A boom in businesses trading on digital marketplaces has underscored the need for local currency accounts, but what do companies need to consider as they go global?

Daniel Howe

Managing director, Europe,

Middle East and Africa

Theo Sprague

Head of relationship

management, ecommerce

| Why have companies targeted international expansion through online sales platforms? |

| DH: The emergence of online technology has made it easier for small and medium-sized enterprises (SMEs) to reach international consumers. International trade has become simpler. Marketplaces like Amazon have made it almost frictionless to sell products in international markets at the click of a button. It is now as easy to sell a product in Australia as it is in the UK. At the same time, logistics and the cost to send and ship goods has come down significantly. I can buy a product from China, have it shipped to the United States and I don’t even have to leave my office in London. |

| What impact did COVID-19 have on international cross-border sales on these platforms? |

| DH: The digitalisation theme has accelerated as a result of COVID. People who weren’t buying products online six months ago are now shopping online. Now they’ve started, they are likely to continue. We have seen a fundamental social shift in behaviour. |

| TS: It has had a profound effect on our ecommerce business and further accelerated the high street’s demise. It is super easy and cheap. During lockdown, the sales volumes have been comparable to peak periods like Black Friday or Christmas and for many it was only a matter of supply chain limitations preventing even greater success. |

| How has the financial services industry kept pace with this change? |

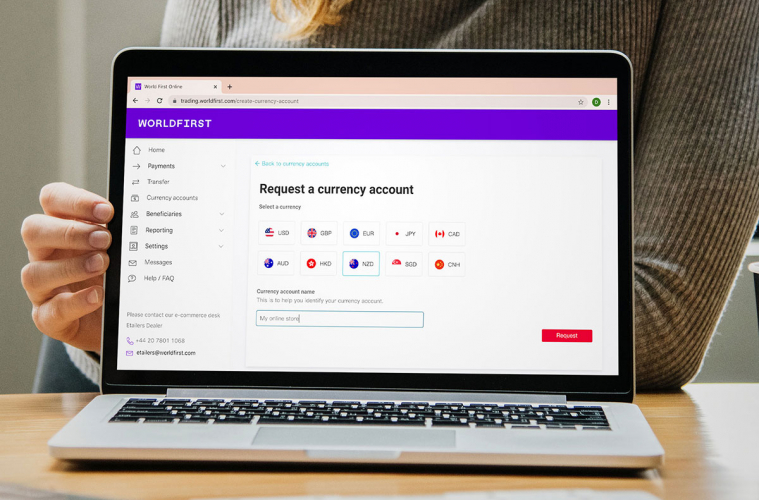

| DH: In many ways, financial services hasn’t caught up in the same way. It still presents a barrier for SMEs operating internationally. During the pandemic, there have been restrictions on people crossing borders in many countries, which has made it more challenging to open traditional bank accounts in some jurisdictions. That’s why we believe in the importance of our World Account proposition. The account is a virtual account that provides customers with a locally domiciled currency account in ten global markets. I can get accounts in US dollars, or Australian dollars etc, locally domiciled in those countries same day, to make payments to local suppliers. |

| TS: Traditionally the acquisition of an overseas bank account is very laborious. You need a physical account in that territory. But we offer a way of having a whole suite of currency accounts around the globe all on a single platform. We made a huge hurdle into a tick-box exercise by offering a viable alternative, without the trade-off of security or peace of mind. |

| With COVID-19 restricting international travel, have you found interest from larger corporate customers for this product? |

| DH: The speed of access we offer to new markets is appealing and we have seen an increase in registrations from businesses that are opening up to new markets and seeking alternative ways of collecting international funds. This means bigger businesses that were previously offline businesses now need these accounts. |

| How are companies likely to approach international expansion in the future trading environment and what role will WorldFirst play in supporting that? |

| DH: International expansion will be digital first for all companies in the future. The process we have been through has pushed business online. We want to be an enabler of international growth, to support businesses in taking their business abroad. They need a broader range of services than just payments and collection products. Companies will increasingly need new products and services in international markets. For us, the important thing is we have a great core product, but we recognise SMEs will need more. The product suite we provide must continue to support our customers’ growth because their international success is our success. |

Excerpt from Raconteur Business Growth & Recovery special report published in The TIMES.

Download the full report here>