8 best payment gateway providers in Singapore [2026 list]

Last update: 17 Dec 2025

In Singapore, digital payments have become the standard way to do business. Over 90% of Singapore’s population has signed up for the nation’s e-payment schemes and almost all merchants now accept QR code payments.

Payment gateways let businesses accept customer payments online and in-store with ease, including credit cards, mobile wallets and bank transfers. In Singapore’s highly connected market, a reliable payment gateway helps boost sales by enabling customers to use their preferred payment methods quickly and securely.

In this 2026 guide, we’ll analyse the best payment gateway providers in Singapore to help you get paid faster, manage currencies smarter and expand with confidence.

We’ll also explore how WorldFirst’s World Account – a dedicated multi-currency account built for global business – helps Singapore businesses manage international transactions more efficiently.

While not a gateway, WorldFirst supports the financial side of global selling – enabling cost-effective currency conversion, faster cross-border payouts and better control over global cash flow.

Open a World Account for free and gain complete control over your international payments, conversions and supplier transfers.

What is a payment gateway?

A payment gateway is the technology that enables digital payments. It connects a customer’s bank with a business’s account, verifies the payment and ensures the transaction is completed securely for both online and in-store purchases.

When a customer makes a payment, the gateway encrypts the details and sends them to the acquiring bank for authorisation. The bank processes the approval, moves the funds and completes the transaction in just a few seconds. The gateway then sends the payment status to the merchant.

Key advantages include:

- Secure processing: Uses encryption and complies with PCI DSS standards to keep sensitive data safe

- Multiple payment options: Supports cards, digital wallets such as Apple Pay and Google Pay and bank transfers to suit customer preferences

- Simple integration: Works smoothly with e-commerce platforms and point-of-sale systems to create a seamless checkout experience

- Fraud protection: Applies AI-driven monitoring to detect and block suspicious activity before it affects your business

In Singapore, digitalisation is now the norm. In fact, 94.6% of SMEs have digitalised at least one core area, such as e-payments, e-commerce or data analytics, reflecting the country’s Smart Nation vision and initiatives, such as SMEs Go Digital.

For these businesses, choosing a trusted, MAS-licensed payment gateway is essential to process payments, build customer confidence and maintain operational security.

But even with digital tools in place, many merchants still struggle with checkout conversion and payment reconciliation, often losing margin through high FX markups and transfer fees.

How to choose the best payment gateway in Singapore

Choosing the right payment gateway starts with knowing what matters most for your business. For Singapore companies that sell internationally or manage cross-border suppliers, the best solution combines local reliability with global reach.

Consider the following factors when comparing providers:

- Supported currencies and markets: Ensure the gateway can accept and settle payments in SGD, USD, RMB, EUR and other currencies your customers want to pay in

- Integration and platform compatibility: Check that it connects smoothly with your e-commerce setup, such as Shopify, WooCommerce, Magento or through custom APIs

- Transparent pricing: Look for clear details on transaction fees, FX mark-ups and settlement costs, particularly for foreign currency payments

- Security and compliance: Select a provider regulated by the Monetary Authority of Singapore (MAS) that meets PCI DSS and other data-protection standards

- Settlement speed and payout options: Review how quickly funds reach your account and if you can withdraw to multiple bank accounts or in different currencies

- Support for local and cross-border payments: The best gateways support both domestic methods like PayNow and FAST and international options such as cards and e-wallets

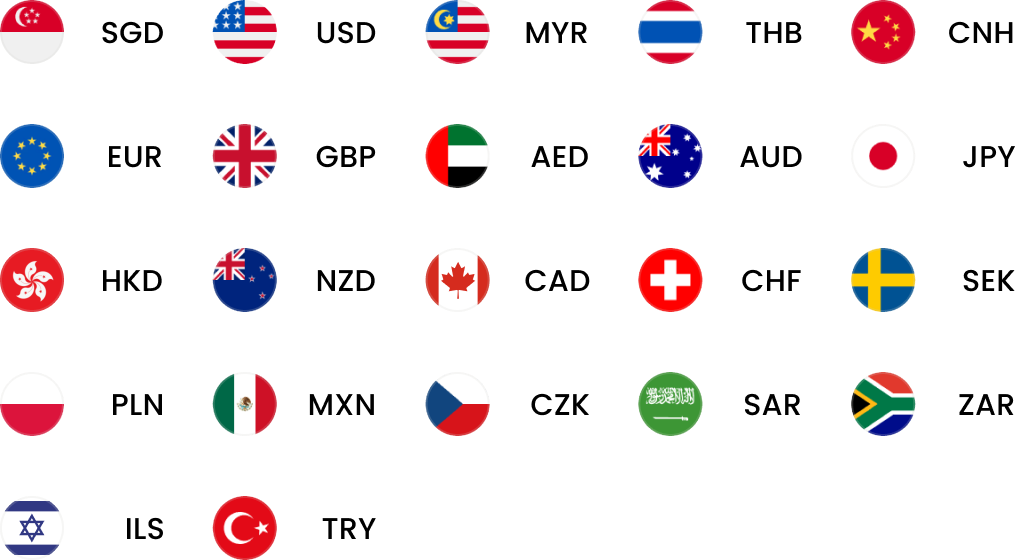

- Open 20+ local currency accounts and get paid like a local

- Pay suppliers, partners and staff worldwide in 100+ currencies

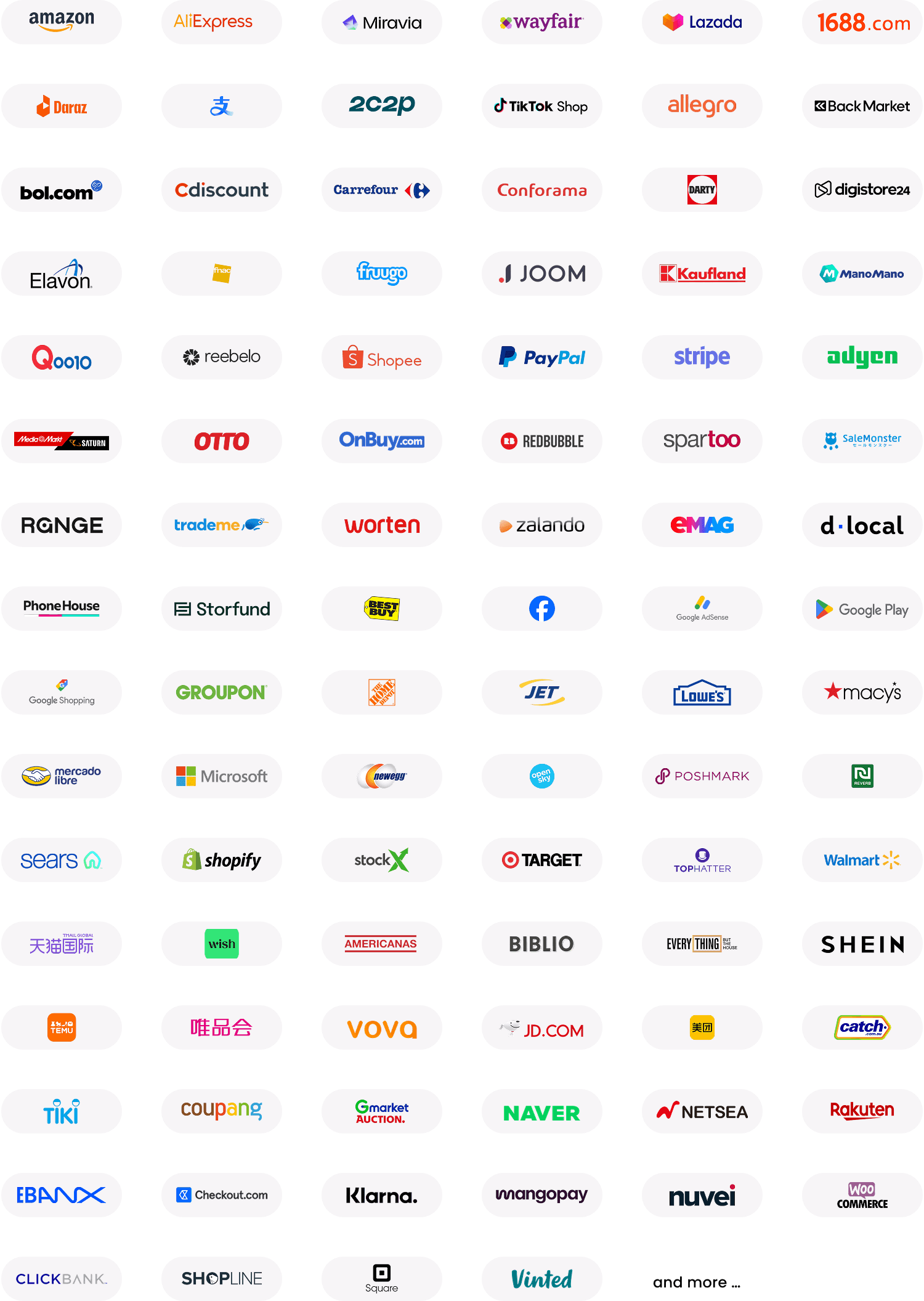

- Collect payments for free from 130+ marketplaces and payment gateways, including Amazon, Etsy, PayPal and Shopify

- Save with competitive exchange rates on currency conversions and transfers

- Lock in exchange rates for up to 24 months for cash flow certainty

Top 8 payment gateway providers in Singapore

Here’s a comparison table of the most popular payment gateway providers in Singapore:

| Provider | Best for | Key features | Pricing |

|---|---|---|---|

Stripe |

Tech-driven SMEs, SaaS providers, and global e-commerce startups | 100+ payment methods across 135+ currencies, PCI Level 1 compliance, AI-driven fraud detection | Domestic cards: 3.3% + SG$0.50 International cards: 3.6% + SG$0.50 Currency conversion: +0.5% above interbankNo setup or monthly fees |

PayPal |

International sellers, freelancers, and marketplace merchants | PayPal Wallet and Checkout, invoicing tools, buyer/seller protection, marketplace integration, mobile POS support | Domestic: 3.9% + SG$0.50 International: 4.4% + SG$0.50 FX fee: 3–4%No setup or monthly fees |

HitPay |

Local retail, F&B, and small businesses | Supports PayNow, GrabPay, Alipay, WeChat Pay, cards; mobile POS; invoicing; recurring billing; fast onboarding | Online cards: 2.8–3.65% + SG$0.50 PayNow: 0.65–0.9% Wallets: 3–5.5% + SG$0.20 No monthly fees |

FOMO Pay |

Retailers, tourism, and luxury merchants | Unified QR acceptance (PayNow, Alipay, WeChat Pay, GrabPay), API/SoftPOS integration, and real-time dashboard | Custom rates on request Cards from ~2.9% + SG$0.30 |

Rapyd |

Regional and global businesses, marketplaces, and fintech platforms | 900+ payment methods, multi-currency accounts, global collection/payout network, built-in KYC/AML, and FX management | Interchange++ modelIssuer fee: 0.2–1.8% + acquirer fee |

Adyen |

Large e-commerce, subscription, and omnichannel retailers | 250+ payment methods, unified online/in-store system, ML-based fraud detection, and advanced analytics | No setup/monthly fee Example: PayNow 1.3% + SG$0.13 |

eNETS |

Domestic services, utilities, B2B billing, and education providers | Direct bank transfers (DBS, UOB, OCBC), SGQR and PayNow integration, card acceptance, and reconciliation tools | Cards: ~3.4% + SG$0.50 Bank/QR: ~0.8% POS: 0.8–1.8% |

Airwallex |

Cross-border e-commerce, SaaS, and exporters | 160+ local methods, multi-currency settlement (SGD, USD, EUR, etc.), 20+ local account details, and no monthly fees | Domestic: 3.3% + SG$0.50 International: 3.6% + SG$0.50 Local methods: SG$0.50 + method fee |

1. Stripe

Stripe is a leading global payments platform built for flexibility, scalability and international reach. It enables Singapore businesses to accept online and in-person payments in over 135 currencies, supporting major cards, mobile wallets like Apple Pay and Google Pay and local options such as PayNow.

Key features:

- Accepts 100+ payment methods across 135+ currencies

- Centralised dashboard for real-time tracking and analytics

- PCI DSS Level 1 compliance and AI-powered fraud detection via Stripe Radar

- Tools for recurring billing, invoicing and one-click checkout

- Seamless integrations with Shopify, WooCommerce and major CRM systems

Best for:

Tech-driven SMEs, SaaS providers and global e-commerce startups that need flexible API integrations, automation and multi-currency support.

Pricing:

- Domestic cards: 3.3% + SG$0.50 per transaction

- International cards: 3.6% + SG$0.50 per transaction

- Currency conversion: +0.5% above the interbank rate for major currencies

- Local payment methods: SG$0.50 + method-specific fee (e.g., Alipay, WeChat Pay)

- Setup or monthly fees: None

Refunds and disputes: SG$15 chargeback fee per case

2. PayPal

PayPal is one of the world’s most recognised payment providers, offering both a payment gateway and a digital wallet that many consumers trust.

In Singapore, it allows merchants to accept payments from PayPal account holders and from credit and debit cardholders via PayPal Checkout. It operates in over 200 markets and supports 25+ currencies for cross-border commerce.

Key features:

- PayPal Wallet lets customers pay directly using their balance or linked bank/card, reducing checkout friction

- Quick setup with PayPal Checkout, invoice links and integration with major marketplaces

- Buyer and seller protection programmes that can reduce charge-back risks and increase consumer trust

- Minimal coding required for integration and mobile POS support via the PayPal Business app

Best for:

Merchants selling internationally to consumers, freelancers or small-scale exporters who serve overseas clients and marketplace sellers who benefit from PayPal’s strong brand recognition and customer trust.

Pricing:

- Domestic payments: 3.9% + SG$0.50 (for sales up to a certain volume)

- International payments: 4.4% + SG$0.50 (or equivalent fixed fee), depending on currency

- Currency conversion fee: Approximately 3%–4% over the wholesale rate

- Withdrawals to local card: 1% of the amount transferred (up to a cap of SG$15) when converting funds

- No monthly or setup fees for the standard business account

3. HitPay

HitPay is a Singapore-built payment gateway designed for SMEs and micro-businesses. It supports online payments, a mobile POS app and plug-and-play card readers, with strong local coverage for PayNow QR, cards, GrabPay, WeChat Pay and Alipay.

Key features:

- Simple setup with plugins for Shopify, WooCommerce and Wix, plus an easy mobile POS

- Pay-per-transaction pricing with no monthly fees

- Local methods built in: PayNow, GrabPay, Alipay, WeChat Pay, alongside Visa/Mastercard/Amex

- Dashboard for invoicing, recurring payments and sales tracking

- MAS-licensed Major Payment Institution coverage for merchant acquisition, domestic and cross-border transfers

Best for:

Local retail and F&B businesses, home-based businesses and SMEs that sell to Singapore customers (or tourists) and want an easy, low-cost way to accept payments.

Pricing:

- Online cards: 2.8% + SG$0.50 (domestic) / 3.65% + SG$0.50 (international) + 2% for foreign currency

- PayNow: 0.65%–0.9% per transaction

- In-person cards: 2.3%–2.5% (domestic) / 3.2% (international)

- Wallets: GrabPay 3%–3.9% + SG$0.20; others up to 5.5%

4. FOMO Pay

FOMO Pay is a Singapore-based fintech that specialises in alternative payments and QR/e-wallet acceptance. Established in 2015, it was a pioneer in enabling Chinese mobile wallets (WeChat Pay, Alipay) in Singapore and is a founding member of the SGQR unified QR code standard.

Key features:

- Consolidates multiple payment methods into one API or QR solution – online cards, e-wallets, SGQR, PayNow, Alipay, WeChat Pay

- Supports both online integration via plugins/APIs and in-store via a single unified QR code or SoftPOS (mobile phone as a terminal)

- Live dashboard for transaction reporting, settlement tracking and fraud monitoring

Best for:

Retailers, tourism merchants, luxury boutiques and online sellers targeting both local and Chinese mobile-wallet customers.

Pricing:

- Fees are volume- and method-based; merchants must contact FOMO Pay for a tailored quote

- Some sources suggest online card rates start around 2.9% + SG$0.30

5. Rapyd

Often called the “Swiss army knife” of payments, Rapyd enables businesses to accept cards, bank transfers and e-wallets, issue payouts and even hold virtual accounts – all from one unified platform.

Rapyd has a strong presence in Singapore and the Asia Pacific, making it a powerful gateway for companies that need multi-country payment solutions without integrating dozens of individual gateways.

Key features:

- Connects to 900+ payment methods across 100+ countries, including PayNow, GrabPay and major cards

- Handles both collections and disbursements, allowing platforms to accept customer payments and pay out globally

- Offers multi-currency business accounts for receiving, holding and managing funds across multiple currencies

- Provides built-in KYC, AML and FX management, helping businesses stay compliant as they scale internationally

Best for:

Regional and global businesses, marketplaces and fintech platforms that need a single payments infrastructure to operate across multiple countries and currencies.

Pricing:

- Model: Interchange++ (issuer fee 0.20%–1.80% + scheme fee 0.02%–0.65% + Rapyd acquirer fee)

- Monthly fee: Some accounts may carry a flat charge (around US$99 in other regions; varies by plan)

- Singapore-specific rates: Custom quotes provided based on transaction type, payment method and volume

6. Adyen

Adyen is a payments platform headquartered in the Netherlands, used by many global enterprises and tech-forward businesses. In Singapore, Adyen Singapore Pte. Ltd. offers a unified payments solution that covers online, in-app and in-store transactions.

Key features:

- End-to-end infrastructure: acts as its own acquirer in many markets, reducing reliance on intermediaries

- Supports 250+ payment methods worldwide and enables truly localised checkout experiences

- Integrates online, mobile and physical POS under one roof so that you can reconcile transactions in a single system

- Includes machine-learning fraud detection, network tokenisation (for subscriptions) and an automatic card updater

Best for:

High-volume e-commerce merchants, subscription platforms and omnichannel retailers that sell across multiple countries and channels.

Pricing:

- No setup or monthly fees – pay per transaction

- The fee model uses a fixed processing fee plus a variable fee based on the payment method (e.g., for PayNow it’s SGD $0.13 + 1.30%)

- Detailed transaction fee varies by method and region; you’ll need to contact Adyen for a full rate sheet

7. eNETS

eNETS is a well-established Singapore payment gateway operated by the NETS group, owned by a consortium of local banks. It handles direct debit and bank transfer payments in Singapore and also acts as an acquirer for credit and debit cards.

Key features:

- Supports Internet banking payments: customers log in to their local bank (DBS/POSB, UOB, OCBC) to authorise transactions that debit their accounts directly

- Also supports card payments (Visa, Mastercard, etc.) and integrates with QR/unified code systems such as SGQR and PayNow for online and in-store use

- Hosted payment gateway option with reconciliation tools and settlement to merchant bank accounts in SGD

- Strong brand recognition and institutional trust in Singapore, especially in the government services, utilities and education sectors

Best for:

Businesses focused on the Singapore market (especially B2B, service billing, utilities and education) that want to offer bank transfer/direct debit and credit card options with minimal fuss, where international payment methods or multi-currency support are less critical.

Pricing:

- Card transactions via eNETS Credit: ~3.4% + SG$0.50

- QR or direct-bank-transfer payments: ~0.8% per transaction

- Terminal/subscription-based models (for POS merchants): transaction fees range from 0.8% to 1.8% for certain payment methods

- Precise merchant plans vary by business type, volume and method; many details are available only via negotiation

8. Airwallex

Airwallex is a global payments and finance platform founded initially in Australia, now operating strongly in Singapore and worldwide. With its Singapore licence obtained in 2021, Airwallex has gained traction among startups and SMEs seeking a single platform to collect payments, hold multiple currencies and make global payments.

Key features:

- Accepts payments via cards (Visa, Mastercard, Amex), mobile wallets (Apple Pay, Google Pay) and 160+ local payment methods

- Supports like-for-like settlement in multiple currencies (for example, if you charge USD, you can receive USD) to avoid forced conversions

- Offers multi-currency business accounts that allow businesses to receive, hold and convert in 20+ currencies, with local bank details (USD, EUR, SGD, etc.)

Best for:

Growing e-commerce businesses, SaaS firms or exporters based in Singapore that transact globally, hold multiple currencies and want a unified platform for payments, currency conversion and global spend.

Pricing:

- Domestic cards: 3.30% + SG$0.50 per successful transaction

- International cards: 3.60% + SG$0.50 per successful transaction

- Local payment methods: SG$0.50 + payment-method fee (varies by method) for e-wallets, etc

- Additional fees: No monthly account or maintenance fees for standard usage

From payment to payout: How the World Account helps you get paid

A payment gateway acts as an intermediary between your customer’s bank and your payment infrastructure, but it’s only half the story. After the sale is made and the payment is processed, you need to be able to hold, convert and use the funds you’ve earned.

WorldFirst’s World Account picks up where payment gateways stop. It’s a global financial platform that helps Singapore businesses manage their money more effectively across borders.

Here’s how it adds value:

- It gives you local bank details in 20+ currencies, allowing you to receive international payments like a local business in USD, EUR, GBP, SGD and more

- You can hold funds in multiple currencies and convert only when the rates are favourable, avoiding forced conversions and reducing FX losses

- You can pay suppliers, partners or employees in 100+ currencies directly from one account, using competitive FX rates

- There are no account opening or monthly fees and no minimum balance requirements

- It connects seamlessly with 130+ marketplaces and payment gateways, including Amazon and Shopify, giving you a single view of your global cash flow

In simple terms, a payment gateway helps you process customer payments at checkout, while the WorldFirst World Account enables you to receive and manage these payments.

Using a payment gateway and the World Account together gives you greater control over your international revenue – from how you receive funds to how you hold, convert and pay. For Singapore’s exporters, e-commerce sellers and SMEs working with overseas suppliers, this control is crucial.

When evaluating payment gateways, ask one more question: What happens after I get paid? If the answer ends at a simple bank transfer, you could be missing out on the real opportunity.

Pair your preferred gateway with the World Account to streamline how you manage incoming funds, optimise currency conversion and pay globally.

Open a WorldFirst World Account for free and manage global payments, conversions and supplier transfers across multiple currencies.

Sources:

2.https://www.trade.gov/country-commercial-guides/singapore-digital-economy

3.https://stripe.com/en-sg

4.https://www.paypal.com/sg/webapps/mpp/about

5.https://thepaypers.com/payments-general/hitpay-receives-mpi-licence-from-mas–1265447

6.https://www.fomopay.com

7.https://www.rapyd.net/legal/singapore/

8.https://www.adyen.com/payment-methods/paynow

Businesses trust WorldFirst

- Almost 1,500,000 businesses have sent US$500B+ around the world with WorldFirst and its partner brands since 2004

- Your money is safeguarded with leading financial institutions