Brief Summary

- The Reserve Bank of Australia cuts the cash rate to a record low of 2.50%.

- U.S. Employment numbers miss the mark though industry indicators show signs of strengthening.

- U.K. industry indicators stride ahead to indicate strongest and longest growth since late 2009.

Flat retail sales, a rate cut, AUD gains…

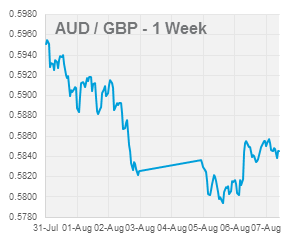

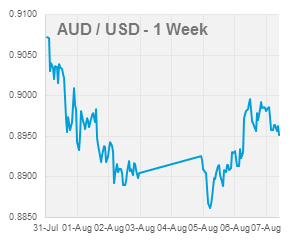

Australian Retail Sales figures missed expectations on Monday, posting flat growth after 0.4% was expected. The bank holiday meant trading volumes were light and the AUD touched a low of 0.8860 against the USD. The following morning, Australia’s Trade Balance was released recording a $600 million surplus, from $800 million expected.

Yesterday at 2:30pm, the Reserve Bank of Australia cut the cash rate to a record low of 2.50%. The move was fully priced into currency markets and the AUD actually gained about half a cent against the USD on release. The price action can be explained by market analysis of the accompanying statement.

The statement was almost a carbon copy of last month’s and echoed themes of recent statements, maintaining their commitment to adjust policy should inflation allow. One subtle difference that seems to have buoyed the AUD is the lack of easing bias. When rates were cut in May, the board stated, “At today’s meeting the Board decided to use some of that scope”. This month, there was no mention of any further scope and the final paragraph seemed more neutral. The board stated that inflation should stay within target in spite of the depreciated AUD. On Monday, the Melbourne Institute released its monthly inflation gauge. The reading increased by 0.5% in July and gives a more timely, albeit unofficial, indication of inflation. Some upward pressure on prices should show up the next official inflation release on the 23rd of October, which may determine the board’s next move.

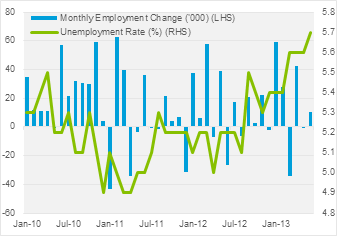

On Thursday, Australian Employment data for the month of July will be released. Market expectations are for 6,000 new jobs after 10,300 were added in May. The RBA noted yesterday that the Unemployment Rate has continued to edge higher as it has for the past year; the market is expecting a climb to 5.8% from 5.7%. . A worse than expected figure may prompt further weakness in the AUD.

On Thursday, Australian Employment data for the month of July will be released. Market expectations are for 6,000 new jobs after 10,300 were added in May. The RBA noted yesterday that the Unemployment Rate has continued to edge higher as it has for the past year; the market is expecting a climb to 5.8% from 5.7%. . A worse than expected figure may prompt further weakness in the AUD.

Please see below for specific currency commentary.

USD

On Friday, the U.S. released its employment numbers for July. Non-Farm Employment Change, the primary measure of employment growth, missed expectations with 162,000 new jobs after 180,000 were expected. Contrary to the Australian experience, the Unemployment Rate edged down from 7.6% to 7.4%. The Participation Rate, the percentage of the total population in the labour force, declined very slightly by 0.1%. As discussed last week, the shedding of workers from the labour force seems to be bottoming and will be crucial to the U.S. recovery.

On Friday, the U.S. released its employment numbers for July. Non-Farm Employment Change, the primary measure of employment growth, missed expectations with 162,000 new jobs after 180,000 were expected. Contrary to the Australian experience, the Unemployment Rate edged down from 7.6% to 7.4%. The Participation Rate, the percentage of the total population in the labour force, declined very slightly by 0.1%. As discussed last week, the shedding of workers from the labour force seems to be bottoming and will be crucial to the U.S. recovery.

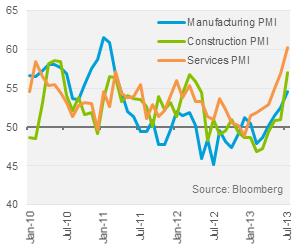

The Institute of Supply Management in the U.S. released PMI figures for its manufacturing and non-manufacturing sectors. The forward indicators of GDP growth indicate strengthening of economic conditions in the third quarter.

GBP

U.K. economic data continues to strengthen, bolstering the recovery. PMI readings, industry surveys of business conditions, smashed expectations for Manufacturing, Construction and Service sectors. The data indicating the strongest and most prolonged expansion since 2009. Yesterday, monthly U.K. Manufacturing Production figures confirmed this strength posting 1.9% growth in June.

U.K. economic data continues to strengthen, bolstering the recovery. PMI readings, industry surveys of business conditions, smashed expectations for Manufacturing, Construction and Service sectors. The data indicating the strongest and most prolonged expansion since 2009. Yesterday, monthly U.K. Manufacturing Production figures confirmed this strength posting 1.9% growth in June.