Quantitative Easing 3 – The Eagle has landed… although there’s no giant leap

Brief Summary:

• The big news of the week was Quantitative Easing III announced early on Friday the 14th. The long awaited announcement set off a rally in risk assets, although it proved short lived (more below…).

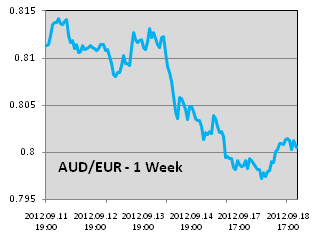

•AUDUSD touched 1.0625 after the announcement, only to drop back to pre-announcement levels this week, to be 1.0440 at time of writing. The EUR continued to gain support; AUDEUR lost 1.7%, falling from last week’s high of 0.8142 to 0.8000 at time of writing. The NZD, one of the best performers recently, made gains against the AUD for the week. AUDNZD fell from 1.2784 to 1.2615, down 1.3%.

• The RBA released minutes from its September 4th meeting yesterday that gave some insight into future policy response. Of particular interest was the statement in the concluding paragraph “The current assessment of the inflation outlook continued to provide scope to adjust policy in response to any significant deterioration in the outlook for growth”, this hints at the RBA’s intention to respond to global macro events and act with rate cuts. This was interpreted by the markets and led to a softening of the AUD on Tuesday.

• Additionally, there was a specific mention of the rapid declines in iron ore and coking coal prices and its impact on wining investment. There was also a statement about the AUD, “Members discussed the possibility that the high level of the exchange rate was weighing more heavily on the economy than might be expected”, this, however, should not be taken as a hint the RBA will attempt to move the AUD. The RBA has never intervened to strengthen or weaken the AUD as was undertaken by the Swiss central bank last year to weaken the CHF. The RBA’s market involvement only serves to reduce volatility.

• A swathe of manufacturing Purchasing Managers’ Indices (PMI) will be released this Thursday and Friday. PMI data is a measure of manufacturing activity in a country, determined by a survey of purchasing managers on business conditions. Notable countries releasing data include China and Germany on Thursday and the US on Friday.

• Last Wednesday, the German Constitutional Court upheld the European Stability Mechanism (ESM). This paves the way for the 500 billion Euro fund to bail-out troubled countries if required. Yields on government bonds in Spain and Italy, a measure of perceived risk, fell on the news the steps are slowly being taken to solve the crisis.

•Please see below for specific currency commentary.

Quantitative Easing 3

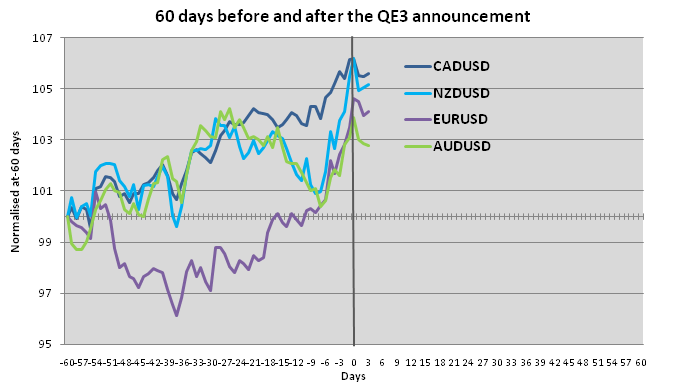

• Last week we looked at the movements of AUDUSD before and after the last two quantitative easing announcements. Aside from QE1 that came by surprise, we saw the market anticipate QE2 and the AUD rally generally made most of its ground before the date of the announcement. This time, we again saw the AUD rally up to and throughout the day of the announcement, however, three trading days later we have fallen back to pre-announcement levels.

• This week, we have added the performance of the Canadian dollar, New Zealand dollars and the Euro to our chart. As you can see the AUD is the worst relative performer in the group. This can be put down to a recent softening of Chinese outlook. Canada and New Zealand have relatively less exposure to China than Australia. China accounts for around 11% of New Zealand’s total exports and about 4% of Canada’s compared to 25% of Australia’s.

• Recently, a sharp fall in commodity prices has led to less bullish bets on Australian resources. The RBA mentioned the 7 percent decline in their commodity price index over the previous month in their latest minutes. This week, Fortescue Metals was forced to renegotiate debt terms adding to their woes caused by falling iron ore prices.

• As has been discussed in previous weekly updates, the continued support of the AUD is largely attributed to foreign demand of the AUD and Australian government bonds. A Bloomberg article this week revealed AUD reserves are held by up to 23 central banks around the world. Today, S&P Ratings Services affirmed Australia’s AAA rating, keeping it in an exclusive club of countries to hold stable AAA ratings from all ratings agencies.

• It’s a little too early to make a call on the result of QE3. Additionally we must stipulate the intention of Quantitative Easing is not to boost the performance of other currencies. The AUD has taken the unusual shape of a commodity currency and a safe haven. With a fading commodities dream, yet a preferred store of wealth for central banks, greater macro events will be the key drivers of the AUD for the next period.

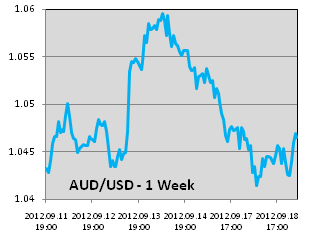

AUDUSD

• AUDUSD rallied sharply after the QE3 announcement last Friday reaching a high of 1.0625. After the weekend however, the risk rally was put on pause and the AUD returned to its pre-announcement levels of around 1.0450.

• Manufacturing PMI data in China and the US is released on Thursday and Friday, respectively.

• Last month’s Chinese release was the lowest reading for 9-months at 47.6. It led to a softening of the AUD, albeit temporary, as confidence in Chinese growth declined. A reading of 50 marks the point between expansion and contraction.

• The Philly Fed Manufacturing Index, the measure of US manufacturing activity, is expected to be -4.1. Whilst it is too early to see any flow on effects from QE3, a better than expected figure will lend weight to the US recovery.

AUDEUR

• The EUR continued its come-back this week. AUDEUR has returned to June 2012 levels of 0.8000 at time of writing.

• On Thursday, Germany will release manufacturing PMI data, a measure of manufacturing activity. This figure was 44.7 last month and expected to be 45.4 this month. A better than expected figure may lead to further EUR strength supporting the theory that European leaders are taking the necessary steps to resolve the crisis.

• On the other hand, uncertainty is still present about Spain’s predicted request for assistance and whether Greece can continue on the prescribed course of austerity.

By Chris Chandler