Home > blog > International Transactions > 10 best OFX alternatives for international transfers in 2026

OFX is often one of the first platforms Singapore businesses use for international transfers. It covers the basics: currency conversion and overseas payments without going through a traditional bank.

That setup works until payment volume increases and the number of routes multiplies. Once a business collects revenue in foreign currencies, pays suppliers across regions and needs faster access to funds, the limitations of a transfer-only model become easier to spot. FX timing, settlement delays and the inability to manage currency balances start to affect day-to-day decisions.

In 2026, many Singapore exporters, e-commerce sellers and service businesses are looking for platforms that support holding, receiving, converting and paying in multiple currencies with predictable costs and fewer manual steps.

This guide reviews 10 OFX alternatives for businesses operating in Singapore. The focus isn’t on headline rates or marketing claims, but on how each option fits into real international workflows from Singapore.

What is OFX?

OFX is a foreign exchange and international payments provider that started in Australia in 1998 and rebranded from OzForex to OFX in 2015.

In Singapore, OFX operates under a Payment Services Act licence issued by the Monetary Authority of Singapore.

Businesses typically use OFX to send cross-border payments and manage foreign exchange for supplier payments, overseas invoices and international operating costs.

How OFX performs on major review platforms and where limitations appear

Public reviews on Trustpilot and G2 generally rate OFX positively.

However, while many users report successful transfers, the feedback also highlights structural limitations that become more visible as businesses rely on the platform more consistently.

A closer reading of Trustpilot and G2 reviews reveals several recurring issues:

- FX pricing concerns: Users frequently note that exchange rates are not always as competitive as expected, especially compared to newer multi-currency platforms

- Operational friction during account checks: Reviews regularly reference delays or uncertainty during verification, compliance reviews or manual checks

- Limited flexibility for ongoing international operations: OFX is often described as effective for sending money but less adaptable for holding balances, reusing funds across currencies or managing more complex payment flows

Support responsiveness under pressure: While some users praise individual support agents, negative reviews tend to cluster around situations where urgent issues arise

What to look for in an OFX alternative

Choosing an OFX alternative usually comes down to how well a platform supports day-to-day international payments, not how it looks on a feature list. For businesses making regular cross-border transfers, a few areas matter most:

- Cost clarity: Businesses should be able to understand FX pricing and fees before sending a transfer. For businesses moving money frequently, slight differences in spreads or charges can add up over time

- Settlement speed: Payment timing affects more than convenience. Delays can strain supplier relationships, disrupt inventory planning or slow access to revenue

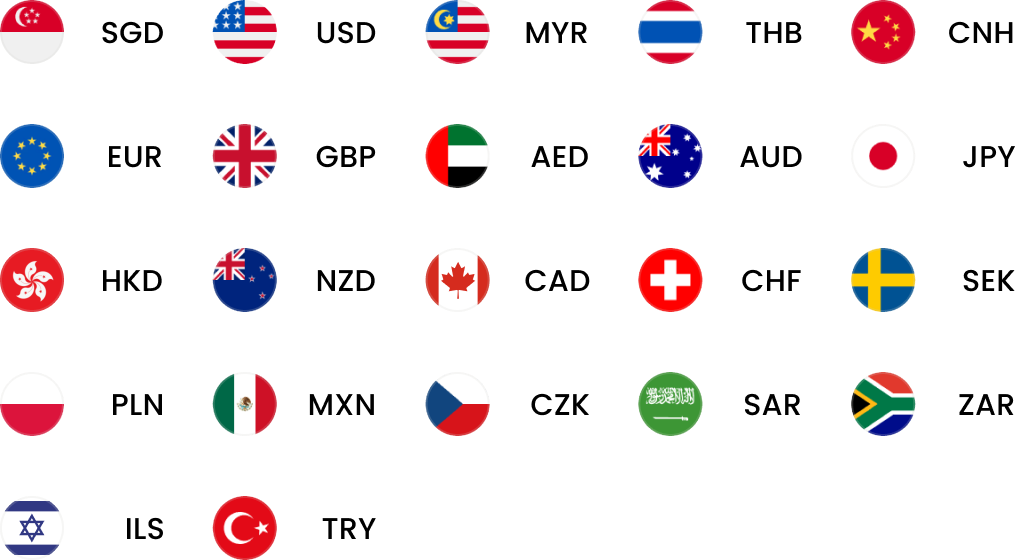

- Currency coverage: The platform should support the currencies and payment routes your business actually uses

- Security and controls: Strong safeguards around accounts, payments and user access help protect funds and reduce operational risk, especially as transaction volumes grow

Operational fit: Integration with accounting systems, marketplaces or internal workflows can reduce manual work and make international payments easier to manage at scale

Power your global growth with one account

Get local currency accounts, fast payments and competitive FX – all in one place.

10 best OFX alternatives

The comparison table below reviews 10 OFX alternatives for international payments in 2026, assessed against real-world operational needs:

| Provider | Local receiving accounts | FX markup / fees | Transfer speed | Integrations |

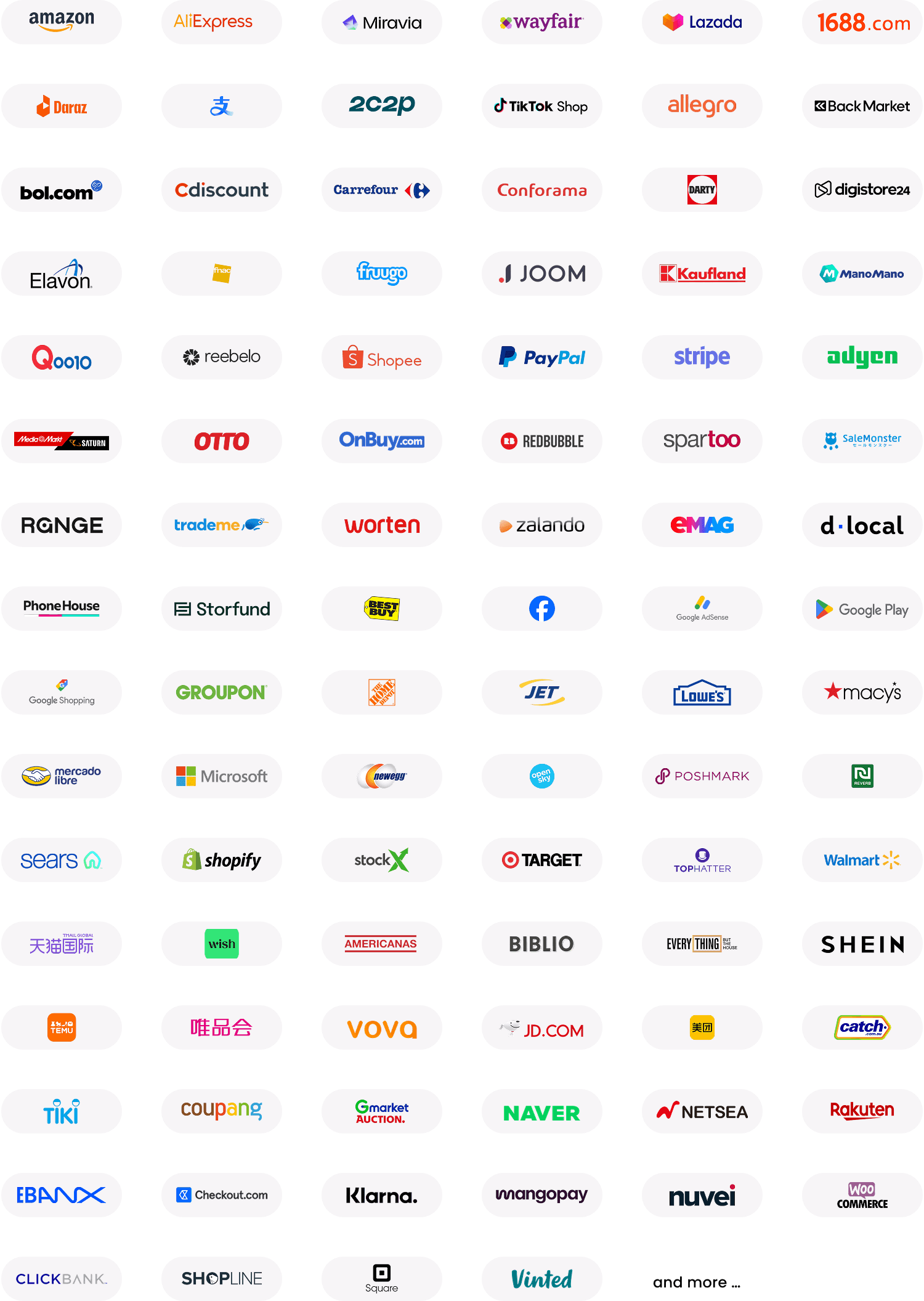

| WorldFirst World Account | 20+ (USD, EUR, GBP, AUD, SGD, JPY, CNH etc.) | Up to 0.6% on major currencies | Same-day / next-day on major routes | Amazon, Shopee, Lazada, Shopify, 1688.com, Xero, NetSuite |

| Wise Business | 9 (SGD, USD, EUR, GBP, AUD, CAD, NZD, CHF, HKD) | From ~0.26% (variable by route) | Typically 1–2 business days | Xero, QuickBooks |

| Airwallex Business | 20+ (USD, GBP, EUR, AUD, HKD, SGD etc.) | ~0.4% on major FX pairs; higher on others | Fast local transfers; FX timing varies by corridor | Xero, QuickBooks, NetSuite, Shopify, Amazon, Stripe |

| PayPal Business | Limited (wallet-based) | FX margin varies by currency and transaction type | Instant to PayPal balance; bank withdrawal varies | Shopify, WooCommerce, BigCommerce |

| CurrencyFair | Limited (bank-to-bank) | Flat transfer fee plus FX margin | Typically 1–3 business days | None (bank transfer focused) |

| TransferGo Business | Local and global accounts in selected markets | FX margin varies by route and speed option | From minutes to 1 business day (route-dependent) | Xero |

| Skrill Business | Wallet-based | FX fee plus transaction charges | Near-instant wallet transfers; bank payout varies | API, e-commerce integrations |

| Convera | Limited (corporate rails) | Negotiated FX pricing | Same-day to several days (route-dependent) | ERP and treasury integrations |

| Nium | Virtual/local accounts in supported markets | Pricing varies by use case and volume | Fast payouts on supported rails | API-first; platform integrations |

| Moneycorp | Selected local accounts | FX margin varies; forwards available | Same-day / next-day on major routes | ERP integrations; batch payments |

1. WorldFirst

WorldFirst suits Singapore businesses that need more than a one-off transfer flow.

It centres around a multi-currency World Account that lets you collect, hold, convert and pay across markets without forcing you back into a bank-first workflow.

WorldFirst supports trading businesses, especially e-commerce sellers and importers moving funds across SG–CN, SG–US and SG–AU routes.

Key features:

- Multi-currency World Account for holding and managing funds in multiple currencies in one place

- Local receiving accounts in key currencies so overseas customers and marketplaces can pay you like a local

- International transfers that support business payments with transparent pricing instead of bundled “all-in” costs

- Risk management tools such as forward contracts (useful when supplier costs sit in USD or CNY but revenue lands in SGD)

Why it’s a good OFX alternative:

OFX works well when the main job is sending money overseas. WorldFirst fits better when international payments connect to a wider loop: getting paid internationally, holding balances and paying suppliers without converting more than necessary. That matters once transfers become routine rather than occasional.

2. Wise Business

Wise Business emphasises transparent pricing and cost visibility.

It appeals to teams that want to see fees upfront, convert at rates close to the mid-market reference rate and avoid pricing that changes depending on who is negotiating that day.

Key features:

- Transparent pricing that shows fees clearly per feature and transfer type

- A multi-currency account for holding and managing multiple currencies in one place

- Currency conversion based on the mid-market rate, with fees displayed separately

- Debit card support for spending from balances, useful for travel or SaaS tools billed in foreign currencies

Why it’s a good OFX alternative:

If your main frustration with OFX is benchmarking FX cost, Wise typically feels easier to audit. Finance teams like it because the numbers are easy to explain internally, especially when payments happen frequently.

For a more in-depth look at Wise Business, including fees, account features and common limitations, see our detailed Wise Business review.

3. Airwallex

Airwallex targets businesses that need global account infrastructure and system-level integration.

Companies commonly shortlist Airwallex when they treat payments as an ongoing workflow rather than a one-time task, especially when they operate across multiple entities or platforms.

Key features:

- Global Accounts to open foreign and multi-currency accounts for collecting funds in key markets

- Multi-currency balances + cards to manage funds and spend in multiple currencies

- High-speed international transfers positioned as a core part of the business account

- API and platform capabilities to create and manage accounts programmatically for embedded flows

Why it’s a good OFX alternative:

Airwallex is a good fit when a business outgrows a transfer-first tool. If you need local collection, tighter operational controls and integrations into finance systems, Airwallex tends to feel more “built for process” than OFX.

For more details on how Airwallex works in practice, see our full Airwallex review.

4. PayPal Business

PayPal is less about paying suppliers efficiently and more about getting paid internationally with minimal friction.

It remains relevant because many overseas buyers already prefer it, especially in cross-border e-commerce and service invoices.

Key features:

- PayPal Invoicing supports multi-currency invoicing and a broad market reach

- Multi-currency management inside PayPal accounts (add and manage currencies)

- Checkout and acceptance options that let customers pay without needing a PayPal account (varies by region and method)

- Published business fee tables (fees vary by country and payment type, but PayPal documents them)

Why it’s a good OFX alternative:

PayPal works well as an OFX alternative when collecting funds matters more than paying them out. International sales often flow through PayPal first, with a separate platform handling cost-efficient supplier payments.

5. CurrencyFair

CurrencyFair offers a pragmatic option for businesses that want a simpler international transfer model with clearly stated pricing mechanics.

Many teams use it for bank-to-bank transfers, where the priority is controlling total cost rather than adding finance workflow tooling.

Key features:

- Published pricing model that explains how CurrencyFair charges for exchange and transfers

- International transfers to many destinations, positioned around bank-to-bank delivery

- Supported currencies and country reach disclosed in its product descriptions

- Regulatory context referenced in independent analysis (verify against your needs before onboarding)

Why it’s a good OFX alternative:

CurrencyFair suits businesses that want a more direct transfer experience with cost expectations set upfront. Businesses that require advanced controls, multiple users or structured payout workflows often find it less suitable.

6. TransferGo Business

TransferGo Business focuses on speed and clarity for cross-border transfers and positions its business account to receive and send across multiple currencies.

Smaller businesses that value fast settlement and simple execution often find it more compelling.

Key features:

- A business account that supports holding, exchanging, receiving and sending multiple currencies

- Local and global account details for receiving payments, more like a local business in supported markets

- Transfer tracking that shows step-by-step status and shareable tracking links

- Speed claims and transfer method options described in its business payments pages (varies by route)

Why it’s a good OFX alternative:

TransferGo fits best when speed and visibility matter more than relationship-led service. Businesses that want a clean way to move money and track delivery without adding a heavy finance platform often choose it.

7. Skrill

Skrill operates more like a digital wallet and merchant tool than a traditional B2B FX provider.

Businesses in digital goods or online services often use Skrill for wallet-based transfers and card options, though careful attention to the fee structure remains essential.

Key features:

- International money transfer service with availability throughout the week

- Published fee pages that outline charges by transaction type and funding method

- Foreign exchange fee disclosures, including stated FX fees that can apply to conversions

- Business registration pathway for merchants to accept payments (separate from simple transfers)

Why it’s a good OFX alternative:

Skrill fits businesses that prioritise online payment acceptance over FX control, with higher costs reducing its appeal for high-value transfers.

8. Convera

Convera operates as a B2B-focused provider for companies that need cross-border payments, FX risk management and structured operational controls.

The platform emerged from Western Union Business Solutions’ rebranding following its acquisition.

Key features:

- Cross-border payment solutions positioned for business use cases rather than consumer transfers

- FX risk and hedging capabilities presented as part of its business offering

- Automated workflows and user access controls referenced in its platform positioning for larger payment governance needs

- Bulk payment and systems integration direction (ERP and finance system integration is a common positioning point)

Why it’s a good OFX alternative:

Convera fits organisations where international payments operate within defined governance frameworks, including approval chains, audit visibility and controlled execution. Businesses managing large or frequent cross-border payments often choose Convera for structure rather than speed alone.

9. Nium

Nium is relevant to Singapore- and Asia-Pacific-based businesses because it focuses on global money movement infrastructure, including multi-currency accounts and programmable payment flows.

It often appears in shortlists for businesses that need payout capability across many markets or want account functionality embedded into their product operations.

Key features:

- Multi-currency accounts positioned to receive, hold, convert and pay

- Global payments network positioning that supports cross-border payout use cases

- API-first options referenced in product pages for account issuance and management

- Collections and local account capabilities described in coverage of its collections product direction

Why it’s a good OFX alternative:

Nium suits teams that need to operate at scale across multiple markets, particularly in payout-heavy models. Many turn to Nium once OFX feels too limited for multi-destination payments and more structured payout flows.

10. Moneycorp

Moneycorp appeals to organisations that want a more traditional FX partner experience delivered through an online platform.

Risk management tools such as forward contracts make it particularly relevant when protecting margins matters as much as executing payments.

Key features:

- A multi-currency business account positioned for sending and receiving in multiple currencies

- Wide currency access and international reach define the account’s positioning

- Forward contracts that can lock in rates for extended periods (as described by Moneycorp)

- Batch payment capability and bulk processing referenced in third-party review summaries of Moneycorp’s tools (validate during sales process)

Why it’s a good OFX alternative:

Moneycorp stands out when FX management plays a central role rather than a supporting one. Planned future payables and exposure to currency movement often drive teams to choose Moneycorp for greater certainty.

Why the World Account is the best OFX alternative for Singapore businesses

While all the platforms reviewed above offer credible alternatives to OFX, one stands out for its comprehensive support for international payment workflows from Singapore.

The World Account from WorldFirst operates as a full international payments setup rather than a transfer-only service. WorldFirst positions the account around managing global money flows end-to-end, not handling transactions one at a time.

The World Account allows you to:

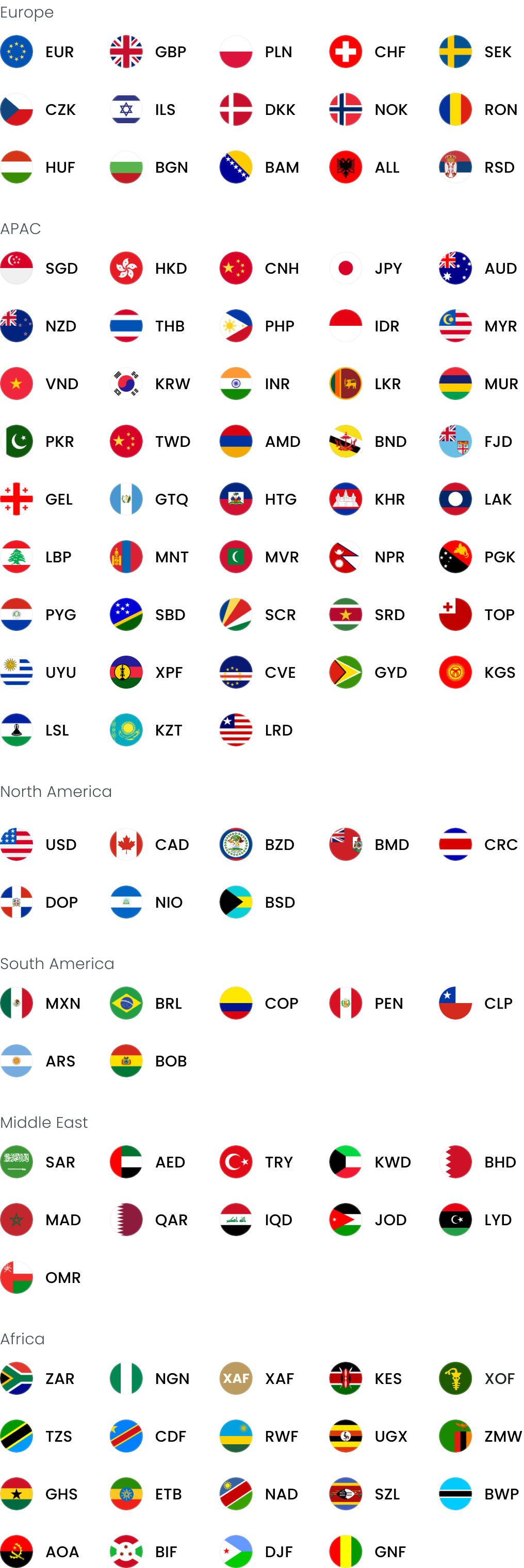

- Receive payments in 20+ currencies using local receiving details, allowing overseas customers, marketplaces and partners to pay you like a local

- Hold and manage multiple currencies in one account, reducing unnecessary conversions between incoming and outgoing payments

- Send payments to 200+ countries and regions, supporting supplier, partner and operational payouts worldwide

- Access FX risk management tools, including forward contracts, to lock in rates and manage currency exposure more deliberately

These capabilities address the main gaps teams encounter when international payments become routine. OFX focuses on executing outbound transfers. The World Account connects collection, holding, conversion and payout into a single workflow.

For Singapore-based exporters, e-commerce sellers and service teams handling regular cross-border activity, that difference shapes daily operations. Local collection, balance reuse across currencies and control over FX timing often matter more than a tool designed primarily to send money overseas.

Are you still evaluating OFX alternatives?

Open a World Account and manage international payments from Singapore in one place. Start receiving and holding multiple currencies, and pay overseas suppliers with greater control over FX and cash flow.

- https://www.trustpilot.com/review/www.ofx.com

- https://www.g2.com/products/ofx/reviews

- https://www.worldfirst.com/sg/product/

- https://www.worldfirst.com/sg/international-payments/

- https://www.wise.com/sg/business/

- https://wise.com/help/articles/2932151/wise-business-fees

- https://www.trustpilot.com/review/wise.com

- https://www.airwallex.com/sg/business-account

- https://www.airwallex.com/sg/pricing

- https://www.airwallex.com/sg/integrations

- https://www.paypal.com/sg/business

- https://www.paypal.com/sg/webapps/mpp/paypal-fees

- https://www.currencyfair.com/business/

- https://www.currencyfair.com/pricing/

- https://www.transfergo.com/business

- https://www.transfergo.com/pricing

- https://www.skrill.com/en/business/

- https://www.skrill.com/en/siteinformation/fees/

- https://www.convera.com/solutions/business-payments/

- https://www.convera.com/solutions/fx-risk-management/

- https://www.nium.com/solutions/global-accounts

- https://www.nium.com/solutions/payouts

- https://www.moneycorp.com/en-sg/business/

- https://www.moneycorp.com/en-sg/fx-risk-management/

Shawn Shen is the Country Manager for Singapore and the Philippines, with over 15 years of experience in commercial leadership across payments, SaaS and fintech.

Shawn Shen

Author

Country Manager, Singapore & Philippines WorldFirst Singapore

Continue reading

Subscribe

The Weekly Dispatch

Get the latest news and event invites. Signup for our weekly update from the worlds of fashion, design, and tech.

Open a World Account for free

Get local currency accounts, fast payments and competitive FX – all in one place.

You might also like

Choose a product or service to find out more

Customer Stories

Latest Happenings

e-Commerce & Online Sellers

Doing business with China

International Transactions

Foreign Currency Exchange

Doing business with China