How long can the Australian Dollar remain at these

levels?

Brief Summary:

• AUD reaches new high against EUR then falls 1 cent during the week

• RBA keeps cash rate at 3.5%

• Greece’s rating outlook lowered by S and P as economy weakens

Another positive week has seen the AUD trading higher against most of the majors 0.29% higher against the USD (1.0558) and 0.63% against GBP (0.6778); but a 0.1% decrease against the EUR (0.8533).

The big question everyone wants to know is where is the Australian Dollar heading in 2013?

Recently, positive sentiment has driven the AUD to a level that many, including the RBA, feel is overvalued. With the USD still suffering post GFC drag and the EUR and GBP underperforming can these levels be sustained? Let’s have a look at where we may be headed.

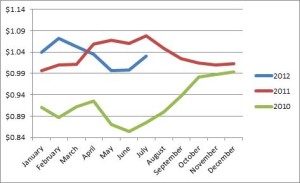

AUD trading over the last 3 years against the USD has seen a yearly average improvement from 2010 to 2011 by 11% and remained constant from 2011 to 2012.

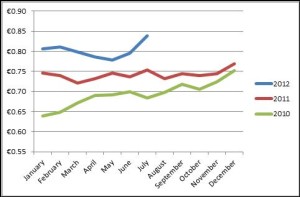

AUD trading over the last 3 years against the Euro has seen a yearly average improvement from 2010 to 2011 by 4.9% and a further rise from 2011 to 2012 by 7.5%.

AUD trading over the last 3 years against the GBP has seen a yearly average improvement from 2010 to 2011 by 7.6% and a further rise from 2011 to 2012 by 1.81%.

What is holding the Australian Dollar above parity? And on average 20-30% above history averages against the major currencies?

• Interest Rates: Return on Australian cash is minimum 3.5%. Europe= 0.75% US=0% UK= 0.5%

• Lower interest rates attract overseas capital and gives the Australian Dollar underlying fundamental strength against all its currency piers.

• The Australian Economy; the only advanced economy to not go into a recession after the GFC in 2008.

• Record mineral exports, low unemployment, tight regulation, and a big pool of superannuation funds and savings. Australian government bonds are AAA rated investments; one of the only governments left to be AAA rated.

What will bring the Australian Dollar down fundamentally?

A rise in interest rates in Europe and the U.S, that provides a comparable return versus Australian return’s (this is not on the cards for at least the next 12 months – 18 months – until those economies improve)

Will the Australian Dollar reach 0.93c against the USD as it did in 2011?

• If a disagreement between European nations over the conditions of bailout installments, or decision’s, this causes investors to panic. They feel if these decisions are delayed or mishandled, this may cause a default by a country, causing a full blown financial crisis…..again.

• Share markets around the world are particularly sensitive to these types of announcements with stocks getting hammered quickly and without warning. The Australian dollar, being a risk-on currency tends to follow these trends.

• This is major cause of volatility in the Australian dollar. Spain, a member of the big four in the European economy (Germany, France, Italy and Spain), is a major piece of the puzzle, and has huge debt problems, massive unemployment, and a destroyed housing sector.

• The prediction of the value of the Australian dollar is linked directly to the unfolding events in Europe, which have been unfolding over the last 2 years. We easily have at least a year to go, if not more, until the uncertainty and the volatility return to more normal levels.

Sell offs:

The AUDUSD fell from 1.0790 on September 1st 2011 to 0.9385 on October 4th 2011. That’s a roughly 14% drop in 4 weeks. This is when Greece was front and centre of news.

The AUDUSD fell from 1.0474 on 30th April 2012, to 0.9580 on June 1st2012. This is a 9c drop in 4 weeks. This is Spain hitting the headlines before receiving their first $100B injection of cash to stop their banking system from collapsing.

Helpful Tips

- The Australian Dollar is a very volatile currency and considered to be overvalued by many. If you are interested in how we can reduce risk and protect your business’s exposure to the market then have a read of Hedging for Beginners

- Happy with the service you receive from World First? Why not refer us to some of your corporate partners that can benefit from our service.

- Want to know FX Rates whilst you are on the go? Why not download our FX App on your IPad or IPhone. Search for World First Currency Converter

By Ray Ridgeway and Matthew Dawe