How to send money abroad (+how to avoid hidden costs)

Last update: 3 Sep 2025

If you’re running a cross-border business, you travel frequently or you have family internationally, you’ll need a reliable way to send money abroad. The trouble is, with high costs and slow settlement times, the traditional options are often not the best choice.

In this guide, we share the details on how to send money abroad, both for businesses and individuals. Along the way, we’ll introduce World Account, our multi-currency account for cross-border businesses – designed to make international business payments simpler and more affordable.

We cover:

- Six methods to send money internationally: Pros, cons and best uses

- The hidden costs of international money transfers: What most businesses miss

- How to save on FX costs when managing multiple currencies

- How WorldFirst makes international transfers faster, simpler and more affordable

Want to send money overseas faster and more affordably? Open a World Account for free today.

6 methods to send money internationally: Pros, cons and best uses

Here are six of the most common ways to send money internationally, with their real-world pros, cons and the situations when they’re the best choice.

Note: Most businesses won’t rely on a single payment method in all contexts. For instance, while multi-currency accounts are typically the best choice for businesses who are frequently transacting in various currencies, it can sometimes make sense to send larger or infrequent payments via SWIFT.

1. Traditional bank wire transfers

Traditional bank wire transfers use the SWIFT network to move money between financial institutions worldwide. When you initiate a wire transfer, your bank sends payment instructions through this global messaging system, and your funds may pass through multiple intermediary banks before reaching the recipient.

The process typically takes three to six business days to complete due to routing through these intermediary banks, each of which may take a cut or apply additional processing time. Costs include upfront fees ranging from $20–50 per transfer, plus hidden exchange rate markups of one to three percent above the mid-market rate.

While wire transfers are secure and backed by established banking relationships, they offer little transparency about when funds will actually arrive or what the total cost will be once all intermediary fees are deducted.

- Best for: Large, infrequent transfers where security and established banking relationships are prioritised over cost and speed.

- Major limitation: Lack of transparency about arrival times and total costs, making cash flow planning difficult.

2. Multi-currency accounts (e.g. WorldFirst)

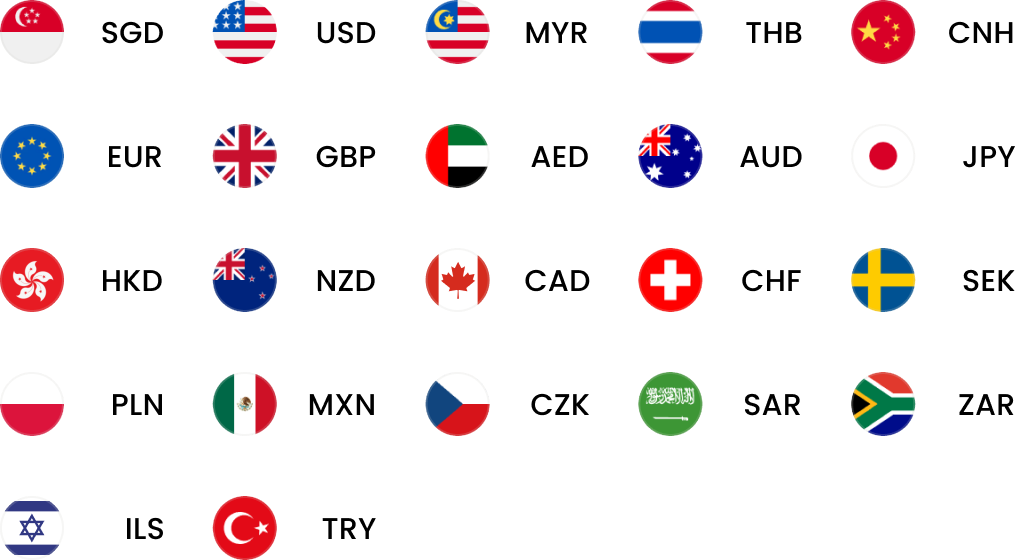

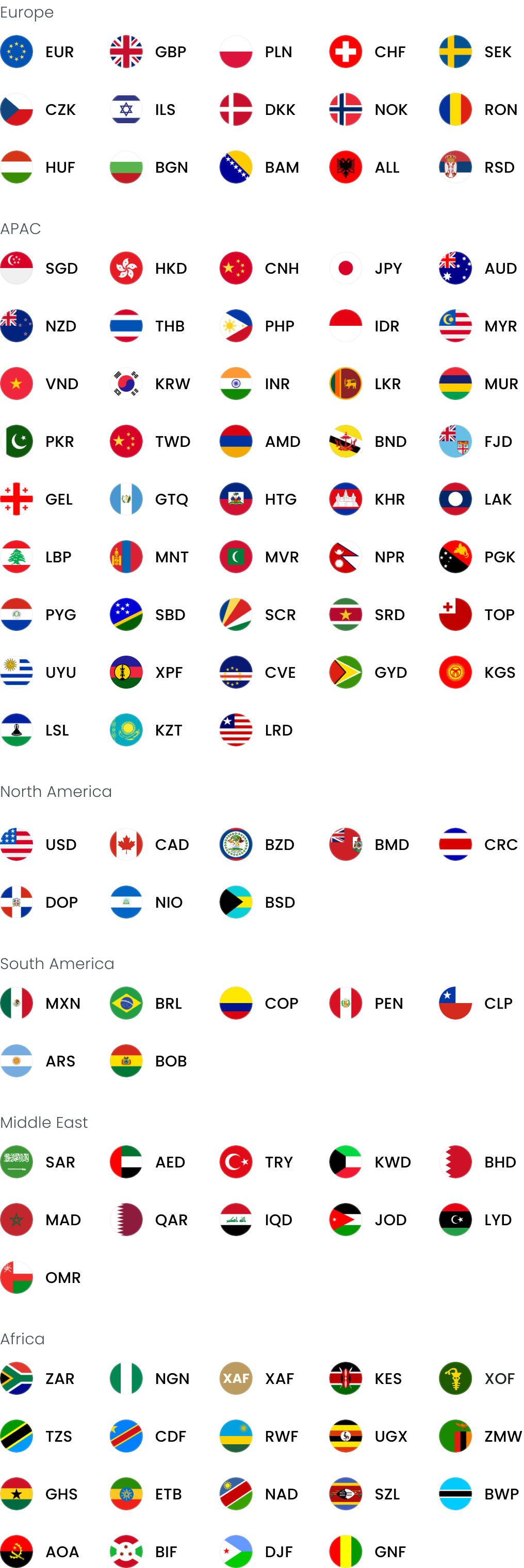

Multi-currency accounts provide local bank details in multiple countries, allowing businesses to receive and hold foreign currencies without opening business bank accounts in each jurisdiction. With a platform like WorldFirst, you can get local receiving details (such as a US routing number or European IBAN) for 20+ currencies.

This enables you to pay suppliers directly in their local currency without conversion fees and receive payments from customers or marketplaces as if you were a local business. Transfers between users on the same platform often arrive instantly, while payments to external accounts typically settle within the same day using local payment rails instead of SWIFT.

The key advantage is eliminating forced currency conversions and international transfer fees when conducting business in multiple markets, while providing complete visibility into your global cash flow from one dashboard.

- Best for: Businesses regularly sending or receiving international payments across multiple currencies and markets.

- Major advantage: Eliminates the need for currency conversion and international transfer fees when paying suppliers in their local currency, while providing local receiving capabilities worldwide.

Read more: Corporate bank account in Singapore: 5 options compared

3. Online money transfer services (Wise, PayPal)

Online money transfer services operate on digital platforms with more transparent fee structures than traditional banks. These services typically show you the exact exchange rate and fees upfront, with transfers arriving within one to two business days.

Fees are generally lower than banks, ranging from 0.4–1.5% of the transfer amount, and many use the mid-market exchange rate with a clear markup rather than hiding costs in poor exchange rates. The user experience is designed for simplicity, with most transfers completed entirely online or through mobile apps.

However, these platforms often have limitations for business users, including transfer limits, restricted access to certain countries, and limited features for managing team permissions or bulk payments.

- Best for: Medium-sized transfers where cost transparency is a priority and business complexity is minimal.

- Major limitation: May have restrictions for business users, high-volume transactions, or certain countries, with limited advanced features for growing companies.

4. Remittance services (Western Union, MoneyGram)

Remittance services offer cash pickup options worldwide through extensive agent networks, making them accessible even in regions with limited banking infrastructure. Transfers typically arrive within minutes to 24 hours, with recipients able to collect cash from thousands of locations globally.

These services excel at reaching areas where traditional banking is unavailable and providing immediate access to funds without requiring bank accounts. However, fees tend to be significantly higher than digital-only services, often including both upfront charges and poor exchange rates.

The business model is designed for personal transfers rather than commercial transactions, lacking features like bulk payments, accounting integrations, or business-grade reporting and controls.

- Best for: Sending money to individuals without bank accounts or in regions with limited banking infrastructure.

- Major limitation: Not designed for business transactions and often have high fees that make them unsuitable for regular commercial use.

5. SEPA transfers (Europe only)

SEPA (Single Euro Payments Area) is a European payment system that treats euro transfers within participating countries as domestic payments. Transfers typically arrive within one business day and often have low fees or no fees at all.

SEPA transfers use standardised formats and local banking rails, making them fast, reliable and cost-effective for businesses operating within Europe. The system covers EU countries plus several non-EU nations like Switzerland and the UK for euro transactions.

The major limitation is that SEPA only works for EUR-to-EUR transfers within participating countries, making it useless for businesses dealing with other currencies or markets outside the SEPA region.

- Best for: Euro-to-euro transfers within Europe, particularly for businesses with regular European operations.

- Major limitation: Only works for EUR transactions within participating countries, providing no solution for multi-currency or global operations.

Related: Opening a European business bank account online: Everything you need to know

6. Cryptocurrency transfers

Cryptocurrency transfers use blockchain technology to move value across borders without traditional banking intermediaries. Transfers can be nearly instantaneous depending on the network used, operating 24/7 without banking hours restrictions.

Fees vary widely based on network congestion and the specific cryptocurrency used, ranging from pennies to hundreds of dollars during peak periods. The process requires converting traditional currency to cryptocurrency, transferring it and then converting back to the recipient’s desired currency.

While innovative, this method requires both parties to be comfortable with cryptocurrency volatility, exchange processes and potential tax implications. The conversion steps add complexity and additional costs that can offset the benefits of fast, direct transfers.

- Best for: Tech-savvy users comfortable with volatility and conversion processes, particularly for urgent transfers when traditional systems are unavailable.

- Major limitation: Requires conversion to and from traditional currency, which adds complexity, potential volatility risk, and tax implications that make it impractical for most business operations.

The hidden costs of international money transfers: What most businesses miss

The trouble with traditional bank transfers is that the advertised fee for an international transaction rarely tells the full story. Hidden costs can easily double or triple your actual expense, making what appears to be a $25 wire transfer cost more on larger amounts.

Here are the most common hidden costs that catch businesses off guard:

- Exchange rate markups are often the largest hidden cost. Banks typically offer exchange rates 1–3% worse than the mid-market rate, which can far exceed their stated transfer fees. For example, on a $10,000 transfer, a two percent markup equals $200 in hidden costs.

- Intermediary bank fees can eat into your transfer amount. When using SWIFT, multiple banks may handle your transfer, each potentially deducting fees. Recipients often receive less than expected because these fees are deducted along the way.

- Receiving bank fees are often overlooked. Many banks charge fees to receive money via international wire transfers too ($10–30). These are typically charged to the recipient, reducing the amount they receive.

- Currency conversion timing can significantly impact costs. Exchange rate fluctuations can change the value of your transfer by several percentage points. Most providers convert at whatever rate is available when they process your transfer.

- Account maintenance and inactivity fees add up. Many international account providers charge monthly maintenance fees ($10–50). Some also charge inactivity fees if accounts aren’t used regularly.

Understanding these hidden costs is crucial for making informed decisions about your international payment method. What appears to be a small difference in advertised fees can translate to thousands in additional costs over time, particularly for businesses making regular international transfers.

- Open 20+ local currency accounts and get paid like a local

- Pay suppliers, partners and staff worldwide in 100+ currencies

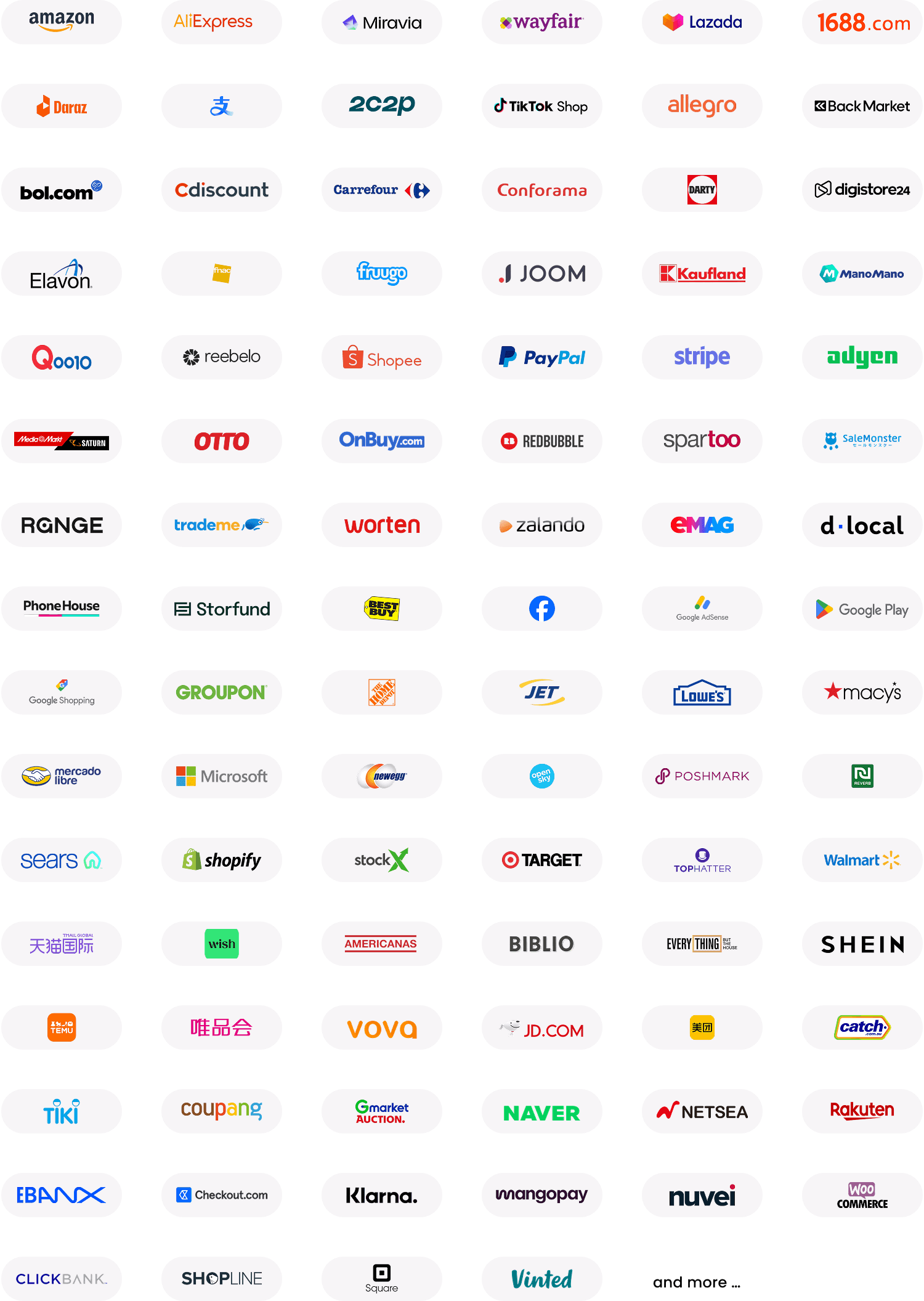

- Collect payments for free from 130+ marketplaces and payment gateways, including Amazon, Etsy, PayPal and Shopify

- Save with competitive exchange rates on currency conversions and transfers

- Lock in exchange rates for up to 24 months for cash flow certainty

How to save on FX costs when managing multiple currencies

One of the biggest drawbacks of conventional transfers is that you’re forced to convert currency. But currency fluctuations can make or break your margins. For instance, a 2–3% swing in exchange rates might seem small, but on a $100,000 supplier payment, that’s $2,000–3,000 directly off your bottom line.

Smart currency management isn’t just about getting better rates – it’s about reducing risk, improving cash flow predictability and protecting your business from the volatility that comes with global trade. Here are five strategies that can help:

- Hold foreign currencies instead of constantly converting. Maintaining balances in frequently-used currencies eliminates the need for repeated currency exchanges, which typically cost 1–3% with traditional banks. Instead of converting GBP to USD every time you need to pay an American supplier, hold a USD balance and pay directly.

For instance, as you’ll see below, with a multi-currency account from WorldFirst, you can hold 20+ currencies in the same account. It makes it easy to receive marketplace earnings and pay suppliers in their local currencies without the friction and cost of constant conversions.

- Time your foreign exchange conversions strategically. Exchange rates fluctuate constantly based on economic indicators, political events and market sentiment. Converting large amounts during unfavourable rates can significantly impact your bottom line – which is why timing matters.

With a firm order, you can set target rates and automatically convert when markets reach your desired level, so you can take advantage of favourable movements without constantly monitoring the markets yourself.

- Use forward contracts to lock in rates. Forward contracts allow you to secure today’s exchange rate for future transfers, protecting your business against currency fluctuations for up to 24 months. This is particularly valuable for businesses with predictable payment schedules or tight margins where rate movements could affect profitability.

- Implement natural hedging where possible. Match incoming and outgoing currencies to reduce conversion needs altogether. For example, if you sell products in the US (earning USD) and source materials from China (paying CNH), hold both currencies and use your USD earnings to fund your CNH supplier payments. This natural hedge reduces your exposure to exchange rate movements between your home currency and these trading currencies.

- Diversify payment timing to spread currency risk. Instead of making one large monthly transfer that’s exposed to that day’s exchange rate, consider smaller weekly transfers to average out exchange rate fluctuations over time. This approach, known as dollar-cost averaging, helps smooth out the impact of short-term volatility.

WorldFirst’s batch payment feature lets you schedule up to 200 payments at once for efficient processing, making it easy to implement a regular payment schedule that spreads your currency risk.

How WorldFirst makes international transfers faster, simpler and more affordable

At WorldFirst, we’re committed to helping cross-border businesses benefit from simpler and more affordable international payments.

With a World Account, you can hold 20+ currencies in one place. For each currency, you’ll also receive local account details, so that you can send money internationally via local payment networks and avoid the costs of frequent currency conversions.

Over the last 20 years, we’ve managed over $300 billion in transactions and enabled over a million businesses to scale globally. We’re also partnered with banks and financial institutions including Barclays, Citibank, J.P. Morgan and Mastercard, so you can rest assured your funds are well protected.

Read on for five reasons why you should open a World Account today.

1. Simplify your spending with an all-in-one solution for global payment needs

Running an international business typically means juggling multiple providers: one bank for EUR accounts, another for USD transfers, a separate platform for marketplace collections and different services for supplier payments. WorldFirst consolidates all of this into one unified platform.

With a World Account, you can:

- Hold balances in 20+ currencies including USD, EUR, GBP, CNH, AUD and SGD – all from a single login

- Get local receiving account details (like US routing numbers or European IBANs) without needing local business entities or residency

- Integrate directly with your existing systems including accounting software like Xero and NetSuite, plus 130+ marketplaces and e-commerce platforms including Amazon, TikTok Shop and Shopify

- Manage all international financial operations from one dashboard, eliminating the complexity of multiple accounts and providers

This unified approach means less admin overhead, better visibility across your global operations, and the ability to scale internationally without setting up new banking relationships in every market.

Read more: How to open a Chinese bank account: A guide for businesses

2. Save on hidden fees and FX compared to traditional payment methods

Traditional banks often hit international businesses with a combination of high FX markups, monthly fees and hidden charges that can quickly erode margins. WorldFirst takes a transparent, competitive approach to pricing.

Key savings include:

- Competitive FX rates with markups capped at 0.60% for major currencies, compared to one to three percent typically charged by traditional banks

- No monthly account fees or minimum balance requirements, unlike many business banking providers

- Free transfers between WorldFirst account holders

- Zero FX fees on World Card transactions when paying in 15 major currencies from existing account balances

For businesses making regular international payments or managing multiple currencies, these savings compound quickly – often covering thousands in reduced fees annually while providing better exchange rates for every transaction.

3. Make faster payments to streamline your business operations

Speed matters when you’re managing international supply chains or collecting marketplace earnings. Traditional wire transfers via SWIFT can take three to six business days and often involve unpredictable delays or deductions from intermediary banks.

WorldFirst uses local payment networks instead of the correspondent banking system, delivering:

- Same-day arrival for 80% of transfers, compared to multi-day settlement with traditional wire transfers

- Direct integration with local payment rails in over 60 countries, bypassing the slower SWIFT network where possible

- Instant transfers between your WorldFirst currency accounts for immediate access to funds

- Real-time payment tracking so you always know the status of your transfers and can provide accurate updates to suppliers or partners

This speed advantage translates into better cash flow management, stronger supplier relationships through faster payments, and the ability to respond quickly to market opportunities.

4. Leverage advanced tools for strategic currency management

Currency volatility can significantly impact your bottom line, especially when dealing with large supplier payments or planning future purchases. WorldFirst provides enterprise-level FX tools to help you manage this risk:

- Forward contracts let you lock in today’s exchange rate for transfers up to 24 months in the future, providing certainty for budgeting and protecting against adverse currency movements

- Firm orders automatically execute currency conversions when the market hits your target rate, so you can take advantage of favourable movements without constantly monitoring rates

- Multi-currency holding across 20+ currencies means you can avoid forced conversions and time your FX transactions strategically

- Batch payments process up to 200 transfers at once, streamlining supplier payments and reducing administrative time

These tools give you the same level of currency control typically available only to large corporations, helping you optimise FX timing and reduce the impact of market volatility on your business.

5. Benefit from specialised features for cross-border businesses

Unlike generic money transfer services, WorldFirst is built specifically for the needs of international businesses, with features that address real operational challenges:

- Direct marketplace integration with 130+ platforms means your earnings from Amazon, Etsy, PayPal and other channels flow directly into your World Account in local currency, often arriving the same day

- Exclusive payment solution for 1688.com – China’s largest wholesale marketplace with over 10 million suppliers – enables instant payments to Chinese vendors

- World Card virtual cards for international business expenses, offering up to 1.2% cashback and zero FX fees in 15 major currencies when paying from existing balances

- Team management features with customisable permissions, so you can delegate payment creation while maintaining approval controls and financial oversight

These features are designed around the real workflows of international businesses, from e-commerce sellers collecting global marketplace earnings to importers paying overseas suppliers.

Open a World Account for free today

Unlike traditional business banking, which often requires branch visits, local presence and weeks of paperwork, opening a World Account is designed for the digital-first nature of modern international business.

The process is straightforward:

- Online account opening takes just minutes with approval typically within 24–48 hours

- No branch visits or local presence requirements – everything is managed through the online platform

- Instant currency account creation from your dashboard as you expand into new markets

- Dedicated support from international payment specialists who understand the complexities of cross-border business

Ready to transform how your business sends money abroad? Open a World Account today and start collecting, converting and paying like a local in 20+ currencies.

Businesses trust WorldFirst

- Almost 1,500,000 businesses have sent US$500B+ around the world with WorldFirst and its partner brands since 2004

- Your money is safeguarded with leading financial institutions