What is a SWIFT Code and how do you use it with your money transfers?

When making global transfers, there are two internationally recognised methods of identifying bank accounts. The first of these methods is via a SWIFT code (Society for Worldwide Interbank Financial Telecommunication), and the second is an IBAN (International Bank Account Number).

So, what’s the difference? Let’s start with SWIFT Codes

Your SWIFT code provides a network that enables banks anywhere in the world to send and receive information in a standardised and secure environment. In practical terms, the SWIFT code is a standard format of Business Identifier Codes (BIC), which are used by banks when transferring money between them.

Why is a SWIFT code useful?

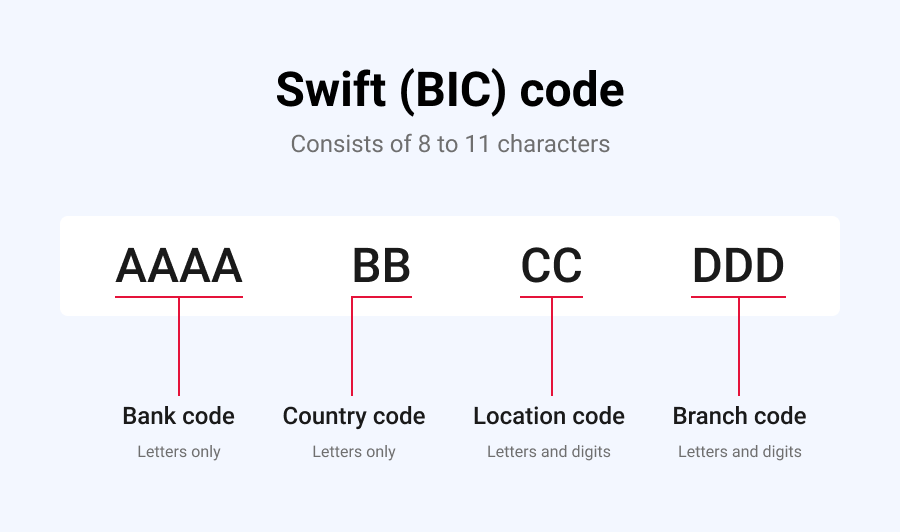

The SWIFT code is usually required when you conduct an international money transfer and is used to identify a specific bank account in the process of verifying international transactions. It can be found as a set of 8 or 11 digits on your bank account statements. These numbers are used to represent your bank branch.

What does a SWIFT code look like?

Swift codes denote the bank code, country code, location code, and branch code associated with a transaction.

Take a look at how it is used to identify financial institutions globally.

With this in mind, how does an IBAN number differ?

Whilst a SWIFT code is used to determine which bank account you are using when you are transacting, your IBAN identifies the specific bank you are using to make a payment/transfer.

This means your IBAN serves as an International Bank Account Number. It is a standard international numeric system created to identify overseas bank accounts. It starts with a two-digit country code, then two numbers, followed by up to third-five alphanumeric characters. The key importance of an IBAN is that it gives additional information that helps in identifying overseas payments.

What do you need an IBAN for?

It is largely used when making or receiving international payments. FX platforms need to check the accuracy of your IBAN when you begin a fund transfer and can only make the funds transfer with a correct IBAN.

Next step, transferring money

Now you know how important your IBAN is when transferring funds to a supplier, you’re ready to start sending money today.

Our FX specialists can walk you through the process of setting up your WorldFirst account, so contact us today.