FX international payments: How to affordably send money abroad

Last updated: 18 Dec 2025

A foreign exchange payment, or FX payment, is any transaction that involves sending or receiving money across borders and converting from one currency to another.

This type of payment typically involves complex infrastructures and multiple intermediaries. It means they can be prone to high fees, long settlement times and unexpected delays, with little visibility into payment progress.

FX payments can be especially risky when you need to commit to a large payment at a future date, such as signing a contract with suppliers or manufacturers. Exchange rates can move against you, eating into your revenue or even landing you in debt.

Below, we’ll share everything you need to know about FX payments, including how to protect your funds from fraud, scams and currency risk.

We’ll also show you why a multi-currency account with WorldFirst is a great way for cross-border businesses to make FX payments, with quick settlement times, competitive fees and multiple ways to manage risk.

In this article:

- Why WorldFirst is a top choice for FX international payments

- How do FX payments work?

- Common issues with FX international payments

- 5 alternative methods for sending FX payments

Open a World Account for free today to start holding foreign currency and making FX payments to 210+ destinations.

What to look for in an FX international payments provider

- Cost: Some providers appear to have low fees, but aren’t truly transparent about additional charges. They may have high monthly fees that aren’t inclusive of all their services, or may inflate their currency conversion rates to disguise higher fees.

Carefully review any potential contracts before signing, or read the long PDF price list on any potential providers’ website. Look for monthly fees, setup fees, fall-below fees, additional transfer fees, and other charges hidden in the fine print.

- Speed: Traditional methods for making FX payments (like bank wire transfers) can take up to 10 days to settle, due to intermediaries and administrative delays. A small paperwork error, fraud alert or bank holiday impacting a correspondent bank can slow your transfer, with little insight into the cause of the delay or when it will be resolved.

Certain electronic platforms may advertise faster speeds than bank wires, but can actually be prone to even longer delays. These providers may pause transfer and hold funds for long periods of time while investigating security or fraud concerns.

- Transaction limits: Many FX payment providers have daily or weekly transfer limits far too low to serve the needs of growing businesses. They may place a cap of just a few thousand dollars on each payment, making it virtually impossible to cover necessary business expenses.

Some providers also place limits on who can use their services, such as only offering payments in China to customers with Chinese residency or citizenship. Before signing up with a provider, it’s critical to ask not just which services they offer, but who is eligible to take advantage of them.

- Security: Certain transfer methods are more prone to frauds and scams, particularly where the barrier to entry is lower. Remittance services and electronic payment methods designed for individual or personal payments, for instance, aren’t usually the best choice for businesses.

Many of these providers have well-known reputations for scams, such as illegitimate suppliers charging for orders they never intended to fill. As such, even if you use them for legitimate transactions, there may still be reputational risks associated with using them.

- Currency risk mitigation: Similarly, transfer methods built for individual use rarely offer options to protect against currency volatility. Businesses should consider partnering with companies that offer various options to protect transfers from extreme fluctuations.

For example, WorldFirst offers a variety of forward contracts that let you lock-in desirable exchange rates for payments up to 24 months in the future. These contracts are designed to help businesses protect their margins when they need to pay for inventory or cover other large cross-border purchases.

- Regions and currencies served: Where your company does business is an important factor in which company (or companies) you choose to partner with. Some FX payment providers have strong coverage in regions like Europe or North America, but lack offerings in key countries like China, where many manufacturers and suppliers are based. WorldFirst has 30+ international offices, with multiple in China – giving you access to local expertise and insight.

The best-fit provider will depend on your unique business needs and where you choose to source any goods you sell, if applicable.

Read more: What’s the cheapest international money transfer method?

Why WorldFirst is the best choice for FX international payments

WorldFirst an FX international payments provider specializing in serving the needs of cross-border businesses.

Our multi-currency World Account offers a range of tools to protect business-critical payments, trade in key manufacturing regions, and make safe, high-volume transfers at much faster speeds than traditional methods.

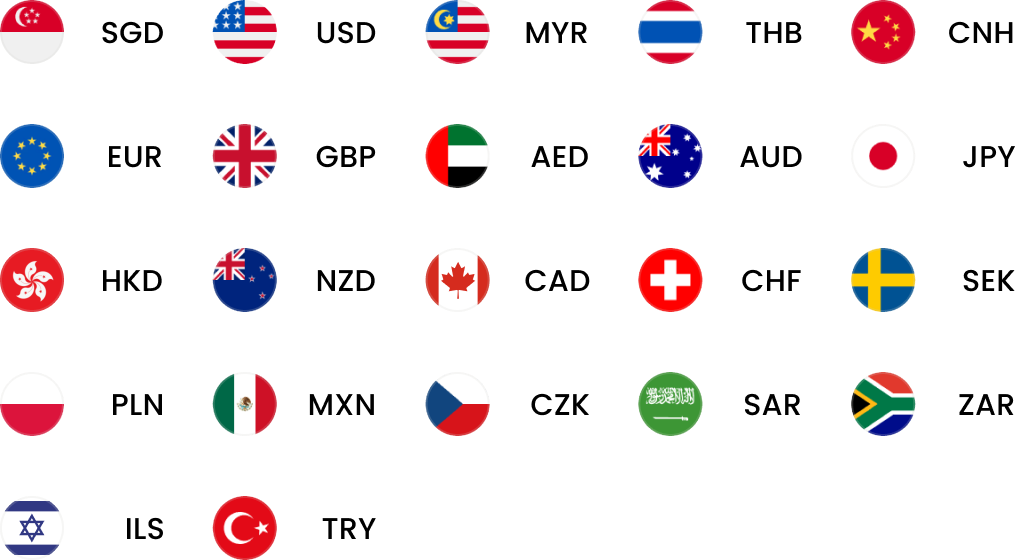

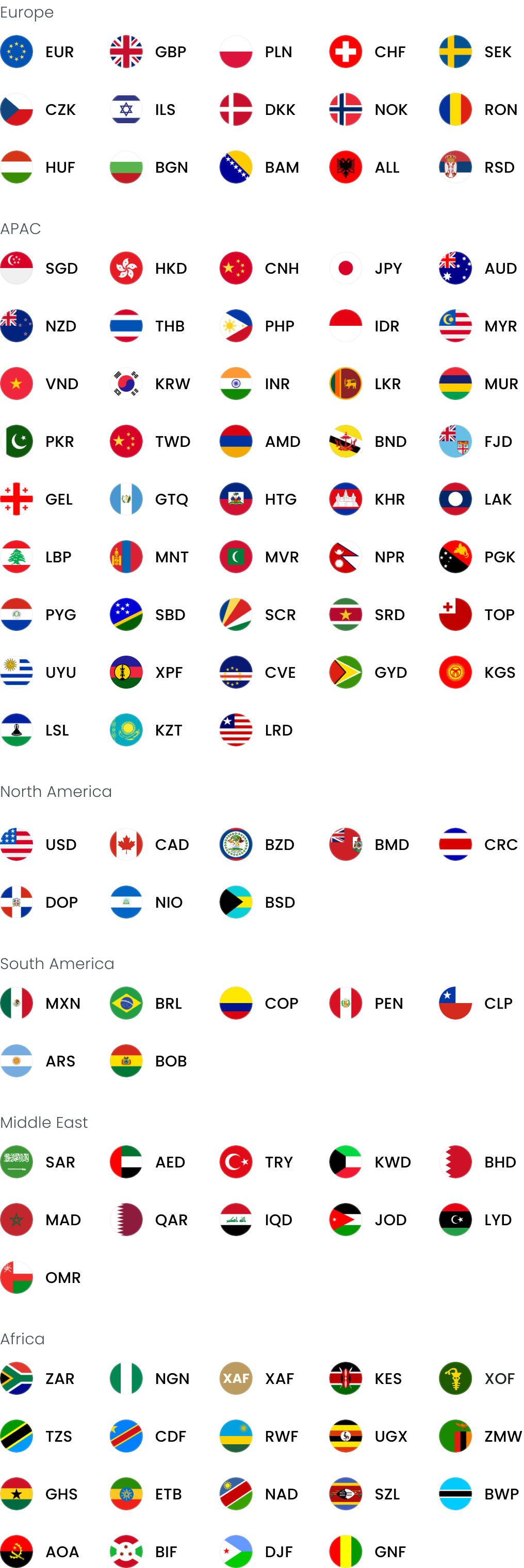

When you join WorldFirst, you also get 20+ currency accounts, each with its own set of account details so you can pay like a local. With just one World Account you can hold SGD, USD, GBP, EUR, CNH and other major currencies and manage all your currency accounts from your WorldFirst dashboard.

In partnership with Ant Group and backed by international banks including Barclays, HSBC and JP Morgan, our FX international payments are among the most secure and reliable options available.

Here’s just some of what we offer when you open a mutli-currency account, for free, with WorldFirst:

Enjoy fast transactions, with 80% of transactions settling on the same day

Use your World Account to pay in 100+ currencies to 210+ countries and territories, with 80% of payments landing on the same day and 90% by the next day. International payments start at just a $1–5 flat fee per transfer.

Instant payments to other World Account holders for free, so you can pay your suppliers in seconds when they join WorldFirst at no charge; there are already 150,000+ suppliers in Chian using the platform.

From Singapore, you can also pay Chinese suppliers in CNY in real-time with our ‘Pay in CNY’ feature. Pay suppliers directly and near-instantly from your WorldAccount balance to their bank account or via AliPay.

Read more: How to send money to China: A guide for international businesses

Send money affordably thanks to competitive FX rates

WorldFirst uses the midmarket exchange rate, widely considered the most accurate real-time rate, to calculate currency conversions. We only add a low, transparent markup, capped at 0.6% for major currencies.

Contrast that with other providers, who often charge up to $100 a month for a basic business plan (or more for growing companies), plus $25–30 per international transfer and a 0.6–0.7% conversion fee. They may also add additional cable charges, hidden currency markups, payment processing fees and more.

Plus, with WorldFirst, it’s free to receive and hold currency in any of your currency accounts. You only have to exchange currency when you need your funds or when the market hits the rate you want.

What’s more, there are no fees to open an account, no monthly or annual fees, and it’s free to receive and hold funds in each of your currency accounts. All other fees are transparently displayed on our Singapore pricing page so there are never any surprises when it comes to your costs.

Read more: How to send money abroad (+ how to avoid hidden costs)

Hedge against currency risk on larger FX international payments

When you need to sign a supplier contract or make a large purchase, such as buying property abroad, it becomes especially important to protect your exchange against currency risk. If you sign a contract for a certain amount, the market can move against you, opening your margins up to a considerable loss.

With forward contracts, you can mitigate the risks associated with currency fluctuation by locking in a specific exchange rate ahead of time. You set the rate, and an amount and date for the future exchange, and you’re protected against market fluctuations.

WorldFirst offers three types of forward contracts:

- Fixed forward: You agree to buy or sell an agreed amount of currency on a particular rate at an agreed date in the future, known as the value date or maturity date.

- Flexible forward: Choose to draw down your funds all at once or make multiple payments over the duration of the contract’s lifespan, as long as it’s all settled by the maturity date.

- Window forward: Buy specific amounts of foreign currency within a range of settlement dates at predetermined rates, for more flexibility securing the best currency rates.

Forward contracts give you far greater control over your FX payments, allowing you to plan ahead and stabilise your costs. With predictable rates, you can send money abroad with confidence and avoid the uncertainty that comes with volatile currency markets.

If you don’t have the time to watch the market, you can use a firm order to let our FX experts execute the trade as soon as the market hits your target rate. With firm orders, just set an amount, a target rate, and an expiration date/time, then let our expert team take care of your trade.

Use WorldTrade escrow to protect your supplier payments

Sending FX international payments can feel daunting, especially when you’re making a very large payment or working with a new partner or supplier. That’s why many cross-border businesses choose to protect their funds with an escrow service, like WorldTrade escrow, to reduce the risk of fraud, scams and issues with unvetted suppliers.

With WorldTrade escrow, your funds are held by a neutral party until the trade is complete. Your supplier doesn’t receive your payment until we’re absolutely confident that your order has been shipped according to your contract terms.

WorldTrade escrow also gives you instant payment confirmation and real-time order tracking for additional peace of mind. Use WorldTrade at no additional charge when you pay from your World Account balance, or pay with a credit card at 2.9%.

- Open 20+ local currency accounts and get paid like a local

- Pay suppliers, partners and staff worldwide in 100+ currencies

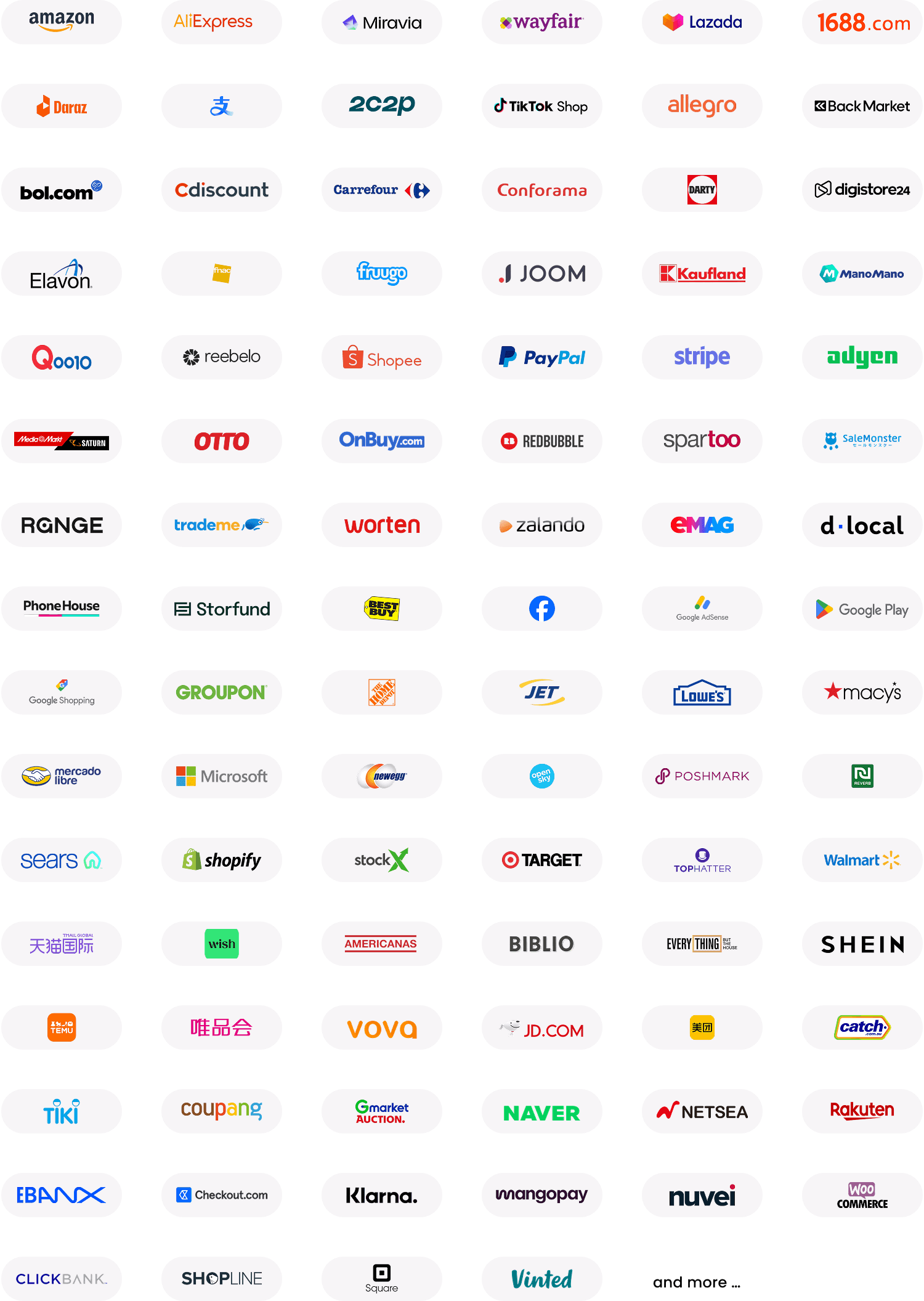

- Collect payments for free from 130+ marketplaces and payment gateways, including Amazon, Etsy, PayPal and Shopify

- Save with competitive exchange rates on currency conversions and transfers

- Lock in exchange rates for up to 24 months for cash flow certainty

How do FX payments work?

All FX payments involve converting one currency into another in order to send or receive money across borders. When you make an international payment, it generally goes through three basic stages:

- First, your provider converts your funds from a currency you hold into your recipient’s preferred currency

- Next, the provider transfers the money via payment network like SWIFT, a local clearing system, or an online platform like WorldFirst.

- During this step, the payment often passes through several intermediaries, which can add fees and delays, especially if there are holidays, any errors or inconsistencies in paperwork, or if your transaction is flagged for potential fraud risk

- After all intermediaries have processed the payment, it is settled in your recipient’s account

A multi-currency account like WorldFirst simplifies this process by letting you convert funds on your own, at your convenience. It can also let you take advantage of alternative and local payment rails to avoid intermediaries, speed up the transfer process and reduce costs.

5 alternative methods for sending FX payments

| Method | Speed | Costs | Best For |

|---|---|---|---|

| WorldFirst | Instant, same-day and next-day options | No setup, no recurring fees, low FX markup and transparent additional fees | SMEs, sole proprietors and growing businesses |

| Bank Wires | Typically 3–5 days but as many as 10 days with delays | High fees and 2–4% FX markup | Very large enterprise transfers |

| Online money transfer services | Instant or same day, but fraud checks can lead to very long delays | High percentage-based fees can cause unnecessary expense with larger transfers | Small personal transfers |

| Remittance services | Usually instant, but take time to send and pick up in person | Very high fees and generally poor FX rates | Emergency or cash pickup |

| Credit cards | Instant or near-instant | 3–5% FX fees | Small and recurring expenses |

| Cryptocurrency | Instant or near-instant | Variable gas fees, which can experience unpredictable surges | Niche cases, such as where traditional banking is restricted |

If you’re still trying to decide which method to use for sending FX international payments, here’s how five alternative methods stack up.

1. Bank wire transfers

One of the most widely used options for international payments, traditional bank wires use the SWIFT network to communicate transfer information between multiple intermediary banks.

- Pros: Familiar, reliable and secure. One of the most reputable options for international transfers

- Cons: Transfers typically take 3–5 business days, and can even take up to 10 days if unexpected delays occur. Along the way, transverse often incur additional intermediary bank fees, on top of FX markups of 2–4%

- Best for: Large enterprises and very large transfers, where reliability is a more significant factor than cost or speed

2. Online money transfer services

Digital platforms like Wise and PayPal have made international transfers faster and easier for individuals, but certain platforms and account types don’t offer much in the way of business functionality.

- Pros: Simple online setup, faster transfers and (typically) transparent fees

- Cons: Many are designed for personal use, with low transfer limits and limited currencies. Fees can be very high for certain services and percentage-based fee structures may penalize larger transfers

- Best for: One-off or small-value personal transfers, not ongoing business payments

3. Remittance services

Providers like Western Union and MoneyGram allow cash-based payments through local agents worldwide. Some of these companies are also beginning to offer online transfer services on a limited basis.

- Pros: With branches virtually everywhere in the world, even underbanked regions, it’s possible to make payments to countries with limited banking infrastructure or recipients without bank access

- Cons: High fees, less favourable FX rates, in-person pickups and a reputation for fraud and scams make these services unsuitable for most business-to-business payments

- Best for: Emergency or low-volume one-time transfers where the recipient can’t receive bank payments. Only safe for very small amounts or with trusted partners.

4. Credit cards

Some businesses use credit cards and debit cards for international purchases or payments. Multi-currency virtual cards are a strong option for international businesses.

- Pros: Convenient and widely accepted, especially for smaller payments, and can be used on many online wholesale platforms

- Cons: High foreign transaction fees (up to 3–5%) with ordinary cards, unfavourable FX rates and limited suitability for supplier payments or larger transfers

- Best for: Small or recurring expenses like advertising costs, subscriptions, recurring marketplace fees (ie. Amazon seller fees) or small MOQ supplier orders.

Read more: How to choose a virtual debit card for international payments

5. Cryptocurrency and blockchain payments

Some companies experiment with cryptocurrency or stablecoin transfers to avoid traditional banking systems. These methods often involve a much higher learning curve and risk tolerance than other international payment methods.

- Pros: Real-time settlement and no intermediary bank fees

- Cons: Limited and evolving regulations make crypto payments tricky to navigate and to manage when tax time comes around. Extreme volatility and fluctuating “gas fees” (essentially network fees subject to surge pricing) can make costs unpredictable and risk difficult to mitigate

- Best for: Niche businesses comfortable with crypto risk and a thorough understanding of the technology. May also be useful for businesses operating in markets where traditional banking access is restricted

Use WorldFirst for simpler FX international payments

FX payments can be expensive and prone to delays or even security issues. But with the right partner, you can avoid hidden fees and know with confidence that your funds will arrive on time.

With a World Account, you make same-day payments to 210+ destinations and hold funds in 20+ currencies with local account details. You can also protect your funds with guaranteed future exchange rates and escrow services for supplier payments.

Open a World Account for free and start making fast, affordable on-time FX payments to your international partners.

Frequently asked questions (FAQ)

What are FX payments and how do they work for global businesses?

FX payments involve sending or receiving money in a local currency that differs from your own, often between countries and across currency pairs. For a global business, this usually includes converting funds through currency exchange services provided by banks or other financial institutions. These transfers can vary in speed and cost depending on the provider and the route used.

How can companies manage FX risk when sending cross-border payments?

Many companies use fx hedging tools, such as forward contracts or firm orders, to stabilize costs and reduce fx risk. These strategies help protect payments from exchange-rate swings and can support more predictable budgeting and risk management for both large and small business users.

What features should I look for in modern FX solutions?

When comparing FX solutions, consider the quality of the provider’s payment solutions, global coverage and ability to support global payments. Look for platforms that help streamline your process, offer transparent pricing and include options relevant to your operating currencies such as the US dollar or others you commonly use in your transfers.

Businesses trust WorldFirst

- Almost 1,500,000 businesses have sent US$500B+ around the world with WorldFirst and its partner brands since 2004

- Your money is safeguarded with leading financial institutions