Reform needed

We maintain a level of neutrality in the Philippine economy in 2018 despite being disappointed in 2017 by both the performance of the PHP and the central government. A lack of a reform agenda, or the ability to meaningfully advance one, is limiting the level of investment flowing into the Philippine economy and therein lies the risk of falls in productivity and overall output.

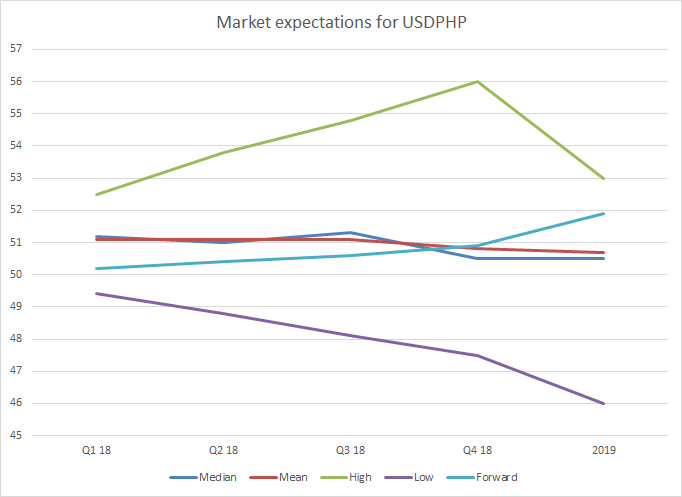

Similar to other Asian emerging market economies we expect that the Central Bank of the Philippines will mirror the Fed in its monetary policy moves in 2018 in a bid to reduce currency volatility but we are net negative the peso heading into the New Year on the basis of a lack of credible reforms from Manila.

Source: Bloomberg