The Seatbelt Sign Has Been Switched Off

Brief Summary: |

||

|

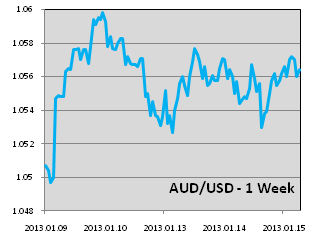

• It was a quiet week for the AUD data wise following last week’s flurry of positive sentiment. AUDUSD corrected from its Thursday high of 1.0599 to be 1.0567. The EUR continued its strong run, AUDEUR declining from a high of 0.8092 to 0.7949. AUDGBP held closest to last week’s high of 0.6598 at 0.6577 (all rates at time of writing). AUDJPY was the big mover of the week, gaining 3.8% to a high of 94.66 (more below). • Last Thursday, much better than expected Chinese Trade Balance paved the way for a risk asset rally; including the AUD and NZD. The figure measures the value of imports less that of exports and was 31.6 billion for December. The AUD broke range bound trading and rallied to 1.0599 against the USD as the data implies continued demand for Australian exports. The AUD found heavy resistance at 1.0600, a level it touched several times in the final segment of 2012. • Australian employment data for December is released on Thursday. Expectations are for an increase of 0.2% in unemployment and just 2300 new jobs created. A preliminary gauge, ANZ Job Advertisements, was down 3.8% for December pointing to a possible softer official figure. The data will be the biggest piece of Australian news for the week as it may influence the Reserve Bank of Australia’s future monetary policy decisions. • Chinese quarterly GDP growth will be released on Friday, a crucial piece of data for the AUD and other risk assets. The GDP measurement is the prime indicator of the health of the Chinese economy. • The German ZEW Economic Sentiment index will be released next Tuesday. The figure read positive for the first time since May 2012 last month, another positive figure could cement the EUR’s recent gains.

|

||

The Safe Havens Unwind |

||

| • Throughout the European Debt Crisis, investors have sought safety in low yielding, stable, safe haven currencies. In several cases it has prompted their central banks to intervene in markets to limit their appreciation. As Australia is experiencing now, an overly strong currency can be damaging to an economy, particularly those with a basis of manufactured exports. This is due to the fact a strong currency makes these exports uncompetitive in the world market. | ||

|

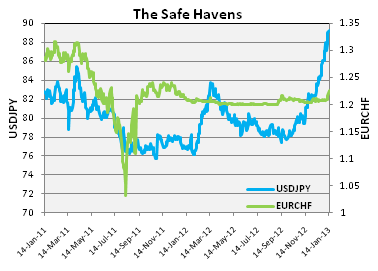

• Holdings in safe haven currencies have begun noticeably unwinding this week. The British Pound, Japanese Yen and the Swiss Franc have all posted weekly losses; we will examine the latter two. The figure to the right shows USDJPY and EURCHF, currency pairs that have been synonymous with the flight to safety; noting that a move down the graph indicates the appreciation of the safe haven currency. |

|

|

|

• The EURCHF (right axis), plots an interesting course through the last two years. In September 2011, the Swiss National Bank (SNB) enacted a price floor of 1.2000 per Euro. This response to drastic Franc appreciation came shortly after the so called peak of the Euro Crisis in July and August of 2011. The floor was held by selling unlimited quantities of CHF and effectively devalued the currency from near parity to just above 1.2000 for all of 2012. • USDJPY plots a similar course; the Yen strengthens through the crisis until the Bank of Japan (BoJ) intervenes at the 76.00 per USD. Given the Yen’s significantly larger share of global trading, the intervention is less aggressive and less effective than that of the SNB. |

||

|

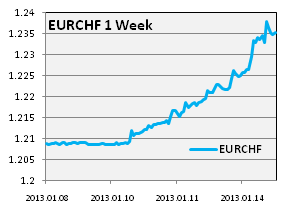

• In the past week, the CHF has depreciated sharply, much to the delight of the SNB and Swiss exporters. • The move is a result of waning safe haven demand as the Eurozone crisis quietens. This is coupled with Swiss Banks’ decision to levy charges, negative interest rates, on Francs held in accounts. • A full unwind of this safe haven positioning could see EURCHF climb above 1.3000 to pre crisis levels. |

|

|

|

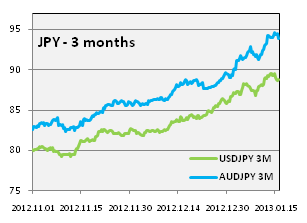

• The Yen’s decline has been occurring for longer than the Franc’s, USDJPY has appreciated over 13% over 3-months. Throughout 2012, the BoJ progressively increased monetary easing measures from 70 trillion Yen to over 100 trillion. • The decline is two folded. The past week has seen a marked acceleration in the Yen’s decline as Shinzo Abe, the Prime Minister elect as of the 26th of December, announced a 10.3 trillion Yen, debt funded stimulus package. This is coupled with his urging of the BoJ to double its inflation target to 2% from 1%. |

|

|

|

• The stimulus will increase in country’s national debt to 245% of GDP this year; twice that of the U.S., itself long considered unsustainable. Takeshi Fujimaki, a prominent adviser, has said, “Abe’s policies would have worked some 10 years ago, but now they will only accelerate an economic collapse.”(Source: Bloomberg) A dire prospect considering Japan is Australia’s second biggest trading partner. • The BoJ will make its next monetary policy statement on Tuesday. |

||

| •Please see below for specific currency commentary. | ||

|

AUDUSD |

|

|

• AUDUSD corrected from its old high and point of heavy resistance at 1.0599 and resumed range trading between 1.0520 and 1.0580. • The U.S. Debt Ceiling will be hit by mid February to early March according to the Treasury Secretary Timothy Geithner. At this point, the U.S. will not be able to pay its existing liabilities like bond coupons and public sector wages and will default. The White House has stated that it will not negotiate as it did last year, in an attempt to lay down the law to Republicans. |

|

| • In a speech on Monday night, Ben Bernanke, Chairman of the U.S. Federal Reserve, reiterated the Fed’s stance of continued easy monetary policy. He stated “the worst thing for the Fed to do would be to raise interest rates prematurely”. This means the USD is likely to remain historically weak and the AUD historically high. He also stated that raising the US debt ceiling was necessary to pay existing bills, not authorise new spending. Echoing the White House, this may have been aimed at supporters of Republicans that intend to use the debt ceiling as leverage for spending cuts. | |

|

AUDGBP |

|

• AUDGBP managed to hold gains more or last week’s gains than other crosses to be 0.6577 at time of writing from a high of 0.6598. The flight from safe havens also led the GBP lower against the EUR this week. • Poor U.K. manufacturing data was released on Friday that showed manufacturing production decreased 0.3% in November. The U.K’s December inflation figures were also released with the Consumer Price Index steady at 2.7% and Producer Price Indexdeclining 0.2% for December. Since the cost of inputs is declining, the data suggest the outlook for inflation is lower which may provide scope for monetary easing. By Chris Chandler |