We have now updated our thoughts on ILS for the 2nd half of the year. These are below:

The shekel has been one of the standout performers in the emerging market space in 2017, gaining 9.05% against the USD since the beginning of the year. A lot of this is as a result of the weakness in the USD and that has contributed to the shekel now being overvalued by as much as 10% on PPP terms.

Investment into the country remains strong and reports that Israeli government debt is set to be included in the World Government Bond Index, generating the potential need for investors to purchase around USD2.5bn worth of bonds, may drag the ILS event higher.

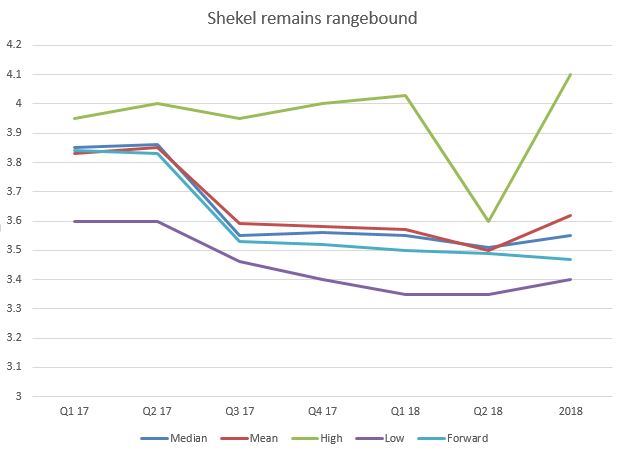

These predictions outline the high, low, median and mean expectations for the above currency pair as found by a Bloomberg survey of banks and brokers and should only be used for illustrative purposes. Source: Bloomberg

Conclusion: Keep half an eye on Washington but some ILS weakness in H2 would not be a surprise.

Israel has had a great 2016 and while we think that a decent proportion of the strength will be carried over into 2017 we must caution against over exuberance. The fundamentals of the Israeli economy remain strong in so much that unemployment is low, wages are rising, investment is strong and the fiscal environment remains supportive.

The discovery of a massive natural gas reserve offshore in September has further boosted demand for the shekel and the combination of decent growth prospects and huge speculative investment inflows have pushed the currency to trade-weighted record. This could increase the chances of something called ‘Dutch disease’ – a stronger currency as a result of investment in one sector could negatively affect other sectors and we will monitor Israel’s manufacturing and semi-conductor spaces for signs of a slowing of demand.

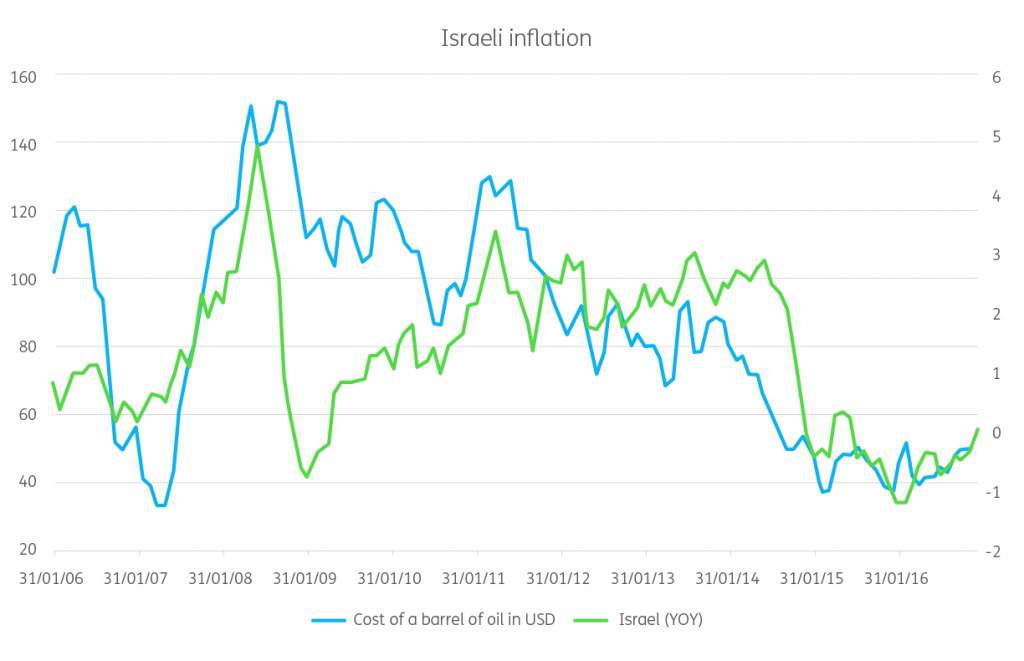

The correlation between inflation and the oil price in Israel is unusually strong and the pick up in oil prices in the past month or so will give expectations a nudge higher through 2017 should commodity price rises be able to sustain themselves.

Despite this, CPI is negative in Israel and the Bank of Israel remains unhappy to make a move into negative interest territory. The Israeli government will support the economy in fiscal terms with tax cuts likely to come through in the coming year and this should allow the BOI to maintain rates as they are. The central bank will continue to buy dollars and other foreign currency in order to weaken the ILS, bolstering reserves.

Want to learn more? Check out our full list of 2017 currency predictions or drop us a line to research@worldfirst.com with any questions.