Slippery oil, slippery prices

Indonesia and its currency enter 2018 in a strange place. The Indonesian economy will need to spend a lot of the coming 12 months in a transitional mind set; government spending and exports have been the main drivers of expansion and consumption by both businesses and private individuals needs to be there to pick up the slack.

The crucial constituent of the macroeconomic picture remains oil prices and given the recent OPEC decision that will see production cuts remain for at least the next 9 months, should the price of a barrel of crude rise to more than the $70/75 a barrel then the central bank will be concerned over whether local inflation busts through the upper end of its inflation targets.

Given investors’ desire for yields alongside low political risk, the IDR is unlikely to feel a dearth of love through 2018.

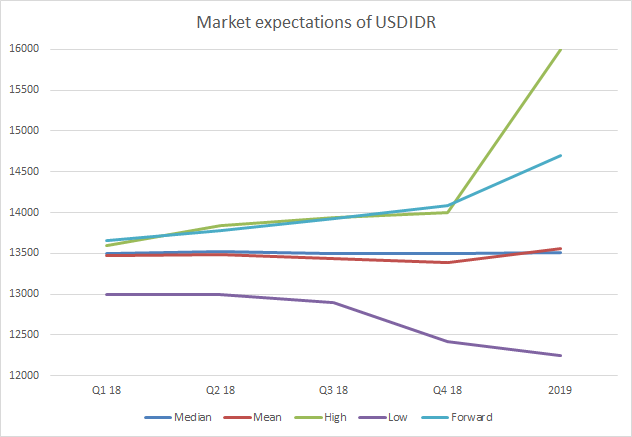

Source: Bloomberg