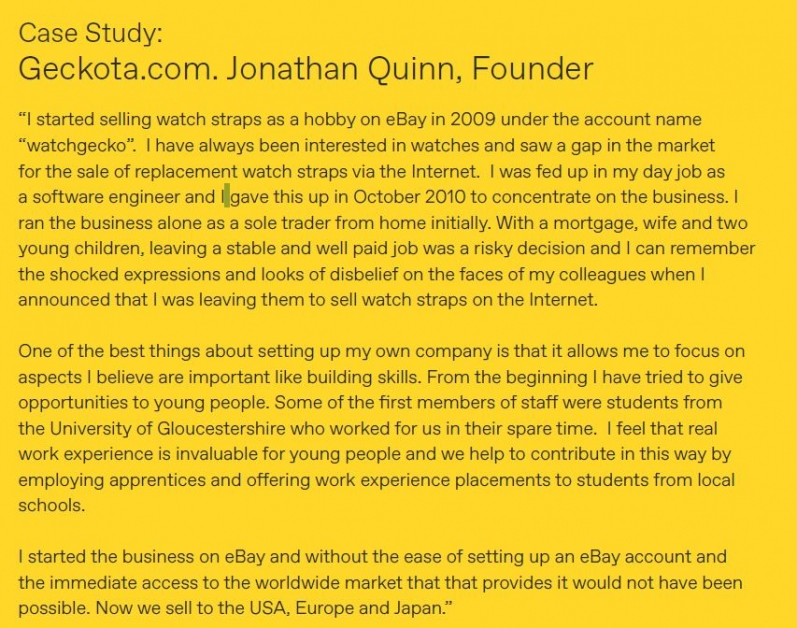

1. The move online

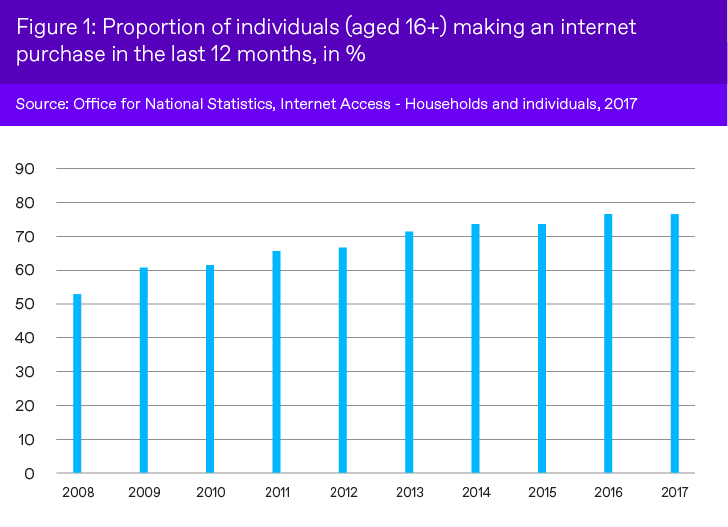

In recent years it has become almost unthinkable for a company to operate successfully without an online presence – in 2016, 83% of internet users in the UK alone shopped online. [1]

This will only rise as consumer habits are increasingly driven by a generation that has grown up in a mobile-first era in which smartphones are the norm. Almost a fifth of online sales are done through mobile devices and 79% of smartphone users have made a purchase via their devices’ browsers[2].

Being constantly connected to the internet has changed purchasing behaviour and has driven huge growth in UK e-commerce sales: latest data from the Office of National Statistics (ONS) indicates growth of 60% since 2008 with total sales standing at £554 billion in 2015 [3].

In 2015, one in five UK businesses sold online, up from just 14% in 2008 and above the EU average of 17%.[4]

Added flexibility of selling online

An online presence provides companies with a number of benefits, including the flexibility to do business 24 hours a day and provide unrivalled access to consumers and markets across the world.

There are also numerous cost-advantages. An online only business can serve businesses worldwide without the costs and upfront commitments associated with an office or shop floor in the locations they serve. These savings can be essential, especially in the early stages of a business’s lifecycle.

As technology, logistics and communications have developed over the past decade, the online-only business has emerged. Whilst behemoths like Amazon and ASOS come to mind as prime examples, in the UK we’ve seen the growth of this kind of business particularly in the smaller end of the market. As retailers move online, powered by digital marketplaces, we’ve seen the birth of the British iStreet.

2. Online sellers and the birth of the iStreet

With e-commerce sales rising, what contribution are online sellers making to this growth?

Recent analysis clearly indicates that they are playing a growing part in the UK’s e-commerce sector and have the power to play an increasingly important role.

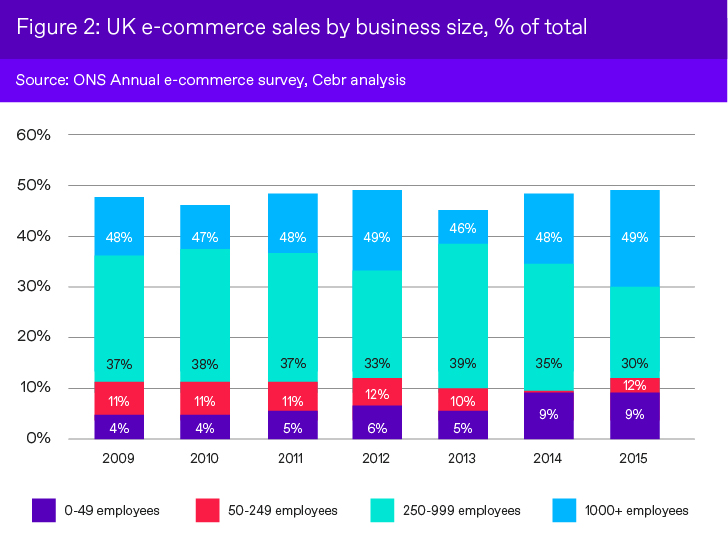

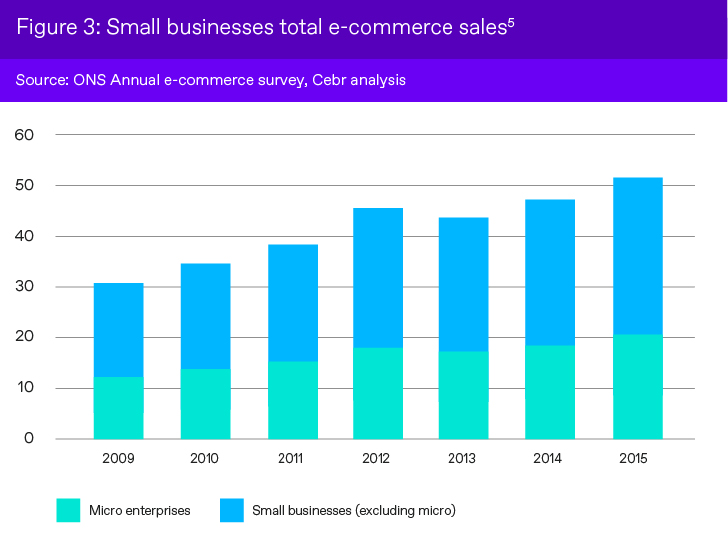

As illustrated in figure 2, while the share of total e-commerce sales made by businesses with less than 50 employees stood at just 4% in 2009, this share has more than doubled to 9% in 2015, accounting for £53 billion in sales. Moreover, findings from YouGov highlight that online sales (both UK and internationally) among online sellers grew at an average rate of 7.3% over the past year alone.

Growing importance of marketplaces

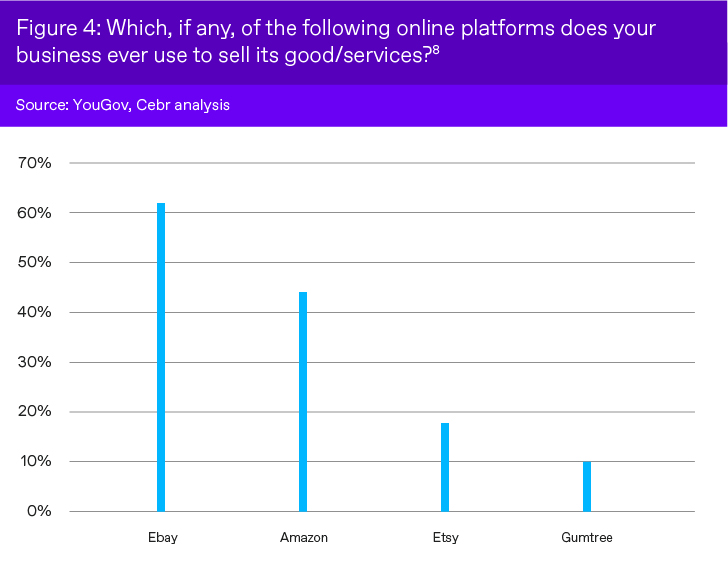

While websites remain an important channel for online sellers, with Cebr estimating that more than three quarters of small business e-commerce sales are done via this channel, the YouGov findings uncovered the growing importance of online marketplaces. Overall a quarter (25%) of online sellers sell goods or services on marketplaces, with a fifth (20%) of all businesses saying it is likely they will expand their presence on marketplaces over the coming year. Marketplaces are coming to represent the new British i-street

Of those businesses that sell through marketplaces, 61% use eBay and 44% sell on Amazon. Other popular marketplaces include Gumtree, Etsy and Facebook. (Figure 4 presents the top five online market platforms).

The use of these platforms can make it easier for online sellers to sell globally, especially in the early life stage of a business. For example, British businesses are able to offer their products to customers on all of Amazon’s European websites – Amazon.co.uk, Amazon.de, Amazon.fr, Amazon.it and Amazon.es – and to customers across all 28 European countries from a single seller account[6].

Moreover, According to Amazon[7], 2016 was a record-breaking year for sellers on the platform, with UK- based businesses achieving export sales of more than £1.8 billion in 2016, up 29% year-on-year. The number of UK-based i-street sellers exporting to European customers also increased by more than 40%.

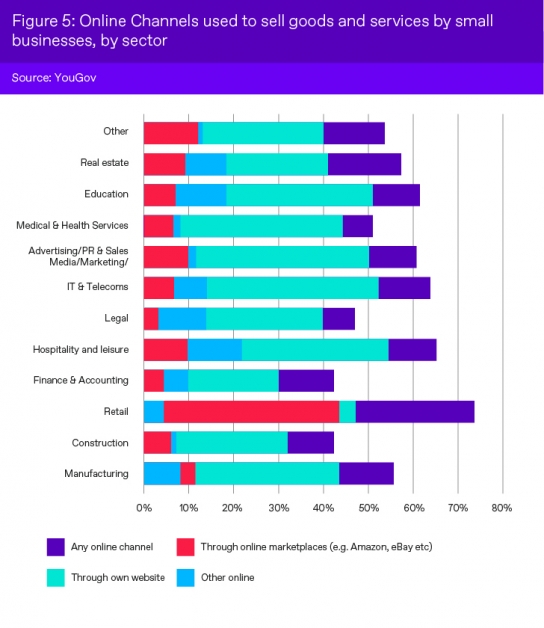

How the use of online channels varies across industry

Some industries naturally have more potential than others to explore the advantages of e-commerce, given the nature of the goods and services they sell.

Figure 5 presents an industry breakdown of which channels small businesses use to sell goods and services. The majority of small businesses across each industry use some form of online channel, with retail sellers the most likely to use marketplaces.

3. Opportunities and challenges

It is clear that online sellers are playing an increasingly important role in the overall UK e-commerce market but what opportunities lie ahead and what challenges need to be overcome in order to drive further growth?

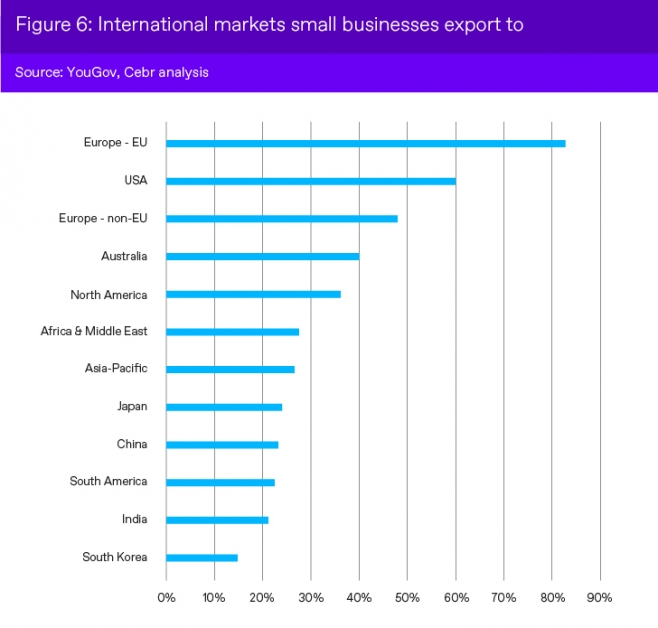

Export opportunities

The YouGov findings highlight that two in five (40%) small businesses sell their goods and services to both the UK and foreign markets. The top two export destinations for small businesses are the EU (84%) and the U.S. (60%).

Data also shows that 9% of i-street sellers saw their total revenues from exports increase by more than £500,000 during the last financial year.

In 2016, there were almost 1.3 million[9] small businesses in the UK and based on the YouGov findings, Cebr estimate that 9.4% of these companies export their goods and services via online marketplaces.

- Therefore, Cebr estimates that iStreet sellers to have contributed to UK exports by up to £11 billion in 2015.[10]

Anticipated future growth

In order to estimate future e-commerce sales, Cebr also tested the correlation between growth in e-commerce sales (as provided by ONS) and various economic indicators. Based on these inputs, overall e-commerce sales will grow at an average annual rate of 5.7% between 2016 and 2020.[11] Given the estimated growth, total e -commerce sales would increase to £729 billion by 2020, up from the observed

£554.2 in 2015.

- Sales from online Sellers could therefore more than double from £53 billion in 2015, to £105.7 billion by 2020.[12]

Cebr also estimates future export contributions from online sellers to reach £21.3 billion by 2020. The YouGov findings also suggest that online Sellers are planning to raise employment levels over the next 12 months, with almost one third (30%) planning to hire up to five more members of staff. The e-commerce market is therefore set to continue expanding, not only by total sales values and turnover, but also in terms of employment numbers, thereby positively impacting the UK economy.

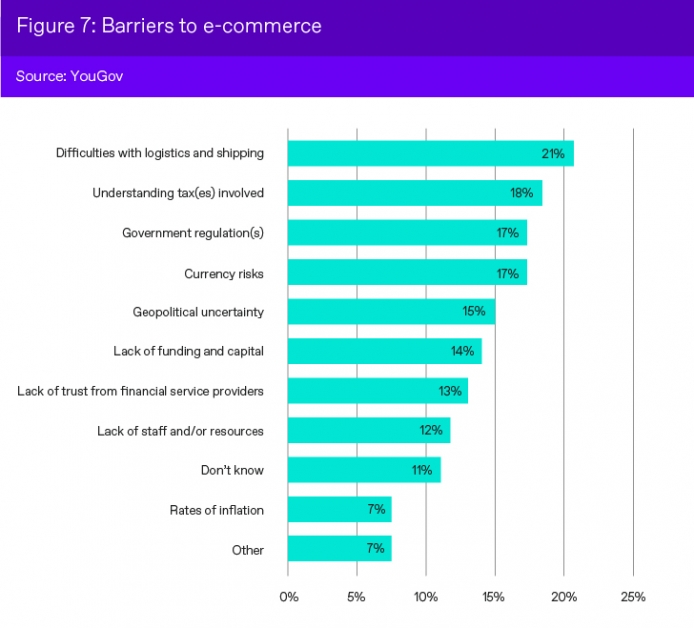

Barriers to growth

Despite the growth opportunities offered by selling online, businesses face a number of hurdles – especially when selling internationally – that need be effectively navigated in order to scale.

Of all small businesses asked by YouGov, one fifth (21%) cited difficulty with logistics and shipping as the leading barrier to selling online. Although this included some businesses who do not yet sell online, it highlights the potential issues that may be putting small businesses off from taking the next step into online selling.

Currency risk, such as fluctuating exchange rates, are identified by 17% of businesses as an issue highlighting the need for businesses to be aware of broader economic trends that could impact their bottom line when selling internationally. Currency fluctuations can be linked to geopolitical uncertainty which was also cited as a danger itself by 15% of small businesses.

Notably, 13% of small businesses also flagged lack of trust from financial service providers as a hindrance to selling online. This cynicism indicates the need for financial institutions to better support the growth plans of such businesses and highlights the potential for dynamic fintech providers to offer solutions more tailored to the needs of online sellers.

World Account- a multi-currency account to power the global iStreet

With 1 in 5 iStreet sellers listing currency risk as a major barrier to e-commerce, it is clear that payments infrastructure has been slow to catch up with the needs for the iStreet. Until now.

The World Account helps businesses and iStreet sellers trade globally, saving time and money for any business dealing in multiple currencies.

World Account helps with:

- Local currency accounts: iStreet sellers can open multiple local currency accounts in GBP, EUR, CAD & USD – for FREE.

- Doing business like a local: For example, collect revenue from clients or online marketplaces in USD, pay your suppliers in USD.

- Save money with great rates: Great rates on all FX transfers. And absolutely no hidden fees.

- One easy-to-use platform: Send, hold and receive funds – online or via the app.

If you’re an iStreet seller, it’s completely free to open a World Account with us. And there are no monthly fees or transfer fees on foreign exchange transactions either.

4. Looking ahead- what’s next for the iStreet

In light of current trends uncovered within this report, it is clear online sellers are set to play an increasingly important role in the future makeup of the UK economy and have the potential to reshape UK exports in the years to come.

The e-street sellers we have identified represent a new dynamic type of business that are able to operate across multiple digital channels and attract customers in every continent. Yet expanding internationally carries risk such as logistical issues, understanding local taxes or currency risk. As such there is key role for financial services providers to do more in order to make international trade simpler and thus support the mini-multinationals of tomorrow on their growth trajectory.

It is hoped, that in shining a spotlight on this type of business for the first time, it will provoke conversation on their economic value and, more importantly, ultimately inspire more entrepreneurs to turn their idea into a business reality.

You can download the Rise of the Global iStreet report with a foreword from Jonathan Quin, CEO of WorldFirst here.

For more information on how to get your iStreet business trading internationally, get in contact with us now

[1] ONS Annual e-commerce survey, cebr analysis

[2] E-commerce sales [isoc_ec_eseln2].

[3] United Kingdom B2B E-commerce Report 2016.

[4] United Kingdom B2B E-commerce Report 2016.

[5] The 2009 to 2013 values for micro businesses are Cebr estimates.

[6] http://www.telegraph.co.uk/sponsored/business/amazon-entrepreneurs/10895541/what-is-amazon-marketplace.html.

[7] http://phx.corporate-ir.net/phoenix.zhtml?c=176060&p=irol-newsArticle&ID=2233730.

[8] This only refers to those firms that sell their goods and services through an online market place.

[9] Business population statistics for the number of small business in the private sector (excluding businesses with no employees). https://www.gov.uk/government/statistics/business-population-estimates-2016.

[10] Assuming that every small business exports the same (£90,336 from the YouGov survey). Note, Cebr estimates also take into account some businesses selling highly valuable goods or services.

[11] Note: actual data only available until 2015.

[12] Under the assumption of linear growth in the share of SME e-commerce