Sterling Tumbles Down

Boris – close to the keys

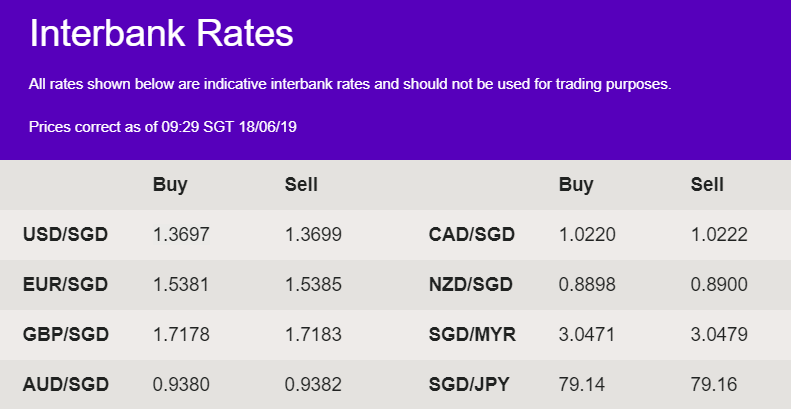

Increased level of volatility may be expected for the Sterling this week, with the Bank of England and Boris Johnson to consider. GBP fell against SGD by 0.48% yesterday and is currently trading at 1.71 interbank levels.

The race for the next Conservative leader is heating up, with the next round of votes in today. The first round resulted in a clear win for Boris Johnson, who gained 114 votes – significantly more than his nearest rival Jeremy Hunt, who came in with 43.

Another key driver of the pound is the Bank of England (BOE) policy meeting on Thursday, which has adopted a hawkish stance of late. There is the risk however, that the Bank could strike a more cautious tone due to slowing global growth, largely resulting from US-China trade tensions.

All eyes on Draghi

For the Euro, the main driver is likely to be PMI data with following commentary from ECB President Mario Draghi, later today at 4pm (GMT 8:00).

The composite Eurozone PMI in June is likely to show no change from the previous months 51.8. Nevertheless, the PMI is widely seen as the leading indicator for the economy and growth, therefore if it comes out lower than expected it will weigh in on the Euro and vice-versa. Markets will also be paying close attention to President Draghi’s speech at Sintra, but already negative rates and uncertainty about future leadership complicate the ECB’s situation.

Disclaimer: The above comments are only our views and should not be construed as advice. You should act using your own information and judgement. Although information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice. Error & omission excepted.