World First Weekly Update 4th July 2012

European Leaders have 13 hour-length meeting which boosts confidence and markets around the world- and the Aussie

Major points to note:

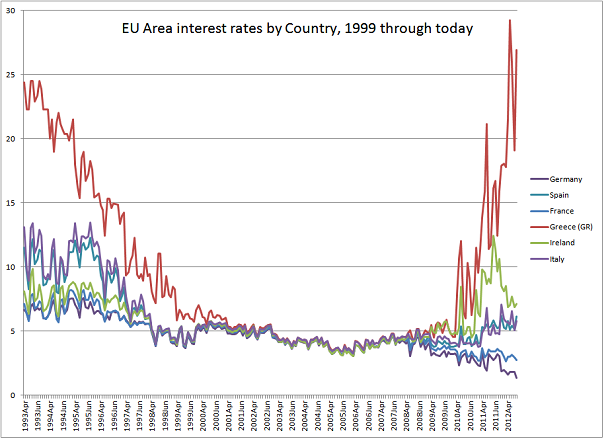

• European leaders spend 2 days coming to an agreement to stop the soaring borrowing costs for Italy and Spain, after Spain announces it cannot hold out, and pay the interest rates on its debt.

• As a result of major concessions from Germany, bailout rules were loosened, a platform laid for a banking union within Europe and an agreement was made to allow direct cash injections into affected countries banking systems by the European Central Bank. ( the ECB has been buying billions of Euros worth of indebted countries bonds, to keep their borrowing costs down – pressure has been to high, and interest rates have risen as investors dump these investments in spite of the ECB efforts.)

• Spain, after its Government agreed to accept a 100B Euro loan from the ECB a couple of weeks ago to prevent the Spanish banking system from imploding, has seen its borrow costs skyrocket, as investors get nervous about its ability to repay its debts.

• Markets have settled down at the moment, regaining ground after weeks of volatility, eroded confidence around the world, falling exports from China, a cooling U.S economy ( not good for Obama who is up for re-election in November), cooling Australian exports, multiple downgrades of economic growth, and credit ratings being slashed. • Major progress was made in talks. ( 59 meetings/summits and counting..) to make major inroads in putting an end to the European debt crisis, which started in Greece in April 2010.

• U.S stocks rallied, and the Australian dollar soared over 2% in the 24 hours after the announcement.

• Take note: The U.S debt ceiling will be reached in a few weeks after the U.S election in November. Last time this limit had to be raised, it resulted in a 1-month bitter battle in the U.S House of Representatives and Senate to legalise an increase in the debt ceiling to prevent the U.S from defaulting on its debt.

• The U.S Government is spending $1,000 Billion+ ( over USD 1 Trillion) dollar’s more than it takes in per year to jump start its economy, after a tepid recovery after the biggest recession since the great depression. This is resulting in US debt climbing at a huge rate to reach the debt limit.

• Obama secured a big enough limit to get him to the next election, so the debt fight between Republicans and Democrats would not affect world markets/ confidence and the U.S can pay its bills until after the presidential election, so not affecting Obama’s prospects of re election. This limit will be reached shortly after the election and promises to be an almighty fight.

“When the time comes, I will again insist on my simple principle of cuts and reforms greater than the debt limit increase,” Boehner said. “This is the only avenue I see right now to force the elected leadership of this country to solve our structural fiscal imbalance.”

The last time Republicans made the demands in the spring of 2011, the U.S. nearly defaulted on its debt for the first time and the country’s sterling Standard & Poor’s credit rating got downgraded.

Has The European Debt crisis been solved? – Events, and announcements reflecting massive debt issues in Europe have dominated the outlook of the Australian dollar for the last 2 years. If we are looking at stability moving forward after this summit, this is a major piece of the puzzle in the world’s economic recovery, and therefore the value of the Australian dollar.

If the debt crisis has not been solved, the only other avenue to completely and utterly solve the European crisis is a complete fiscal union (individual country) consolidation, meaning that Europe would solely be responsible as hole to pay its debts as a region, rather than individual countries. Basically combining the parts to make the whole stronger.

Matthew Dawe Corporate Foreign Exchange Dealer

If you would like to discuss your foreign exchange requirements, please call 1800 701 540 or email australia@worldfirst.com for a live exchange quote. *Rates are dependent on the amount you transact Any rates given are “interbank” i.e. for amounts of A$100 million and thus are not indicative of rates offered by World First for smaller amounts. World First Pty Ltd is regulated in Australia by ASIC (AFS Licence number 331945). ACN 132 368 971 Member of Financial Ombudsman Service (membership number 134005)