Brief Summary:

- The U.S. released mixed monthly employment data last Friday showing lacklustre jobs growth. The data made neither a clear case for or against the tapering of quantitative easing in September; known as Septaper.

- The AUD rallied broadly this week, touching 0.9319 against the USD a two and a half month high. The rally’s primary drivers seem to be better than expected Chinese data and the possibility of an alternative resolution to military strikes on Syria. Monthly, Australian Employment data will be the next test for the AUD tomorrow morning at 11:30am.

Solution for Syria

In what looks suspiciously like a backroom deal struck by the major powers, Russia’s proposal for Syria to surrender its chemical weapons stockpiles was accepted by Syria placing any U.S. military action on hold for now. The United Nations are now discussing the proposal and developing a timeline and drafting a resolution. The turn of events seems like an engineered outcome for the major powers. It allows Russia to play the good guy whilst still maintaining its strategic alliance with Syria. It also allows the U.S., U.K. and France to sidestep their responsibility to punish the Syrian regime as they face widespread public disapproval of military action in their respective countries. Scepticism aside, President Obama did make a passionate plea to the public about the need for the U.S. to act when a rouge regime violates international conventions, stressing that any action would not be an Iraq or Afghanistan.

Confidence that a resolution may be just around the corner paves the way for the AUD to rally on the back of stronger than expected Chinese data. The AUD and NZD have gained 2.55% and 3.07% over the week, respectively, making them the best two performing currencies in the G10. Over the weekend, China released data that showed its Trade Balance unexpectedly extending to a surplus of 28.5 billion. Following this, the monthly Industrial Production figure gained for the third month in a row to 10.4% year on year.

Please see below for specific currency commentary.

USD

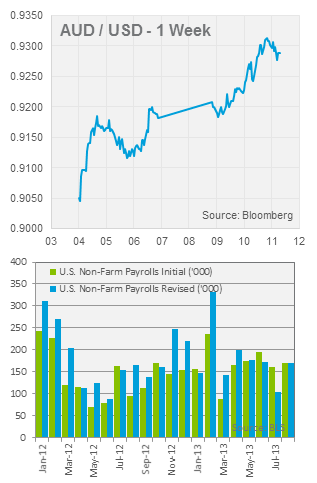

AUDUSD has rallied this week, driven by a combination of solid Chinese data, mixed US data and confidence of a Syrian solution (of sorts).

On Friday, Non-Farm Payrolls, U.S. monthly employment growth, missed expectations with 169,000 jobs added in August. Expectations were for a stronger figure of 178,000 and the release included downward revisions totalling 74,000 in June and July. The figure to the right shows jobs growth and revisions since January 2012. The Unemployment Rate declined to 7.3%, however as it has since 2009, it was largely due to decreases in the Participation Rate; the percentage of people in the labour force. This decline is due to people retiring or giving up looking for work, indicating both the demographic shift and weaker underlying employment conditions. Friday’s jobs number was said to be the most major consideration for the September 17-18 Federal Open Market Committee meeting. The lacklustre result providing neither a clear case for or against a shift in monetary policy. The view expressed by renowned Fed commentator Jon Hilsenrath’s article on the 6th of September expressed doubts over a Septaper. The recent downward revisions seem insignificant compared to the upward revisions from earlier in the time period, though it may still be a sign that stimulus should not be removed too early. Couple this with possible U.S. military action in Syria, there grows a case for Octaper or Dectaper; though the latter point has developed significantly in the last 24 hours.

On Friday, Non-Farm Payrolls, U.S. monthly employment growth, missed expectations with 169,000 jobs added in August. Expectations were for a stronger figure of 178,000 and the release included downward revisions totalling 74,000 in June and July. The figure to the right shows jobs growth and revisions since January 2012. The Unemployment Rate declined to 7.3%, however as it has since 2009, it was largely due to decreases in the Participation Rate; the percentage of people in the labour force. This decline is due to people retiring or giving up looking for work, indicating both the demographic shift and weaker underlying employment conditions. Friday’s jobs number was said to be the most major consideration for the September 17-18 Federal Open Market Committee meeting. The lacklustre result providing neither a clear case for or against a shift in monetary policy. The view expressed by renowned Fed commentator Jon Hilsenrath’s article on the 6th of September expressed doubts over a Septaper. The recent downward revisions seem insignificant compared to the upward revisions from earlier in the time period, though it may still be a sign that stimulus should not be removed too early. Couple this with possible U.S. military action in Syria, there grows a case for Octaper or Dectaper; though the latter point has developed significantly in the last 24 hours.

EUR & GBP

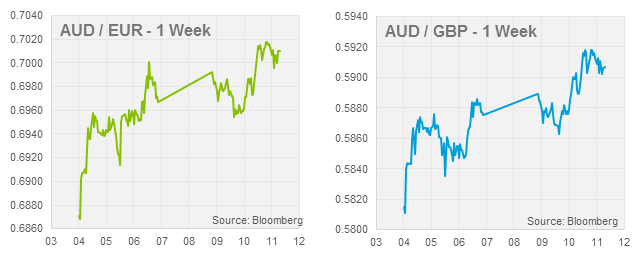

This week saw the AUD rally against the EUR and GBP climbing to 0.7010, a one and a half month high, and 0.5907, a one month high; respectively.

Both the European Central Bank and Bank of England made no changes to monetary policy at their respective meetings last Thursday.

A U.K. inflation report will be released on Thursday night that will give insights into inflation expectations. The inflation outlook is one of the knock-out clauses of the Bank of England’s pledge to keep monetary policy on hold until unemployment reaches 6.5%.