Greenback Reeling from Trade War

Bullard takes a dovish stance amidst worries

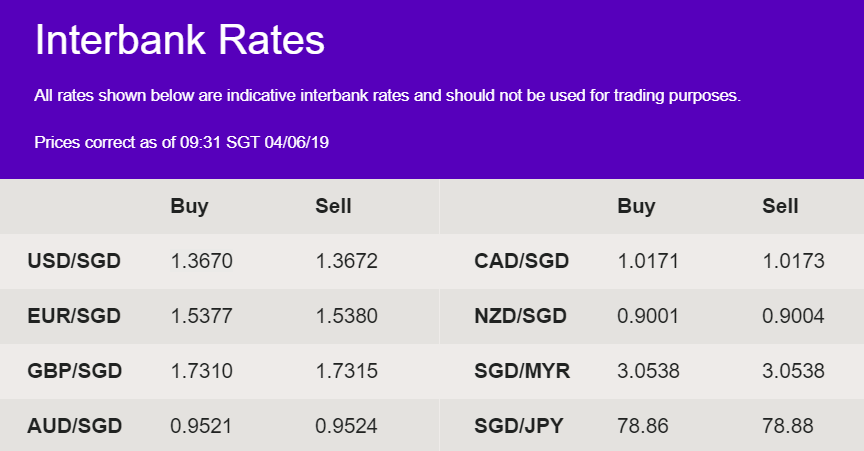

USD weakness is reflected across the board, and dipped even further as Fed’s CEO, James Bullard, warns of a rate cut that may be ‘warranted soon’ in anticipation of the trade uncertainty and slowdown in US economic growth. Fed’s Chairman, Jerome Powell will be speaking tonight at 10.55pm (GMT +8:00) and the market is pricing in a 50% chance of lowering of rates in July. USD/SGD pair plunged by 0.59% yesterday after last week’s high and interbank rate is currently at 1.36 level.

RBA expected to cut rate to historic low of 1.25%

The RBA is widely expected to drop the cash rate to 1.25% today, in an attempt to lift employment conditions and preserve its inflation target. Since August 2016 rates have been unchanged at 1.5%, and while the banks will be under pressure to pass on any RBA cut in full, some experts are sceptical that they will, as banks continue to look for ways to recover loss profit margins eroded by previously high funding costs.

Australian retail sales are first on the agenda, (9.30am, GMT +8:00) expected to come in at 0.2%, before the all-important decision at 12:30pm, with the accompanying RBA statement.

Disclaimer: The above comments are only our views and should not be construed as advice. You should act using your own information and judgement. Although information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice. Error & omission excepted.