Home > blog > International Transactions > 10 best Airwallex alternatives in 2026: global payments and FX options

For many Singapore businesses, international payments become a core operational concern earlier than expected.

Airwallex is often one of the first platforms businesses adopt when expanding beyond traditional banking. It helps simplify cross-border activity in the early stages.

Over time, higher transaction volumes, wider currency exposure and more demanding payout requirements can surface limitations. FX costs become more visible, settlement timelines matter more and maintaining clear oversight across markets becomes harder.

That is often the point at which teams step back and reassess their payment setup. The focus shifts from “Does this work?” to “Is this still the right platform for how we trade today?”

This guide examines the best Airwallex alternatives for Singapore-based companies operating across borders in 2026. We assess each option based on how it performs in real trading conditions and which business models it best suits.

Why Singapore businesses are looking for Airwallex alternatives

Airwallex is a financial technology platform, not a traditional bank, that provides multi-currency business accounts and cross-border payment services. Founded in 2015, it has grown quickly and now reports serving more than 150,000 businesses worldwide.

Singapore companies use it to hold funds in multiple currencies, send and receive international payments and manage global cash positions from a single online platform.

For a deeper look at how Airwallex works in practice, including fees, features and common limitations, see our detailed Airwallex review.

How Airwallex performs on major review platforms

Based on reviews across Trustpilot, G2 and Capterra, Airwallex’s ratings typically range from the mid-3s to the low-to-mid-4s, depending on region and use case.

Users frequently praise the platform for simplifying international business payments, offering multi-currency accounts and providing a modern interface that is easier to use than traditional bank setups.

However, a common pattern also emerges across these review sites. As businesses scale or rely on the platform more heavily, recurring concerns begin to appear:

- Customer support responsiveness, especially when issues require urgent resolution

- Account reviews, restrictions or holds that feel unclear or difficult to navigate

- Operational limitations around reporting, controls or flexibility for more complex payment flows

Taken together, these reviews suggest that Airwallex works well for straightforward international payment needs, but may feel less suitable as transaction volumes grow and operational requirements become more demanding.

What to look for in an Airwallex alternative

When comparing Airwallex alternatives, the most important factors tend to appear in day-to-day use rather than in marketing claims. Focusing on a few areas can quickly narrow the field:

- Account access and eligibility: Check which types of businesses the platform fits, how onboarding works and how long approval typically takes. Requirements can vary depending on business model, transaction volumes and markets served

- Clarity around fees and FX pricing: Look for transparent, predictable pricing across receiving funds, currency conversion and international transfers

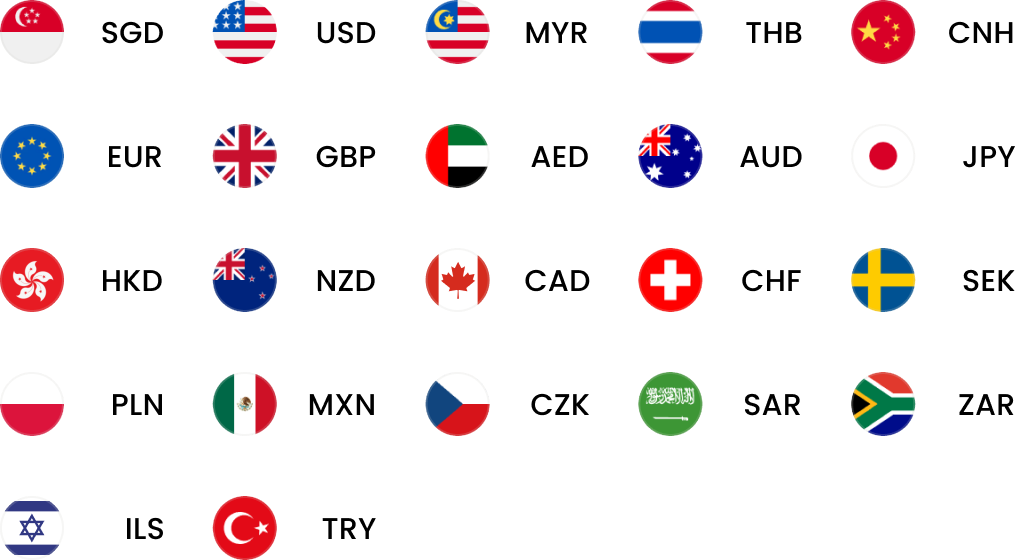

- Multi-currency and payout capabilities: A strong alternative should support holding multiple currencies, paying suppliers in different markets and receiving funds from customers or marketplaces without unnecessary conversions

- Currency and market coverage: Make sure the platform supports the currencies and regions your business trades in today, as well as those you plan to expand into. Transfer speed and reliability matter as much as coverage

- Support and service quality: Teams need responsive, human support to resolve delayed payments or account reviews

Once you have narrowed the options, it is worth confirming the latest fees and features directly with each provider before making a final decision.

Power your global growth with one account

Get local currency accounts, fast payments and competitive FX – all in one place.

10 best Airwallex alternatives in 2026

Below, we review ten alternatives to Airwallex based on key strengths, currency and FX support, regional presence with a focus on Singapore and typical use cases. We also added a comparison table for side-by-side review of the options.

| Provider | Currency support | FX approach | Integrations / usage | Best suited for |

| WorldFirst World Account | 20+ | Transparent spot FX; rate lock available | 130+ marketplaces; World Card | E-commerce sellers and companies needing marketplace collections and supplier payments |

| Wise Business | 40+ | Mid-market FX with clear fees | Xero, QuickBooks | Cost-focused SMEs prioritising FX clarity |

| Payoneer | Multi-currency balances | FX conversion with markup | Major marketplaces | Marketplace sellers and freelancers paid by platforms |

| Revolut Business | 25+ | Interbank FX with plan limits | Expense tools; business cards | Teams needing spend control and internal transfers |

| OFX | 50+ | Spot FX; limit orders; flat fees | Accounting integrations | Firms making fewer, high-value transfers |

| Nium | Multi-currency payout infrastructure | Real-time FX; hedging for scale | API-driven payouts and cards | Platforms and fintechs building payment flows |

| PayPal Business | Hold multiple currencies | FX adds cost | Checkout, invoicing, marketplaces | E-commerce sellers prioritising customer payment choice |

| PingPong Payments | 20+ | FX across many pairs | Marketplace-focused payouts | Cross-border marketplace sellers, especially Asia-focused |

| Currenxie | Major currencies incl. SGD, USD, EUR | Competitive FX; forwards available | Simple web platform | SMEs wanting a lighter multi-currency setup |

| CurrencyFair | Major currencies | Peer-to-peer FX | Transfer-first platform | Occasional transfers with low FX cost focus |

1. WorldFirst World Account

WorldFirst is a multi-currency business account provider regulated in Singapore by the Monetary Authority of Singapore (MAS).

It lets Singapore companies open a single platform to receive and hold payments in multiple currencies, send payments globally and collect marketplace revenue, without traditional banking complexity.

The World Account supports businesses that need international collections, cross-border payouts and FX management under one account.

Key features:

- Multi-currency World Account: Hold and manage funds in 20+ currencies with local bank details for receiving payments directly in key markets

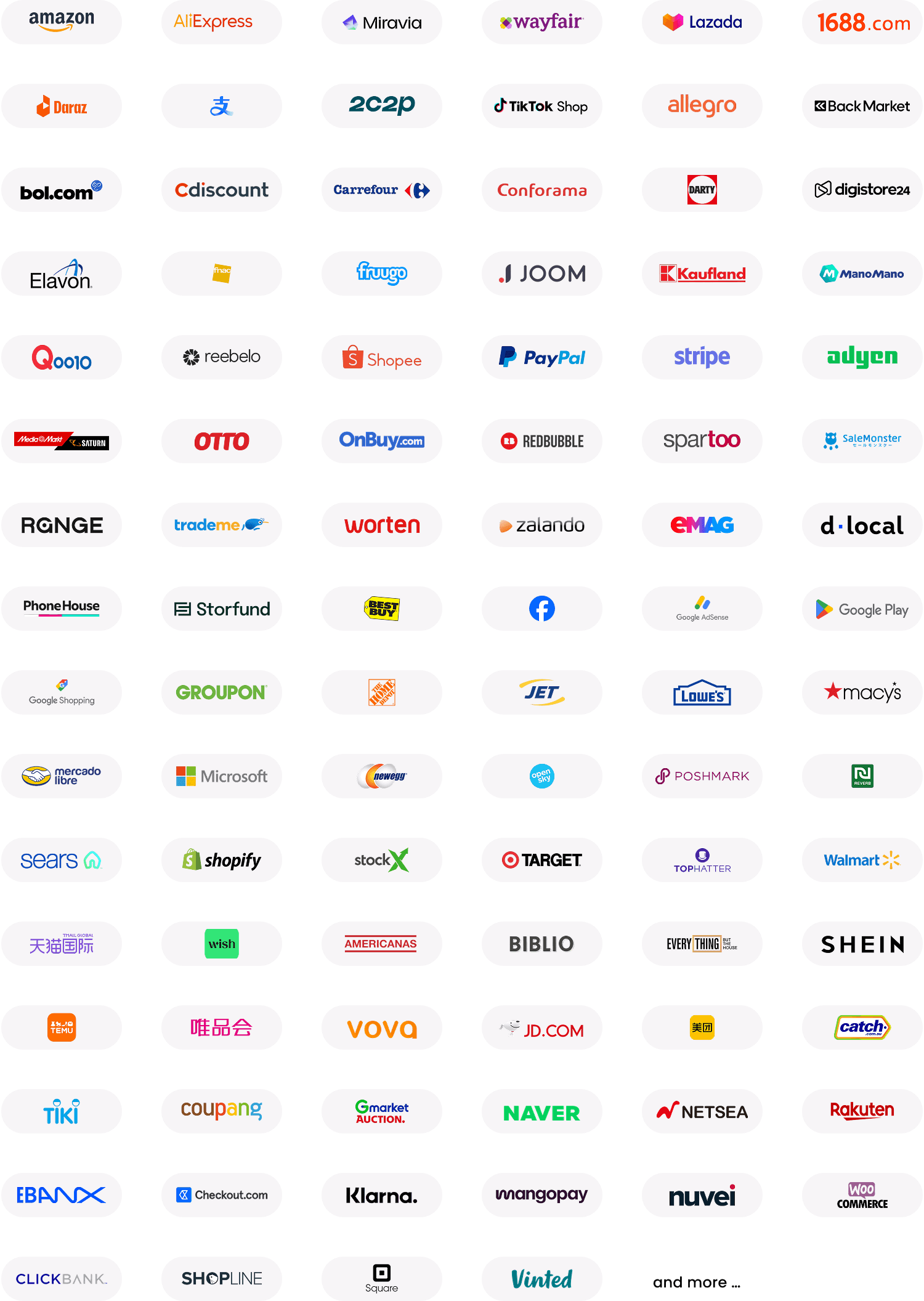

- Marketplace collections: Receive payout earnings from 130+ online marketplaces and payment gateways such as Amazon, Shopify, Shopee, TikTok Shop and more, in multiple currencies

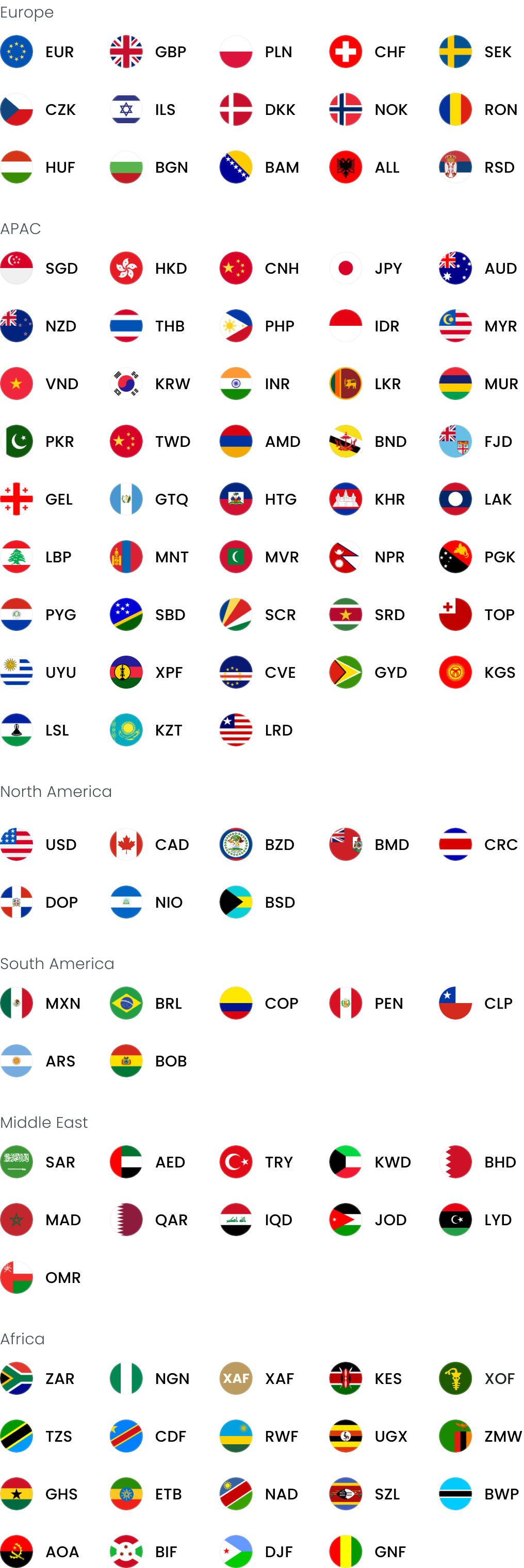

- Global payments: Send payments in 100+ currencies to 210+ countries and territories with competitive FX rates

- Transparent pricing: There are no setup, subscription or monthly account fees and the platform shows transfer fees and FX costs upfront

- World Card (business Mastercard): Linked to your account for online spending in multiple currencies, with cashback and 0% FX fees on eligible currency balances

Best use cases:

World Account works well for SMEs, e-commerce sellers and trading companies in Singapore that handle revenue from international marketplaces and need to consolidate payments in local currencies without separate bank accounts.

Why it fits as an Airwallex alternative:

Unlike Airwallex, WorldFirst places a stronger emphasis on marketplace collections and local receiving accounts across a wide range of currencies. This makes it easier for sellers to consolidate revenue from multiple platforms into a single location and pay suppliers without having to perform repeated conversions.

2. Wise Business

Rather than positioning itself as a full payments ecosystem, Wise focuses on reducing conversion costs and keeping fees visible at every step.

For Singapore companies, Wise is often used as a low-cost option for international transfers and currency holding, especially when margins are sensitive and FX leakage needs tight control.

For a closer breakdown of Wise Business features, fees and trade-offs, read our in-depth Wise Business review.

Key features:

- Multi-currency account: Hold balances in 40+ currencies and send or receive payments in 50+ currencies globally

- Local receiving details: Access local bank details across key regions, including Singapore, the US, the UK, the EU, Australia and others

- Mid-market FX model: Convert currencies at the real exchange rate, with a clearly stated fee added per transaction

- Accounting integrations: Sync transactions with Xero and QuickBooks to simplify reconciliation

- No hidden fees: No account fees, with all costs shown before you confirm a transfer

Best use cases:

Wise Business works best for Singapore companies that prioritise FX cost control over advanced payout workflows, especially service businesses, consultants and importers paying overseas suppliers.

Why it fits as an Airwallex alternative:

Where Airwallex blends payments, FX and platform features, Wise keeps things deliberately simple. For businesses that care more about exchange rates than dashboards or marketplace tools, Wise often delivers lower overall FX costs with fewer moving parts.

3. Payoneer

Payoneer has become deeply embedded in the global marketplace, serving sellers, freelancers and platforms that need local collection accounts across multiple regions.

In Singapore, businesses commonly use Payoneer as a receiving layer rather than a complete treasury solution.

Key features:

- Marketplace-first collections: Receive payouts from platforms such as Amazon, Lazada, eBay, Walmart and Upwork using local receiving accounts

- Multi-currency balances: Hold funds in several major currencies and convert or withdraw when needed

- Global payouts and mass payments: Pay suppliers, contractors or partners individually or in bulk

- Prepaid business cards: Spend directly from Payoneer balances using linked Mastercard cards

- Platform APIs: Support automated payout flows for platforms and partner networks

Best use cases:

Payoneer suits Singapore-based marketplace sellers, freelancers and digital platforms that receive income from overseas platforms rather than direct customers.

Why it fits as an Airwallex alternative:

Compared with Airwallex, Payoneer trades FX precision for marketplace reach. If most revenue already comes from global platforms, Payoneer can be easier to connect to and more widely accepted, even if FX margins are higher.

4. Revolut Business

Revolut Business positions itself as a digital operating account for modern teams.

Instead of specialising in cross-border payouts or FX optimisation, it combines multi-currency balances, cards and internal controls into a single app-first experience.

Key features:

- Multi-currency accounts: Hold and exchange 25+ currencies from one account

- Team access and controls: Create sub-accounts, issue physical and virtual cards and manage spending limits

- FX at interbank rates: Access competitive FX during market hours, with plan-based allowances

- Expense management: Track spending in real time and sync data with accounting platforms

- Tiered plans: Scale features and FX allowances as usage grows

Best use cases:

Revolut Business fits Singapore companies with distributed teams that want tighter control over expenses, cards and internal transfers alongside basic international payments.

Why it fits as an Airwallex alternative:

For businesses where expense tracking and team spending matter more than marketplace collections, Revolut can feel more complete day to day.

5. OFX

OFX is an FX-led provider rather than a fintech wallet. It caters to businesses that move large amounts of money internationally and want to reduce bank spreads without relying on percentage-based FX markups.

Singapore businesses often use OFX alongside their existing bank accounts rather than replacing them.

Key features:

- 50+ supported currencies: Send payments to a wide range of global destinations

- FX execution tools: Use spot transfers, limit orders and rate alerts to manage timing

- Low fixed transfer fees: Pay a small flat fee per transfer instead of FX markups

- Business accounts: Hold selected currencies and connect transfers to accounting systems

- MAS-regulated presence: Operates locally in Singapore under MAS oversight

Best use cases:

OFX suits Singapore companies making fewer but larger international transfers, such as importers, exporters or firms settling overseas invoices.

Why it fits as an Airwallex alternative:

Airwallex is built for ongoing payment flows, while OFX shines when transfer size matters more than speed or features. For high-value FX transactions, OFX can deliver better value even without wallets or cards.

6. Nium

Nium operates behind the scenes of global payments rather than in front of SMEs. It provides infrastructure for payouts, accounts and cards that businesses can embed directly into their own systems.

Most Singapore clients use Nium as a payment infrastructure, not as a ready-made business account.

Key features:

- Global payout reach: Send funds to 190+ countries, with real-time payments in many markets

- Multi-currency account infrastructure: Issue local or virtual accounts across regions

- API-driven design: Build payouts, FX and card issuing directly into your platform

- Advanced FX capabilities: Access real-time rates and hedging tools for larger volumes

- Card issuing: Create physical or virtual cards at scale

Best use cases:

Nium is best suited to platforms, marketplaces and fintechs based in Singapore that need programmable global payouts rather than a simple business account.

Why it fits as an Airwallex alternative:

While Airwallex targets SMEs directly, Nium targets builders. For businesses that need deep control over payment logic and the ability to scale across markets, Nium offers far more flexibility.

7. PayPal Business

PayPal Business sits at the intersection of payments and checkout rather than treasury or FX optimisation. It is less about managing currencies efficiently and more about being where customers already want to pay.

Singapore businesses typically use PayPal as their primary customer-facing payment method, then handle withdrawals and conversions as secondary concerns.

Key features:

- Global acceptance: Accept payments from customers in 200+ markets using PayPal balances, cards and local payment methods

- Multi-currency balances: Hold multiple currencies in your PayPal account before converting or withdrawing

- Checkout and invoicing tools: Use PayPal Checkout, payment links and invoicing to collect funds online

- Marketplace compatibility: Receive payouts from platforms that offer PayPal as a default payout option

- Buyer and seller protection: Built-in dispute resolution and transaction protection for online sales

Best use cases:

PayPal Business works best for Singapore e-commerce sellers and digital businesses that prioritise sales and customer trust over FX efficiency.

Why it fits as an Airwallex alternative:

Unlike Airwallex, PayPal operates at the point of sale rather than just behind the scenes. For businesses where customer payment preference matters more than FX margins, PayPal can unlock sales that other platforms cannot, even if conversion costs are higher.

8. PingPong Payments

PingPong is designed almost entirely around cross-border e-commerce, with a strong emphasis on sellers operating in or into China.

Rather than acting as a general-purpose business account, it focuses on helping marketplace sellers collect and move funds efficiently across borders.

Key features:

- Local receiving accounts: Open local collection accounts in 20+ currencies, including USD, EUR, SGD, HKD and CNY

- Marketplace-focused payouts: Collect revenue from global marketplaces and route funds to local bank accounts or cards

- Cross-border payments: Send payouts to 200+ countries and regions

- FX and risk tools: Convert currencies across hundreds of pairs, with additional risk tools available for larger clients

- API and platform support: Integrate PingPong into seller platforms and payout workflows

Best use cases:

PingPong suits Singapore-based marketplace sellers, especially those trading into China or operating across Asian e-commerce platforms.

Why it fits as an Airwallex alternative:

Where Airwallex aims to be broadly applicable, PingPong goes deep on marketplace selling. For businesses whose revenue depends on cross-border e-commerce rather than general B2B payments, PingPong can feel more purpose-built, even if support and onboarding can be uneven.

9. Currenxie

Currenxie positions itself as a multi-currency account for businesses trading between Asia, Europe and North America. It avoids broad feature expansion and instead focuses on fast onboarding, competitive FX and responsive service.

Singapore businesses often choose Currenxie when they want a simpler alternative to large fintech platforms.

Key features:

- Multi-currency accounts: Hold and transact in major currencies including SGD, USD, EUR, GBP, HKD and JPY

- Local receiving accounts: Access local bank details in Singapore, the US, UK, EU and Hong Kong

- Competitive FX rates: Convert currencies close to the mid-market rate, with optional forward contracts

- Supplier and mass payments: Pay international suppliers directly from your currency balances

- User-focused platform: Web-based dashboard with multi-user access and straightforward controls

Best use cases:

Currenxie fits Singapore SMEs trading regularly with overseas suppliers or customers who want better FX rates without a complex platform.

Why it fits as an Airwallex alternative:

Compared with Airwallex, Currenxie offers a lighter, more service-led experience. For businesses that value responsiveness and simplicity over scale and integrations, it can feel easier to manage day to day.

10. CurrencyFair

CurrencyFair takes a different approach to FX by allowing users to exchange currencies directly with other participants at close-to-market rates. It is less about speed or automation and more about reducing conversion costs.

Singapore businesses tend to use CurrencyFair as a transfer tool rather than a central account.

Key features:

- Peer-to-peer FX model: Exchange currencies at or near the mid-market rate by matching with other users

- Multi-currency holding: Hold balances in several major currencies before converting or sending

- International transfers: Send money to 150+ countries using local rails where available

- Transparent fees: Pay a fixed transfer fee plus a small FX percentage

- Simple interface: Web-based platform focused on transfers rather than ongoing account activity

Best use cases:

CurrencyFair suits Singapore businesses making occasional international payments where FX cost matters more than speed or platform features.

Why it fits as an Airwallex alternative:

For businesses that only need to move money periodically and want to minimise FX loss, it can be a cost-effective option without long-term commitment.

Why World Account stands out among Airwallex alternatives

Choosing an Airwallex alternative in 2026 comes down to fit, not features in isolation. As international activity grows, payments platforms need to support more currencies, more payout routes and clearer visibility without adding operational friction.

Across the options covered in this guide, World Account from WorldFirst consistently aligns with what many Singapore businesses need once they move beyond early-stage cross-border payments:

- A single account that supports collections, payouts and FX across multiple markets

- Strong compatibility with global marketplaces and international trading flows

- Transparent, predictable pricing that remains manageable as volumes increase

Rather than solving one narrow problem, World Account supports the full payment lifecycle that many internationally active businesses deal with every day.

Is Airwallex still the right fit for your business?

Open a World Account for free and explore a practical Airwallex alternative built for international trading.

Sources:

- https://www.worldfirst.com/sg/

- https://www.wise.com/sg/business/

- https://www.payoneer.com/

- https://www.revolut.com/business/

- https://www.ofx.com/en-sg/

- https://www.nium.com/

- https://www.paypal.com/sg/business/

- https://www.pingpongx.com/

- https://www.currenxie.com/

- https://www.currencyfair.com/

- https://www.trustpilot.com/

- https://www.g2.com/

- https://www.capterra.com.sg/

- https://eservices.mas.gov.sg/fid

Joan Poon leads marketing across Southeast Asia at WorldFirst, driving growth and brand leadership in key markets including Singapore, Malaysia and the Philippines.

Joan Poon

Author

Head of Marketing SEA, WorldFirst Singapore

Continue reading

Subscribe

The Weekly Dispatch

Get the latest news and event invites. Signup for our weekly update from the worlds of fashion, design, and tech.

Open a World Account for free

Get local currency accounts, fast payments and competitive FX – all in one place.

You might also like

Choose a product or service to find out more

Customer Stories

Latest Happenings

e-Commerce & Online Sellers

Doing business with China

International Transactions

Foreign Currency Exchange

Doing business with China