Airwallex Singapore review 2026: Features, pros, cons and fees

Last updated: 12 Dec 2025

Singapore remains one of the world’s most connected business hubs, where even small companies think globally from day one. Managing payments across currencies is now a normal part of doing business and that’s where platforms like Airwallex have stepped in.

Airwallex promises to simplify international finance with quick transfers, multi-currency accounts and better FX rates than traditional banks. For many Singapore companies, that sounds like the flexibility they’ve been looking for.

In this Airwallex Singapore review, we take a closer look at how Airwallex performs for Singapore-based businesses in 2026. We’ll examine how it handles payments, fees, integrations and compliance, as well as what it offers beyond a standard business account.

We’ll also compare it with the World Account by WorldFirst, a specialised alternative designed for international businesses that need transparent FX pricing and local receiving accounts across major markets.

Key takeaways:

● Airwallex keeps cross-border payments cost-effective and straightforward: Singapore businesses can hold over 20 currencies, send funds to 150+ countries and convert at interbank rates with low markups from 0.5%

● Best for SMEs and online-first companies: Quick setup, local receiving accounts and integrations with platforms like Shopify, Amazon, Xero and QuickBooks make it ideal for e-commerce and digital service businesses

● Limited for larger or complex operations: Airwallex doesn’t yet offer features such as forward contracts, credit lines or dedicated account managers, which bigger firms often need

● WorldFirst provides stronger tools for growth: With free setup, 20+ local currency accounts, NetSuite integration and FX support for supplier payments, WorldFirst’s World Account gives Singapore companies better control and scalability when expanding globally

Open a World Account for free and simplify how your business pays and gets paid around the world.

What is Airwallex?

Airwallex is a financial technology platform (not a traditional bank) that provides multi-currency business accounts and cross-border payment services. Founded in 2015, it has grown rapidly and now serves over 150,000 businesses globally.

Singapore businesses can use Airwallex to hold multiple currencies, send and receive payments and manage global finance from a single online account.

Quick overview: Pros and cons of Airwallex Business

Airwallex gives Singapore businesses a digital-first way to manage money globally.

The table below summarises the main pros and cons to help you decide if Airwallex suits your international payment needs:

| Category | Pros | Cons |

|---|---|---|

Currency support |

Hold and transact in over 20 currencies with local receiving accounts in major markets | Some niche currencies are not supported; local account availability varies by market |

| International transfers | No setup or monthly fees; transfers via local rails to 120+ countries | SWIFT transfers cost extra (0.5–1% FX markup or SG$20–SG$35 per transfer) |

| Local receiving accounts | Receive funds like a local business in key markets (USD, GBP, EUR, AUD, JPY, SGD) | Terms and limits differ by currency and region |

Integrations |

Works with Xero, QuickBooks, Shopify and other major platforms; supports cards and expenses | Larger firms may need manual setup or custom API work |

| User experience | Fully digital onboarding; start receiving payments in minutes | Some users report delays during compliance or verification reviews |

| Fees and maintenance | No minimum balance or ongoing maintenance fees in Singapore | Card payments incur 3.30% + SG$0.50; incoming funds may be charged around 0.3% |

Scalability |

Fits SMEs, exporters and digital businesses; multi-currency and team tools included | Enterprise-level users may need custom pricing or expanded features |

Regulation and trust |

Licensed by MAS as a Major Payment Institution; client funds safeguarded in partner banks | Funds safeguarded but not covered by SDIC insurance |

Airwallex fees (Singapore): the breakdown

Here is a summary of the key fees for Singapore-registered businesses using the Airwallex business account:

| Fee type | Typical cost / allowance |

|---|---|

| One-time setup fee | SG$0 (no account-opening fee) |

| Monthly account / maintenance fee | SG$0 for base account (no minimum balance); other plans have a fixed monthly fee |

| Sending international transfers | Transfers via local payment rails in many corridors may have no added fee; SWIFT or non-local rails have fees or markups |

| Receiving overseas funds | Free in many standard cases, but independent sources report ~0.3% fee for incoming funds from accounts not owned by your Airwallex account holder |

| Domestic card payment (Singapore) | 3.30% + SG$0.50 for domestic cards; +0.3% for international cards |

| FX conversion mark-up | ~0.5% above interbank for major currencies, around ~1% for less common conversions |

Note: Features and fees are subject to change; refer to Airwallex’s official Singapore pricing page for the latest information.

Key features of Airwallex's Singapore business account

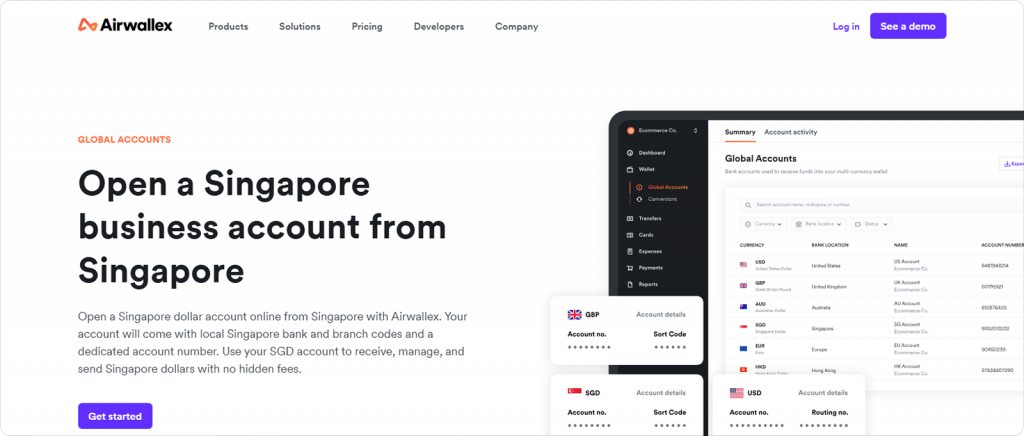

1. Multi-currency support and global accounts

One of Airwallex’s core strengths is its multi-currency account offering. With a single Airwallex business account, you can hold and manage funds in 20+ currencies at once. All incoming funds go into a multi-currency digital wallet where balances in different currencies are maintained separately.

Importantly, Airwallex lets Singapore businesses open local receiving accounts in 13 markets worldwide. These global accounts have local bank details (such as account numbers, routing codes, etc.) in major currencies, including USD, EUR, GBP, AUD, JPY, SGD, HKD and more.

In practice, it’s as if you have a local bank account in those regions. For instance, you can receive USD with US bank details or EUR with European IBAN details, allowing clients to pay you via local transfers without incurring international wire fees.

Airwallex provides local account capabilities in key markets, including the US, UK, EU, Australia, Hong Kong, Japan, Canada and Singapore itself. This global account network is a major advantage for e-commerce sellers and service providers who bill overseas customers in their home currency.

2. International payments infrastructure

With Airwallex, you can send payments to over 150 countries in 60+ currencies from Singapore. The platform leverages a network of local banking partners and payment rails to route many transfers domestically within the target country, rather than via SWIFT, wherever possible.

This results in faster and cheaper cross-border payments. In fact, Airwallex advertises that 95% of international transfers sent through its platform arrive on the same day. For example, suppose you transfer funds from your SGD account to a recipient’s EUR account in Europe. In that case, Airwallex may use SEPA (the European payments network) to deliver the payment quickly, rather than an expensive wire transfer.

Another benefit: zero-fee local transfers to many countries. Airwallex enables free transfers via local payment networks in over 120 countries, including popular payment corridors such as Singapore to Malaysia.

Of course, not every currency route offers local clearing. If a payment must go via SWIFT (the global interbank network), Airwallex will charge a flat fee. For Singapore-based customers, international SWIFT transfers cost around SG$20–SG$35 per transfer. The exact fee depends on the destination and whether fees are shared or borne by the sender (SHA/OUR options).

It’s worth noting that Airwallex does not mark up SWIFT intermediary fees – any third-party bank charges may still apply to the recipient, as is standard with SWIFT. In addition to one-off payments, Airwallex supports batch payments and scheduled transfers. You can upload a batch file or use the API to pay up to 1,000 recipients at once – useful for payroll or mass supplier payments.

3. FX rates and currency conversion

Foreign exchange (FX) cost is a critical factor in any international account. Airwallex stands out by offering very competitive exchange rates for currency conversion. It uses real-time interbank rates (the mid-market rate) with a small markup when you convert currencies in your account.

The markup depends on the currency: for major currencies, Airwallex’s exchange fee is just 0.5% above the interbank rate. Major currencies include SGD, USD, EUR, GBP, AUD, HKD, JPY, CNY, CAD, CHF and NZD – the most commonly traded. For less common currencies, the fee is 0.6%.

To illustrate, if you convert SG$10,000 to USD via Airwallex, the fee would be 0.5% (SG$50), since SGD→USD is a major currency pair. In contrast, a traditional bank might charge SG$300 or more via a poorer rate for the same conversion.

4. Account usability and platform experience

Singapore users have found the platform intuitive and efficient, offering a clear interface that simplifies the management of global finances in one place.

Key usability highlights:

- Unified dashboard: Manage SGD and foreign currency accounts in one place with quick view switching for different currencies

- Access control: Invite team members and assign roles and permissions for stronger internal payment controls

- Approval workflows: Set up dual or custom approvals for high-value transfers, similar to corporate banking

Mobile app: Monitor balances, make transfers and approve payments on the go

5. Business tool integrations

Airwallex integrates with key business platforms to simplify daily operations. It connects with Xero and QuickBooks, automatically syncing transactions and balances for easier reconciliation and real-time cash flow visibility.

For online sellers, Airwallex links with Shopify, Amazon, eBay, Shopee, Stripe and PayPal, allowing sales proceeds to flow directly into your Airwallex account in local currencies.

Its open API also supports custom integrations, enabling larger businesses to connect Airwallex with their internal systems for automated payments and reporting.

6. Regulation and security

The Monetary Authority of Singapore (MAS) licenses Airwallex as a Major Payment Institution under the Payment Services Act. This licence allows it to issue accounts, process domestic and cross-border transfers and handle foreign exchange while meeting strict AML and KYC standards.

Airwallex is not a bank and the Singapore Deposit Insurance Corporation (SDIC) doesn’t cover client funds. Instead, all customer funds are safeguarded in segregated accounts with partner banks, ensuring they remain separate and protected.

The platform uses enterprise-grade security, including encryption, two-factor authentication and user-level permissions. Transactions may trigger compliance verification checks, which are standard across regulated payment providers.

- Open 20+ local currency accounts and get paid like a local

- Pay suppliers, partners and staff worldwide in 100+ currencies

- Collect payments for free from 130+ marketplaces and payment gateways, including Amazon, Etsy, PayPal and Shopify

- Save with competitive exchange rates on currency conversions and transfers

- Lock in exchange rates for up to 24 months for cash flow certainty

How to open an Airwallex business account in Singapore

Here are the steps to open an Airwallex business account for your Singapore-registered company:

- Sign up online: Visit the Airwallex Singapore website, register with your business email and create a secure password

- Add company details: Provide your business name, UEN (Unique Entity Number) and registered address. Airwallex supports most Singapore entities, including private limited companies and sole proprietors

- Verify your business: Upload the required documents, including each director’s NRIC or passport, proof of address and your ACRA business profile. Airwallex reviews these for compliance checks

- Wait for approval: Once submitted, Airwallex verifies your details, typically within one to three working days

- Activate your account: After approval, log in to open SGD and foreign currency wallets, send and receive payments and issue virtual or physical cards

Connect business tools: Link Airwallex to accounting or e-commerce platforms such as Xero, QuickBooks, Shopify or Amazon to streamline financial operations

Customer feedback and reputation of Airwallex Business (Singapore)

Airwallex earns mixed but generally positive reviews from business users in Singapore and abroad. Most praise the platform’s speed, transparency and multi-currency flexibility, while others highlight gaps in support and specific enterprise-level tools.

What users like:

- Airwallex has an average rating of 3.4 out of 5 on Trustpilot based on more than 1,700 reviews, with many users noting lower FX costs and simpler international payments compared to banks

- Businesses say the dashboard is clear and modern, making it easy to manage SGD and foreign currency balances in one place

- Several Singapore SMEs report that account setup is fast, with approval and verification often completed within a few working days

- Users also appreciate transparent pricing and multi-currency wallets, which simplify payouts to suppliers and overseas teams

- Companies selling on platforms like Shopify or Amazon note that integrations save time, allowing them to collect funds in USD or EUR without automatic conversions

Where users report issues:

- The most common frustration relates to customer support. Some reviews mention slow responses or repeated email follow-ups during compliance reviews

- A few users have experienced temporary account holds during verification, which can delay urgent payments

- Businesses managing very high transaction volumes say Airwallex lacks advanced tools such as FX hedging and forward contracts that larger organisations might need

When Airwallex fits and when you might need an alternative

Best suited for:

- SMEs, e-commerce sellers and service providers in Singapore that send and receive payments globally

- Companies that value clear FX rates, fast onboarding and integrations with tools like Xero, QuickBooks or Shopify

- Businesses focused on operational efficiency rather than complex treasury management

Less suitable for:

- Large corporations requiring trade finance, credit lines or advanced currency risk tools

- Businesses that prioritise immediate phone support or need tailored compliance handling

- Companies with very high payment volumes across multiple corridors that depend on treasury-level infrastructure

In short:

Airwallex suits Singapore businesses that trade internationally and want a modern, low-friction way to move money. It’s efficient and cost-conscious, but companies needing hands-on banking services or advanced FX management will likely outgrow it over time.

Why Singapore businesses choose WorldFirst over Airwallex

For many Singapore businesses that trade internationally – whether sourcing from China, selling online or managing suppliers across borders, WorldFirst’s World Account fits more cleanly than Airwallex in several practical ways.

Business-first model

WorldFirst has designed its core account for businesses, providing local bank details in 20+ currencies (including SGD, USD, EUR, GBP and AUD). That means you can receive, hold and pay in those currencies like a local in each market. While Airwallex also offers multi-currency capabilities, WorldFirst’s local account network is more comprehensive for traditional trading routes.

Cost clarity and simplicity

Opening a World Account costs nothing and there are no monthly maintenance fees. That transparency appeals to companies wanting to control overheads. While Airwallex also advertises low / no monthly fees for many cases, some users report additional costs or more complex tiers for premium features.

Marketplace and charging the right channels

If your business uses platforms like Amazon, eBay, Shopify or PayPal, WorldFirst supports collection and payout workflows that fit these operations. It also integrates with ERP/accounting systems like NetSuite, making finance processes smoother.

FX and supplier-payment readiness

For firms paying overseas suppliers or managing currency risk, the ability to access tools like forward contracts gives WorldFirst the edge in specific use cases. If your business regularly pays in CNY or USD and needs foreign exchange risk management, that may matter more than simply holding multiple currencies.

Local relevance

Since WorldFirst is dominant in the Asia Pacific (including Singapore), with local support, many Singapore SMEs feel it aligns more closely with their trading context – receiving in SGD, paying regional suppliers in Thailand, Malaysia and Vietnam for example, and managing cash flow across multiple markets.

If you’re still unsure about Airwallex or WorldFirst, check out our comparison of fees:

| Category | Airwallex Business Account | WorldFirst World Account |

|---|---|---|

| Account setup and fees | No setup fee; base plan free but some payment types and FX routes may include added costs | Free to open with no monthly fees or minimum balance. Simple pricing for all users |

| Currency support | Hold and transact in 20+ currencies; fewer local collection options on niche routes | Local account details in 20+ currencies including SGD, USD, EUR, GBP and AUD. Send payments in 100+ currencies worldwide |

| Integrations and marketplaces | Integrates with Xero and QuickBooks; open API available but fewer native ERP options | Connects to 130+ global marketplaces and integrates directly with NetSuite and Xero for automatic reconciliation |

| FX tools and control | Competitive FX rates but limited treasury tools or forward contracts | Offers forward contracts, rate alerts and dedicated FX support for supplier payments and currency planning |

| Support and reliability | MAS-licensed; online support model with fewer local touchpoints | Singapore-licensed (MAS) with regional support and dedicated account managers for business clients |

Note: The actual fee charged may vary by currency pair, destination country or payment method.

Grow your Singapore business across borders.

Open a World Account today for free and move money worldwide with competitive FX and full control.

- https://www.airwallex.com/sg/pricing

- https://www.airwallex.com/sg/business-account/global-accounts

- https://www.airwallex.com/sg/expense-management

- https://www.airwallex.com/sg/blog/digital-bank-singapore

- https://aspireapp.com/blog/airwallex-review-business-account-singapore

- https://statrys.com/sg/reviews/airwallex-business-account

- https://exiap.sg/reviews/airwallex

- https://en.wikipedia.org/wiki/Airwallex

- https://www.worldfirst.com/sg/products/world-account

- https://www.worldfirst.com/sg/blog/business-banking-insights

- https://eservices.mas.gov.sg/fid

Businesses trust WorldFirst

- Almost 1,500,000 businesses have sent US$500B+ around the world with WorldFirst and its partner brands since 2004

- Your money is safeguarded with leading financial institutions