How to transfer money to a China bank account the easy way

Last updated: 27 Nov 2025

Many businesses start out by using consumer money transfer services, such as Wise or Western Union, to send payments to China. But they often quickly discover that these solutions have significant limitations for business use cases.

For instance, consumer services typically charge high fees for business-sized transactions, they offer limited compliance documentation and they don’t always provide the local payment infrastructure that Chinese suppliers prefer. Plus, they don’t have the currency hedging tools that businesses need to manage procurement costs effectively.

In this guide, we’ll share a better way for businesses to transfer money to Chinese bank accounts.

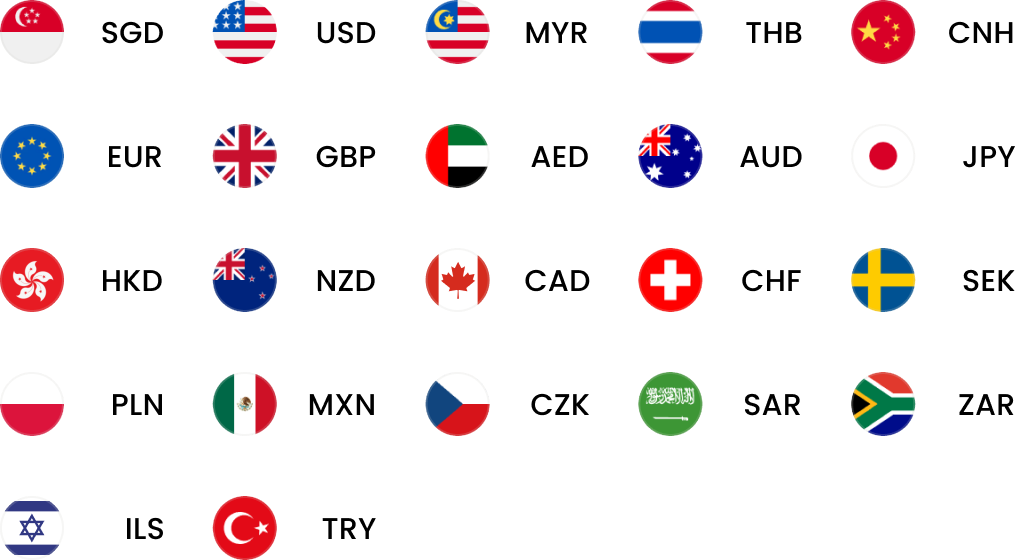

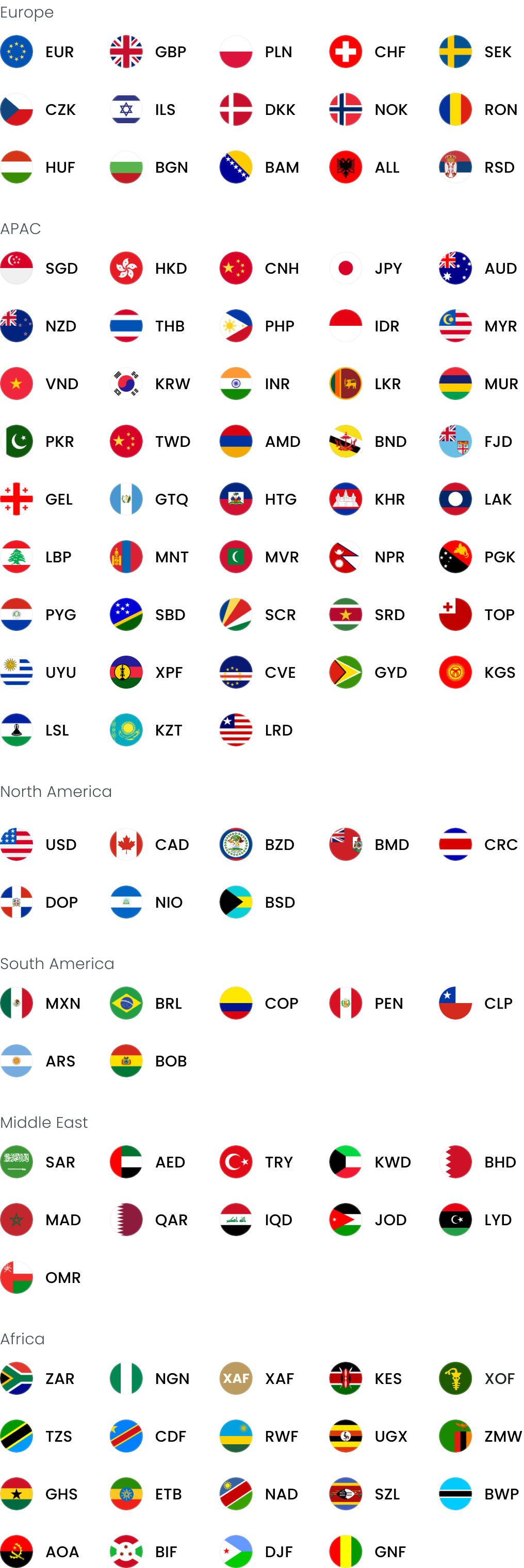

At WorldFirst, we’re specialists in cross-border business payments. With a World Account, you can hold 20+ currencies, including CNH, as if you had a local account in each country. Plus, you can make business payments in CNH, CNY and USD directly to a Chinese account, with 80% of transactions settling on the same day.

Below, we share why over a million cross-border businesses choose WorldFirst for business payments. Then, we’ll cover consumer remittance options if you’re still interested in personal payments.

Want a simple, secure and affordable way to send money to China? Open a World Account today.

How WorldFirst simplifies business transfers to China bank accounts

At WorldFirst, we make it easier for businesses around the world to send money across borders. And, as a subsidiary of Ant International, our particular strengths are in payments to China.

We’re regulated by the Monetary Authority of Singapore (MAS) and we partner with financial institutions across the world – including J.P. Morgan, HSBC, DBS and local banks within China – to enable seamless and secure payments worldwide.

If you’re a business looking to transfer money to a Chinese bank account, we can help. With a World Account, not only can you hold and receive money in CNH, SGD and 20+ other currencies, but you can also leverage local payment networks within China to pay suppliers faster and more affordably in CNY and USD, without the need for a local business entity or local account.

What’s more, if you’re looking for or already working with wholesale suppliers in China, a World Account makes this easier too. We have an exclusive payment integration with China’s largest wholesale marketplace, 1688.com, so you can access and pay over 10 million suppliers more easily.

Here are four reasons why WorldFirst is the best way for businesses to transfer money to China.

1. Make direct CNY payments to Chinese accounts without a local presence

Managing payments to Chinese suppliers has traditionally required complex workarounds or a local business presence in China. WorldFirst eliminates these barriers entirely by enabling Pay-on-Behalf-Of (POBO) payments directly to mainland Chinese bank accounts, even if you don’t have a local Chinese business entity or registration.

This means you can send funds directly to your suppliers’ CNY accounts using local Chinese payment rails, avoiding the 3–6 business days typical of SWIFT transfers. With WorldFirst, 80% of international payments settle on the same day.

With local CNH account details through WorldFirst, you essentially operate like a domestic Chinese company when making payments. This eliminates intermediary banks and their associated fees, while giving you the flexibility to pay Chinese suppliers in CNH, CNY or USD depending on their preferences and your business needs.

Faster payment is not the only benefit. Chinese manufacturers often prioritise customers who pay quickly and reliably, giving you better negotiating power for pricing, minimum order quantities and delivery timelines.

Read more: How to send money abroad (+ how to avoid hidden costs)

2. Leverage business-grade features that consumer services lack

WorldFirst provides enterprise-level features that enable you to streamline procurement and ensure compliance with business requirements.

For instance, batch payment functionality allows you to send up to 200 simultaneous payments to multiple Chinese suppliers, dramatically reducing the administrative burden of managing complex supply chains. This capability is essential for businesses managing seasonal purchasing, coordinating complex product launches or simply maintaining efficient cash flow management.

Proper invoicing and compliance documentation accompanies every business transfer (unlike consumer remittance services that may not provide adequate records for accounting or tax purposes). WorldFirst’s online platform generates detailed transaction records that integrate directly with your accounting systems, ensuring you have the documentation necessary for audits, tax filings, and financial reporting.

These integrations with Xero and NetSuite enable automated reconciliation and accounting management. When you make payments to Chinese suppliers, the transfer details automatically sync with your accounting software, categorising expenses and updating supplier payment records without additional administrative work.

Read more: How to send money to China: A guide for international businesses

3. Save on FX costs with currency risk management tools

Currency exchange rate volatility between SGD, CNY or another currency can significantly impact procurement costs over time. That’s why WorldFirst offers sophisticated hedging tools that protect your purchasing power and enable more predictable budgeting for Chinese payments:

- Forward contracts allow you to lock in exchange rates for up to 24 months, protecting your budgets from FX volatility. By securing today’s exchange rate for future payments, you eliminate the risk of currency movements eroding your profit margins or forcing you to pay significantly more for the same goods.

- Firm orders provide automated currency conversion when target rates are reached, maximising your purchasing power without requiring constant market monitoring. Simply set your target exchange rate and let WorldFirst execute the conversion automatically when the market reaches your target. It’s especially useful during volatile periods, ensuring you capture favourable rates when they occur.

WorldFirst’s competitive exchange rates are capped at 0.60% for major currencies, significantly lower than traditional banks that often charge 2–4% markups. For businesses making substantial supplier payments, this difference translates to meaningful cost savings. A company spending SG$100,000 monthly on inventory could save SG$1,500–3,500 per month compared to traditional bank transfer fees and exchange rate markups.

Find out more about our transparent pricing on our pricing page.

4. Pay suppliers more easily with WorldFirst's exclusive integration with 1688.com

If you’re a business that sources products from China, you may have heard of 1688.com, China’s largest wholesale supplier marketplace. Historically, though, foreign companies have struggled to access the 10 million suppliers who use the platform, due to language and payment barriers.

Today, WorldFirst is the only payments service provider offering direct payment integration with 1688.com. It means that your World Account is not just a convenient way to send money to China, but one of the best tools to make product sourcing easier too.

The integration enables instant payment capabilities through World Pay, eliminating the need for sourcing agents or complicated payment arrangements that often involve additional fees and delays. When you find a supplier on 1688.com, you can complete the entire transaction – from negotiation to payment – within the platform ecosystem.

Price advantages are substantial, with suppliers on 1688.com typically offering products up to 40% lower than other marketplaces like Alibaba.com or Global Sources. This is because 1688.com primarily serves the domestic Chinese market, where margins are tighter and competition is more intense. International buyers who can access this marketplace directly gain significant procurement advantages.

You can expect the same fast settlement times through 1688.com too, with payments settling instantly.

Read more: WorldFirst and 1688.com: All you need for wholesale sourcing in Singapore

- Open 20+ local currency accounts and get paid like a local

- Pay suppliers, partners and staff worldwide in 100+ currencies

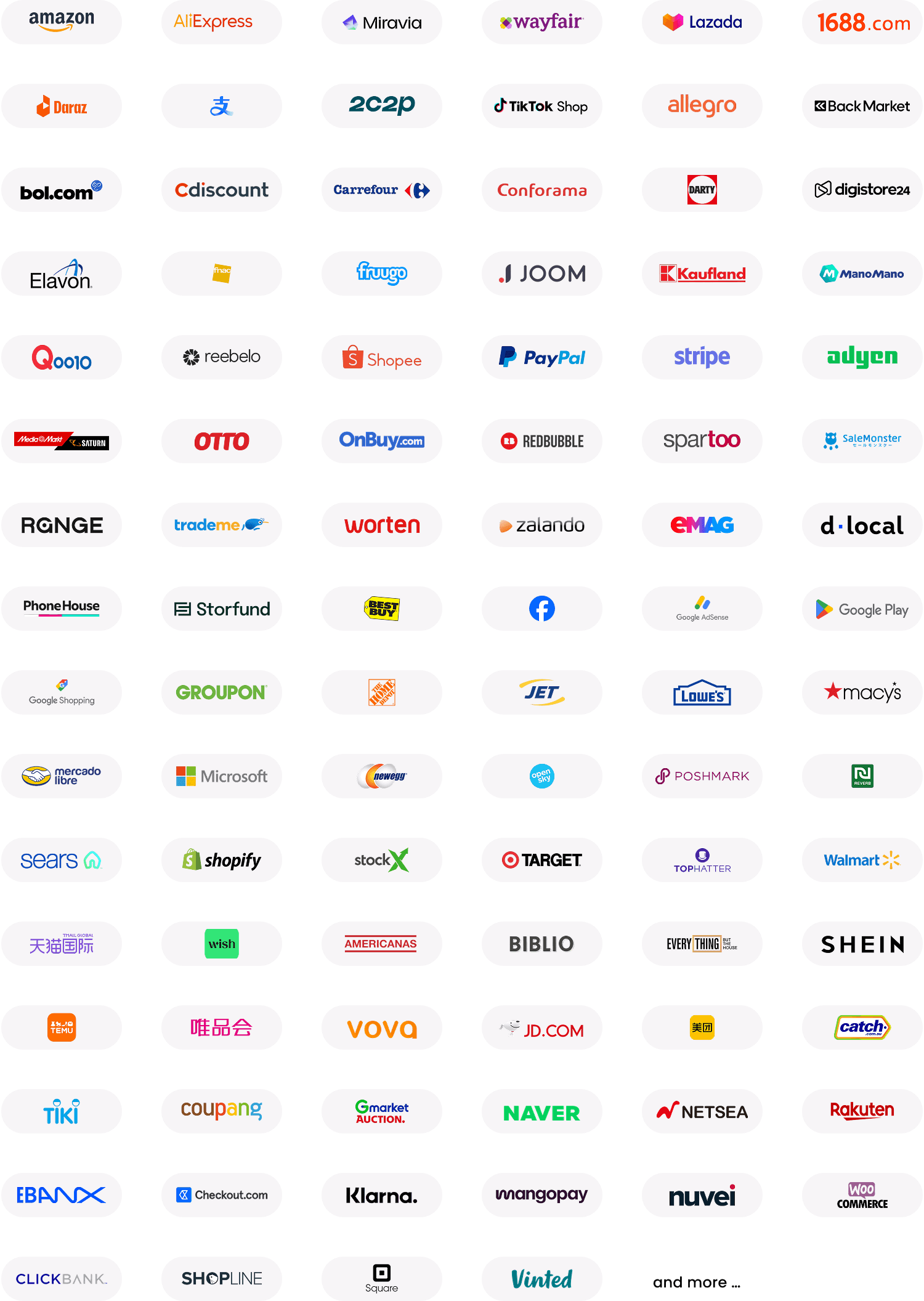

- Collect payments for free from 130+ marketplaces and payment gateways, including Amazon, Etsy, PayPal and Shopify

- Save with competitive exchange rates on currency conversions and transfers

- Lock in exchange rates for up to 24 months for cash flow certainty

Alternative options for transferring money to Chinese bank accounts

If you’re not a business – or if WorldFirst doesn’t feel like a good fit – there are alternative payment methods out there for transfers to Chinese bank accounts.

1. Traditional bank wires to China

Traditional overseas transfers to China rely on the SWIFT network through correspondent banking relationships with Chinese financial institutions. When you initiate a wire transfer to China, your bank communicates with Chinese banks using standardized SWIFT codes to route your payment through the global banking network.

This payment option typically requires comprehensive recipient information, including the Chinese bank’s SWIFT code, the beneficiary’s account number and detailed information about the recipient such as their full name, address in China and purpose of payment.

The process involves your bank sending payment instructions through a chain of correspondent banks until the funds reach the recipient’s Chinese bank account. While this system provides global coverage and regulatory compliance, the multiple intermediaries create several significant challenges for businesses:

- Settlement times of 3–6 business days are too slow for competitive procurement and can strain supplier relationships. Chinese suppliers often prioritise customers who can pay quickly. Slow SWIFT transfers put you at a disadvantage when negotiating terms or securing inventory during peak seasons, potentially affecting your ability to maintain strong supplier partnerships.

- Hidden intermediary bank fees and poor exchange rates can add 2–4% to total transfer costs. Traditional bank wires often pass through multiple correspondent banks, each potentially deducting transaction fees along the way. Banks also typically offer foreign currency exchange rates that are 1–3% above mid-market rates, and these costs aren’t always clear upfront.

- Lack of transparency makes it difficult to predict exact arrival amounts or timing for cash flow planning. With SWIFT transfers, you often can’t see exactly how much your supplier will receive or when the payment will arrive. This uncertainty makes cash flow forecasting challenging and can create confusion with suppliers who may not know when to expect payment or why the received amount differs from what you sent.

- No integration with supplier platforms or business systems, requiring manual payment processing. Unlike modern payment solutions, traditional bank wires require manual processing for each transaction. You can’t automate payments to platforms like 1688.com or integrate transfers with your procurement software, creating administrative overhead and increasing the risk of payment errors or delays.

Read more: What’s the cheapest international money transfer method?

2. Consumer payment services

Consumer services like Western Union and Wise are primarily built for small personal transfers. These platforms offer competitive rates for individual transactions and have user-friendly interfaces that make sending money straightforward for occasional users. For these use cases, consumer platforms can be cost-effective and convenient.

However, these platforms can lack the features businesses need for ongoing supplier relationships:

- Transaction limits often cap transfers well below typical supplier invoice amounts, requiring multiple transfers that increase costs and complexity. Most consumer platforms impose daily, monthly, or per-transaction limits that may work for personal use but become restrictive when paying supplier invoices. Breaking large payments into multiple smaller transfers not only increases total fees but also creates administrative burden and potential compliance issues.

- No batch payment capabilities mean paying multiple suppliers requires separate transactions with individual fees. Consumer platforms are built for one-to-one transfers, not the one-to-many payment flows that businesses need. If you’re paying ten suppliers, you’ll need ten separate transactions, each with its own fee, exchange rate, and processing time. This approach becomes expensive and time-consuming as your supplier base grows.

- Lack of proper business documentation and invoicing creates accounting and tax compliance challenges. Consumer transfer services typically don’t provide the detailed transaction records, commercial invoicing support, or compliance documentation that businesses need for proper bookkeeping and tax reporting. This creates problems during audits and makes it difficult to maintain accurate financial records.

- No integration with procurement systems or accounting software increases manual work and error risk. Consumer platforms operate as standalone services without connections to business tools like Xero, NetSuite, or procurement systems. This means manual data entry for every transaction, increasing the likelihood of errors and making it difficult to maintain accurate financial visibility across your operations.

Choose WorldFirst for business payments to Chinese bank accounts

If you’re a business looking to transfer money to a bank account in China, there’s no better option than WorldFirst.

With a World Account, you can send CNH, CNY or USD directly to Chinese bank accounts – and 80% of payments settle on the same day. Plus, you can hold funds in SGD, GBP, EUR and many other currencies.

It couldn’t be easier to get started. Simply visit our online application portal and submit some information about your business. It only takes a couple of minutes – and signing up is completely free.

Businesses trust WorldFirst

- Almost 1,500,000 businesses have sent US$500B+ around the world with WorldFirst and its partner brands since 2004

- Your money is safeguarded with leading financial institutions