What to watch out for in EUR in the next three months

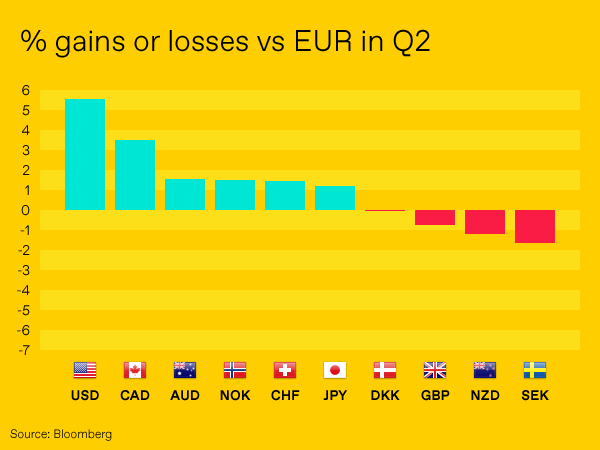

Much like Q1, euro was a middle of the pack player in Q2 losing 5.6% against the USD but gaining just shy of 1% against the pound. But what do the next three months hold for the euro?

Here are three things that will determine the movement of the euro over the next three months.

How on hold is the ECB?

Most of the euro’s losses, especially against the USD, came in the aftermath of the June European Central Bank (ECB) meeting. Despite the central bank announcing that it will end its Quantitative Easing (QE) plan by the end of year should the economic data warrant it, the euro collapsed as it became clear that the ECB would not raise interest rates until at least next summer and that the reduction of stimulus via QE could be reversed in the face of weak economic data.

These decisions on guidance and rates were also unanimous, which added to the euro negativity and has to limit the possibility of euro strength in the short term.

Coming back to the pack

Italy has a government led by populist elements of the political spectrum. While fears of a government initiative to take the country out of the euro have fallen by the wayside, legislation on migration, debt spending and taxes are all of a concern to the international investment community.

Similarly, Angela Merkel seems to have headed off a threat to her leadership (in the short-term at least) but her ruling coalition has been weakened. One commentator told me that “if you underestimate Angela Merkel, then you have already lost” but many still seem happy to try.

Needless to say, the euro does not like political uncertainty at the best of times.

Trade terms

As we enter the third quarter, the EU is attempting to broker a deal to allow for a reduction in punitive tariff arrangements on motor vehicles with the US. Similar concessions may be offered to other large motor vehicle exporting companies like Japan and South Korea. Last month President Trump threatened to impose 20% duties on EU cars if barriers to US exports were “not soon broken down”.

Anything that keeps the world trading will see USD fall – and that should prompt EUR gains.

You can keep up to date with all the latest news, commentary and predictions for the dollar by signing up to the free WF morning update delivered to your inbox every weekday morning.