If one word summarises the UK economy this year, it’s uncertainty.

With the UK’s imminent departure from the European Union, the handover of the White House in early 2017 and looming Presidential elections in both France and Germany, it’s becoming increasingly difficult to foresee what the state of global politics, and thus the markets, will look like in twelve months’ time.

With so many independent, standalone events that the global economy has to work its way through next year, each individual hurdle must be viewed in isolation, as another building block toward the composition of the global market at the end of 2017.

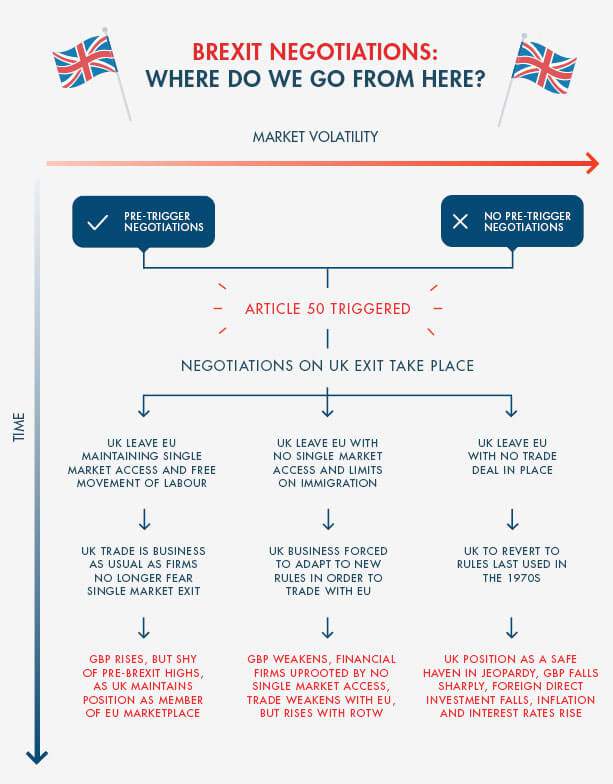

To help visualise the different scenarios and twists and turns, we’ve distilled the plethora of different options, scenarios and paths that the UK’s negotiations with the EU could take and plotted the possible outcomes for the pound, the UK economy and general market volatility.

NOTE: These are our opinions and estimates and therefore they shouldn’t be relied on as advice. Financial markets are affected by many different factors which could cause any of these outcomes to be significantly altered.

This article is taken from the winter issue of Transfer, World First’s magazine for private clients. To download your complimentary copy, click here.