Forget the politics and back China

NZD has been one of the most volatile major currencies over 2017. Large gains came through the beginning of the summer as the Chinese yuan strengthened against the US dollar with declines spurred on by the uncertainty over the election of Jacinda Arden as the new PM.

Investors are yet to let NZD off the hook for the election of the coalition Labour/New Zealand government in Q4. Most of this fear stems from the belief that the coalition government is considering charging the Reserve Bank of New Zealand with a dual mandate of inflation stability and full employment.

A change in the mandate would undermine the main reason for holding the NZD; the amount of ‘carry’ that investors receive from holding the kiwi dollar would likely fall as monetary policy loosened. Unemployment is only 4.8% in New Zealand and that is close to what is considered to be a Natural Rate of Unemployment (NAIRU) in an economy. The issue in New Zealand is much like the issue in the UK; higher employment, stagnant wages and poor productivity. This is more an issue for government than a central bank.

As they lowered their growth forecasts and keeping interest rates as is in their most recent meeting the Reserve Bank’s forward guidance now projects that its first hike of a new cycle will take place in Q2 2019 compared to Q3 previously. The currency will also found succour in the Bank’s estimates that the overall impact of the new government’s policy is a positive stimulus to aggregate demand of about 0.5% of GDP.

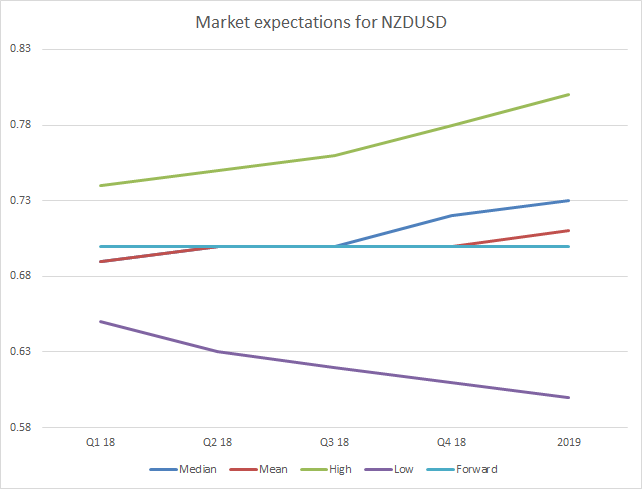

If the Chinese economy performs as we expect in the coming 12 months then we are optimistic on New Zealand growth and the currency in 2018.

Source: Bloomberg