What to watch out for in USD in the next three months

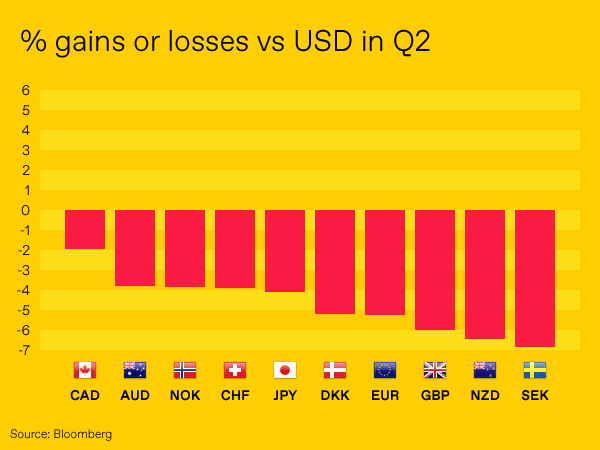

The US dollar was the best performing currency in the G10 in Q2, taking 6% out of the pound, gaining 5.2% against the euro and over 4% against the yen. But the question is: can this performance continue in Q3?

Here are three things that will rule the USD in the next quarter:

How hot is hot?

The only thing that can stop the USD from heading higher will be news that suggests that the US economy is starting to slow. While some indicators are suggesting that these growth levels are unsustainable over the course of the next 18 months, there is room for those to change and first order numbers like GDP, inflation, wages and retail sales are still strong. Market and Federal Reserve expectations of two more hikes by the end of the year are firmly aligned.

The next Fed minutes should be enough to keep the USD going as well, given the overt optimism that typified Governor Powell’s most recent appearance in front of the press. The one caveat is how many Fed members express concerns over the trade tensions that the White House is propagating.

Trade ups and downs

The Trump team continues to antagonise the world of free trade with additional tariffs on goods that it considers to be hurting the US economy. That said, the USD does not seem to give a monkey’s and has continued to drive higher.

US businesses are finally getting angry about this – Harley Davidson is one of many to speak publically on this – but that doesn’t mean that the Trump administration is going to listen. Trump trade team member Wilbur Ross told CNBC a few days ago; “There’s no downside level in the stock market that would change the Trump trade policy”. Similarly, the Chinese could retaliate by intervening in the currency or by selling US debt; we don’t think either will happen however and USD will keep the pressure on yuan and other emerging market currencies.

Mueller investigation

The clock is ticking on the investigation and while we will not know when the investigations will conclude, when they do the dollar will be in the crosshairs.

You can keep up to date with all the latest news, commentary and predictions for the dollar by signing up to the free WF morning update delivered to your inbox every weekday morning.