Best corporate cards for small businesses in Singapore: 5 options compared

Last update: 23 Oct 2025

If you’re a small business looking for a corporate card, then this article is for you.

There are many great options out there, but finding the one that’s best for your company depends on what you do, where you do business and how much flexibility you need. For instance, WorldFirst’s multi-currency World Card is best suited for businesses that work across borders.

To help you decide which is best for you, we’ll compare 5 of the best corporate cards for small businesses:

In this article:

- Comparison table: 5 best corporate cards for small businesses

- WorldFirst’s World Card

- Aspire Corporate Card

- Wise Business Card

- DBS Platinum Business Card

- UOB World Signature Business Card

Ready to get set up with a multi-currency virtual card? Get started by opening a World Account for free today.

Comparison table: 5 best corporate cards for small businesses

| WorldFirst’s World Card | Aspire Corporate Card1 | Wise Business Card2 | DBS Platinum Business Card3 | UOB World Signature Business Card4 | |

|---|---|---|---|---|---|

| Multi-currency account | ✅ Draw from 15+ currencies with no FX fees, and make transactions in 150+ | You can transact in 30+, but you can’t hold a currency unless it’s what your card is issued in. | ✅ Hold and make transactions in 40+ currencies | ❌ Not included with this card | ❌ Not included with this card |

| Foreign transaction fees (FX) | Free in 15 currencies when you spend from existing balances | Free when you spend directly in a currency you hold | Free | 3.25% | 3% |

| Cashback | 1.2% | 1% (when you spend on digital marketing or SaaS) | ❌ No mention | 0.4% cash rebate | 0.3% cash rebate |

| Annual account fee | Free to open and maintain | Free to open and maintain | One-time fee of SG$99 | SG$196.20 annually | SG$183.36 annually |

| Virtual cards | Up to 25 (physical cards coming soon) | Unlimited | Up to 32a | ❌ Not included in this card | ❌ Not included in this card |

| Opening requirements | Supports businesses from most countries worldwide. You must be a registered business or sole trader and provide the necessary ID and business information during the application process. You must open a World Account in order to receive a World Card. |

You must be legally incorporated in Singapore, Hong Kong, or Indonesia. You must provide the necessary ID and business information during the application process. Submission of registration, financials and ID documents for directors. Proof of business activity (such as location or contracts). |

You must open a Wise Business Account in order to receive this card. You must submit personal and business details, verify identity with documents like passports and company registration, and provide proof of business activity. |

You must be 21 years old or above. Annual income of SG$30,000+ |

You fill out the Cards Application form and have the following documents ready: Board Resolution Specimen Signature form Business Banking Facilities form Notice of Assessment (latest 2 years) Audited Financials (latest 2 years) NRIC/Passport for Shareholders and Cardholders |

All information presented in this blog has been sourced from provider websites and is accurate to the best of our knowledge at the time of writing (September 2025). However, providers may update their offerings, and details can change over time.

1. WorldFirst’s World Card: The best option for cross-border businesses

At WorldFirst, we’re a digital payments platform that helps cross-border businesses hold, send and receive funds from overseas. We were founded in 2004, and since then our multi-currency World Account has been adopted by over one million business customers worldwide.

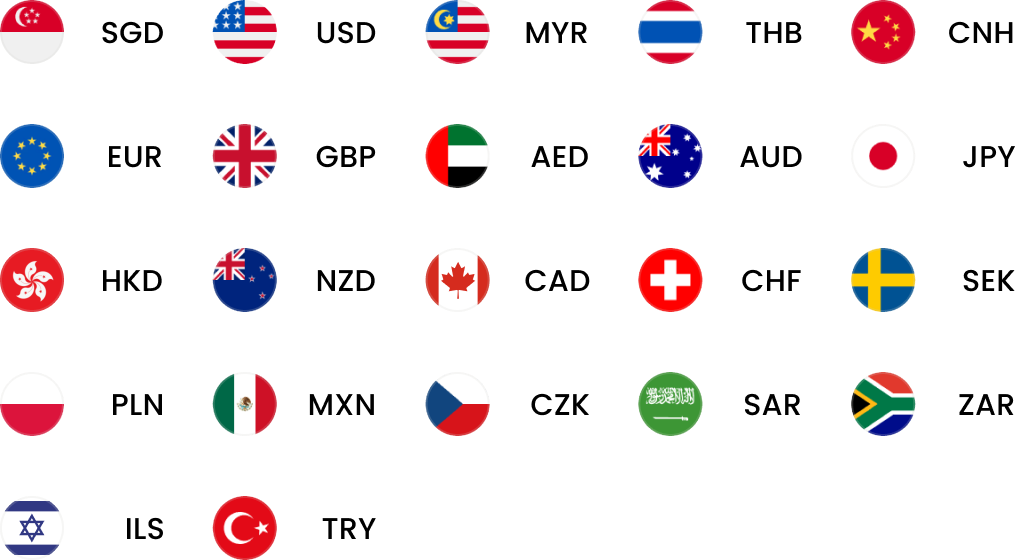

The World Account lets you hold funds in 20+ currencies, with local account details, making it easier for you to more easily pay international suppliers and partners.

Our World Card is a virtual card linked to the World Account that lets you make fast business transactions, both domestically and overseas.

Here’s how the World Card can benefit your small business:

Pay in 15 currencies without any FX margin or admin fees

With a World Card, you can spend in 15 major currencies (like SGD) without incurring any FX fees if you hold enough balance in that currency.

For example, if you hold a USD balance and use your World Card for a USD purchase, then the payment will be deducted from your existing balance, completely fee-free – no margin added and no FX admin fees.

It helps you avoid the double FX trap that traditional bank-issued corporate cards often charge (where both sending and receiving foreign currency results in you being charged a fee).

Currently, the World Card supports online payments in over 150 currencies, and you can pay wherever Mastercard is accepted. A physical World Card and support for Apple Pay and Google Pay are coming soon.

Create up to 25 virtual cards to help you manage your spending

With a WorldFirst virtual debit card, you can instantly create up to 25 virtual cards to help you better manage your business expenses.

For example, you can assign a card to each member of your team (or to each currency) and set unique payment limits for each card to keep track of employee spending. You can even use virtual cards to keep your expenses separate: one card for digital marketing, one for business travel and one for sorting shipping logistics.

Each virtual card comes with its own unique card number and payment details, adding an extra layer of security. Transactions are protected with advanced features like 3D Secure (3DS) and AVS verification to help prevent fraud.

However, if an emergency occurs where you need to freeze, delete or create a new card, it’s easy to do, either online or via the app. Instantly apply for a new World Card, track transactions in real time, set spending controls, view card details and cancel cards as needed for security.

Read more: How to choose a virtual debit card for international payments

Earn up to 1.2% cashback on eligible business spending

We offer up to 1.2% unlimited cashback for a wide array of eligible business purchases, ranging from SaaS subscriptions to client entertainment (T&Cs apply). To be eligible, these transactions must be made through your World Card.

While other cards on this list offer cashback, most are either restricted to just a few categories (such as digital advertising or SaaS payments), or are limited-time offers. In contrast, the World Card permanently offers one of the highest cash reimbursement rates in the market.

There’s also zero admin fees when you transact with a World Card, unlike other Singaporean corporate cards on this list that charge around 3.25% in admin fees. If you combine that with WorldFirst’s 1.2% cashback offer, you could save a total of 4.25% on costs.

Read more: Corporate bank account in Singapore: 5 options compared

Get set up with a World Card instantly

While most traditional cards have a complicated application process (that often involves sharing years of financial history, audited statements and directors’ guarantees), you can sign up for a World Account without hassle.

The whole application process takes place online – and getting a World Card is entirely free. After submitting the required documents and completing verification, you’ll receive a notification of approval (usually within two days).

To use a World Card, you’ll need to first sign up for a World Account:

- Sign up for free and create your account

- Fill in your account details

- Provide the necessary verification documents

- Submit your application and wait for the activation email

- Open 20+ local currency accounts and get paid like a local

- Pay suppliers, partners and staff worldwide in 100+ currencies

- Collect payments for free from 130+ marketplaces and payment gateways, including Amazon, Etsy, PayPal and Shopify

- Save with competitive exchange rates on currency conversions and transfers

- Lock in exchange rates for up to 24 months for cash flow certainty

2. Aspire Corporate Card

The Aspire Corporate Card is a debit card that targets SMBs and startups that want to manage team expenses efficiently.

The card supports multi-currency spending by allowing you to issue cards in four currencies: SGD, USD, GBP and EUR. While you can’t hold foreign currency, you can spend in 30+ currencies with competitive FX rates.1

You can create unlimited virtual cards for your team, with the ability to set individual spending limits and merchant locks. Aspire offers 1% cashback when you spend on eligible expenses such as digital marketing and SaaS subscriptions. Their virtual cards also have advanced security features, including instant issuance, freezing or cancellation from the app. Approval is fast and fully online.

Applicable card fees:1a

- Free to open and maintain, with no ongoing account fees

- Free to send funds locally

- SG$15 per additional card, though the first card is free per user

- Aspire uses its own exchange rate which may include a fee

- SG$5 ATM withdrawal fee, with a maximum withdrawal amount of US$500 per day

3. Wise Business Card

The Wise Business Card is a multi-currency debit card linked to a Wise Business account. It was designed for SMEs and online sellers who want to make international payments affordably and with clear, transparent exchange rates.2

The Wise Business Card allows you to create up to three virtual cards per account, which you can assign to individual team members and set spending limits for. While it doesn’t offer any cashback, you can hold and spend in 40+ currencies worldwide with real mid-market exchange rates and no hidden currency conversion fees.

The application process is fully online and typically completes within 10 days or less.

Applicable card fees:2b

- There’s a one-time setup fee of SG$99, which covers the verification and setup of your multi-currency business account. Once paid, you can apply for a Wise Business Card.

- SG$4 card replacement fee

- 2% fee applies when you top up your e-wallets

- 2 free ATM withdrawals each month, as long as you don’t withdraw over SG$350 total (in which case you’ll be charged 1.75% of any amount over SG$350 that you withdraw). After your 2 free withdrawals, there’s a SG$1.5 fee per withdrawal. Fees apply per account, per month.

- There are no monthly maintenance fees after paying the setup fee, but transaction fees apply for currency conversion, sending money and ATM withdrawals.

4. DBS Platinum Business Card

The DBS Platinum Business Card is a credit card that’s suitable for small to medium-sized businesses seeking rewards and expense management benefits. In order to qualify for it, you’re required to have a minimum annual income of SG$30,000 and be over 21 years old.3

This card’s reward program offers one DBS point for every SG$5 spent, which is redeemable for vouchers, air miles or a 0.4% cash rebate. DBS Platinum Business Cardholders can benefit from complimentary travel accident insurance coverage of up to SG$1 million per cardholder (when airfare is charged directly to the card). You can also benefit from complimentary employee misuse coverage up to US$25,000 per cardholder.

However, the DBS Platinum Business Card doesn’t include a multi-currency wallet or virtual card issuance as a built-in feature. For multi-currency or virtual card needs, separate DBS business accounts would be required.

Applicable card fees:3

- Annual fee of SG$196.20 (waived for the first year)

- Late payment fee SG$45

5. UOB World Signature Business Card

The UOB World Signature Business Card is a corporate credit card aimed at business owners and executives seeking a premium business credit card experience. In order to sign up, you’ll need a board resolution signed by all partners in your firm.4

Earn either a 0.3% cash rebate or UNI$1 (reward points) for every SG$5 charged on monthly purchases. Alongside complimentary Travel & Personal Accidents insurance of SG$1 million, UOB offers worldwide coverage for online purchases. This includes situations where items aren’t delivered after 30 days from the scheduled date.

Multi-currency capability and virtual cards are available for UOB, just not with this card. Virtual cards are offered separately through UOB’s Virtual Payment Control service for business payments, and the UOB Corporate Global Currency Account is multi-currency.

Applicable card fees:4

- Annual fee of SG$183.36

- Card replacement fee of SG$20

What small businesses need from a corporate card

The card that’s best for you will vary depending on what your business does and how you operate, but in general you should look out for:

| Businesses it’s best for | How is it beneficial? | |

|---|---|---|

| Multi-currency capabilities | E-commerce sellers, international consultants, import/export businesses | Avoid high FX fees by making payments in multiple currencies. Ideal for dealing with overseas clients, suppliers or SaaS. |

| Low, transparent fees | Everyone, but especially small business with a tight budget | Price transparency means you’re less likely to face hidden charges, which keeps costs predictable and helps you plan ahead for payments. |

| A high cashback offering | Everyone | Corporate credit cards may offer cashback (or other rewards) on all or select company spending, which can help you save on costs. |

| Customisation options | Finance teams managing multiple employees or departments | Customisation lets you set individual limits, streamline reconciliation and stick to your budget. |

| Additional employee cards at no extra cost | Scaling startups, agencies or businesses with large teams | Teams with a lot of members (or businesses with lots of departments) will need many cards, so it speeds up operations if they’re free and quick to create. |

| Fast domestic and international payments | SMEs with overseas suppliers or remote teams | Pay vendors in their local currency, take advantage of timely deals and maintain strong business relationships. |

| Rewards aligned with your spending | Everyone | If your staff don’t travel much, choose rewards like cashback or software discounts instead of travel perks like airport lounge access, travel insurance or travel rewards. |

Pay in 15 currencies with 0% FX fees and earn up to 1.2% cashback on eligible business spending with World Card

After comparing five popular business card options, the World Card stands out as the top choice for small businesses making frequent cross-border payments.

Pay zero FX fees when you spend in 15 major currencies, and make card payments in a total of 150+ currencies worldwide. Create up to 25 virtual cards to better manage your expenses, and assign a card per team member to keep track of employee expenditures.

Plus, with up to 1.2% unlimited cashback, WorldFirst offers one of the highest cashback rates on the market, which you can qualify for with a wide range of business spending categories.

Ready to get set up with WorldFirst? Sign up for free and start earning rewards for your business purchases today.

FAQs

What’s the best corporate card for small businesses?

The best corporate card for small and medium businesses will depend on the individual business. The World Card is popular because it has no annual fees and caters to cross-border businesses. Plus, it provides up to 1.2% cashback for a wide range of business spending (including subscriptions, marketing and client entertainment among others).

How can I avoid FX fees with my World Card?

If you make an international payment with your World Card and already have a sufficient balance in that currency, then you’ll pay zero FX fees.

Do I need a multi-currency corporate card?

Whether you require a multi-currency corporate card depends largely on your business operations. For example, if you’re a cross-border business that imports or exports internationally, then you’ll likely benefit from a multi-currency card as it can reduce the amount of currency conversion you have to do. However, even as domestic businesses you might benefit from a multi-currency card, particularly if you’re paying for international SaaS subscriptions or digital marketing services.

How much does a World Card cost?

Setting up a World Card is completely free. In order to set one up, all you need to do is open a World Account (sign-up is also free). Here’s a step-by-step of the application process:

- Sign up for free and create your account

- Fill in your account details

- Provide the necessary verification documents

- Submit your application and wait for the activation email

Read more: Other FAQs about the World Card

Sources:

1. https://aspireapp.com/corporate-card

a. https://aspireapp.com/pricing

2. https://wise.com/sg/business/card

a. https://wise.com/sg/virtual-card/

b. https://wise.com/sg/pricing/business/card-fees?

3. https://www.dbs.com.sg/sme/day-to-day/business-cards/dbs-visa-business-platinum-card?

4. https://www.uob.com.sg/business/transact/cards/uob-business-card.page

Businesses trust WorldFirst

- Almost 1,500,000 businesses have sent US$500B+ around the world with WorldFirst and its partner brands since 2004

- Your money is safeguarded with leading financial institutions