The RBA makes the cut

Brief Summary:

• Yesterday, the Reserve Bank of Australia (RBA) surprised most by cutting the cash rate to 3.25% from 3.5%.

• As a result, the AUD was down against the majors for the week. AUDUSD was down 2.6% to be at 1.0212, AUDEUR was down 2.5% to be at 0.7919 and AUDGBP was down 1.9% to be 0.6333 at time of writing.

• The Chinese manufacturing Purchasing Managers’ Index (PMI), a measure of manufacturing activity, was released on Monday by the China Federation of Logistics and Purchasing at 49.8, whilst HSBC released their final manufacturing PMI figure on the weekend at 47.9. Both figures show manufacturing activity continues to contract and adds further uncertainty about China’s growth.

• Spain continues to steal the spotlight in Europe. The market is a rouse with speculation over when Spain will request assistance from the European Central Bank (ECB). Prime Minister Rajoy and the Spanish government is said to be assessing the ECB’s bond buying program to see whether it will accept the terms.

• The US released better than expected manufacturing data on Monday. The Institute of Supply and Management PMI came in at 51.5, from 49.8 expected. The data may pave the way for improved non-manufacturing data and employment data to be released later in the week. Although too early at this stage, the figures will give the first indication of any beneficial flow on from Quantitative Easing III over the next six months.

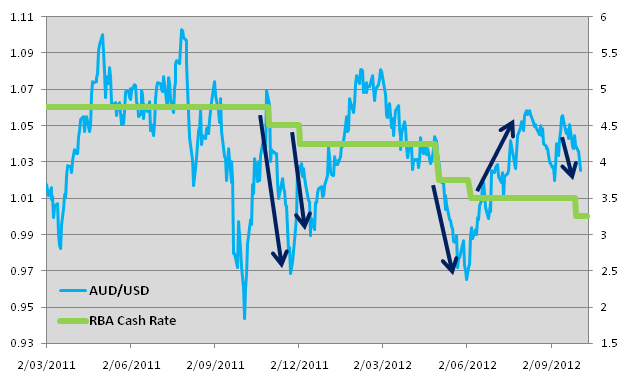

The Cash Rate vs. AUD/USD

• The news of the week came from the RBA, who cut cash rate to 3.25% from 3.5%. The move came as a surprise to some, and although largely priced in by the foreign exchange and interest rate markets, was only predicted by nine of twenty-eight surveyed economists. The cut is the fifth in a year, down from 4.75% in November 2011.

• The figure above shows the reaction of AUDUSD to rate cuts for the last year. Aside from the anomaly in June 2012, a rate cut will generally cause the AUD to fall against the majors; namely, the USD, EUR and GBP. This is due to the interest rate differential between Australia and the rest of the developed world, where rates are generally less than 1%. As the AUD interest rate is cut international investors move their money into relatively higher yielding assets, thereby reducing demand for the currency. At 3.5%, the Australian interest rate is still the highest in the developed world. Lacking a further deterioration of the global economy, we would expect the AUD to remain fairly supported by this demand.

• Albeit similar to last month’s, the statement released in conjunction with the decision has some standout remarks. Of particular note, the board stated “Investment in dwellings has remained subdued, though there have been some tentative signs of improvement, while non-residential building investment has also remained weak.” This suggests earlier cuts have not flowed through to the housing and property sectors as much as expected. The cut should further ease the interest burden on households thereby stoking consumption and investment.

• Additionally, the board made specific mention of the peak in resource investment, “the peak in resource investment is likely to occur next year, and may be at a lower level than earlier expected”, this is in response to decisions by companies such as BHP, Rio Tinto and Fortescue Metals, to scale back investments and slow expansion.

•The Australian trade balance was released today at 11:30am and came in at -2.03 Billion. This is the lowest figure since 2010, and reflects lower commodity prices and the relatively high AUD.

•Please see below for specific currency commentary.

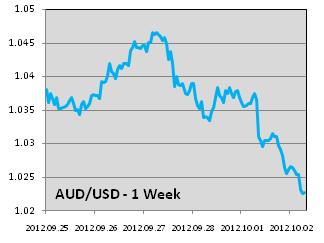

AUDUSD

• Over the past week, AUDUSD has fallen 2.6% from a high of 1.0475 on Friday to 1.0212 at time of writing. The short lived rally before the weekend was the result of speculation the Chinese government would add further stimulus to the economy. This move up was hastily reversed on Tuesday as the RBA made an unexpected rate cut of 25 basis points.

• The Institute of Supply Management in the US released Manufacturing PMI of 51.5 from 49.8 expected. A reading of 50 marks the point between expansion and contraction. The better than expected figure suggests Quantitative Easing III (QE3) is working, and may lead to improved Non-Manufacturing PMI and Non-Farm Payroll employment numbers released on Thursday and Friday, respectively.

• Non-Farm Payrolls is one of the most important pieces of monthly US data. Given unemployment is a major topic in the upcoming presidential election and the prime target of the Fed’s third round of Quantitative Easing, this data will be closely watched by the markets for the next few months. Although too early at this stage, over the next few months, these figures will be an opportunity to see whether QE3 has had the desired effect on the economy.

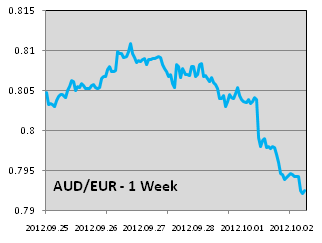

AUDEUR

• AUDEUR made its first meaningful break below 0.8000 after the RBA rate cut on Tuesday. AUDEUR has fallen 2.5% from last week’s high of 0.8112. News has not been positive out of Europe; the move is due to AUD weakness.

• Rumours have been circulating that the Spanish government will request assistance from the ECB as early as this weekend. Prime Minister Rajoy seems to be holding off on requesting a bailout for as long as possible. This is perhaps due to the ill political fate suffered by other governments that have requested ECB bailouts.

• Catalonia, a mischievous Spanish province, has used the instability as a springboard to relaunch its push for independence. The region accounts for a fifth of the Spanish economy and fears are that a separation will send the remainder of Spain bankrupt. Secession in the near term is unlikely though, and the tactics are more so an attempt to achieve greater independence and autonomy over taxation and spending. The province is of the view that it pays more in taxes to Madrid than it gets in return through government spending.

• Last Friday, a stress test on Spanish banks revealed they would face a 59.3 billion Euro capital deficit. Moody’s, however, disagreed with the findings early this week stating that the shortfall is more like 105 billion Euros.

• The ECB will set the minimum bid rate on Thursday; they are expected to remain on hold at 0.75%.

AUDGBP

• The Bank of England will decide the official interest rate on Thursday, expectations are to remain on hold at 0.5%

• The GBP, although strengthening against the AUD, has fallen against the USD in the past week. This was due to worse than expected Manufacturing data released on Monday and worse than expected Construction data released on Tuesday.

By Chris Chandler