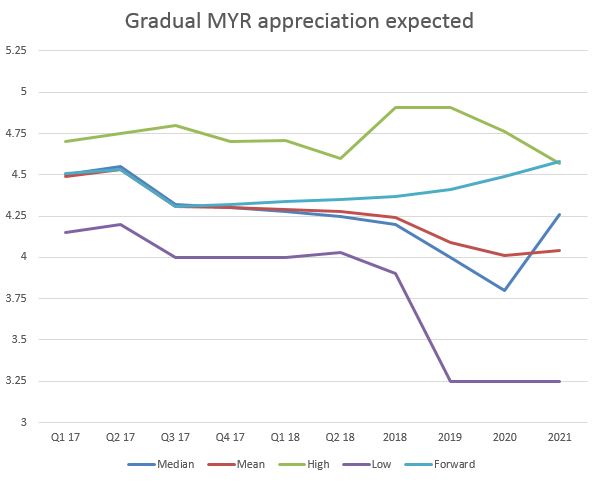

We have now updated our thoughts on MYR for the 2nd half of the year. These are below:

Oil prices have been a friend to the ringgit in the first half of the year as have the breakdown in interest rate differentials between the US and Malaysia. As with all emerging market currencies the inability of the Trump presidency to take on and amend legislation as it was elected to do has made the dollar’s path very uneasy in 2017; something that we don’t see changing anytime soon.

These predictions outline the high, low, median and mean expectations for the above currency pair as found by a Bloomberg survey of banks and brokers and should only be used for illustrative purposes. Source: Bloomberg

Conclusion: we see the authorities keeping a tight leash on MYR at current levels.

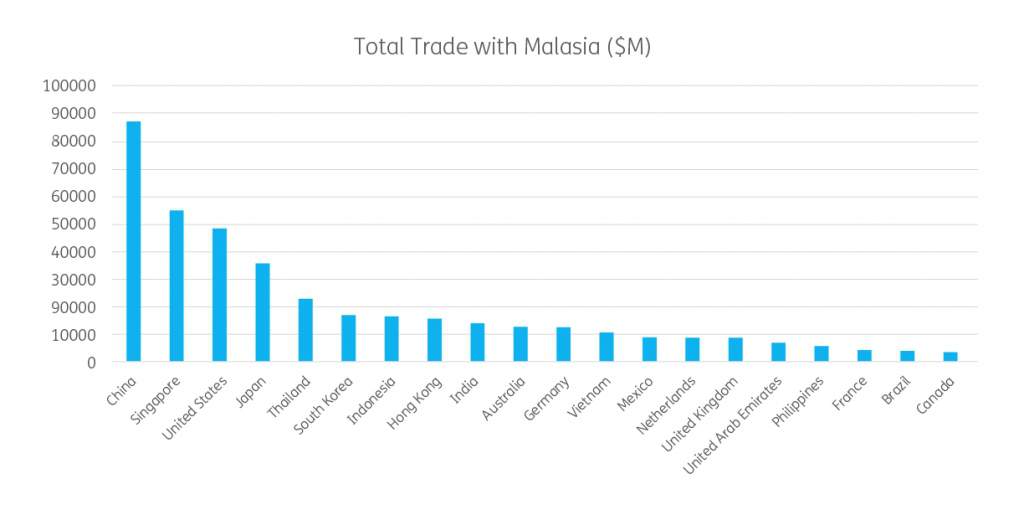

If there is one economy that has begun and will likely need to continue its pivot to China in 2017 it is Malaysia. In the first half of 2016, 3 out of 5 dollars invested in the Malaysian country came from either China and Hong Kong and a trade environment that is expecting damage from an aggressive US President will see this relationship become stronger. Indeed, investment is set to become an increasingly more relied upon growth driver in the coming months wherever it comes from.

The 1MDB scandal remains in the back of everyone’s minds but Chinese state-owned enterprises have led a bailout of the company whilst acquiring assets owned by the investment fund. The political pressure on Najib Razak’s Malaysian government has lessened but regulatory risk from the United States, Switzerland and Singapore will remain through 2017.

Malaysian watchers will have been pleased with the recent OPEC deal that has allowed for a slight gain in oil prices in recent weeks and a higher oil price will feed right into a determined fiscal outlay from the Malaysian government. Internal forecasts of oil prices in 2017 have been very conservative ($45/bbl in 2017 vs a current spot price of $52) and while not all of this will be passed on, it will allow for a rebuilding of any spending buffers.

The outlook for the ringgit has been made more occluded by Trump and the belief that the Bank Negara Malaysia will no longer need to, or have the room to cut interest rates in 2017 although we believe that it will be caught up in the overall USD strength atmosphere and spend a lot of the year under pressure and moving towards 4.60.

Do you need to buy ringgit for your business? Find out how World First can help you or check out our full list of 2017 currency predictions.