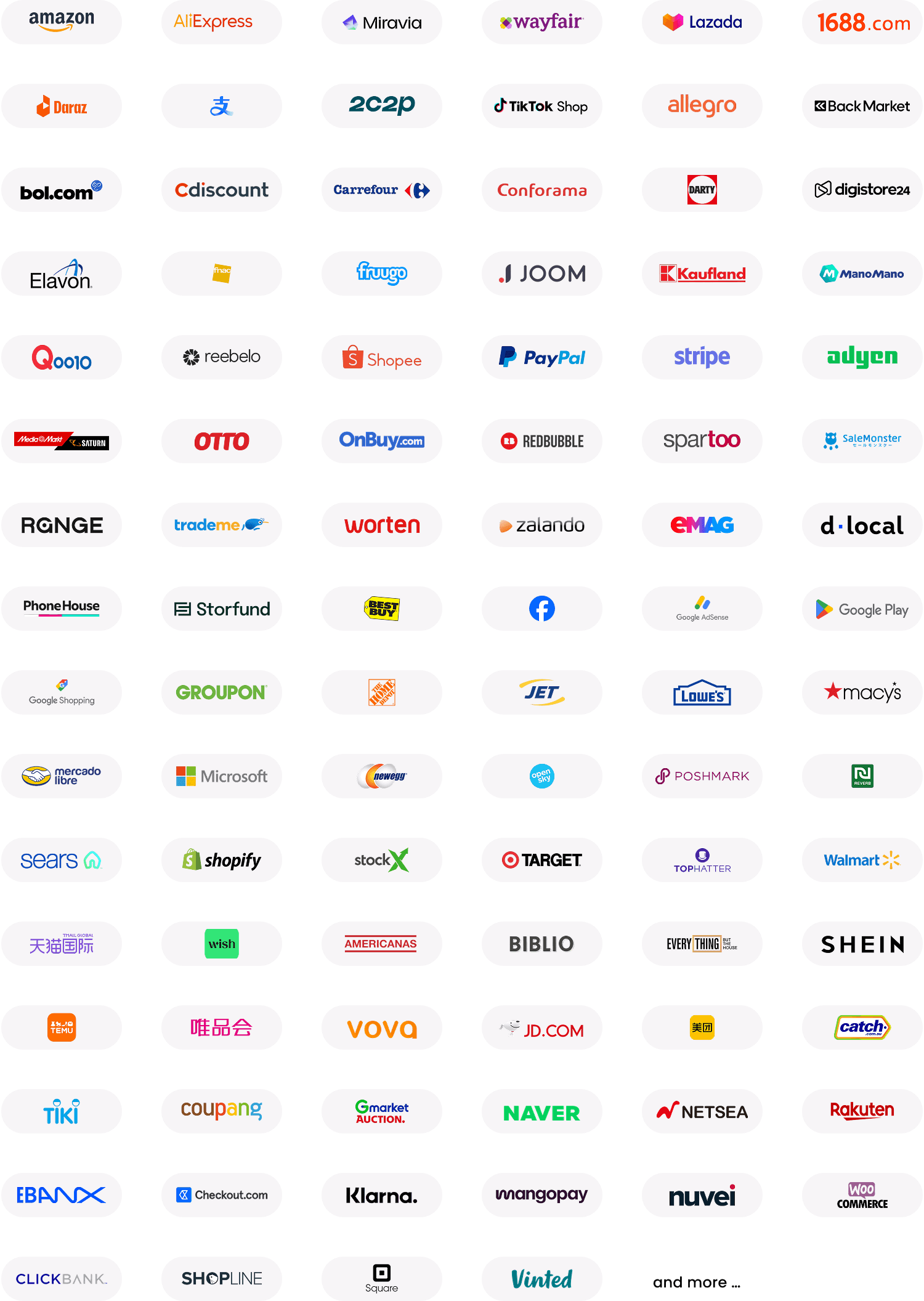

- Connect to 130+ marketplaces and payment gateways, including Amazon, Etsy, Shopify, Shopee and TikTok Shop, so international revenue flows directly into the World Account without switching between tools

Singapore businesses use World Account to pay overseas suppliers on time, receive funds from global marketplaces and platforms and manage regional cash flow from a single view. Instead of treating international payments as exceptions that require manual handling, World Account integrates them into everyday operations.

Looking for a simpler way to manage digital payments for your Singapore business?

Open a World Account for free and start receiving, holding and paying in multiple currencies through one platform built for cross-border trade.

Continue reading

Subscribe

The Weekly Dispatch

Get the latest news and event invites. Signup for our weekly update from the worlds of fashion, design, and tech.

Open a World Account for free

Get local currency accounts, fast payments and competitive FX – all in one place.

Joan Poon leads marketing across Southeast Asia at WorldFirst, driving growth and brand leadership in key markets including Singapore, Malaysia and the Philippines.

Joan Poon

Author

Head of Marketing SEA, WorldFirst Singapore

You might also like

Choose a product or service to find out more

Customer Stories

Latest Happenings

e-Commerce & Online Sellers

Doing business with China

International Transactions

Foreign Currency Exchange

Doing business with China