![]() You may already know that Chinese Renminbi (RMB) is the official currency of China, but did you know you can easily make international payments in RMB? Here’s our quick guide to Chinese Renminbi and how to save on your payments into Mainland China by using WorldFirst’s forward contracts.

You may already know that Chinese Renminbi (RMB) is the official currency of China, but did you know you can easily make international payments in RMB? Here’s our quick guide to Chinese Renminbi and how to save on your payments into Mainland China by using WorldFirst’s forward contracts.

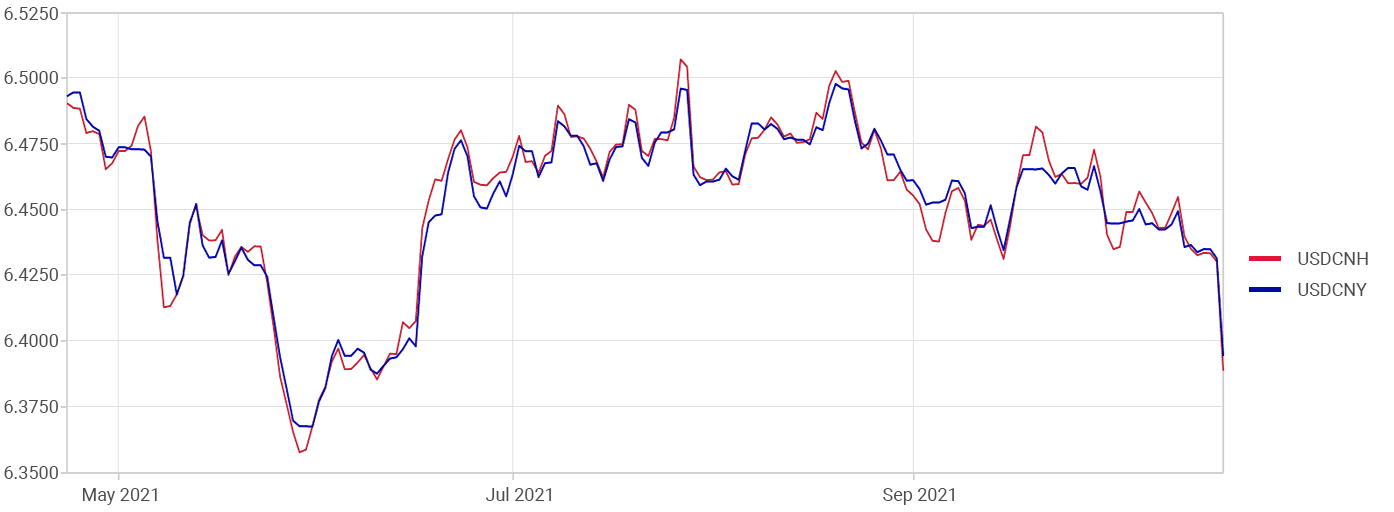

CNH vs CNY

Renminbi (RMB), CNH, CNY and yuan might all be used when talking about the currency of China, but there are subtle differences. RMB literally means ‘the people’s money’ and is the official name of the currency introduced by the Communist People’s Republic of China in 1949. The Chinese yuan (meaning ‘round’) is the unit of currency.

Where the financial system gets confusing, however, is when it comes to transferring money in and out of the country. There are two ISO currency codes for the RMB: CNY and CNH. The former is used domestically, while the latter is for international trade.

Both use the same bank notes and in China are equivalent in value when exchanging the two; the ‘exchange rate’ is always 1:1.

Why China has two currencies

Back in the days before China was the industrial and economic behemoth that it is now, the Chinese economy was relatively closed and the conversion of international currency was heavily restricted. The Chinese government wanted to limit the amount of currency and wealth that could flow out of the country.

But as manufacturing and industry boomed and money started flowing into the country from consumers around the world – and especially the west – the government created a parallel currency, allowing banks to start trading the new CNH currency from 2004.

China is now the second largest economy in the world; having the state-controlled CNY allows the currency to be controlled by the government, while CNH opens up trade in the international markets, with its value changing based on the free market.

Rates taken on 20 October 2021 from Oanda

Benefits of trading in CNH

Over the years, the Chinese Renminbi has internationalised and become a globally accepted currency. This is particularly beneficial to businesses outside of the Chinese mainland using RMB because:

- It improves price transparency for suppliers in the Chinese mainland who prefer to settle in local currency.

- Using CNH could alleviate currency risk for the supplier, which means avoiding any renegotiation of purchase prices. This means suppliers won’t be required to add an exchange rate buffer within their price, which may lead to access to a larger pool of suppliers.

- CNH can be traded as a deliverable forward currency.

Because CNH can be traded like other international currencies, you can transfer SGD to CNH and make international payments to your Chinese suppliers in their home currency. This means you can pay suppliers in what is likely to be their preferred currency.

Because CNH can be traded like other international currencies, you can transfer SGD to CNH and make international payments to your Chinese suppliers in their home currency. This means you can pay suppliers in what is likely to be their preferred currency.

Paying your Chinese suppliers in CNH also means they can provide a quote in their home currency without having to consider currency fluctuation. As a result, the quotation could be more favourable for you, plus you can avoid renegotiation of purchase prices and build more scope for price negotiations.

This may ultimately lead to better relationships with your suppliers.

What is a forward contract?

A forward contract from WorldFirst locks in an exchange rate for up to 12 months, protecting budgets from currency fluctuations and helping to mitigate risk. If you see that the currency is dropping, you can book a forward contract at the current rate.

Businesses typically use forward contracts to secure exchange rates for their known future international payment needs. You will be able to lock in an exchange rate for up to 12 months.

How can a forward contract save money?

Locking in an exchange rate with a forward contract means you know exactly what exchange rate you’re getting, for a set time. This helps you predict cash flow so you can be more prepared, more accurate and more competitive with your planning.

Furthermore, exchange rates can be volatile between the Singapore Dollar and other currencies. With a forward contract, you would have secured a predetermined exchange rate between SGD and your preferred currency for your future payments. This mitigates your financial exposure to currency fluctuations for that future payment.

Manage your foreign exchange exposure with forward contracts. Lock in an exchange rate to secure your future cross border payment needs, and protect your business from adverse foreign currency fluctuations.

Disclaimer:

This advertisement has not been reviewed by the Monetary Authority of Singapore.

World First Asia Pte Ltd, a subsidiary of Ant Group, is registered in Singapore with UEN 201229924N and is regulated by the Monetary Authority of Singapore (“MAS”). We are authorised by the MAS as a licensed Major Payment Institution under the Payment Services Act to conduct Cross-Border Money Transfer Service and also holds a Capital Markets Services licence with the MAS to carry on dealing in capital market products that are over-the-counter derivatives contracts under the Securities and Futures Act.

These comments are the views and opinions of the author and should not be construed as advice. You should act using your own information and judgement. Whilst information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice. Please consider FX derivatives are high risk, provide volatile returns and do not guarantee profits.